- Home

- »

- Petrochemicals

- »

-

Toluene Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Toluene Market Size, Share & Trends Report]()

Toluene Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Solvent, TDI & Other Derivatives), By Region (North America, Europe, Asia Pacific, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-190-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Toluene Market Summary

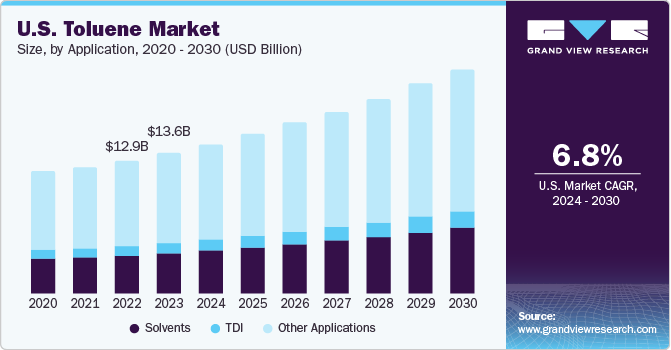

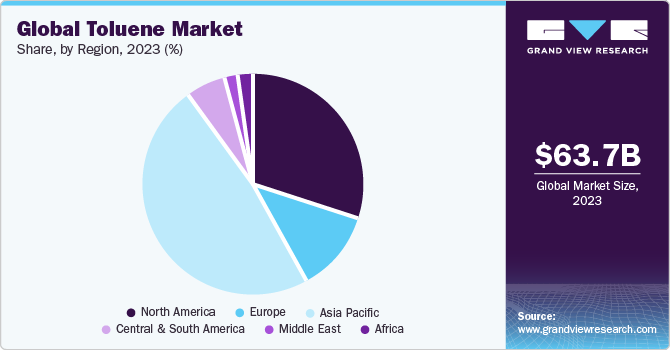

The global toluene market size was estimated at USD 63.67 billion in 2023 and is expected to reach USD 105.27 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. This is attributable to its increasing application as solvent in the chemical industry in manufacturing of different chemical compounds such as benzyl chloride, phenol, nitrobenzene, and benzoic acid.

Key Market Trends & Insights

- The Asia Pacific toluene market held the largest revenue share of 48.1% in 2023.

- The toluene industry in Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030.

- By application, the solvent segment held the largest revenue share of 30.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 63.67 Billion

- 2030 Projected Market Size: USD 105.27 Billion

- CAGR (2024-2030): 7.4%

- Asia Pacific: Largest market in 2023

Moreover, the increasing demand for products in different end-use industries including paints and coatings, pharmaceuticals, cosmetics, and fertilizers among others is expected to boost the market in the upcoming years.

Toluene is a clear liquid with a distinct odor like benzene. It possesses high volatility and can cause irritation to the nose, lungs, eyes, and skin. This compound occurs naturally in small quantities in crude oil and is separated during the production of gasoline through catalytic reforming, ethylene cracking, or coke manufacturing from coal. The separation process involves distillation or solvent extraction.

One of the primary applications of product is in the production of bulk chemicals like benzene and xylenes. Moreover, it holds significant industrial importance as a precursor in the manufacturing of toluene diisocyanate (TDI), which finds use in flexible polyurethane foam production. Additionally, TDI is employed in coatings and elastomers manufacturing.

Toluene is commercially available in three standard grades that is TDI grade, nitration grade, and commercial grade. Nitration-grade product is extensively utilized in the production of downstream nitro compounds, such as trinitrotoluene (TNT).

The product market is expected to witness continued growth due to sustained demand in the petrochemical and chemical industries. As the automotive sector continues its transition towards sustainable mobility, toluene's significance as a gasoline additive may evolve to meet emerging environmental regulations. Additionally, the increasing adoption of renewable and eco-friendly solvents could pose potential challenges to the traditional product market.

Application Insights

The solvent application dominated the market, with the highest revenue share of 30.0% in 2023. This is attributable to its excellent properties like low viscosity, and relatively low toxicity compared to other solvents. Some common solvent applications of product include paints and coatings, adhesives, printing inks, pharmaceuticals, cleaning agents and fragrances & perfumes among others. In paints and coatings, the product is used as a solvent in the formulation of paints, varnishes, lacquers, and other coatings. It helps dissolve the resins and pigments and evaporation of the solvent during drying. Whereas in adhesive it enables the dissolution of adhesive components and promotes adhesion to different surfaces.

In the rubber and polymer industry product is used in the processing and compounding of rubber and polymer materials, improving their workability and performance. Moreover, in pharmaceuticals it is used as a solvent in some pharmaceutical preparations, assisting in the formulation of liquid medications and coatings for solid dosage forms.

