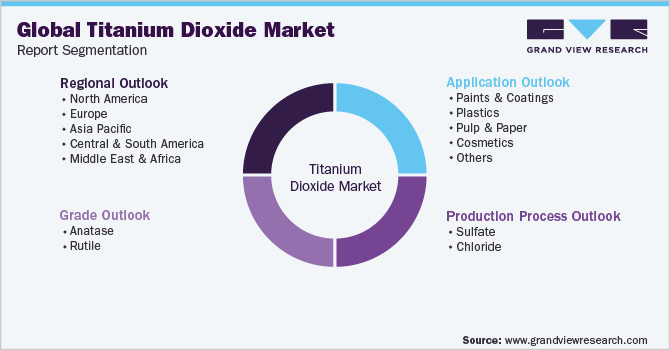

Titanium Dioxide Market Size, Share & Trends Analysis Report By Grade (Anatase, Rutile), By Carrier Production Process (Sulfate, Chloride), By End-use, By Application (Paints & coatings, Plastics, Inks), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-705-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Titanium Dioxide Market Size & Trends

The global titanium dioxide market size was estimated at USD 20.43 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. Increasing investments in the chloride production processes and the flourishing construction industry worldwide are anticipated to contribute to the growth of the market for titanium dioxide (TiO2)in the coming years. TiO2 is widely used in paints & coatings applications. TiO2 combined with other colored pigments is employed in numerous end-use applications, including automotive coatings, aircraft coating, marine coatings, and architecture & decorative coatings. Growing construction activities are positively influencing the demand for paints & coatings, thereby creating significant demand for TiO2.

TiO2 is used in various applications such as plastics, cosmetics, pulp & paper, paints & coatings, and others. Rising demand for the product in the plastics industry is anticipated to fuel the market growth over the forecast period. TiO2 is used in various plastics such as polyolefins, polystyrene, acrylonitrile butadiene styrene, polyvinyl chloride, and others. Properties such as UV damage resistance, color retention, gloss, brightness, mechanical strength, and others are propelling the demand for the product in plastic applications.

The prices of TiO2 are expected to increase over the forecasted period on account of higher raw material prices, stringent regulations, and production process complexity. Even though various manufacturers are undertaking strategic initiatives to tackle the rise in the raw material prices, this factor is expected to impact the overall prices of TiO2 in the long run. As a result, various manufacturers are also increasing prices of TiO2.

For Instance, in March 2023, LB Group, one of the leading manufacturers of TiO2 from China, have announced price increase for all grades of their TiO2 products for international and domestic markets. According to the company, this upshift in prices is mainly due to tight supplies as well as boost in the procurement from downstream paints & coatings sector.

TiO2 has wide application scope and is used in numerous end-user applications. However, various regulations on the use of the product are expected to restrain the market growth. Dust particles of the product are grouped under 2B carcinogenic by IRAC and have the possibility of being carcinogenic to humans. In manufacturing plants, various protective measures are to be followed by workers including the use of personal protective equipment and safety data sheets for material handling.

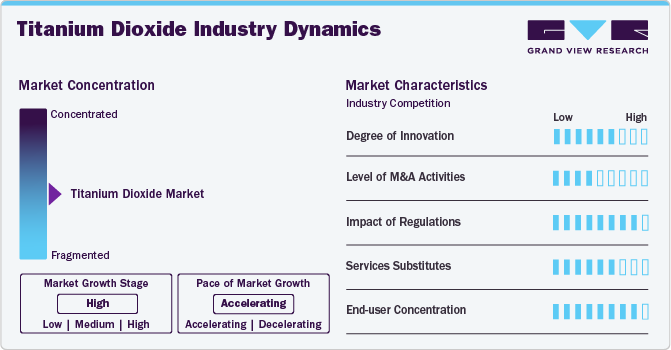

Market Concentration & Characteristics

The global product market is moderately fragmented with players aim to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, research & development. For instance, in 2021, LB Group announced to promote its wide range of TiO2 pigments for plastics in Chinaplas. This is expected to strengthen their position in the Chinese market for supply of TiO2 pigments in plastic applications.

