Torque Vectoring Market Size, Share & Trends Analysis Report By Propulsion (Front Wheel Drive), By EV Type (BEV, HEV), By Vehicle Type (Passenger Car), By Clutch Actuation Type, By Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-418-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Torque Vectoring Market Size & Trends

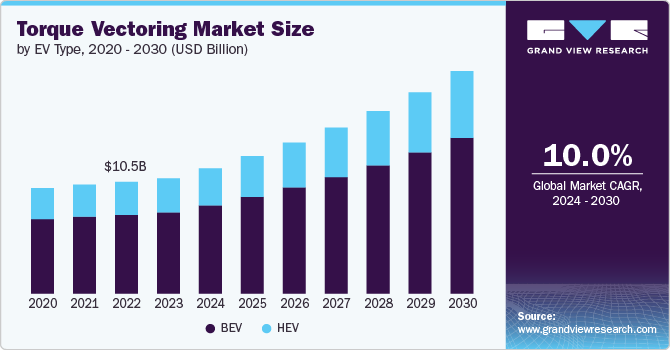

The global torque vectoring market size was estimated at USD 10.89 billion in 2023 and is projected to grow at a CAGR of 10.0% from 2024 to 2030. The market is experiencing significant growth due to the increasing emphasis on vehicle performance, safety, and handling. As consumers seek more dynamic and engaging driving experiences, torque vectoring technology has emerged as a critical component. For instance, high-performance sports cars and luxury vehicles are increasingly incorporating torque vectoring systems to enhance cornering abilities and improve traction control.

Beyond the performance-oriented segment, the demand for torque vectoring is expanding across various vehicle segments. Electric vehicles (EVs) are particularly well-suited for torque vectoring, as electric motors can independently control torque distribution to each wheel. This enables precise handling and stability, especially in challenging road conditions. Additionally, the growing focus on vehicle safety has driven the adoption of torque vectoring systems, as they can help prevent accidents by optimizing traction and stability.

Drivers, Opportunities & Restraints

The torque vectoring market is enjoying robust growth, driven by several key factors. Firstly, advancements in automotive technology are making sophisticated systems like torque vectoring more achievable and cost-effective for a broader range of vehicles. This technology, which enhances vehicle handling and safety by distributing power to individual wheels as needed, is becoming a sought-after feature among consumers seeking improved performance and driving dynamics. Additionally, the global push towards electrification in the automotive sector acts as a catalyst for the torque vectoring market. Electric vehicles (EVs) inherently benefit from the ease of integrating torque vectoring systems, given their electric drivetrains and the necessity for enhanced traction control in varying conditions. Furthermore, the increasing consumer demand for all-wheel-drive (AWD) vehicles, which traditionally utilize torque vectoring systems to improve grip and cornering performance, is propelling market growth. Such trends, coupled with regulatory pushes for safer, more efficient vehicles, promote the widespread adoption of torque vectoring systems across the automotive industry.

The proliferation of torque vectoring systems presents significant opportunities in both the automotive and mobility sectors. One major opportunity lies within the burgeoning electric vehicle market. As more manufacturers enter this space, the demand for advanced drivetrain technologies that can enhance vehicle performance, safety, and energy efficiency is on the rise. Torque vectoring systems offer a compelling solution, particularly for performance-oriented EVs, where differentiation in handling and driving experience becomes a key competitive advantage. Additionally, the shift towards autonomous and connected vehicles opens up new avenues for integrating torque vectoring systems with advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communications, paving the way for more intelligent and responsive vehicle control mechanisms. Furthermore, there is a growing opportunity for aftermarket torque vectoring systems, driven by enthusiasts and the motorsports industry, seeking to retrofit or upgrade existing vehicles for enhanced performance and safety on the road and track.

