- Home

- »

- Advanced Interior Materials

- »

-

Torque Converter Market Size, Share & Growth Report, 2030GVR Report cover

![Torque Converter Market Size, Share & Trends Report]()

Torque Converter Market Size, Share & Trends Analysis Report By Transmission Type (Automatic, CVT, DVT), By Component (Clutch Plate, Impeller), By Vehicle Type (Passenger Vehicle), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-416-8

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Torque Converter Market Size & Trends

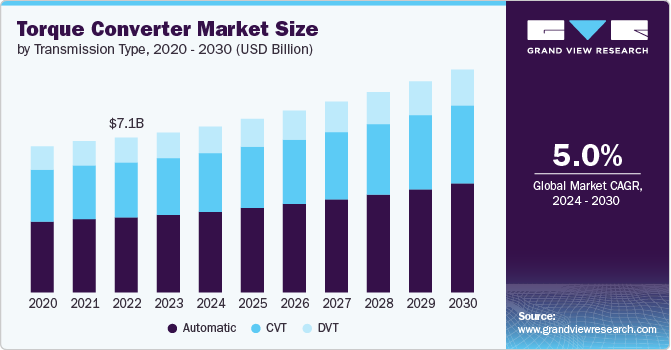

The global torque converter market size was estimated at USD 7.32 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. The market is experiencing robust growth driven by the surging demand for passenger and luxury vehicles globally. Advancements in torque converter technology, enhancing efficiency and performance, are further fueling market expansion. As consumers increasingly prefer the convenience of automatic transmissions, the demand for torque converters is expected to remain strong in the coming years, benefiting from the growing automotive industry.

According to the International Organization of Motor Vehicle Manufacturers 2023 report, there has been a notable increase in automotive production across Japan, South Korea, Thailand, Indonesia, and Malaysia. Specifically, production volumes in units rose from 8.1 million, 3.5 million, 1.4 million, 0.7 million, and 0.5 million in 2020 to 9.0 million, 4.2 million, 1.8 million, 1.4 million, and 0.8 million in 2023, respectively. In contrast, the automotive industry in Vietnam and the Philippines showed minimal growth in production volumes from 2020 to 2023. The rising automotive production in Asia Pacific is significantly driving the demand for torque converter in the region.

Torque converters play a pivotal role in enhancing the driving experience of both passenger and commercial vehicles by smoothly transferring the engine's power to the transmission. For instance, in passenger cars like the Toyota Camry or the Ford Escape, the torque converter allows for seamless acceleration from a stop and efficient power delivery during highway cruising, making drives more comfortable and engaging. In the realm of commercial vehicles, such as the Ford Transit or the Freightliner Cascadia, torque converters are essential for handling heavy loads and demanding work conditions, providing the necessary torque multiplication for improving fuel efficiency and reducing strain on the engine during start-up, towing, and uphill drives. These examples underscore the versatility and critical function of torque converters across various vehicle categories.

Drivers, Opportunities & Restraints

The market is propelled by the escalating demand for passenger and commercial vehicles, particularly in emerging economies. The growing preference for automatic transmissions due to their convenience and ease of operation further fuels market growth. Moreover, advancements in torque converter technology, such as lock-up clutches and improved efficiency, are expanding their application across various vehicle segments.

The primary challenge for the market is the increasing adoption of electric and hybrid vehicles, which utilize different powertrain systems. Additionally, stringent emission regulations and fuel efficiency standards are prompting automakers to explore alternative transmission technologies. Furthermore, the economic downturns can negatively impact vehicle sales, thereby affecting the demand for torque converters.

The market presents promising opportunities in the development of advanced torque converters with higher efficiency and lower emissions. Expanding into emerging markets with growing automotive industries can also yield substantial growth. Moreover, the integration of torque converters with hybrid and electric vehicle systems to enhance performance and efficiency could create new market avenues.

Transmission Type Insights

“The demand for automatic transmission type segment is expected to grow at a significant CAGR of 5.2% from 2024 to 2030 in terms of revenue”

The automatic transmission typesegment led the market and accounted for 48.5% of the global market revenue share in 2023. Torque converters are indispensable in automatic transmissions, contributing to their smooth operation and power delivery. The rising popularity of SUVs, crossovers, and luxury vehicles, often equipped with automatic transmissions, is driving the demand for torque converters.

While traditionally using pulleys and belts, recent advancements have integrated torque converters into some CVT systems to enhance low-speed torque and overall performance. As CVT technology matures and finds wider application in various vehicle segments, the demand for torque converters in this segment is expected to grow.

Component Insights

“The demand for damper component segment is expected to grow at a significant CAGR of 7.4% from 2024 to 2030 in terms of revenue”

The impeller componentsegment led the market and accounted for 38.5% of the global market revenue share in 2023. The market has seen significant advancements in impeller designs and materials. The trend is heavily skewed toward the use of lightweight, high-strength materials such as composites and advanced alloys. These materials not only reduce the overall weight of the torque converter, leading to improved fuel efficiency but also enhance the durability and performance under high-stress conditions. Moreover, there is a growing inclination toward optimizing the geometry of impeller blades through computational fluid dynamics (CFD) and other simulation tools. This shift aims at improving fluid dynamics within the torque converter, thus enhancing torque multiplication efficiency and reducing energy losses.