Partnerships, acquisitions & mergers, expansions, and new product developments are the key strategies adopted by most players operating in the global product market. For instance, in July 2023, Chemours, a global chemistry company, announced the closure of its titanium dioxide plant in Taiwan. The decision to close the plant is part of a comprehensive strategy to improve the earnings quality of Chemours' Titanium Technologies (TT) segment, which produces the popular Ti-Pure brand of titanium dioxide.

Large manufacturers like The Chemours Company, The Tronox Holdings Plc., LB Group, Venator Materials Plc., Evonik Industries AG aim to strengthen their market position by widening their customer base. They also focus on new product launches and merger and acquisition to meet the current as well as future demand from end use industries. For instance, in 2022, the Chemours Company begun mining at its newest sand mine in Florida, increasing the company's output of TiO2. Ilmenite, which Chemours needs for their chloride based TiO2 production method, will be obtained from the mining.

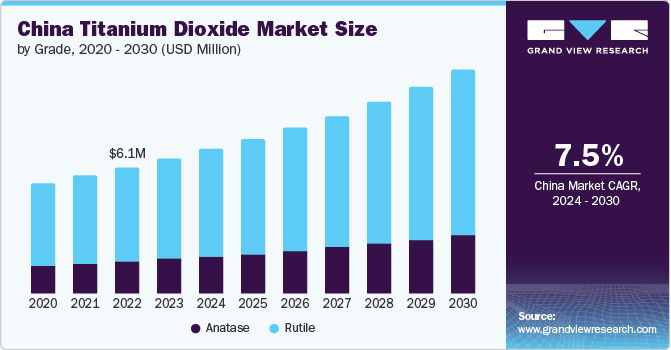

Grade Insights

Rutile grade dominated the market with a revenue share of 76.4% in 2023 owing high weathering properties in compared to anatase. At higher temperature conditions, anatase TiO2 converts to rutile TiO2, having higher weatherability and hiding power in comparison to its other counterparts and making it suitable for the manufacturing of indoor & outdoor coatings, inks, plastics, and paper.

The rutile grade of TiO2 is used to manufacture refractory ceramics, titanium oxide pigments, and the production of titanium metal. Furthermore, it is used as a carrier in paint applications, produces white color in plastics, and provides color fading in paper and other products. In recent years, the rising construction industry is anticipated to fuel the demand for paints & coatings, along with paper applications such as wallpapers and sanitary products. This is in turn expected to increase the demand for rutile grade of TiO2 during the forecast period.

Anatase (TiO2) pigment is mainly used in fibers, ceramics, cosmetics, and pharmaceuticals, along with manufacturing of enamels and welding electrodes. Pure TiO2 contains 80% content of anatase by weight with a smaller portion of rutile, 20%. Increasing demand for TiO2-based cosmetics is anticipated to propel the demand for anatase TiO2 during the forecast period.

Carrier Production Process Insights

Sulfate carrier production process dominated the market with a revenue share of 78.0% in 2023. Iodine powder is treated with concentrated sulfuric acid (H2SO4) to produce titanyl sulfate and is further hydrolyzed for the formation of metatitanic acid and is then calcined and pulverized to obtain whiter Titanium power. In addition, this method is used to produce anatase and rutile titanium dioxide (TiO2). In the sulfate process of producing tit TiO2, ilmenite (FeTiO3), a common iron/titanium oxide, is used by treatment with concentrated sulfuric acid (H2SO4), and titanium oxygen sulfate (TiOSO4) is selectively extracted and converted into TiO2.

Titanium containing raw materials are used in the chloride process which is treated with chlorinated high-titanium slag or artificial rutile, or natural rutile to form titanium tetrachloride (TiCl4). TiCl4 is further purified by rectification and is then subjected to gas phase oxidation, post rapid cooling and TiO2 is obtained.