Despite the opportunities, the torque vectoring market faces several challenges. One of the primary concerns is the high cost of development and integration of these systems, particularly for mass-market vehicles. The complexity of torque vectoring systems necessitates substantial research and development (R&D) investment, alongside sophisticated manufacturing and assembly processes. This could potentially increase the overall cost of vehicles, affecting their market competitiveness. Moreover, the added weight and complexity of torque vectoring systems can impact vehicle efficiency, a particularly pertinent issue for electric vehicles where range is a crucial selling point. Another hurdle is the regulatory landscape, which can vary significantly across different regions, affecting the standardization and adoption of torque vectoring technologies globally. Finally, there is a need for consumer education and trust in torque vectoring systems, as their benefits and operational nuances might not be immediately apparent to all drivers, potentially slowing down market acceptance.

Vehicle Type Insights

“The demand for passenger car vehicle type is expected to grow at a significant CAGR of 10.2% from 2024 to 2030 in terms of revenue”

The passenger car vehicle typesegment led the market and accounted for 60.6% of the global market revenue share in 2023. The torque vectoring market for passenger cars and light commercial vehicles has seen substantial growth in recent years, fueled by the increasing demand for improved vehicle safety, performance, and driving dynamics. The integration of torque vectoring systems enhances the driving experience by providing better traction, reducing understeer and oversteer, and improving vehicle stability during sharp turns and in varied driving conditions. This technology has become particularly relevant with the rise in popularity of electric and hybrid vehicles, as it allows for better distribution of power to the wheels, greatly enhancing efficiency and performance. The push towards autonomous driving and the need for advanced driver-assistance systems (ADAS) also contribute to the growth of this market, as torque vectoring plays a crucial role in the precise control and safety of these vehicles.

On the global scale, regions like Europe and Asia Pacific are leading in the demand for torque vectoring systems due to their stringent vehicle safety regulations, high adoption rate of electric vehicles, and the presence of key automotive players. Manufacturers are investing in research and development to innovate and integrate torque vectoring systems that are more efficient, cost-effective, and compatible with a wide range of vehicles. The light commercial vehicle segment, in particular, is witnessing increased interest in torque vectoring technologies to enhance load carrying capacity while maintaining safety and performance. As consumer awareness and regulatory pressures grow, the market is expected to continue its upward trajectory, playing a pivotal role in the evolution of safer, more efficient, and performance-oriented vehicles.

Propulsion Insights

“The demand for front wheel drive (FWD) propulsion is expected to grow at a significant CAGR of 10.5% from 2024 to 2030 in terms of revenue”

The AWD/4WD propulsionsegment led the market and accounted for 56.00% of the global revenue share in 2023. The demand in the AWD/4WD segment is driven by the technology's ability to provide superior handling, stability, and traction control across varied terrains and driving conditions. The capability of torque vectoring systems to distribute power not just between the front and rear axles but also across the wheels on the same axle significantly enhances off-road performance, making it indispensable for SUVs and off-road vehicles.

Furthermore, the push towards electrification in the automotive industry has further elevated the relevance of torque vectoring in AWD/4WD vehicles, as it aids in improving energy efficiency and performance of electric and hybrid models. The integration of torque vectoring technology in AWD/4WD vehicles is increasingly becoming a standard, driven by consumer expectations for higher safety, performance, and off-road capabilities, thereby stimulating the market demand.

In FWD vehicles, the application of torque vectoring primarily focuses on improving traction and reducing understeer by intelligently distributing power to the wheels, thereby enhancing the driving experience especially in slippery or cornering conditions. This is increasingly becoming a sought-after feature in the compact and mid-sized vehicle segments, where manufacturers aim to offer a competitive edge in terms of safety and performance. As a result, the market for torque vectoring in FWD vehicles is witnessing a steady growth, fueled by consumer demand for more dynamic and safer vehicles within these segments.

EV Type Insights

“The demand for HEV EV type is expected to grow at a significant CAGR of 10.3% from 2024 to 2030 in terms of revenue”

The BEV EV type segment led the market, accounting for 70.5% of the global market revenue share in 2023. The automotive industry's pivot towards electrification has significantly influenced the development and integration of advanced technologies such as torque vectoring. Hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs) represent two primary categories in the EV landscape, each with unique impacts on the torque vectoring market. BEVs, which rely solely on electric power, present a different value proposition for torque vectoring. Given their electric motor architecture, BEVs inherently enable more precise control over torque distribution across the wheels. This precision significantly benefits vehicle maneuverability and safety, essential factors for consumer acceptance and market growth. The torque vectoring in BEVs not only optimizes traction control but also enhances the driving experience by providing smoother acceleration and more responsive handling.

