- Home

- »

- Medical Devices

- »

-

Topical Drugs CDMO Market Size, Industry Report, 2033GVR Report cover

![Topical Drugs CDMO Market Size, Share & Trends Report]()

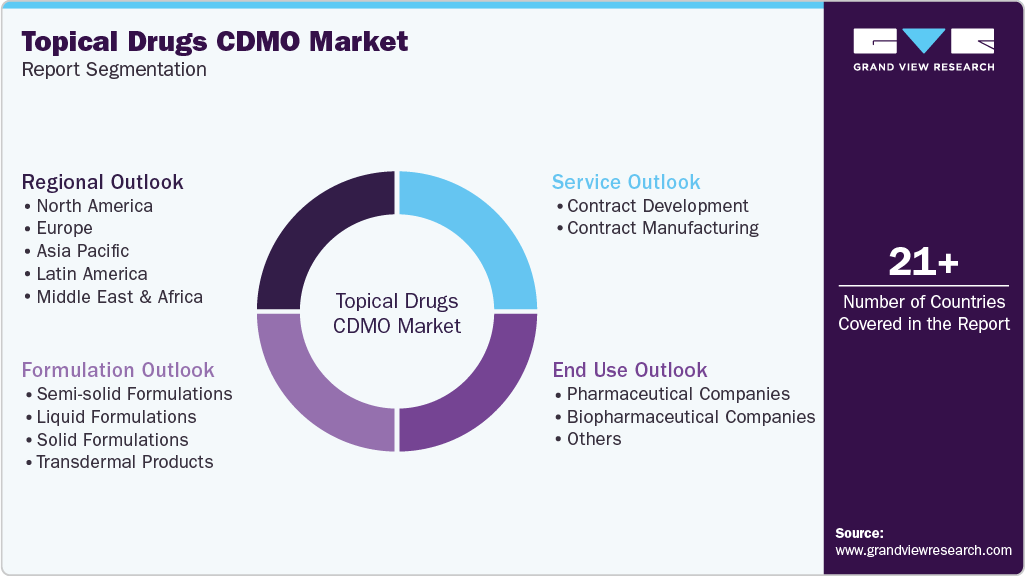

Topical Drugs CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Formulation (Semi-solid Formulations, Liquid Formulations Drugs, Solid Formulations, Transdermal Products), By Service, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-150-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Topical Drugs CDMO Market Summary