Application Insights

Paints & Coatings dominated the market with a revenue share of 44.2% in 2023 owing to its extensively application of white pigment TiO2 in the paint and coatings sector. When used in coatings, it’s highly effective visible light scattering properties add whiteness, brightness, and opacity. Due to their superior stability and durability compared to their competitors, rutile TiO2 pigments are highly preferred due to their great light scattering.

These inorganic surface treatments enhance one or more crucial coating performance characteristics, such as the coatings’ ability to disperse in water and a variety of organic liquids, their effectiveness as concealing agents, their resistance to chalk, and their resistance to color fading brought on by heat and photoreduction. Paint films are opaqued by TiO2 and other white pigments predominantly through diffuse light reflection. Strong light scattering caused by exposure to the white pigment surface results in this reflection.

TiO2 is widely used in various industries, including the ink industry. It is a white pigment that provides opacity, brightness, and whiteness to inks. The quality of TiO2 used in inks has a significant impact on the performance and properties of the ink. TiO2 is considered a crucial component in the creation of white and light-colored inks. It is used in various types of inks, including offset, flexographic, gravure, and screen printing inks, as well as other liquid and solid ink systems.

Talc, calcium carbonate (CaCO3), and calcined kaolin are frequently used in low-end paper because of their low production costs. In comparison to the materials, TiO2 provides higher whiteness, high density, reflective index, fine, and uniform particles. Hence paper treated with titanium dioxide (TiO2) has enhanced whiteness stronger hiding power, and high strength. Furthermore, the opacity of paper using TiO2 is 10 times higher than that of other materials, and the weight can be reduced by 15% to 30%.

Regional Insights

The construction industry in North America is expected to witness significant growth over the coming years, owing to the high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges. The "Affordable Healthcare Act" in 2023 is expected to stimulate the construction of a greater number of healthcare units and hospitals, which, in turn, is expected to boost the demand for products in the region over the forecast period.

U.S. Titanium Dioxide Market Trends

The U.S. titanium dioxide market the demand for titanium oxide has seen a significant uptick in increasing applications in the paints & coatings industry. The consumption of paints & coatings in the U.S. has received a considerable push from the increasing infrastructure projects being implemented in the country by both private players and government organizations.

The titanium dioxide market of Mexico is projected to witness stable growth. There has been strong support from independent government and parastatal agencies such as INFONAVIT (the Institute of the National Housing Fund for Workers), FOVISSSTE (the most significant housing fund for state workers in Mexico), and National Housing Commission (CONAVI) which is further expected to prominently fuel the growth of the housing sector in the country, which, in turn, is anticipated to create high demand for paints and coatings.

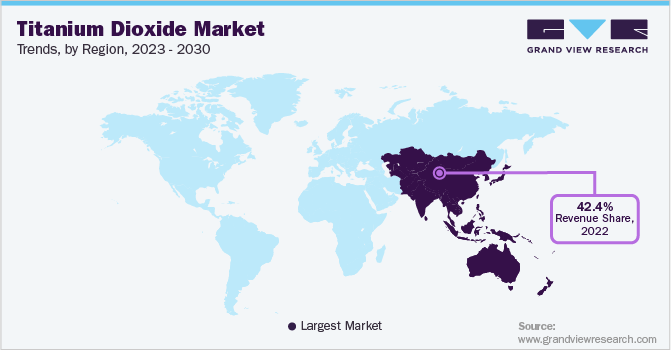

Asia Pacific Titanium Dioxide Market Trends

Asia Pacific titanium dioxide market dominated with a revenue share of 42.6% in 2023 owing to rapid modernization and recent economic expansion have accelerated the market throughout Asia and the Pacific. The region is predicted to exhibit the fastest growth rate in the market over the forecast period. Countries such as India, Japan, China, South Korea, Malaysia, Indonesia, and Vietnam, are projected to be the major contributors to the growth of market in Asia Pacific.

