- Home

- »

- Medical Devices

- »

-

Topical Wound Agents Market Size, Industry Report, 2030GVR Report cover

![Topical Wound Agents Market Size, Share & Trends Report]()

Topical Wound Agents Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Creams, Gels, Sprays), By Application (Chronic Wounds, Acute Wounds), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-889-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Topical Wound Agents Market Summary

The global topical wound agents market size was estimated at USD 1.78 billion in 2024 and is projected to reach USD 2.84 billion by 2030, growing at a CAGR of 7.74% from 2025 to 2030. The growing prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is propelling the market for topical wound treatments.

Key Market Trends & Insights

- The North America held the largest revenue share of more than 45.47% in the market in 2024.

- The U.S. is expected to dominate the North American market over the forecast period.

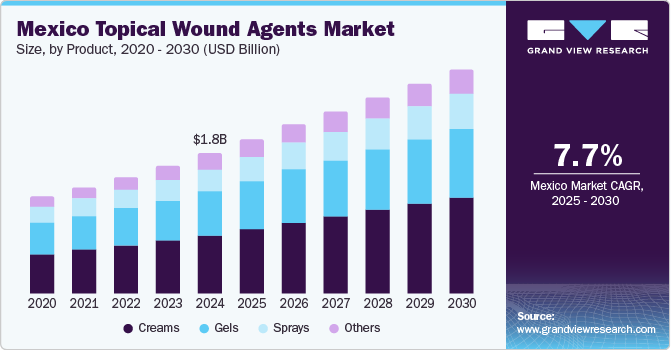

- Based on product, the creams segment held the largest market share, 42.15%, in 2024.

- Based on application, the acute wounds segment held the largest share in 2024.

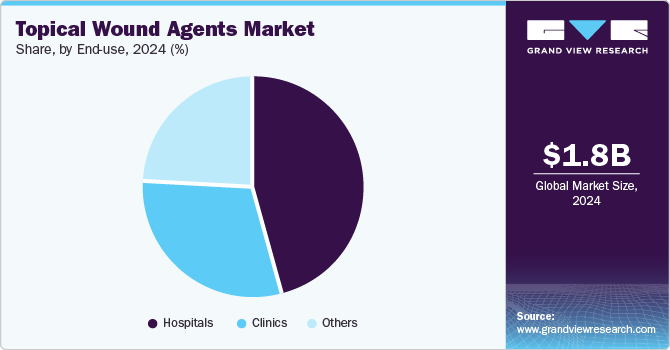

- Based on end-use, the hospitals segment held the largest share of 46.34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.78 Billion

- 2030 Projected Market Size: USD 2.84 Billion

- CAGR (2025-2030): 7.74%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

An aging global population, which is more susceptible to chronic wounds, is also driving market expansion. In addition, the increase in diabetes cases, advancements in wound care technology, and a heightened focus on infection control are all key factors contributing to this growth. According to data released by the WHO in November 2024, over 800 million adults worldwide are now living with diabetes.

As reported by the CDC in May 2024, roughly 38 million people in the U.S. are living with diabetes. In addition, the International Diabetes Federation indicated that in 2021, approximately 10.7% of the population aged 20 to 79 had diabetes, with projections suggesting an increase to 12.1% by 2030 and 12.9% by 2045. Chronic conditions such as diabetes often lead to long-term complications, including chronic wounds such as diabetic foot ulcers. These conditions can be effectively managed with topical wound agents, highlighting a significant opportunity within the market.

The increasing incidence of chronic and acute wounds, along with the launch of advanced wound care products, is expected to boost the market for topical wound agents over the forecast period. For instance, a study published by the American Medical Association in November 2023 indicates that approximately 33.33% of people with diabetes will experience a foot ulcer at some point in their lives. In the U.S., diabetic foot ulcers affect around 1.6 million individuals annually.

Moreover, the rising prevalence of chronic diseases and the related increase in surgical interventions are expected to drive market growth. A study published by the JAMA Network in November 2024 projects that the total number of cancer cases will rise to 35.3 million by 2050, marking a 76.6% increase from the 2022 estimate of 20 million. Topical wound treatments are increasingly utilized to prevent surgical site infections. After cancer surgeries, many surgical wounds tend to be deeper and larger, producing exudates that necessitate regular care. Enzyme-based formulations are particularly effective in managing these larger wounds, significantly reducing the risk of infection. Therefore, the growing prevalence of chronic conditions and surgical site infections is anticipated to boost the demand for topical wound agents, driving industry expansion.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The topical wound agents market is characterized by growth owing to the rising number of surgical procedures , increasing prevalence of chronic wounds, along with advancements in topical wound agents.