HEVs, which combine a conventional internal combustion engine with an electric propulsion system, benefit from torque vectoring by enhancing vehicle stability and handling. This synergy improves not only fuel efficiency but also the driving dynamics, making HEVs more attractive to consumers seeking a balance between environmental consciousness and performance.

Clutch Actuation Type Insights

“The demand for electronic clutch actuation type is expected to grow at a significant CAGR of 10.3% from 2024 to 2030 in terms of revenue”

The hydraulic clutch actuation type segment accounted for 55.5% of the global revenue share in 2023. The hydraulic and electronic torque vectoring market has seen significant growth in recent years, driven by the increasing demand for improved vehicle safety, stability, and performance. Torque vectoring technology, which allows for the distribution of torque to individual wheels, enhances a vehicle's handling capabilities, making it a key feature in both high-performance vehicles and electric vehicles (EVs). Hydraulic torque vectoring systems have been prevalent, especially in performance-oriented vehicles, due to their proven reliability and effectiveness in enhancing vehicle dynamics. However, the trend is shifting towards electronic systems due to their compatibility with electric drivetrains and the increasing push towards electrification in the automotive industry.

Electronic torque vectoring represents the cutting edge in this technology, offering greater precision and flexibility in torque distribution. This shift is driven by the growth in EVs and the need for advanced control systems to manage their power delivery. As vehicles become more connected and autonomous driving technologies advance, the integration of electronic torque vectoring systems becomes even more critical, offering manufacturers a way to differentiate their vehicles through improved safety and driving dynamics. The market is witnessing an influx of new developments and investments focusing on electronic systems, suggesting a future where electronic torque vectoring becomes a standard feature across various vehicle segments, further pushing the boundaries of vehicle performance and efficiency.

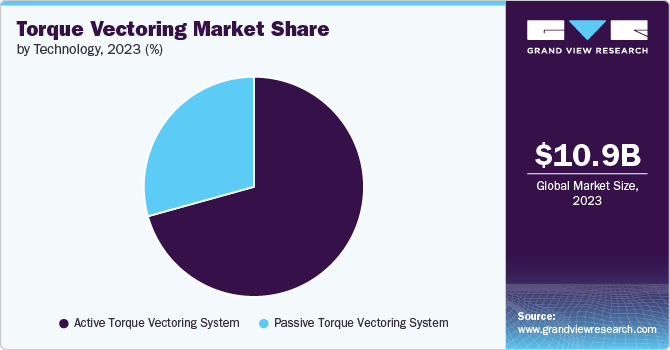

Technology Insights

“The demand for active torque vectoring system technology is expected to grow at a significant CAGR of 9.9% from 2024 to 2030 in terms of revenue”

The active torque vectoring system segment accounted for 70.5% of the global revenue share in 2023. Active torque vectoring systems have gained, particularly, notable traction in the market for their ability to dynamically adjust the power sent to individual wheels in real-time, thus improving traction, cornering, and overall performance of the vehicle, especially under diverse driving conditions. This system finds extensive application in high-performance and electric vehicles, reflecting the industry's pivot towards more responsive and safer driving experiences. The increasing consumer demand for vehicles that offer superior control and stability, along with the burgeoning electric vehicle (EV) market, is expected to spur further growth in the active torque vectoring sector, positioning it as a significant trend in automotive innovation.

On the other hand, passive torque vectoring systems, although less complex and costly compared to their active counterparts, continue to be relevant in the market due to their simplicity and efficacy in enhancing vehicle performance by distributing torque through the braking system or differential mechanics. This system is predominantly found in economy and mid-range vehicles, catering to consumers seeking improved vehicle dynamics at a lower cost. However, as the market shifts towards advanced mobility solutions and electrification, the demand for more sophisticated and adaptable systems like active torque vectoring is on an upswing. Consequently, while passive torque vectoring maintains its stance, especially in certain vehicle segments, the overarching market trend leans towards innovations that favor active systems, underlining the automotive industry's drive towards higher efficiency, safety, and performance standards.