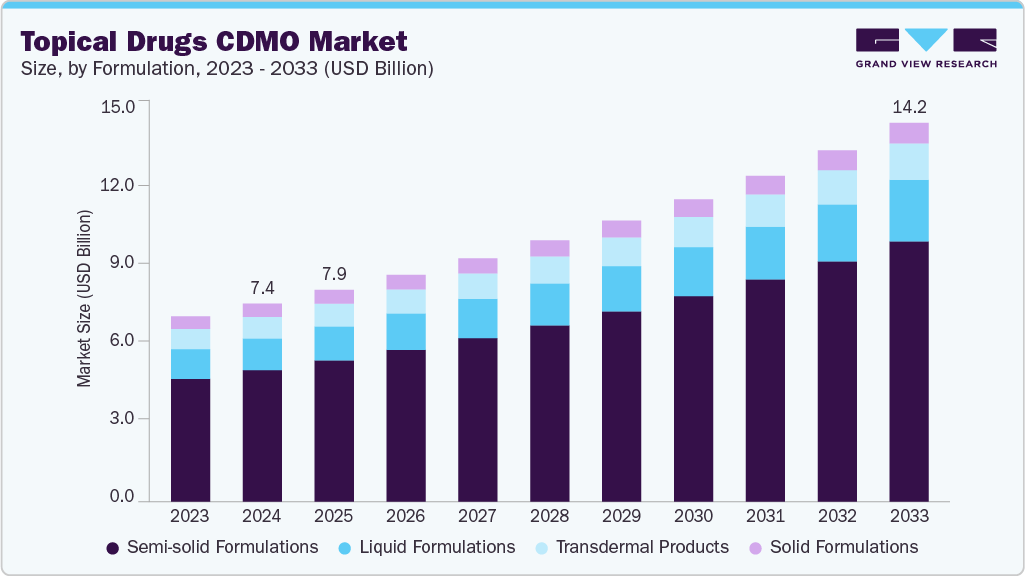

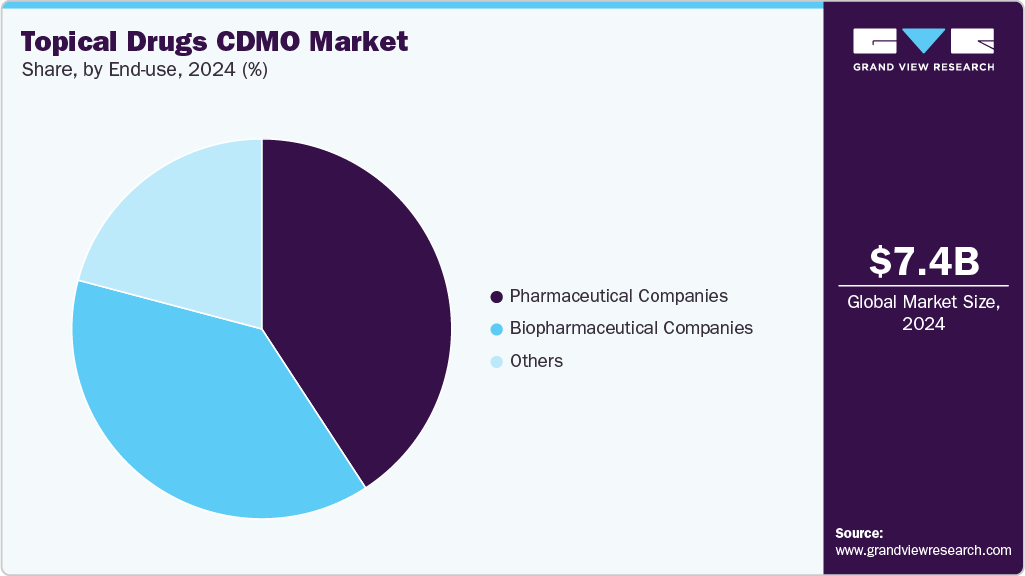

The global topical drugs CDMO market size was estimated at USD 7.43 billion in 2024 and is projected to reach USD 14.22 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The market is gaining momentum driven by an increase in chronic skin disorders, the rising need for topical medications, and growing demand for CDMO services, including formulation, development, & manufacturing, and expanding demand for targeted drug delivery.

Key Market Trends & Insights

- North America topical drugs CDMO market held the largest share of 32.02% of the global market in 2024.

- The topical drugs CDMO in the U.S. is expected to grow significantly over the forecast period.

- By formulation, the semi-solid formulations segment held the highest market share of 66.44% in 2024.

- Based on service, the contract manufacturing segment held the highest market share in 2024.

- By end use, the pharmaceutical companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.43 Billion

- 2033 Projected Market Size: USD 14.22 Billion

- CAGR (2025-2033): 7.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The demand for topical medications is expanding beyond traditional skin disorders to include products like skin-lightening agents, anti-aging creams, and scar-reducing treatments. These topical formulations are increasingly used for conditions such as eczema and acne, as well as for pain relief, wound healing, cosmetic purposes, and scar management. For instance, as of February 2025, the American Academy of Dermatology Association mentioned that acne is the most common skin disorder in the U.S., accounting for over 50 million people annually. Moreover, it is estimated that around 9,500 individuals are diagnosed with skin cancer every day. Hence, the number of skin cancer patients in the U.S. is expected to propel the demand for novel therapeutics, accelerating the topical drugs CDMO market growth. Furthermore, according to the American Burn Association, over 500 thousand individuals have burn injuries annually in the U.S. This increasing patient pool with burn injuries is also expected to improve the demand for topical drugs. These factors are expected to broaden pharmaceutical innovation and development opportunities in topical drug formulations.Moreover, affordability and accessibility are key drivers of demand for the topical drugs CDMO market. The cost-efficiency of developing and manufacturing topical drugs through CDMOs, when compared to in-house production, along with technological advancements & development of innovative drug delivery systems to cater to the rising product demand, play significant roles in the market's expansion. Also, advancements in research studies have led to prescription topical drugs for a broader range of medical conditions, including pain management, systemic conditions, and wound healing, thereby enhancing their market growth.

Furthermore, CDMOs are investing significantly in automation, continuous manufacturing, and modular fill-finish systems to enhance flexibility and minimize turnaround times. Current consumer trends towards non-invasive, locally acting therapies offering minimal systemic side effects further drive the demand for innovative topical formulations in prescription and over-the-counter markets. The innovation in topical biologics and personalized dermatology solutions further shapes the CDMO landscape, with an increased focus on regulatory compliance and scale-up efficiency. As demand grows for faster market entry, cost control, and product differentiation, topical drug companies are turning to CDMOs as strategic partners for agile, tech-enabled, and compliant manufacturing solutions. Such factors are expected to drive the market growth over the estimated period.

Opportunity Analysis

The market for topical drugs CDMOs is expected to grow significantly, driven by increasing demand for targeted and non-invasive therapies across the dermatology, ophthalmology, and pain management industries. Besides, the rising need for novel drug development and the integration of topical drug development and manufacturing is expected to drive the market in the forthcoming years. In addition, increased awareness of advanced drug delivery systems, government initiatives, and improved access to CDMOs in the region further contributes to market growth.