On the other hand, the development in the area of damper components focuses on improving the vibration isolation and enhancing the torque handling capabilities. The industry has been moving toward adaptive damper systems, which can adjust their stiffness and damping properties in real-time based on driving conditions. This adaptability provides a smoother driving experience, particularly in vehicles equipped with automatic transmissions where seamless gear shifts are critical. Furthermore, there's an emphasis on making these damper systems more compact and lightweight, without compromising on their performance. This is achieved through the integration of advanced materials and innovative design approaches, including the use of multi-stage damping systems that can more effectively manage the wide range of torque fluctuations encountered during vehicle operation.

Vehicle Type Insights

“The demand for passenger vehicle type segment is expected to grow at a significant CAGR of 5.2% from 2024 to 2030 in terms of revenue”

The passenger vehicle type segment led the market, accounting for 70.5% of the global market revenue share in 2023. In passenger vehicles, such as sedans, SUVs, and hatchbacks, torque converters are highly valued for their ability to smoothly transition engine power to the transmission, enhancing the driving experience with seamless acceleration. Major automobile manufacturers such as Toyota and Ford integrate advanced torque converters in their automatic transmission models to improve fuel efficiency and performance. These components are crucial for meeting consumer expectations for comfort, reliability, and efficiency in daily commuting and personal transport.

Moreover in commercial vehicles, including trucks, buses, and heavy-duty equipment, the demand for torque converters is primarily driven by the need for durability, torque multiplication, and efficient power transfer under heavy-load conditions. Companies such as Volvo and Caterpillar employ robust torque converters in their commercial and construction vehicles to ensure reliability and performance in demanding work environments. These torque converters are engineered to withstand the rigors of prolonged use and variable load conditions, making them indispensable in sectors that require high torque and power for hauling, lifting, and moving heavy materials.

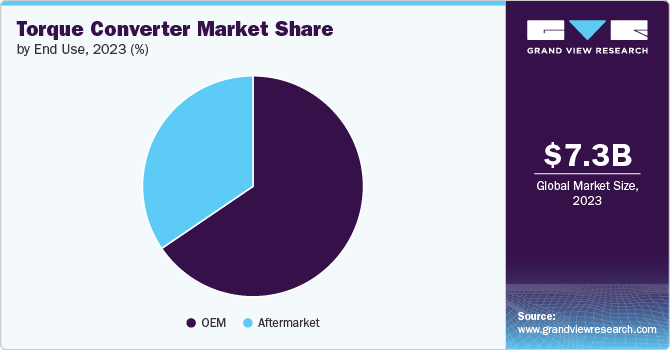

End Use Insights

“The demand for aftermarket end use segment is expected to grow at a significant CAGR of 5.3% from 2024 to 2030 in terms of revenue”

The OEM end use segment accounted for 65.5% of the global torque converter market revenue share in 2023. In the OEM sector, there is an increasing demand driven by the production of vehicles, particularly automatic transmission vehicles, where torque converters are indispensable. Manufacturers are focusing on innovation, such as developing converters that offer better fuel efficiency and higher performance, to meet the stringent emission norms and consumer demands. This gear toward innovation, coupled with the rise in vehicle production rates, especially in emerging economies, significantly fosters the growth of the torque converter market within the OEM segment.

Moreover, the aftermarket segment presents a somewhat different trend. The demand is primarily fueled by the need for replacement and upgrade torque converters in aging vehicles. As vehicles exceed their service life, the wear and tear on components like torque converters necessitate their replacement, driving the aftermarket sales. Additionally, there is a notable trend toward aftermarket products that offer enhancements over OEM specifications, including better torque capacity and efficiency, catering to the enthusiasts' market or those looking to improve their vehicle's performance. Thus, while the OEM market thrives on production and innovation, the aftermarket segment grows through replacement demand and performance upgrades, indicating a healthy and dynamic scenario for the torque converter market across both sectors.

Regional Insights

North America torque converter market is mature, characterized by a strong presence of established automakers and a well-developed supply chain. While the region has witnessed a shift toward fuel-efficient vehicles, including hybrids and electrics, the demand for torque converters remains steady due to the continued popularity of traditional internal combustion engine vehicles, especially in segments like SUVs and trucks. Technological advancements focused on improving efficiency and performance are key trends in this market.

Asia Pacific Torque Converter Market Trends

“India to witness the fastest market growth at 6.4% CAGR”

The torque converter market in Asia Pacific has seen remarkable growth, attributed largely to the booming automotive sector and the increasing adoption of automatic transmission systems in vehicles. This market benefits significantly from the rising middle-class population, coupled with growing disposable incomes, which boosts the demand for passenger vehicles equipped with automatic transmissions.

