Titanium Market Size, Share & Trends Analysis Report By End-use (Aerospace & Defense, Industrial, Coatings), By Region (North America, Asia Pacific, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-331-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Titanium Market Size & Trends

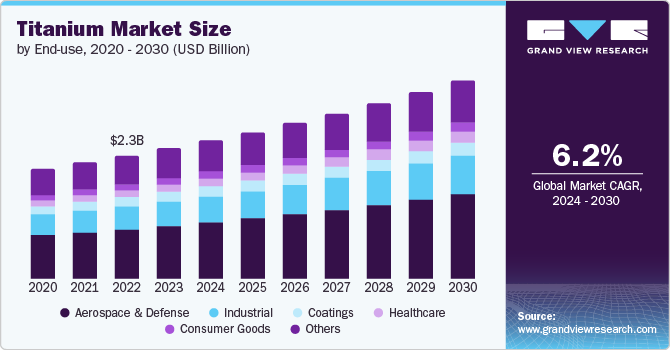

The global titanium market size was estimated at USD 2.44 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030.The growth of the travel & tourism industry has also led to an expansion of the civil aviation segment, propelling the demand for titanium. The rise in defense expenditure for modernized equipment, systems, and aircraft on account of growing territorial disputes has further contributed to market growth.

Titanium sponge is produced using the Kroll process on titanium ore. In the process, titanium tetrachloride is heated with magnesium metal to 900 degrees Celsius. After the process is completed, magnesium is extracted from a lump of titanium sponge. In the final stage, the sponge is crushed into small pieces with the help of crushers and shears. Various-sized particles are mixed in a blender to get a uniform-quality sponge.

Drivers, Opportunities & Restraints

The increasing demand for titanium is primarily driven by its exceptional properties including high strength-to-weight ratio, corrosion resistance, and biocompatibility, which make it indispensable in aerospace, automotive, medical, and industrial applications. Growing aerospace and defense expenditures globally, coupled with rising demand for lightweight and durable materials in automotive manufacturing, are key drivers propelling the market forward. Additionally, advancements in titanium production technologies and expanding applications in emerging industries such as renewable energy and consumer electronics further bolster its demand.

Despite its advantages, the market faces several challenges, including high production costs, primarily due to energy-intensive extraction and refining processes. Supply chain vulnerabilities and geopolitical tensions affecting raw material access and trade routes also pose significant restraints. Moreover, regulatory barriers and environmental concerns associated with titanium mining and processing impact operational feasibility and add complexity to market dynamics, hindering widespread adoption in cost-sensitive industries.

The market presents promising opportunities driven by ongoing R&D efforts to enhance manufacturing efficiencies and reduce production costs. Expanding application scope in additive manufacturing and development of titanium alloys tailored for specific industrial requirements open avenues for market growth.

Furthermore, increasing investments in infrastructure development, particularly in emerging economies, and the rising demand for titanium-based products in medical implants and consumer electronics underscore robust growth prospects. Strategic partnerships and acquisitions within the titanium value chain also offer opportunities for market expansion and innovation, positioning titanium metal as a crucial material in future technological advancements.

Price Trends of Titanium Metal

The market witnessed significant price volatility in recent years, driven by multiple factors. In 2022, titanium metal prices surged due to supply chain disruptions caused by the Russia-Ukraine conflict, as Russia is a major exporter. However, in 2023, prices exhibited regional differences, with the Asian markets remaining relatively stable, while the European markets faced supply concerns. Looking ahead, the market is expected to continue experiencing price fluctuations, influenced by the pace of global economic recovery, changes in trade policies, and advancements in extraction and processing technologies, as well as the increasing adoption of lightweight materials in industries like automotive and renewable energy.

End-use Insights

“Aerospace & defense held the largest revenue share of over 40% in 2023.”

The aerospace and defense End-use segment is anticipated to continue its dominance over the forecast period. The high demand is attributed to its usage in aircraft fuselage and engine parts applications. Growing demand for the aerospace industry is owing to a surge in defense expenditure and global air passenger traffic. As a result of increasing demand, there has been a surge in production of aircraft production across the globe for commercial and defense applications.

For instance, according to Boeing's Commercial Outlook 2022-2041 report, the worldwide market for commercial aviation services, including services such as flight operations, cargo operations, ground station, maintenance, and engineering, is expected to grow significantly in the coming years.

Titanium and its alloys are used in coatings of medical implants to accelerate the healing process and bone growth. Other applications include liquid propellant tanks for satellites and launch vehicles, interface rings, liners, inter-tank structures, heat exchangers, steam turbines, airframes, ship structures, wing structures, connecting rods, springs, and many more.