Also, pharmaceutical and biotechnology companies are increasingly prioritizing patient-centered and site-specific drug delivery, where CDMOs with expertise in complex topical formulations such as creams, gels, foams, and transdermal systems support to meet the rising outsourcing needs. In addition, the growing prevalence of chronic skin conditions, combined with consumer preference for topical treatments over systemic options, supports the innovation of new formulation and delivery strategies. Moreover, the reformulation of topical generics and the 505(b)(2) regulatory pathway offers a cost-efficient approach to managing product lifecycles while differentiating in the marketplace, thus providing new opportunities for CDMOs in terms of formulation and scaling further supporting the market.

Furthermore, over-the-counter (OTC) and cosmeceutical product advancements create new growth opportunities for CDMOs with substantial research and development capabilities. Expanding into emerging markets and investing in automated, GMP-compliant manufacturing is expected to drive the competitiveness of the market. In addition, CDMOs that can offer comprehensive solutions, from formulation development to packaging, are likely to drive the sponsors to demand rapid turnaround times, flexibility, and regulatory support for launching new topical therapies. Such factors are expected to drive the market over the estimated time period.

Impact of U.S. Tariffs on the Global Topical Drugs CDMO Market

U.S. tariffs have created a supply chain and caused cost pressure within the contract development and manufacturing organization (CDMO) market for topical drugs. Tariffs on imported raw materials, excipients, active pharmaceutical ingredients (APIs), and packaging components, particularly from China and other key manufacturing regions, have driven up production costs for CDMOs operating in the U.S. These increased input expenses have reduced the profit margins, particularly for small to mid-sized CDMOs that work under fixed-price or competitive contract models. In addition, trade barriers have led to difficulties and delays, disrupting manufacturing protocols and prompting many CDMOs to reassess their sourcing approaches.

Moreover, to mitigate the effects of these tariffs, U.S.-based CDMOs are increasingly looking to diversify their suppliers, nearshore API production, and invest in domestic manufacturing capabilities. While this strategic shift drives long-term supply chain resilience, it also requires capital investment and coordination with regulators. Furthermore, some contract manufacturers are adjusting pricing agreements with clients or adopting surcharge models to counteract cost inflation related to tariffs. Thus, tariffs have increased the movement towards localized, vertically integrated manufacturing in the U.S., giving CDMOs with diversified supply chains a competitive edge in the evolving landscape of topical drug manufacturing, further contributing to market growth.