India torque converter market is estimated to grow at a significant CAGR of 6.4% over the forecast period. India's burgeoning automotive sector is a key driver for the torque converter market. The country's robust GDP growth and rising disposable incomes are fueling vehicle demand. With India emerging as a global manufacturing hub, automotive production is surging, reaching 284.3 million units in FY24 from 263.5 million units in 2020 according to the Society of Indian Automobile Manufacturers. This surge directly translates to heightened demand for torque converters, as automatic transmissions gain popularity across passenger and commercial vehicle segments.

Europe Torque Converter Market Trends

The torque converter market in Europe is characterized by a strong emphasis on luxury and performance vehicles. The region has been at the forefront of automotive technology, with a focus on downsizing engines and improving fuel efficiency. While there is a growing inclination toward electrification, the demand for torque converters persists in high-performance and premium segments. Additionally, stringent emission norms have spurred the development of advanced torque converter technologies to meet regulatory requirements.

Key Torque Converter Company Insights

Some of the key players operating in the market include Schaeffler, ZF Friedrichshafen, Aisin, BorgWarner, and Valeo, among others.

-

Schaeffler is a globally operating automotive and industrial supplier. The company is a leading manufacturer of components and systems for engine, transmission, and chassis applications. Known for its innovative technologies, Schaeffler offers a wide range of products, including bearings, clutches, dampers, and electric drives. With a strong focus on sustainability and efficiency, Schaeffler plays a crucial role in shaping the future of mobility.

-

ZF Friedrichshafen is a global technology company that supplies systems for passenger cars, commercial vehicles, and industrial applications. The company specializes in driveline and chassis technology, offering a comprehensive portfolio of products including transmissions, axles, steering systems, and electric drive components. With a strong emphasis on research and development, ZF is committed to advancing mobility solutions and reducing emissions.

Exedy Corporation and Jatco Ltd. are some of the emerging market participants in the torque converter market.

-

Exedy is a global automotive components manufacturer specializing in clutch systems, torque converters, and other drivetrain components. With a strong focus on quality and innovation, Exedy serves a wide range of customers, including OEMs and aftermarket suppliers. The company operates globally with a presence in multiple countries, catering to the diverse needs of the automotive industry.

-

Jatco is a leading automotive transmission manufacturer renowned for its expertise in automatic transmissions, particularly continuously variable transmissions (CVTs). As a major supplier to global automakers, Jatco offers a comprehensive range of transmission solutions, including conventional automatic transmissions and hybrid transmission systems. The company's focus on technological advancements and fuel efficiency has positioned it as a key player in the evolving automotive landscape.

Key Torque Converter Companies:

The following are the leading companies in the torque converter market. These companies collectively hold the largest market share and dictate industry trends.

- Schaeffler

- ZF Friedrichshafen

- Aisin

- BorgWarner

- Valeo

- Exedy Corporation

- Jatco Ltd.

- Precision Industries

- Sonnax Transmission Company

- Continental AG

- Delphi Technologies

- Isuzu Motors Ltd.

- Subaru Corporation

- Transtar Industries

- Voith GmbH & Co. KG

Recent Developments

-

In May 2024, Schaeffler introduced the LuK TorCon 6L80 torque converter, committing a lifespan up to five times longer than rebuilt alternatives. Unlike remanufactured options that require time-consuming sourcing and matching of specific cores, the new torque converter simplifies the installation process by needing only a basic transmission match. This streamlined approach saves customers both time and effort.

Torque Converter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.59 billion

Revenue forecast in 2030

USD 10.20 billion

Growth Rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Transmission type, component, vehicle type, end use and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Schaeffler, ZF Friedrichshafen, Aisin, BorgWarner, Valeo, Exedy Corporation, Jatco Ltd., Precision Industries, Sonnax Transmission Company, Continental AG, Delphi Technologies, Isuzu Motors Ltd., Subaru Corporation, Transtar Industries,

Voith GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Torque Converter Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global torque converter market report on the basis of transmission type, component, vehicle type, and region:

-

Transmission Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automatic

-

CVT

-

DVT

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clutch plate

-

Damper

-

Impeller

-

Turbine

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aftermarket

-

OEM

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global torque converter market size was estimated at USD 7.32 billion in 2023 and is expected to reach USD 7.59 billion in 2024.

b. The global torque converter market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 10.20 billion by 2030.

b. The OEM end use segment accounted for 65.5% of the global torque converter market revenue share in 2023. In the OEM sector, there is an increasing demand driven by the production of vehicles, particularly automatic transmission vehicles, where torque converters are indispensable.

b. Some of the key players operating in the torque converter market include Schaeffler, ZF Friedrichshafen, Aisin, BorgWarner, Valeo, Exedy Corporation, Jatco Ltd., Precision Industries, Sonnax Transmission Company, Continental AG, Delphi Technologies, Isuzu Motors Ltd., Subaru Corporation, Transtar Industries, Voith GmbH & Co. KG.

b. The torque converter market is experiencing robust growth driven by the surging demand for passenger and luxury vehicles globally. Advancements in torque converter technology, enhancing efficiency and performance, are further fueling market expansion. As consumers increasingly prefer the convenience of automatic transmissions, the demand for torque converters is expected to remain strong in the coming years, benefiting from the growing automotive industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."