Total Wrist Replacement Market Trends

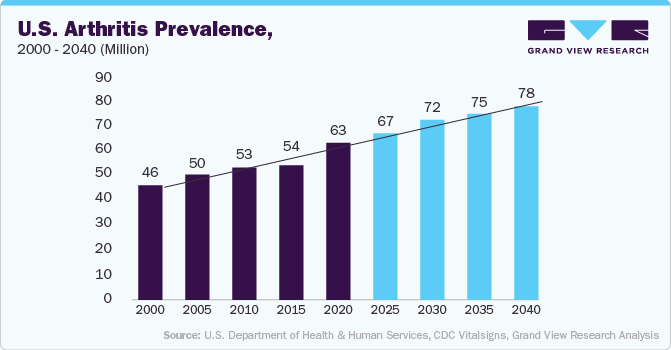

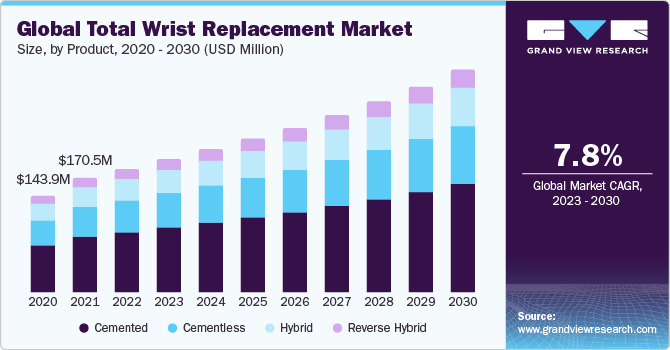

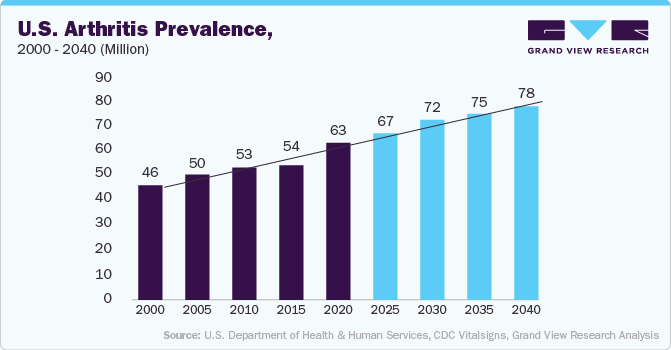

The global total wrist replacement market was valued at USD 183.85 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.76% from 2024 to 2030. The increasing prevalence of orthopedic disorders, osteoporosis, and osteoarthritis are key forces driving the market growth. As per Arthritis Foundation estimates, the prevalence of arthritis in the U.S. in the population age group was estimated to be over 78 million by 2040. Furthermore, increasing participation in sporting and physical activities resulting in trauma and fractures contributes to the growing demand for total wrist replacement.

The outbreak of the COVID-19 pandemic negatively impacted the demand for total wrist replacement owing to the imposed lockdown and postponement of non-emergent surgical interventions. According to a study published by Annals of Surgery, the cost of postponing/cancelling non-emergent surgical procedures during the COVID-19 pandemic was estimated to be USD 22.3 billion across the U.S. healthcare system. Renowned market players reported significant revenue losses owing to the cancellation or restrictions imposed on surgical interventions. For instance, Stryker reported a decline of 9.1% in revenue earnings as compared to last year (FY 2019), and Zimmer Biomet recorded a decline of 11.8% in revenue earnings in FY2020. However, with the resumption of surgical procedures and the easing of lockdown restrictions, orthopedic companies reported a revival of revenue earnings during the 3rd quarter of 2020.

Increasing demand for minimally invasive surgeries, surgeons are adopting several different techniques. Innovations in minimally invasive surgeries coupled with the multiple benefits offered by these procedures such as minimum collateral tissue damage, shortened hospitalizations, quicker recovery time, and lesser post-operation complications is driving the adoption of these surgeries. Therefore, the growing adoption of minimally invasive surgeries is one of the key driving forces responsible for market growth.

