Toaster Market Size, Share & Trends Analysis Report By Product (Pop-up, Oven, Conveyor), By Application (Residential, Commercial), By Region ( North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-722-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Toaster Market Size & Trends

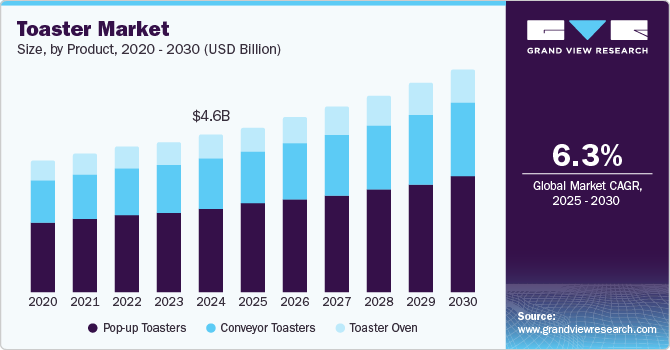

The global toaster market size was valued at USD 4.55 billion in 2024 and is expected to expand at a CAGR of 6.3% from 2025 to 2030. The market growth is attributed to technological advancements that have led to the development of multipurpose and highly automated toasters, which attract consumers who seek convenience in their daily kitchen tasks. Rapid urbanization and rising consumer demand for electric kitchen appliances also contribute significantly to market growth.

The increasing popularity of energy-efficient appliances aligns with the growing trend of sustainability, as modern toasters consume less energy than conventional ovens. The food service and hotel industries are also expanding, driving the demand for toasters in commercial settings. In addition, the rise of e-commerce platforms has made it easier for consumers to access a wide range of toasters, further boosting market growth.

Product innovation is key for players to stay ahead of their competition and expand their reach. Appliances that have technologically advanced features while being user-friendly and easy to use are in high demand. Smart toasters have appeared in the market. Today, an increasing number of companies have been offering products that can be integrated into the user’s smartphone and other connected devices.

Product Insights

Pop-up toasters dominated the market, with the largest revenue share of 53.7% in 2024. Pop-up toasters are highly popular due to their convenience and ease of use, making them a staple in many households. Their compact size and efficient performance cater to the needs of consumers looking for quick and straightforward breakfast solutions. Technological advancements have also enhanced the functionality of pop-up toasters, with features such as multiple toasting settings, defrost options and even smart connectivity for precise control. Additionally, the affordability of pop-up toasters compared to other types of toasters makes them accessible to a broad range of consumers. The high demand from both residential users and the food service industry, where quick and consistent toasting is essential, further supports the substantial revenue share of pop-up toasters in the market.

Conveyor toasters are expected to grow at the fastest CAGR of 7.4% over the forecast period. Conveyor toasters are increasingly popular in commercial settings, such as hotels, restaurants, and cafes, due to their ability to toast large quantities of bread efficiently and consistently. The growing food service industry and the expansion of hospitality sectors are major drivers of demand for conveyor toasters. These toasters are designed for high-volume use, making them ideal for busy environments where speed and efficiency are essential. Additionally, technological advancements in conveyor toasters, such as adjustable speed and temperature controls, make them more versatile and user-friendly. The trend towards automation and the need for reliable kitchen equipment in commercial kitchens further support the market growth.

Application Insights

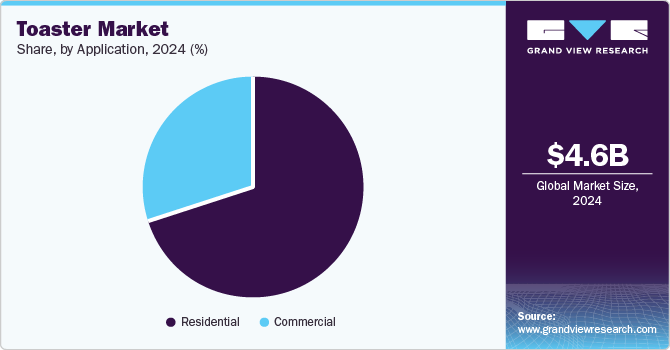

The residential segment dominated the market with the largest revenue share in 2024. The rising trend of home cooking and the growing interest in convenient and efficient kitchen appliances among consumers are major contributors. Pop-up toasters, in particular, are highly popular in households due to their compact size, ease of use, and affordability. Technological advancements have also made modern toasters more versatile, with features like multiple toasting settings, defrost options, and even smart connectivity. Additionally, the increasing disposable income levels and the preference for energy-efficient appliances further boost the demand in the residential segment. The availability of a wide range of toasters through offline and online channels makes it easier for consumers to find products that meet their specific needs and preferences.

The commercial segment is expected to grow at the fastest CAGR over the forecast period. The expanding food service industry, including restaurants, hotels, cafes, and catering services, is a major contributor to the increasing demand for commercial toasters. These establishments require reliable and efficient toasters to handle high-volume operations and ensure consistent quality. Technological advancements in commercial toasters, such as faster heating elements, multiple toasting options, and enhanced durability, make them more appealing to businesses. Additionally, the trend towards automation and the need for equipment that can streamline kitchen operations further support the market growth. The rise in the number of quick-service restaurants and the growing popularity of breakfast menus also boost the demand for commercial toasters.

