Topical Drugs Market Size, Share & Trends Analysis Report By Route Of Administration (Dermal, Ophthalmic, Rectal, Vaginal, Nasal), By Type (Semi-solid, Transdermal), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-959-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Topical Drugs Market Size & Trends

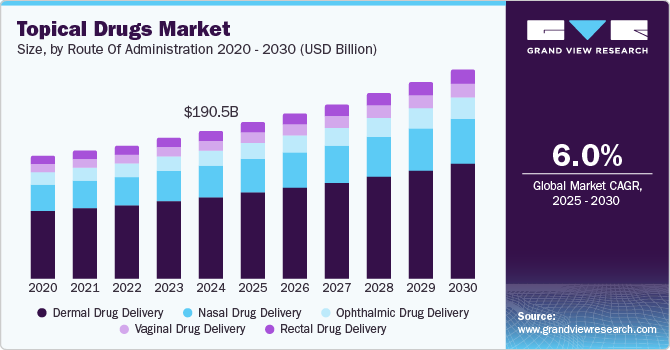

The global topical drugs market size was estimated at USD 190.5 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. The market growth is increasingly influenced by the rising prevalence of skin conditions and chronic diseases globally. According to the American Academy of Dermatology Association, skin issues such as acne, along with eczema and psoriasis, affect approximately 50 million individuals in the U.S. annually.

In India, surveys indicate that 41.7 per 1,000 people suffer from skin complaints, with allergies being the most common. Similarly, about 20% of adults in Germany experience chronic dermatological conditions, while in Saudi Arabia, 34% of respondents report diverse skin issues. This widespread incidence of skin disorders has catalyzed a growing demand for effective topical treatments, further invigorating the market.

The increasing prevalence of diabetes also amplifies the need for topical solutions, particularly for managing skin complications associated with the disease. The International Diabetes Federation has forecasted that an estimated 643 million individuals worldwide are projected to have diabetes by 2030, highlighting the urgency for innovative management strategies. In markets such as Mexico, around 12 million people currently live with diabetes, necessitating effective dermatological care. As diabetes management becomes a critical public health concern, the demand for topical treatments that address conditions such as neuropathic pain and foot ulcers is set to grow, influencing the diabetes management market significantly.

Technological advancements in drug delivery systems are revolutionizing treatment efficacy and enhancing patient compliance in the topical drugs market. Innovations, including transdermal patches and nanotechnology, facilitate improved skin permeation and controlled drug release. The increasing consumer preference for non-invasive aesthetic treatments further supports this trend, with over 60% of patients in North America favoring topical therapies for their ease of use. This preference is echoed in emerging markets such as China and India, where healthcare reforms are streamlining access to innovative treatments, supporting the growth of the compounded topical drugs market that offers tailored formulations for diverse patient needs.

Regulatory reforms in India and China are crucial in bolstering the market landscape for topical drugs. For instance, in India, proposed amendments to the Drugs Rules, 1945, in July 2024 seek to enhance drug transparency and safety, while a recent waiver on clinical trials for specific drug categories expedites the introduction of innovative therapies. Likewise, China’s healthcare reforms, propelled by the National Healthcare Security Administration, allow for faster drug approvals and expanded health insurance coverage, enhancing access to essential medications. These initiatives are instrumental in ensuring that populations in both countries have access to advanced topical solutions for treating various skin disorders, thereby fueling the overall expansion of the topical drugs market.

Route Of Administration Insights

Dermal drug delivery dominated the market and accounted for a share of 54.1% in 2024, fueled by its capacity to offer targeted treatment, user-friendly application, and improved patient compliance. Patients increasingly favor non-invasive topical solutions over injections, contributing to the heightened adoption of these therapies for the effective management of skin disorders.