Fixation Type Insights

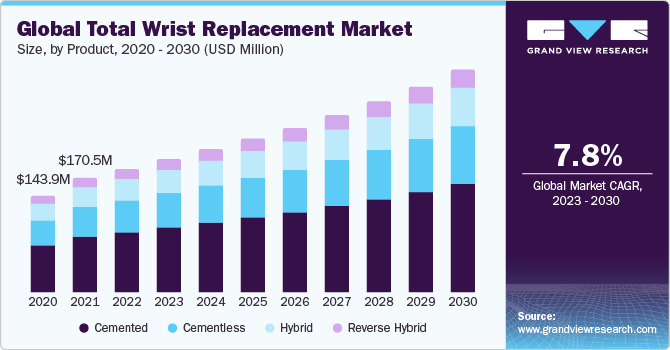

Based on the product, the total wrist replacement market is segmented into cemented, cement-less, hybrid, and reverse hybrid. The cemented segment held the largest market share in 2023. Cemented fixation is the most suitable fit for the elderly population, while cement-less fixation is widely adopted by the younger patient population.

Lower revision rates offered by cemented fixation are the key factor driving the adoption rate compared to other types.

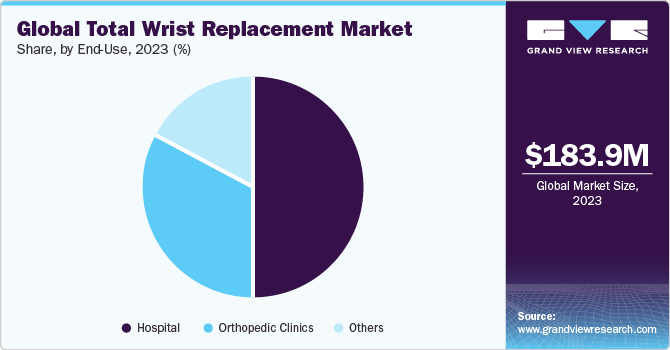

End Use Insights

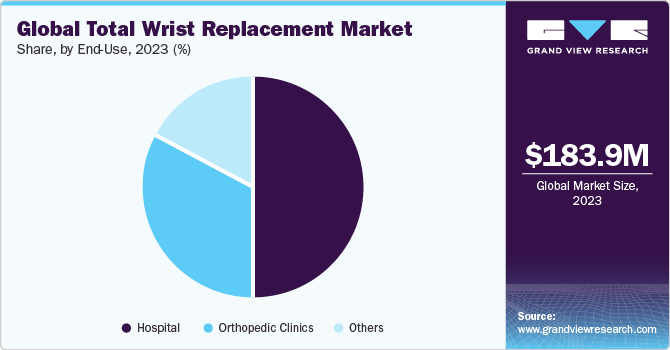

On the basis of end-use, the market is segmented into hospitals, orthopedic clinics, and others. Hospitals were the largest end user in 2023. The availability and accessibility of advanced treatment options in hospitals, coupled with the growing prevalence of sporting injuries, is attributable to the growth of hospitals.

Furthermore, favorable reimbursement policies available through Medicare and Medicaid are further accelerating the segment growth.

Regional Insights

North America dominated the market in 2023. This is attributed to the growing demand for advanced healthcare services, the widespread presence of major market players, the presence of well-established healthcare infrastructure, and the availability of comprehensive reimbursement coverage policies. The growing target patient population, coupled with an increasing number of orthopedic surgeries, is driving the market growth in North America.

Key Total Wrist Replacement Companies:

The following are the leading companies in the total wrist replacement market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these total wrist replacement companies are analyzed to map the supply network

Key players operating in the market are DePuy Synthes, Stryker, Zimmer Biomet, Smith+Nephew, Arthrex Inc., Corin Group, MicroPort Orthopedic, and Conformis. The market participants are constantly working towards new product development, M&A activities, and other strategic alliance to gain new market avenues. The following are some instances of such initiatives.

-

In August 2022, Ossio, Inc. launched OSSIOfiber Suture Anchors as a product portfolio expansion strategy. These anchors are used across hand/wrist surgeries.

-

In May 2021, the Orthopedic Implant Company received U.S. FDA clearance for the DRPx System, a wrist fracture plating technology.

-

In September 2021, Anika Therpaeutics, Inc. launched WristMotionTotal Wrist Arthroplasty (TWA) at the annual meeting of the American Society for Surgery of the Hand (ASSH) in 2021.