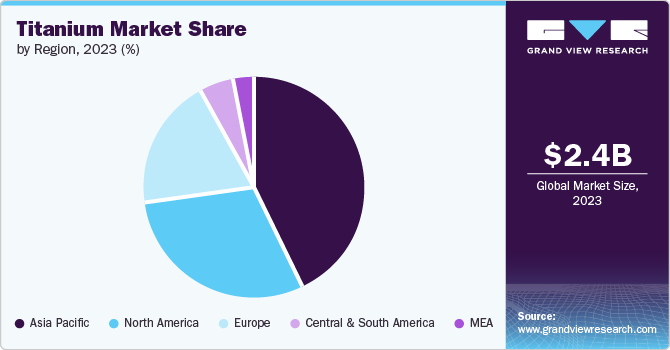

Regional Insights

“China held over 60% revenue share of the overall Asia Pacific titanium market.”

North America titanium market majorly benefits from the aerospace & defense industry, which are the vital end users of titanium components in the region. Airbus clocked a significant revenue in 2022 that surged its profits by 200% owing to the rise in sales of passenger aircraft and rising demand for military aircraft. As a result of this, in May 2022, Airbus announced an increase of 50% in its A320 aircraft production and aims at manufacturing at least 75 aircraft per month by 2025.

U.S. Titanium Market Trends

The titanium market of the U.S. has witnessed significant growth as air transportation has become a popular mode of transportation in the world, resulting in an increased number of air passengers in the country. This, in turn, has fueled the demand for aircraft, thereby leading to the growth of the aviation industry.

Asia Pacific Titanium Market Trends

Asia Pacific titanium market dominated the global industry and accounted for over 43.0% revenue share of the global market in 2023. It is anticipated to continue over the forecast period owing to rapid industrialization and infrastructure development in countries like China and India. The growing demand for titanium in the aerospace, industrial, and coatings sectors, coupled with the presence of major titanium producers in the region, has solidified Asia Pacific's position as the largest and fastest-growing market for titanium metal.

Europe Titanium Market Trends

The titanium market of Europe is dominated by Spain in owing to an increased usage of titanium components in various End Use industries in the country. According to International Trade Agency (ITA), the highly developed aircraft industry of Spain offers significant growth potential for U.S.-based aerospace businesses as majority of aerospace products are purchased from Spain.

Key Titanium Company Insights

Some of the key players operating in the market include TiFast S.r.l. and Toho Titanium Co., Ltd.

-

TiFast S.r.l. is a prominent player in the titanium market, specializing in the production and distribution of high-quality titanium products globally. Leveraging advanced manufacturing processes and a commitment to innovation, TiFast caters to diverse industries including aerospace, medical, and industrial sectors. With a strong emphasis on precision engineering and customer satisfaction, TiFast continues to be a trusted partner known for reliability and excellence in the titanium industry.

-

Toho Titanium Co., Ltd. is a leading manufacturer in the titanium market, renowned for its extensive expertise and advanced technology in titanium production. Serving a wide array of industries such as aerospace, automotive, and chemical processing, it is committed to delivering high-quality titanium products that meet stringent global standards with a focus on sustainability.

Key Titanium Companies:

The following are the leading companies in the titanium market. These companies collectively hold the largest market share and dictate industry trends.

- ATI

- TiFast s.r.l.

- Titanium Metals Corporation

- Toho Titanium Co., Ltd.

- UST-KAMENOGORSK TITANIUM AND MAGNESIUM PLANT JSC (UKTMP)

- Hermith GmbH

Recent Developments

-

In July 2023, ATI, Inc., a U.S.-based manufacturing company, announced the expansion of its titanium melting operations at Richland, Washington, to increase the production capacity owing to rising demand for titanium metal in the aerospace & defense industry.

-

In June 2023, Toho Titanium Co., Ltd. announced expanding its titanium sponge production capacity by adding 3,000 tons of annual production capacity. The company planned to improve its two domestic facilities in Japan and construct a new production facility.

Titanium Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.59 billion |

|

Revenue forecast in 2030 |

USD 3.71 billion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

End-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Spain; Russia; China; India; Japan; Brazil; GCC |

|

Key companies profiled |

ATI; TiFast s.r.l.; Titanium Metals Corporation; Toho Titanium Co., Ltd.; UST-KAMENOGORSK TITANIUM AND MAGNESIUM PLANT JSC (UKTMP); Hermith GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Titanium Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global titanium market report based on end-use, and region:

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

Aerospace & Defense

-

Industrial

-

Coatings

-

Healthcare

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global titanium market size was estimated at USD 2.44 billion in 2023 and is expected to reach USD 2.59 billion in 2024.

b. The global titanium market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 3.71 billion by 2030.

b. By end-use, aerospace & defense dominated the market with a revenue share of over 40.0% in 2023.

b. Some of the key vendors of the global titanium market are ATI, TiFast s.r.l., Titanium Metals Corporation, Toho Titanium Co., Ltd., UST-KAMENOGORSK TITANIUM AND MAGNESIUM PLANT JSC (UKTMP), Hermith GmbH.

b. The key factor driving the growth of the global titanium market is attributed to the growing application in aerospace & defense sector.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."