Regional Insights

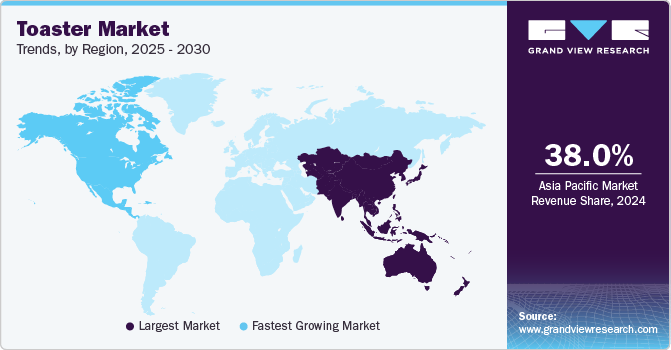

Asia Pacific toaster industry dominated the global market with the largest revenue share of 38.0% in 2024. The region's rapid urbanization and rising disposable incomes have increased the demand for household appliances, including toasters. The growing middle class and their preference for modern kitchen appliances further boost the market. Additionally, major manufacturers and suppliers in countries such as China, Japan, and South Korea enhance the availability and variety of toasters, catering to diverse consumer needs. The increasing popularity of Western-style breakfasts, which often include toasted bread, has also contributed to the rising demand for toasters. Furthermore, the expansion of e-commerce platforms has made it easier for Asian Pacific consumers to access a wide range of toaster options, supporting market growth.

Europe Toaster Market Trends

The European toaster industry held a considerable share in 2024. The region's diverse culinary traditions and the increasing popularity of Western-style breakfasts have led to higher demand for toasters. The emphasis on home-cooked meals and the rising trend of enjoying leisurely breakfasts at home contribute to this demand. Technological advancements and the introduction of innovative toaster models with multiple functions and energy-saving features appeal to eco-conscious European consumers. Additionally, strong consumer preference for high-quality, durable kitchen appliances and the presence of well-established brands enhances market growth.

North America Toaster Market Trends

North America's toaster industry is expected to grow at the fastest CAGR of 7.5% over the forecast period. The region's strong culture of home cooking and the popularity of breakfast foods that require toasting, such as bread and bagels, contribute to the high demand for toasters. Additionally, the presence of major kitchen appliance manufacturers and the continuous introduction of innovative toaster models enhance market growth. The increasing disposable income and the trend towards energy-efficient and smart kitchen appliances also play a role. Furthermore, the rise of e-commerce and the availability of a wide range of toasters through online platforms make it easier for consumers to access and purchase these appliances.

U.S. Toaster Market Trends

The U.S. toaster industry is expected to grow significantly over the forecast period. The rise in disposable incomes and the trend towards kitchen convenience and efficiency encourage consumers to invest in advanced, multifunctional toasters. Technological innovations, such as smart toasters with customizable settings and energy-efficient models, are also driving the market. Additionally, the growing e-commerce sector and widespread availability of toasters through online platforms make it easier for consumers to purchase these appliances. The influence of food bloggers and social media showcasing trendy breakfast recipes and kitchen gadgets further boosts the interest in high-quality toasters.

Key Toaster Company Insights

Some key companies in the toaster market include De’ Longhi Appliances S.r.l., Hamilton Beach, Cuisinart, KitchenAid, Black & Decker, Toastmasters International, and others.

-

De’ Longhi Appliances S.r.l. is a renowned Italian company known for its innovative and stylish kitchen appliances. De’ Longhi offers a range of high-quality toasters in the toaster market, including the Distinta Titanium Toaster CTIN2103.TB.

-

Hamilton Beach is a well-known brand in the kitchen appliance market, offering various toasters designed for home and commercial use. One of their popular models is the 2 Slice Toaster with Extra-Wide Slots. This toaster features digital controls, a bagel setting, defrost function, and a slide-out crumb tray for easy cleaning.

Key Toaster Companies:

The following are the leading companies in the toaster market. These companies collectively hold the largest market share and dictate industry trends.

- De’ Longhi Appliances S.r.l.

- Hamilton Beach

- KitchenAid

- Black & Decker

- Toastmasters International

- West Bend Insurance Company

- Breville Pty Limited

- Dualit

- WARING COMMERCIAL

Toaster Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.79 billion |

|

Revenue forecast in 2030 |

USD 6.50 billion |

|

Growth Rate |

CAGR of 6.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

De’ Longhi Appliances S.r.l.; Hamilton Beach; Cuisinart; KitchenAid; Black & Decker; Toastmasters International; West Bend Insurance Company; Breville Pty Limited; Dualit; WARING COMMERCIAL |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Toaster Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global toaster market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pop-up Toasters

-

Toaster OvenConveyor Toasters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."