TDI is a significant chemical derived from products and plays a crucial role in various industries. TDI is primarily used in the production of flexible polyurethane foams, which are used in a wide range of applications due to their versatility and comfort. Some key applications of TDI include flexible polyurethane foam, automotive interiors, mattresses and bedding, and packaging and insulation among others.

Regional Insights

Asia Pacific region dominated the product market with the highest revenue share of 48.1% in 2023. This is attributed to the increasing application of downstream derivatives of product used in automobiles, oil & gas, and construction among others in the region. Countries like China, India, and Japan are expected to maintain dominancy in the global market during the forecast period, primarily due to the continuous expansion of the manufacturing sector in these nations.

Moreover, economic expansion, rapid industrialization, and increasing demand for petrochemicals and consumer products have driven the consumption of products in various applications in the region. Furthermore, the rising automotive production and consumption in countries like China and India have driven the demand for products as a gasoline additive. Toluene's role in enhancing the octane rating of gasoline makes it valuable in meeting stringent fuel quality standards and improving fuel efficiency.

China is one of the prominent manufacturers of paints, coatings, and adhesives globally. The continuous growth in these industries is anticipated to be a major driving force for the product market in China. Moreover, as part of the union budget 2021-22, the Indian government has allocated USD 32.2 million to the Chemicals and Petrochemicals department. The Indian government is focusing on the implementation of a production-linked incentive (PLI) scheme in the chemical sector, in order to boost chemical manufacturing in the country. This is further expected to have a positive impact on India's toluene market, fostering growth in the coming years.

Key Toluene Company Insights

The market is highly competitive, with several prominent players operating globally. These industry giants dominate a significant share of the market, while smaller regional players also contribute to the overall supply.

Players are moving towards manufacturing bio-based products owing to driven by environmental concerns, sustainability goals, and market demand for eco-friendly products. For instance,in September 2022, Covestro introduced bio-based polyether polyols derived from bio-based feedstock. This development enables the company to provide renewable TDI and methylene diphenyl diisocyanate (MDI) for the manufacturing of polyurethane foams.

Key Toluene Companies:

The following are the leading companies in the toluene market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these toluene companies are analyzed to map the supply network.

- Exxon Mobil Corporation

- SABIC

- China Petroleum and Chemical Corporation

- INEOS Capital Limited

- BASF SE

- Covestro AG

- LyondellBasell Industries Holdings B.V.

- Royal Dutch Shell Plc

- Chevron Phillips Chemicals LLC

- Mitsubishi Chemicals Corporation

Toluene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 67.84 billion

Revenue forecast in 2030

USD 105.27 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Netherland; Italy; Belgium; France; Russia; China; India; Japan; Malaysia; Indonesia; Vietnam; Australia; New Zealand; Brazil; Argentina; Colombia; Peru; Iran; Oman; UAE; Qatar; Kuwait; Saudi Arabia; South Africa; Angola; Nigeria

Market Players

Exxon Mobil Corporation; SABIC, China Petroleum and Chemical Corporation; INEOS Capital Limited; BASF SE; Covestro AG; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell Plc; Chevron Phillips Chemicals LLC; Mitsubishi Chemicals Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Toluene Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global toluene market report based on application and region:

-

Toluene Application Outlook (Revenue, USD Billion; Volume, Million tons, 2018 - 2030)

-

Solvents

-

TDI

-

Other applications

-

-

Toluene Regional Outlook (Revenue, USD Billion; Volume, Million tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

Netherlands

-

Belgium

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

Peru

-

-

Middle East

-

Saudi Arabia

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

-

Africa

-

South Africa

-

Angola

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global toluene market size was estimated at USD 63.67 billion in 2023 and is expected to reach USD 67.84 billion in 2024

b. The global toluene market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 105.27 billion by 2030.

b. Asia Pacific region dominated the toluene market with the highest revenue share of 48.1% in 2023. This is attributed to the increasing application of downstream derivatives of products used in automobiles, oil & gas, and construction among others in the region.

b. Some key players operating in the toluene market include Exxon Mobil Corporation, SABIC, China Petroleum and Chemical Corporation, INEOS Group AG , BASF SE, Covestro AG, LyondellBasell Industries Holdings B.V., Royal Dutch Shell Plc, Chevron Phillips Chemicals, Mitsubishi Chemicals Corporation.

b. Key factors that are driving the market growth include its increasing application as a solvent in the chemical industry in the manufacturing of different chemical compounds such as benzyl chloride, phenol, nitrobenzene, and benzoic acid.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.