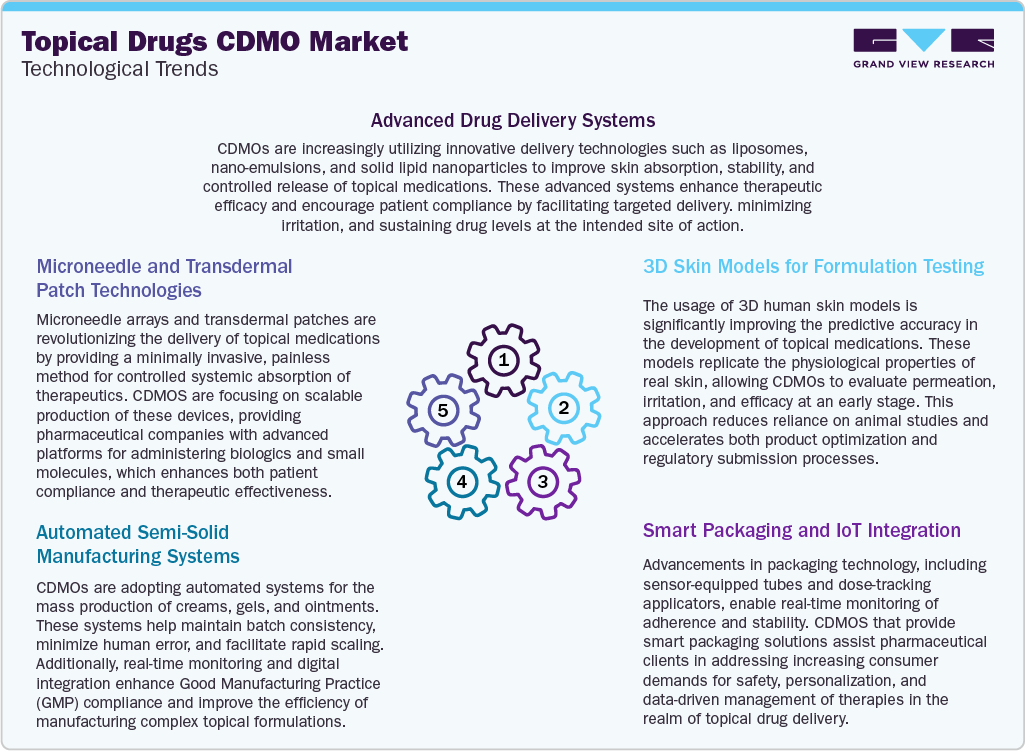

Technological Advancements

Technological innovations are transforming the landscape of CDMOs in the topical drug industry by enhancing delivery, testing, and manufacturing efficiency. Next-generation drug delivery systems, such as lipid-based carriers, nano emulsions, and micro sponges further support to improve the penetration and bioavailability of topical medications, particularly for challenging skin conditions. Moreover, innovations such as microneedles and transdermal patches enable precise and minimally invasive drug administration, making them well-suited for applications in pain management, hormone delivery, and cosmetics. This technological advancement supports release and improves patient compliance, further gaining popularity in personalized dermatology.

In addition, automated semi-solid manufacturing solutions are enhancing production consistency and scalability by integrating in-line quality control measures and minimizing human error while creating ointments and creams. Moreover, 3D skins models, which mimic layered human-like structures, allow for early-stage, non-animal testing of formulations concerning permeability, irritation, and effectiveness, further supporting the R&D timelines. Furthermore, emerging smart packaging and Internet of Things (IoT) technologies are increasingly focusing on introducing capabilities like temperature monitoring, tamper detection, and tracking of patient adherence. These factors are expected to drive the innovation of topical drug CDMOs in upcoming years.

Pricing Model Analysis

Topical CDMOs utilize a range of pricing models to address clients' diverse needs at different stages of development and manufacturing. Milestone-based pricing is widely used for projects involving innovative topical formulations or intricate regulatory submissions, where payments are linked to specific deliverables such as the completion of formulation, validation at pilot scale, or submission of regulatory documents. This method helps mitigate client risk and enhances transparency. Besides, the value-based pricing supports CDMOs in offering strategic insights or technologies that support the product's clinical or market value, such as improved bioavailability or faster time-to-market. In addition, for routine or high-volume services, such as the production of generics or over-the-counter products, fixed-fee models are often preferred, providing both parties with cost predictability and operational efficiency. Moreover, the subscription or retainer models are becoming increasingly popular among emerging pharmaceutical and cosmeceutical companies, offering continuous access to R&D, analytical, or regulatory support for a monthly fee, further fueling the long-term collaboration and flexibility.

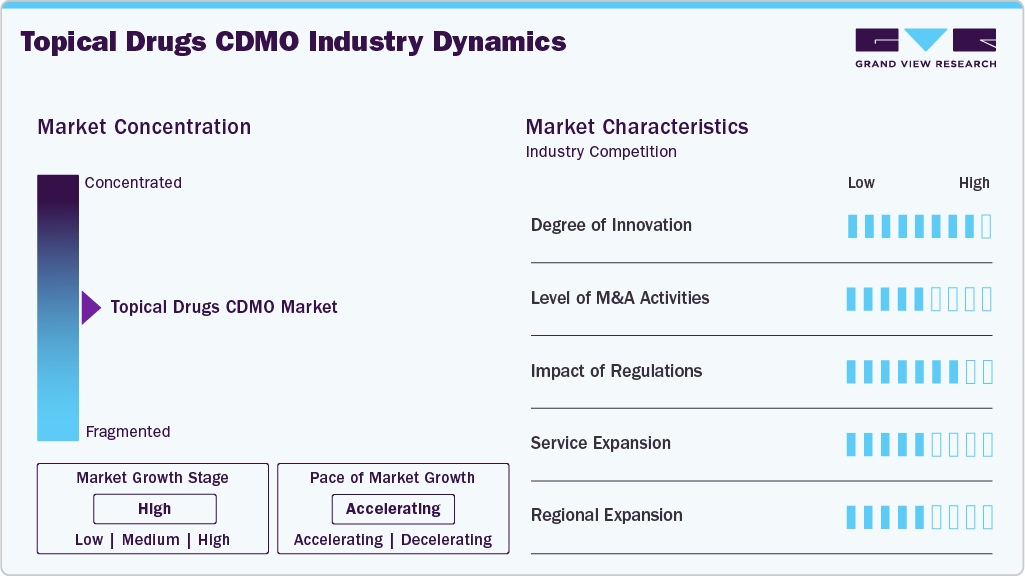

Market Concentration & Characteristics

The topical drugs CDMO market growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

CDMOs specializing in topical drugs are focusing on innovating the range of drug delivery methods, such as lipid nanoparticles, microneedles, and transdermal patches. Advances in AI-driven formulation design, techniques to enhance bioavailability, and the use of unique excipient combinations are expected to drive the innovations. Besides, the incorporation of 3D skin models for preclinical evaluation and increased automation in the production of semi-solid formulations creates a rising demand for new formulations. These factors support CDMOs to accommodate an array of complex topical products, ranging from prescription dermatological treatments to over-the-counter cosmetics, thereby enhancing their competitive edge in the outsourced development and manufacturing sector.