Industry stakeholders and researchers are increasingly dedicated to creating innovative, advanced topical wound agents. For instance, in February 2023, SERDA Therapeutics submitted an Investigational New Drug Application to the U.S. FDA for its flagship product, SN514 hydrogel. This advanced enzymatic wound debriding agent represents a significant advancement in wound care. Such developments are expected to stimulate further innovation within the topical wound agents industry.

Regulatory bodies such as the Food and Drug Administration (FDA), the European Union, Health Canada, and others play a crucial role in overseeing the regulations governing medical devices, including topical wound agents. These authorities are responsible for the authorization, clinical trials, and marketing of such products. For instance, in December 2023, the FDA approved Filsuvez (birch triterpenes) topical gel, intended for treating partial thickness wounds in patients 6 months and older suffering from junctional and dystrophic epidermolysis bullosa.

Several industry players operating in the topical wound agents industry are undergoing mergers and acquisitions to strengthen their industry position and expand their product portfolio. Industry players such as Mölnlycke Health Care AB have adopted this strategy to acquire manufacturers of topical wound agents such as topical oxygen therapy spray.

Companies in the topical wound agents industry are undertaking provincial expansion to capture emerging opportunities and enhance market presence. This strategy aims to increase customer bases, build brand loyalty, and improve access to products while responding effectively to regional healthcare needs.

Product Insights

The creams segment held the largest market share, 42.15%, in 2024 and is expected to grow fastest during the forecast period. Topical creams are used in burns and chronic injuries as they enable rapid healing and reduce the risk of further complications. The increasing incidences of burns and chronic injuries are anticipated to propel the segment's growth.

The gels segment is expected to grow significantly over the forecast period. Topical gels are popularly used in burns and surgical bruises. These gels contain hydrogel, which allows rapid cooling of wounds and helps relieve pain. Topical gels also provide adequate moisture to wounds and offer potential resistance against contamination.

Application Insights

The acute wounds segment held the largest share in 2024. This segment includes surgical & traumatic wounds and burns. The increasing number of surgical procedures and associated wounds are anticipated to support the segment's growth in the coming years. In addition, the large patient population suffering from burns is projected to propel the segment growth over the forecast period. According to the data published by Rosenfeld Injury Lawyers LLC, around 600,000 burn injuries occur each year in the U.S.

The chronic wounds segment is projected to experience the fastest growth, with a compound annual growth rate (CAGR) of 7.9% during the forecast period. Chronic wounds are expected to remain a major clinical, social, and economic challenge due to the increasing aging population, the persistent global issues of diabetes and obesity, and current infection concerns. According to the "Human Wound and Its Burden: Updated 2022 Compendium of Estimates" report, chronic wounds impact 10.5 million Medicare beneficiaries in the U.S.

End-use Insights

The hospitals segment held the largest share of 46.34% in 2024 and it is anticipated to witness the fastest growth in the coming years. This growth is driven by the increasing need to treat both acute and chronic injuries and the rising prevalence of diabetic foot ulcers and venous leg ulcers. Key factors contributing to this growth include higher hospitalization rates due to increased trauma cases and the development of hospitals with advanced facilities and treatment methods. In addition, supportive policies and increased funding for developing hospitals and clinics are expected to further strengthen this segment's growth.

The clinics segment is expected to witness significant growth over the forecast period. An increasing number of clinics and rising surgical procedures are major factors contributing to the segment’s growth over the forecast period. Moreover, increasing cases of surgical wounds are among the major driving factors for the strong segment demand. Wound management after surgeries is essential, resulting in a growing demand for topical wound agents among clinics and patients.

Regional Insights

North America held the largest revenue share of more than 45.47% in the market in 2024. The increasing incidence of burns, a growing prevalence of chronic diseases, and the presence of several key players are expected to drive market growth in the region. In addition, as the older population continues to expand, the incidence of chronic wounds is anticipated to rise. According to data from the Population Reference Bureau published in January 2024, the number of individuals aged 65 and older in the U.S. is projected to grow from 58 million in 2022 to 82 million by 2050, representing a 47% increase.

U.S. Topical Wound Agents Market Trends

The topical wound agents market in the U.S. is expected to dominate the North American market over the forecast period due to the presence of key players and the increasing launches of products. Furthermore, the rising approvals for topical wound agents from the U.S. regulatory authority and growing investment in the wound care industry are expected to boost the country's market growth.

Europe Topical Wound Agents Market Trends

The European topical wound agents market is expected to grow substantially in the coming years, fueled by increased surgical procedures, a rising incidence of trauma cases, and the growing burden of chronic wounds. In addition, the rising aging population is anticipated to drive market expansion further. According to data from Eurostat published in February 2024, the estimated EU population reached 448.8 million as of January 2023, with more than one-fifth (21.3%) aged 65 and older.