Regional Insights

“India to witness fastest market growth at 11.5% CAGR from 2024 to 2030”

In the Asia Pacific, the torque vectoring market is witnessing a remarkable expansion, driven primarily by the burgeoning electric vehicle (EV) sector and the increasing consumer demand for high-performance vehicles. Countries such as China and Japan are at the forefront, with automotive manufacturers integrating advanced torque vectoring systems to elevate vehicle safety and enhance driving dynamics. This surge is also fueled by supportive government policies aimed at increasing EV adoption, positioning the Asia Pacific region as a pivotal market for torque vectoring technology innovations and adoptions.

India's torque vectoring market is poised for significant growth, with the automotive sector witnessing a shift towards electrification and advanced vehicle technology implementations. The rising consumer awareness regarding vehicle safety, coupled with the increasing demand for fuel-efficient vehicles, is driving the adoption of torque vectoring systems in the country. As India continues to establish itself as a manufacturing hub for automotive components, the market is expected to see substantial advancements, contributing to the overall growth of safer and more efficient vehicles in the region.

North America Torque Vectoring Market Trends

In North America, the torque vectoring market is thriving due to the high demand for SUVs, crossovers, and performance vehicles that benefit significantly from enhanced stability and control offered by torque vectoring systems. The United States and Canada are leading this demand, backed by an enthusiastic automotive culture and an increasing preference for technologically advanced and safe vehicles. Moreover, the growing emphasis on electric vehicles as part of the broader move towards sustainable transportation is expected to bolster the regional market growth.

Europe Torque Vectoring Market Trends

The growth of the torque vectoring market in Europe is propelled by a strong automotive industry foundation, characterized by the presence of leading luxury and sports car manufacturers. Europe's stringent emission standards, coupled with a keen focus on vehicle safety and performance, have made torque vectoring systems an essential feature in modern vehicles. The shift towards electric and hybrid vehicles further amplifies the demand for advanced torque vectoring technologies, making Europe a critical market for the development and implementation of these systems.

Key Torque Vectoring Company Insights

Some of the key players operating in the market include Schaeffler, ZF Friedrichshafen, Aisin, BorgWarner, and Valeo.

-

BorgWarner Inc. is a global leader in delivering innovative and sustainable mobility solutions for the vehicle market. Established in 1880, the company has profoundly evolved over the years, navigating through the changing landscapes of the automotive industry. BorgWarner's primary focus encompasses a vast array of powertrain solutions aimed at improving efficiency, emissions, and performance in vehicles. Its product portfolio includes technologies for combustion, hybrid, and electric vehicles, addressing the broad spectrum of the automotive sector's needs as it transitions towards a more sustainable future.

-

ZF Friedrichshafen is a global technology company that supplies systems for passenger cars, commercial vehicles, and industrial applications. The company specializes in driveline and chassis technology, offering a comprehensive portfolio of products including transmissions, axles, steering systems, and electric drive components. With a strong emphasis on research and development, ZF is committed to advancing mobility solutions and reducing emissions.

Magna International Inc. and Nexteer Automotive are some of the emerging market participants.

-

Magna International Inc. is a global automotive supplier headquartered in Aurora, Ontario, Canada. Founded in 1957, Magna stands as one of the largest companies in the automotive sector, providing a wide array of products and services to OEMs (Original Equipment Manufacturers) around the world. Its product lines encompass automotive systems, assemblies, modules, and components. The company dives deep into innovation with capabilities spanning from body exteriors and structures to power and vision technologies, as well as seating systems and complete vehicle solutions. Magna's commitment to innovation and its comprehensive product range allow it to meet the needs of virtually all aspects of the automotive manufacturing process. This, combined with its strategic locations in key automotive markets across the globe, enables Magna to maintain a significant role in the industry's shift towards electrification and smart mobility solutions.