Regulatory bodies in the market mandates strict compliance with current Good Manufacturing Practices (cGMP), comprehensive product characterization, and the use of standardized excipients. The expectations set by the FDA and EMA for dermal toxicity assessments, skin permeation studies, and stability evaluations require CDMOs to possess advanced analytical capabilities. Furthermore, regulations affect the site registration and the traceability of supply chains, making expertise in regulatory matters crucial consideration for clients when selecting outsourcing partners.

Mergers and acquisitions in topical drugs CDMO is increasing driven by the increasing demand for comprehensive capabilities. Strategic acquisitions focus on companies that specialize in sterile topical production, innovative delivery methods, or possess extensive knowledge of global regulations. These consolidations allow CDMOs to broaden their service offerings, enhance operational scalability, and provide integrated solutions for clients in the dermatology and cosmeceutical markets.

CDMOs are expanding their capabilities to include topical formats such as foams, sprays, and transdermal systems, while strengthening analytical & regulatory consulting services. Besides, the latest offerings in the market include formulations for niche indications, microbiome-driven products, and preservative-free alternatives. This service expansion meets the evolving needs of clients in dermatology, ophthalmology, and cosmetics, ultimately improving project scalability and market readiness

Topical CDMOs based in North America and Europe are broadening their services into the Asia-Pacific and Latin America regions to utilize emerging market opportunities. The investments encompass establishing GMP-compliant manufacturing facilities, research and development centers, and regulatory liaison offices in these regions. This geographic expansion facilitates quicker turnaround times, improved access to local markets, and enhanced compliance with regional regulatory standards. As a result, CDMOs can serve a diverse range of clients while minimizing supply chain disruptions and boosting their global competitiveness.

Formulation Insights

The semi-solid formulations segment held the largest market share in 2024, accounting for a revenue share of 66.44%. The segment growth is driven by increasing interest in semi-solid dosage forms, an increase in research and development activities, and a growing pipeline of semi-solid topical drugs. This dosage forms encompass a variety of formulations, including creams, ointments, and lotions, which contain active ingredients either dissolved or uniformly mixed within a suitable base and excipients. The advantages of semi-solid formulations, such as ease of application, quick preparation, and localized delivery, have contributed to their growing popularity in recent years. This increased interest has, in turn, driven demand for CDMOs that specialize in the development of these products.Therefore, topical drug CDMOs support pharmaceutical companies seeking efficiency in drug development and help them drive efficiency across their value chains by providing in-house quality labs, robust quality systems, and a team of experienced specialists.

The liquid formulations segment is expected to grow significantly during the forecast period. Liquid formulations, such as suspensions and solutions, are increasingly prevalent in the pharmaceutical industry due to their numerous advantages. These formulations provide a non-invasive and convenient method for delivering medications through the skin, making them suitable for a wide range of therapeutic applications. Moreover, advancements in formulation strategies, innovative drug delivery technologies, and a growing focus on personalized medicine have led to increased research and development investments in this area. Thus, the pipeline for liquid formulation topical drugs is expanding to treat patients with diverse medical conditions. Hence, increase in the pipeline of liquid formulation topical drugs developed by pharmaceutical companies drives the demand for CDMO services. These factors are expected to support the sponsors in reducing development costs while promoting growth within the sector.

For instance, in June 2025, the National Psoriasis Foundation (NPF) and Arcutis Biotherapeutics, Inc. announced that Arcutis' ZORYVE (roflumilast) cream 0.3% and ZORYVE (roflumilast) topical foam 0.3% have received the NPF’s Seal of Recognition. In addition, this groundbreaking FDA-approved treatment have received the Seal of Recognition, which further highlights that the products are non-irritating and safe for people with psoriasis.

Service Insights

The contract manufacturing segment accounted for the largest revenue share in 2024. The segmental growth is primarily attributed to increasing number of CDMOs entering the topical drug industry. Pharmaceutical and biopharmaceutical companies are increasingly outsourcing their production needs to these contract manufacturers, which helps reduce manufacturing costs and the associated expenses for equipment. Furthermore, contract manufacturing typically offers a faster turnaround time for developing topical drugs. CDMOs also enable these companies to access high-quality products and innovative formulations that utilize innovative technologies. With their specialized expertise in topical drug formulation and production, contract manufacturing organizations ensure compliant, high-quality manufacturing processes.