The topical wound agents market in the UK is projected to grow significantly during the forecast period. The increasing incidence of chronic wounds, particularly among patients with diabetes and vascular diseases, leads to a higher demand for effective wound care solutions. Moreover, a rise in elective and emergency surgical procedures is expected to boost the demand for topical wound agents in the coming years.

The topical wound agents market in France is projected to grow during the forecast period, driven by a rising number of surgical procedures and an increasing prevalence of chronic wounds. In addition, the growing incidence of chronic diseases is anticipated to boost market growth further. According to the IDF Diabetes Atlas, the age-adjusted prevalence of diabetes among individuals aged 20 to 79 in France is projected to rise from 5.3% in 2021 to 6.0% in 2030 and 6.5% in 2045.

Asia Pacific Topical Wound Agents Market Trends

The Asia Pacific region is anticipated to witness the highest CAGR of 8.4% during the forecast period. The presence of developing countries such as China, India, and Japan is anticipated to boost market growth in this region. Also, increasing cases of chronic diseases, especially diabetes, are expected to surge the growth of the Asia Pacific market over the forecast period.

China's topical wound agents market is expected to grow throughout the forecast period. The market is driven by a growing aging population, increasing chronic disease prevalence, rising surgical procedures, and advancements in wound care technology. In addition, government healthcare initiatives are anticipated to support the market growth.

Japan's topical wound agents market is anticipated to grow significantly during the forecast period, fueled by several key factors. These include a rise in surgical procedures nationwide and an increasing prevalence of chronic conditions resulting in chronic wounds. Also, the growing aging population is expected to drive demand for topical wound agents. According to data published by the World Economic Forum in October 2023, more than 1 in 10 people in Japan are now aged 80 or older.

Middle East and Africa Topical Wound Agents Market Trends

The topical wound agents market in the Middle East and Africa is projected to experience significant growth in the coming years, driven by an increasing healthcare investment and a rising prevalence of chronic wounds and diabetes. Growing surgical procedures and heightened wound care awareness also contribute to market expansion.

The topical wound agents market in Saudi Arabia is anticipated to grow over the forecast period. This is due to the rising prevalence of chronic wounds, mainly due to diabetes. Moreover, government investments in healthcare infrastructure enhance access to advanced wound care solutions, supporting market growth.

The topical wound agents market in Kuwait is expected to grow over the forecast period due to the growing prevalence of chronic wounds, especially among diabetic patients. In addition, increased surgical procedures contribute to the demand for effective wound care.