-

Nexteer Automotive is a global leader in intuitive motion control, specializing in advanced steering and driveline systems. Headquartered in Auburn Hills, Michigan, USA, Nexteer stands out for its focus on electric and hydraulic power steering systems, steering columns, driveline systems, and advanced driver assistance systems (ADAS) and automated driving technologies. Founded over a century ago, the company has evolved into a critical player in the automotive industry's push towards more efficient, safe, and sustainable vehicles. With a strong emphasis on innovation and technology, Nexteer leverages its engineering expertise to serve a diverse range of customers from various segments of the automotive industry, including passenger cars, light trucks, and commercial vehicles. The company's global footprint, with facilities around the world, supports its vision of shaping the future of motion control by delivering robust solutions that enhance the driving experience while improving vehicle efficiency and safety.

Key Torque Vectoring Companies:

The following are the leading companies in the torque vectoring market. These companies collectively hold the largest market share and dictate industry trends.

- GKN Automotive

- BorgWarner Inc.

- ZF Friedrichshafen AG

- Continental AG

- Dana Incorporated

- Bosch Group

- Aisin Seiki Co., Ltd.

- Haldex AB

- Magna International Inc.

- Nexteer Automotive

- Porsche AG

- Audi AG

- General Motors (GM)

- Kia Motors Corporation

- Drako

Recent Developments

-

In May 2024, BorgWarner has reached a pivotal industry achievement with the introduction of its pioneering electric Torque Vectoring and Disconnect (eTVD) system for battery electric vehicles (BEVs), initially debuting in the Polestar. This innovative system is set to expand its presence by being adopted in models from another leading European automotive manufacturer later in the year.

Torque Vectoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.84 billion |

|

Revenue forecast in 2030 |

USD 21.02 billion |

|

Growth rate |

CAGR of 10.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle type, propulsion, EV type, clutch actuation type, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

GKN Automotive; BorgWarner Inc.; ZF Friedrichshafen AG; Continental AG; Dana Incorporated; Bosch Group; Aisin Seiki Co., Ltd.; Haldex AB; Magna International Inc.; Nexteer Automotive; Porsche AG; Audi AG; General Motors (GM) Kia Motors Corporation; Drako |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Torque Vectoring Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global torque vectoring market report based on vehicle type, propulsion, EV type, clutch actuation type, technology, and region:

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Car

-

Light Commercial Vehicle

-

-

Propulsion Outlook (Revenue, USD Billion, 2018 - 2030)

-

Front wheel drive (FWD)

-

Rear wheel drive (RWD)

-

All wheel drive/Four-wheel drive (4WD)

-

-

EV Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

BEV

-

HEV

-

-

Clutch Actuation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hydraulic

-

Electronic

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Active Torque Vectoring System

-

Passive Torque Vectoring System

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global torque vectoring market size was estimated at USD 10.89 billion in 2023 and is expected to reach USD 11.84 billion in 2024.

b. The global torque vectoring market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.0% from 2024 to 2030 to reach USD 21.02 billion by 2030.

b. The hydraulic clutch actuation type segment accounted for 55.5% of the global torque vectoring market revenue share in 2023. The hydraulic and electronic torque vectoring market has seen significant growth in recent years, driven by the increasing demand for improved vehicle safety, stability, and performance.

b. Some of the key players operating in the torque vectoring market include GKN Automotive, BorgWarner Inc., ZF Friedrichshafen AG, Continental AG, Dana Incorporated, Bosch Group, Aisin Seiki Co., Ltd., Haldex AB, Magna International Inc., Nexteer Automotive, Porsche AG, Audi AG, General Motors (GM), Kia Motors Corporation, Drako

b. The torque vectoring market is experiencing significant growth due to the increasing emphasis on vehicle performance, safety, and handling. As consumers seek more dynamic and engaging driving experiences, torque vectoring technology has emerged as a critical component. For instance, high-performance sports cars and luxury vehicles are increasingly incorporating torque vectoring systems to enhance cornering abilities and improve traction control.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."