The contract development segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is driven by increasing R&D investment in topical drugs and technology for topical drug development. Contract development in topical drug delivery is gaining increasing attention as pharmaceutical companies increasingly outsource formulation, testing, and manufacturing to specialized CDMOs. The development of topical drug delivery through CDMOs is increasingly gaining traction as pharmaceutical companies seek to outsource formulation, testing, and production to specialized entities. The landscape of topical drug development is continually advancing, with CDMOs possessing enhanced expertise and specialized knowledge, making them the preferred partners for drug development innovations.

These collaborations provide pharmaceutical companies with streamlined design, production, and analysis processes for topical drug products. In addition, growing number of partnerships further facilitate the innovation of dermatological solutions, including creams, gels, lotions, and transdermal patches. As a result, numerous pharmaceutical and biopharmaceutical companies are opting for contract services for personalized therapies, intricate formulations, and adherence to regulatory standards, which further supports the market growth.

End Use Insights

The pharmaceutical companies segment accounted for the largest market share in 2024. A significant trend within the pharmaceutical sector is the increasing demand for integrated CDMOs that can boost the innovation for range of topical drugs, enhance manufacturing efficiency, and leverage specialized formulation expertise. In addition, CDMOs provide comprehensive services that span formulation, scale-up, packaging, and regulatory support, allowing pharmaceutical companies to shorten their time to market and manage costs effectively. Moreover, a notable rise in regulatory approvals for various topical products is further enhancing the demand for outsourced services. Furthermore, as the demand grows for complex semi-solid and transdermal products, CDMOs deliver value through advanced technologies such as nanoencapsulation, microneedle delivery systems, and 3D skin model testing. This trend of outsourcing is particularly prominent among small and medium-sized enterprises looking for agile, compliant, and cost-effective solutions for topical drug development, which further support the segment growth.

The biopharmaceutical companies segment is expected to grow at the highest CAGR during the forecast period. The segment growth is driven by growing outsourcing of comprehensive services, particularly among small and mid-sized biopharmaceutical firms, as well as established companies that may lack the expertise needed for topical drug development. Besides, increasing number of biopharmaceutical companies investing in the development and production of topical drugs for various skin conditions, further fuels the segment growth. These investments are fueled by potential for targeted drug delivery, minimized systemic side effects, and a rising demand for treatment options for skin diseases. In addition, ongoing investments in topical formulations within the biopharmaceutical sector and the increasing need for effective, patient-friendly treatment solutions is expected to drive the segment growth.

Regional Insights

North America topical drugs CDMO marketaccounted for the largest revenue share of 32.02% in 2024. The regional growth can be attributed to the presence of established CDMOs specializing in topical drug development. The U.S. is the biggest market for topical drugs as several pharmaceutical & biopharmaceutical companies prefer outsourcing their drug development to CDMOs based in the U.S. Moreover, several companies such as The Lubrizol Corporation and Cambrex Corporation, are present in North America. The presence of these companies in North America is expected to drive the topical drugs CDMO market. Furthermore, the growing burden of skin diseases is expected to lead to an increase in investments by market players over the forecast period. Moreover, the increasing number of new strategic initiatives is encouraging big pharmaceutical and biopharmaceutical companies to outsource topical drug development to CDMOs.

U.S. Topical Drugs CDMO Market Trends

The topical drugs CDMO market in the U.S.accounted for the highest market share of the North America market owing to strong presence of numerous pharmaceutical and biopharmaceutical companies in the region. CDMOs in the U.S. offer a range of capabilities, including semi-solid, liquid, and solid formulations. Furthermore, the rising need for topical treatments for various skin conditions in the country further drives healthcare expenditures, contributing to market growth. For instance, the American Academy of Dermatology mentioned that acne affects approximately 50 million Americans each year. In addition, around 1 in 10 individuals in the U.S. will experience atopic dermatitis at some point in their lives, while approximately 7.5 million people have psoriasis. These factors have led pharmaceutical companies to invest in R&D for new topical drugs, enhancing the demand for CDMOs.

The Canada topical drugs CDMO market is expected to grow at a significant CAGR during the forecast period. The country's pharmaceutical and biopharmaceutical sectors are experiencing significant advancements, fueled by rising investments, strategic partnerships, and initiatives by CDMOs focusing on research into skin diseases and various dermatological conditions. In addition, research activities in topical and transdermal drug delivery systems support market growth. Moreover, the country's strong regulatory framework, skilled workforce, and investment in research and development make it an attractive hub for topical drug development and manufacturing. The growing trend of outsourcing topical drug manufacturing to enhance time-to-market and reduce costs is anticipated to further propel market growth in the country. Such factors are expected to drive the market over the estimated time period.