Ophthalmic drug delivery is expected to grow lucratively over the forecast period, owing to the growing prevalence of eye disorders, including glaucoma and age-related macular degeneration. Furthermore, advancements in drug delivery technologies improve therapeutic efficacy while reducing systemic side effects, rendering these treatments more attractive to patients. For instance, in April 2024, Eyenovia provided updates on Mydcombi and Clobetasol Propionate, reporting positive Phase IV results highlighting efficacy and tolerability, positioning these innovations favorably for topical ophthalmic drugs.

Type Insights

Semi-solid formulations led the market with a revenue share of 61.9% in 2024 due to their versatility, ease of use, and effectiveness in delivering active ingredients directly to the skin. Formulations such as creams, gels, and ointments improve patient compliance and offer targeted treatment for various dermatological conditions.

Liquid formulations are expected to register significant growth over the forecast period. Liquid formulations, including solutions and suspensions, facilitate precise dosing and rapid skin absorption. Their non-invasive characteristics enhance patient compliance, making them highly effective for treating various dermatological conditions. Furthermore, advancements in formulation technologies improve product stability and efficacy.

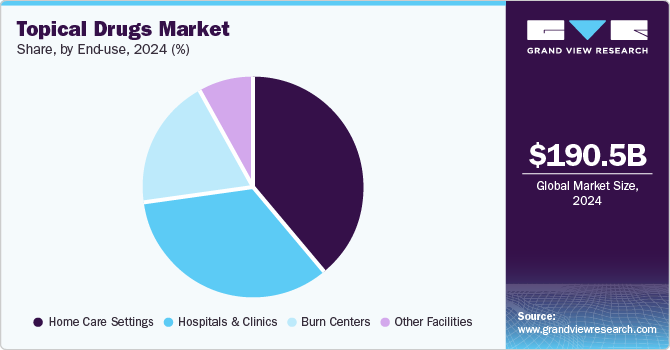

End Use Insights

Hospitals & clinics held the largest revenue share of 38.9% in 2024, driven by the growing prevalence of skin disorders and chronic diseases necessitating professional intervention. These facilities offer specialized care, ensuring effective management of conditions through advanced topical therapies, which cultivates patient trust and promotes adherence to prescribed treatment regimens.

Burn centers are projected to experience rapid growth over the forecast period. Burn centers are increasingly utilizing a diverse array of topical medications to enhance wound management and scar healing, as tailored treatments are essential for effective care. This trend is driven by advancements in burn care practices and an increased awareness of the significance of effective topical therapies in managing complex burn cases.

Regional Insights

North America topical drugs market dominated the global market in 2024, driven by a high prevalence of skin disorders, advanced healthcare infrastructure, and robust investments in research and development. The presence of major pharmaceutical companies and a strong consumer emphasis on skincare bolster the region’s growth potential.

U.S. Topical Drugs Market Trends

The topical drugs market in the U.S. dominated North America with the largest revenue share in 2024. The U.S. boasts a sophisticated pharmaceutical industry, cutting-edge drug delivery technologies, and substantial healthcare expenditure. The presence of leading manufacturers and contract development organizations promotes research and development, while strong consumer demand for effective topical treatments stimulates market growth for a range of dermatological products.

Europe Topical Drugs Market Trends

Europe topical drugs market held a substantial market share in 2024, aided by heightened awareness of skin health, increasing dermatological conditions, and a rising demand for advanced therapies. For instance, in November 2024, Dupixent received EU approval as the first medicine for young children with eosinophilic esophagitis. Strong regulatory frameworks and a focus on innovation in drug formulations further enhance the region’s competitive edge in the global market.

The topical drugs market in Germany is expected to grow over the forecast period, supported by its robust healthcare system, substantial investments in pharmaceutical research and development, and a large patient population suffering from chronic skin conditions. In October 2024, Germany became the first country to launch LEO Pharma’s Anzupgo (delgocitinib) cream, specifically indicated for adults with moderate to severe Chronic Hand Eczema, following European Commission approval. The nation’s strong emphasis on quality control and regulatory compliance bolsters consumer trust and stimulates demand for effective topical therapies.