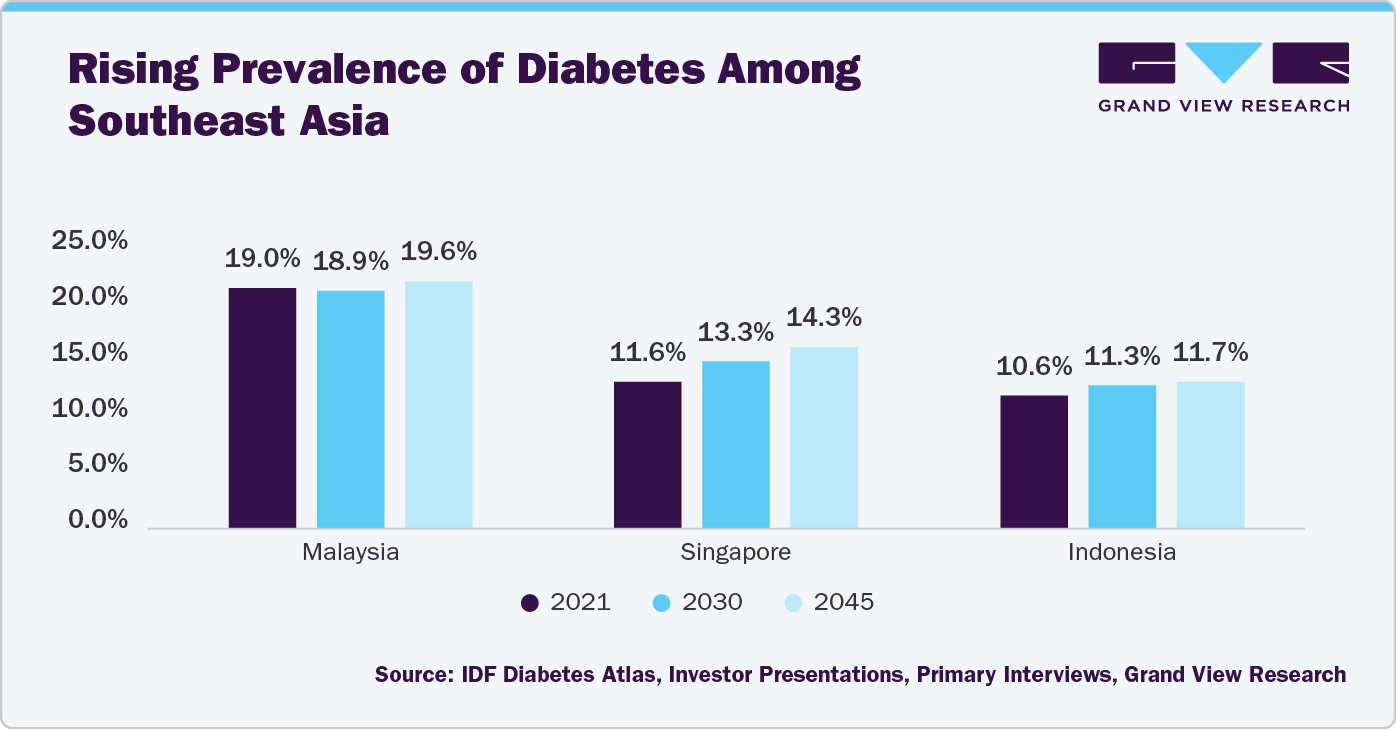

Rising Prevalence of Diabetes Among Southeast Asia

The estimated age-adjusted prevalence of diabetes among individuals aged 20-79 years is illustrated in the graph below:

The rising prevalence of diabetes in Southeast Asia represents a significant driver for the topical wound agents market. As the diabetic population increases, the incidence of complications, particularly chronic wounds such as diabetic foot ulcers, also rises. These conditions necessitate specialized care and advanced treatment solutions to prevent infections and facilitate healing.

This growing diabetic population significantly enhances the demand for effective topical wound agents tailored to manage these complications. Due to the increasing need for effective wound care solutions in the region, companies looking to enter this market have a substantial opportunity to capitalize on this opportunity and expand their presence in Southeast Asia.

Key Topical Wound Agents Company Insights

Smith+Nephew, Mölnlycke Health Care AB, Teva Pharmaceutical Industries Ltd, Arch Therapeutics, Inc., Viatris Inc., Ipca Laboratories Ltd., and Chiesi USA are some of the major players in the topical wound agents market. Organizations are expanding their product portfolios to gain a competitive advantage in the coming years. Moreover, industry players are also focusing on gaining regulatory approvals to strengthen their market position.

Key Topical Wound Agents Companies:

The following are the leading companies in the topical wound agents market. These companies collectively hold the largest market share and dictate industry trends.

- Smith+Nephew

- Mölnlycke Health Care AB

- Teva Pharmaceutical Industries Ltd

- Arch Therapeutics, Inc.

- Viatris Inc

- Ipca Laboratories Ltd.

- Chiesi USA

- SERDA Therapeutics

Recent Developments

-

In August 2024, Ipca Laboratories introduced Diulcus, a topical gel specifically designed for diabetic foot ulcers (DFU) in India. The product is distributed through a network of over 4,000 distributors, which is expected to enhance the accessibility of topical wound agents in the market.

-

In June 2024, SERDA Therapeutics, a biopharmaceutical company dedicated to developing enhanced treatments for chronic wounds and burns, announced the start of its first Phase 1 human clinical trial for SN514 hydrogel. This novel enzymatic wound debriding agent is being tested in healthy adult volunteers.

Topical Wound Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.96 billion

Revenue forecast in 2030

USD 2.84 billion

Growth rate

CAGR of 7.74% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith+Nephew; Mölnlycke Health Care AB; Teva Pharmaceutical Industries Ltd; Arch Therapeutics; Inc.; Viatris Inc.; Ipca Laboratories Ltd.; SERDA Therapeutics; Chiesi USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Topical Wound Agents Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global topical wound agents market on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Creams

-

Gels

-

Sprays

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Others

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global topical wound agents market size was estimated at USD 1.78 billion in 2024 and is expected to reach USD 1.96 billion in 2025.

b. The global topical wound agents market is expected to grow at a compound annual growth rate of 7.74% from 2025 to 2030 to reach USD 2.84 billion by 2030.

b. North America dominated the topical wound agents market in 2024 with a market share of 45.47% owing to the increasing cases of burns, rising prevalence of chronic diseases, and the presence of several key players in the region.

b. Some key players operating in the topical wound agents market include Smith+Nephew, Mölnlycke Health Care AB, Teva Pharmaceutical Industries Ltd, Arch Therapeutics, Inc., Viatris Inc., Ipca Laboratories Ltd., and Chiesi USA.

b. Key factors that are driving the topical wound agents market growth include technological advancement, increasing prevalence of chronic diseases, rising number of surgical procedures, and rising geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.