Europe Topical Drugs CDMO Market Trends

Europe's topical drugs CDMO market is driven by rising demand for dermatological and pain management products, regulatory harmonization via EMA, and the growing trend of outsourcing among pharma companies. In addition, growing innovative advancements in topical formulations, high investments in R&D, and growing elderly population fuel the development and manufacturing partnerships across the region. Moreover, CDMOs are improving their capabilities in advanced drug delivery methods, such as nano-emulsions and transdermal patches, to address the changing requirements of pharmaceutical and biopharmaceutical companies. With a strong regulatory framework, a skilled workforce, and commitment to research and innovation, the region serves as one of the destinations for the development and production of topical medications. By prioritizing innovation and quality, the CDMO sector in Europe is well-equipped to cater to the increasing global demand for specialized topical therapies.

The topical drugs CDMO market in Germany held the highest share in 2024. This growth can be attributed to a robust pharmaceutical infrastructure, a highly skilled workforce, and a strong commitment to research and development, making the country a one of the destination centers for topical drug development and production. CDMOs in the country are advancing their capabilities in drug delivery systems to cater to the changing needs of pharmaceutical and biopharmaceutical companies. With a focus on innovation and high-quality standards, Germany's CDMO sector is well-equipped to support the increasing global demand for specialized topical therapies, which further supports the market growth.

Topical drugs CDMO market in UK is expected to grow significantly over the forecast period. The country's growth is driven by rising demand for semi-solid formulations like creams and gels. Besides, the prevalence of skin conditions, an aging population, and increasing consumer interest in advanced dermatological treatments are contributing to market growth. Moreover, there is a growing interest in over-the-counter (OTC) topical formulations, particularly for pain relief, eczema, and acne, which is further propelling market growth. Pharmaceutical companies are exploring a range of ingredients, while CDMOs are facilitating the development of innovative delivery systems, including foams and sprays. Moreover, the supportive regulatory environment is encouraging more rapid approvals, especially for generic and repurposed medications. Such factors are expected to drive the market over the estimated time period.

Asia Pacific Topical Drugs CDMO Market Trends

Asia Pacific is expected to grow at a significant CAGR over the forecast period. The region’s growth is driven by the presence of several countries in the Asia Pacific region, specifically China and India, providing cost-effective manufacturing options for pharmaceutical companies. The lower operational and labor expenses in these countries make outsourcing the production of topical drugs to regional CDMOs an attractive choice, leading to considerable cost reductions. In addition, numerous Asian countries are experiencing rapid growth in their pharmaceutical industries, driven by an increasing demand for innovative therapies and expanding healthcare requirements. This trend has fueled the pharmaceutical companies seeking reliable topical drug CDMO partners within the region. Such factors are expected to drive the market over the forecast period.

The topical drugs CDMO market in China is driven by increasing trend of outsourcing among pharmaceutical companies, stringent standards surrounding patient safety in clinical trials, and the availability of large patient pool for skin diseases, and low operating costs, among other factors. In addition, low operational costs and increased investments to improve technology, along with the growing adoption of international R&D standards, are expected to drive the demand for outsourcing services within the country. Moreover, increased awareness of topical treatments, innovations in topical drug formulations and a strong pharmaceutical manufacturing infrastructure is anticipated to drive the accessibility of these topical drug products. Such factors are expected to drive the market over the estimated time period.

Japan topical drugs CDMO market is driven by advancements in drug development, an expanding pipeline of drug candidates, and a focus on cost-efficiency combined with innovative manufacturing practices. In addition, factors such as an aging population, a rising incidence of dermatological disorders, and improvements in drug delivery systems are anticipated to drive the market growth. Moreover, a trend towards personalized topical formulations is expected to drive the market in the coming years. Moreover, the rising competition among industry players is driving pharmaceutical companies to outsource their topical drug production to CDMOs, which enhances process control, shortens manufacturing times, and improves quality assurance, ultimately leading to the innovation of new products.

Topical drugs CDMO market in India is driven by expanding opportunities in developing transdermal patches, specialized gels, and innovative formulations that enable controlled and sustained drug release. These advancements cater to specific therapeutic requirements while improving patient compliance and convenience. As a result, pharmaceutical companies are increasingly partnering with CDMOs to outsource various phases of drug development, including formulation design, preclinical studies, and clinical trials. This outsourcing not only accelerates the development process but also allows companies to leverage the expertise and resources of CDMOs to shorten timelines. Furthermore, growing competition among market players and a strong focus on establishing infrastructure, funding, and global collaborations further drive India's topical drugs CDMO market.

Latin America Topical Drugs CDMO Market Trends

The topical drugs CDMO market in the Latin America region is expected to significant growth over the estimated time period. In Latin America, economic development in Latin America has led to higher disposable incomes, enabling more individuals to purchase specialized cosmetic dermatological products and topical treatments. Moreover, in Latin America countries such as Brazil stands out with its thriving beauty and cosmetics sector owing to rising demand for topical products that serve both cosmetic and therapeutic functions. These factors are expected to drive market growth over the forecast period.