Asia Pacific Topical Drugs Market Trends

Asia Pacific topical drugs market is expected to register the fastest CAGR of 7.2% over the forecast period, driven by rising healthcare expenditures, a higher prevalence of skin disorders, and enhanced awareness of dermatological health. Moreover, rapid urbanization, improving healthcare infrastructure, and a growing middle-class population are further boosting demand for effective topical treatments in the region.

The topical drugs market in India is expected to register the fastest growth in the Asia Pacific market over the forecast period. India’s topical drugs market is experiencing significant growth, driven by its vast population suffering from skin diseases, improved healthcare accessibility, and rising disposable incomes. The government’s emphasis on enhancing healthcare infrastructure and regulatory reforms that expedite drug approvals present substantial opportunities for topical therapies. For instance, in November 2024, Clariant unveiled eight high-performing excipients at CPHI India 2024, thereby advancing its portfolio for effective pharmaceutical formulations.

Key Topical Drugs Company Insights

Some key companies operating in the market include Bayer AG, Cipla, GSK plc, Johnson & Johnson Services, Inc., and Novartis AG. The market is distinguished by notable innovation and strategic partnerships, with companies investing in advanced formulation technologies and personalized medicine to enhance product offerings and expand their geographical reach.

-

Bayer AG’s consumer health division provides diverse topical products for pain relief, skincare, and wound healing, prioritizing innovative formulations that enhance patient compliance and effectively address various dermatological conditions.

-

Bausch Health Companies Inc. focuses on topical pharmaceuticals in dermatology and ophthalmology. It offers both prescription and over-the-counter products for conditions such as acne and psoriasis, emphasizing innovation and efficacy in topical drug delivery solutions.

Key Topical Drugs Companies:

The following are the leading companies in the topical drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Cipla

- GSK plc

- Johnson & Johnson Services, Inc.

- Novartis AG

- Bausch Health Companies Inc.

- Hisamitsu Pharmaceuticals Co., Inc.

- Merck KGaA

- GLENMARK PHARMACEUTICALS LTD.

- MedPharm Ltd.

View a comprehensive list of companies in the Topical Drugs Market

Recent Developments

-

In September 2024, Mankind Pharma entered the topical analgesic market with the launch of Nimulid Strong, featuring a unique 2X diclofenac formulation aimed at alleviating neck pain and enhancing consumer flexibility with gel and spray options.

-

In April 2024, Cipla Health Limited acquired Ivia Beaute Private Limited’s cosmetics and personal care distribution business, enhancing its portfolio with established brands and strengthening its position in India’s growing beauty market.

-

In April 2024, Bausch Health announced public drug plan listings for PrUCERIS aerosol foam in five Canadian provinces, improving access for ulcerative colitis patients.

Topical Drugs Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 201.4 billion |

|

Revenue forecast in 2030 |

USD 269.3 billion |

|

Growth rate |

CAGR of 6.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Route of administration, type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Bayer AG; Cipla; GSK plc; Johnson & Johnson Services, Inc.; Novartis AG; Bausch Health Companies Inc.; Hisamitsu Pharmaceuticals Co., Inc.; Merck KGaA; GLENMARK PHARMACEUTICALS LTD.; MedPharm Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Topical Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global topical drugs market report based on route of administration, type, end use, and region:

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermal Drug Delivery

-

Ophthalmic Drug Delivery

-

Rectal Drug Delivery

-

Vaginal Drug Delivery

-

Nasal Drug Delivery

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-solid Formulations

-

Creams

-

Ointments

-

Lotions

-

Gel

-

Pastes

-

-

Liquid Formulations

-

Suspensions

-

Solutions

-

-

Solid Formulations

-

Powders

-

Suppositories

-

-

Transdermal Products

-

Transdermal Patches

-

Transdermal Semi-Solids

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Care Settings

-

Hospitals & Clinics

-

Burn Centers

-

Other Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."