Brazil topical drugs CDMO market is driven by rising demand for semi-solid formulations like creams and gels, which are commonly used to treat skin conditions. Besides, the increasing prevalence of diseases, increased awareness of healthcare facilities, and growing consumers spending for skin conditions and skincare are likely to boost the demand for topical drug CDMO services among pharmaceutical companies. Furthermore, rising competition in drug development, advancements in drug delivery technologies, and a robust pharmaceutical manufacturing infrastructure contribute to the growth and availability of innovative topical formulations. These factors offer the Brazilian market a significant opportunity for pharmaceutical and biopharmaceutical companies to introduce new drugs.

Middle East & Africa Topical Drugs CDMO Market Trends

The topical drugs CDMO market in the MEA region is expected to experience steady growth in the forthcoming years. Countries such as South Africa, Saudi Arabia, the UAE, and Kuwait are increasingly emphasizing advancing dermal drug delivery systems, expanding the pharmaceutical industry, and increasing prevalence of skin diseases. In addition, the available pharmaceutical products in South Africa, along with affordability, accessibility, and quality, are expected to drive market growth throughout the forecast period. These factors are anticipated to boost demand for the topical drugs CDMO market over the estimated period.

South Africa topical drugs CDMO market is driven by rising demand for topical drugs, growing prevalence of skin diseases, and rising investments in R&D activities. In addition, changing market dynamics on enhancing local manufacturing capabilities and decreasing reliance on imports is expected to drive the market growth.

Key Topical Drugs CDMO Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge. For instance, in March 2025,LGM Pharma announced USD 6 million investment to enhance its manufacturing facility in Texas as part of its Phase I growth strategy for CDMO. The expansion will increase capacity for liquid, semi-solid, suspension, and suppository drug products to meet the increasing demand for production requirements in the U.S.This development is aimed to provide customers with the quality, reliability, and assurance necessary to successfully launch these products in the market.

Key Topical Drugs CDMO Companies:

The following are the leading companies in the topical drugs CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Lubrizol Life Science

- Cambrex Corporation

- Contract Pharmaceuticals Limited

- Bora Pharmaceutical CDMO

- Ascendia Pharmaceuticals

- Pierre Fabre group

- Piramal Pharma Solutions

- DPT Laboratories, LTD

- MedPharm Ltd

- PCI Pharma Services

Recent Developments

-

In January 2025, Mankind Pharma's OTC division introduced Heal-o-Kind first aid ka all-rounder, a four-in-one gel featuring nano crystalline silver for the treatment of various injuries, including wounds, burns, bruises, and cuts. In addition, the company further mentioned it utilizes advanced nano crystalline silver technology, which is effectively absorbed by the skin and promotes faster healing compared to larger particle sizes offered by competitors.

-

In July 2024, MedPharm and Tergus Pharma announced merger to create an innovative CDMO specifically focuses on comprehensive development and commercialization of topical and transepithelial pharmaceuticals. The CDMO facility will operate under the MedPharm, and will focus on scientific & clinical trial manufacturing, as well as commercial production for the broader pharmaceutical market.

Topical Drugs CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.95 billion

Revenue forecast in 2033

USD 14.22 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year of estimation

2024

Historical Year

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Formulation, service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lubrizol Life Science; Cambrex Corporation; Contract Pharmaceuticals Limited; Bora Pharmaceutical CDMO; Ascendia Pharmaceuticals; Pierre Fabre group; Piramal Pharma Solutions; DPT Laboratories, LTD.; MedPharm Ltd.; PCI Pharma Services among others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Topical Drugs CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global topical drugs CDMO market report based on formulation, service, end use, and region:

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Semi-solid Formulations

-

Creams

-

Ointments

-

Gel

-

Others

-

-

Liquid Formulations

-

Solid Formulations

-

Transdermal Products

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Development

-

Contract Manufacturing

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global topical drugs CDMO market size was valued at USD 7.43 billion in 2024 and is expected to reach USD 7.95 billion by 2025. .

b. The global topical drugs CDMO market is anticipated to witness a lucrative CAGR of 7.55% from 2025 to 2030, reaching USD 14.22 billion by 2033.

b. The semi-solid formulations segment accounted for the largest revenue share of 66.44% in 2024. The high shares of this segment are attributed to the increasing approval of semi-solid topical drugs in the past few years.

b. Some prominent players in the topical drugs CDMO market are Lubrizol Life Science, Cambrex Corporation, Contract Pharmaceuticals Limited, Bora Pharmaceutical CDMO, Ascendia Pharmaceuticals, Pierre Fabre group and few others.

b. Factors such as increasing demand for topical products, rise in R&D investments by pharmaceutical companies, growing application of topical drugs etc, fuel the demand for topical drugs CDMOs, thus augmenting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.