Titanium dioxide is employed in enormous applications including polyamide fibers, polyolefin, PVC, polystyrene, and other engineering plastics. Due to the strong growth potential of the building and construction industry, Asia Pacific, the region with the largest PVC market, is anticipated to experience considerable expansion throughout the projected period.

The titanium dioxide market of China the demand for paints and coatings has increased because of the country's expanding building industry. This is expected to have a positive impact on the market over the next few years. The utilization of TiO2 in China has exceeded the U.S. on account of its increasing demand in numerous applications including plastics, printing inks, paper & pulp, chemical fibers, paints & coatings, and cosmetics.

India titanium dioxide market has recently witnessed a rise in demand for paints and coatings, owing to the flourishing construction industry. Furthermore, growing middle-class population, improving standard of living, and rising disposable incomes are the major factors contributing to the growth of the construction industry, which, in turn, is expected to generate a demand for architectural and decorative paints and coatings.

Europe Titanium Dioxide Market Trends

Europe titanium dioxide market is expected to showcase substantial growth during the forecasted period. The growth can be attributed to the surging demand for cost-effective and environmentally friendly lightweight automobiles from various economic levels of consumers. It has a wide application scope in exterior paints, automotive and industrial coatings, and decorative paints. Surging automobile production in Germany, Hungary, Romania, Austria, and the UK is expected to drive the demand for paints and coatings. A few top automotive OEMs in Europe include Mercedes-Benz Group AG Volkswagen AG, Stellantis NV, Bayerische Motoren Werke AG, and Renault SA.

The titanium dioxide market of Germany is expected to grow owing tothe rising automotive production. The automotive industry is one of the largest in the world. According to the KBA federal transport authority, new car sales in Germany accounted for a 7.3% share in 2023 and reached a total of 2.8 million vehicles. Germany sold over 524,000 full-electric cars in 2023. According to trading economics, car production in Germany increased to 312,100 units in January from 258,254 units in December 2023. Thus, this rising production, import, and export of vehicles positively impact the automotive manufacturing industry in Germany, in turn, propelling the demand for paints and coatings. This is expected to be a significant contributor to the demand for TiO2 in the country over the forecast period.

Central & South America Titanium Dioxide Market Trends

Central & South America titanium dioxide market is expected to pose a market challenge over the forecast period due to the low availability of raw materials. Calcium carbonate and zinc oxides are used as a substitute in pigments. Titanium Dioxide (TiO2) has been used in paints & coatings and plastic industry over the past few years. In the paint and varnish industries, it is responsible for weather resistance, providing coverage, brightness, and whiteness. The product is also widely used in the plastic industry and derivatives such as master batches and PVC.

The titanium dioxide market of Brazil is projected to witness the product demand increase due to growing photovoltaic installation market. PV module is made up of titanium dioxide and used to convert solar energy into direct current electricity. Government investing in extensive research & development and rising awareness about energy conservation results in increasing the demand for PV installation is expected to have a positive impact on the industry over the next few years.

Middle East & Africa Titanium Dioxide Market Trends

TheMiddle East & Africa titanium dioxide market is boosting due to increasing paints and coatings industry. Titanium dioxide pigments with properties such as gloss, opacity, and UV absorption are used in paints and coatings. These pigments are employed in decorative paints and architectural paints and are also used in numerous coatings.

The titanium dioxide market of Saudi Arabia has been experiencing a significant rise in demand for the product due to several factors. Firstly, the country's construction sector has witnessed substantial growth, driven by mega projects such as the Red Sea Project and the Qiddiya Entertainment City. These developments have increased the need for paints and coatings manufacturing using TiO2.

Mega construction projects are major end users of paints and coatings formulated using titanium dioxide in the country. Several infrastructure projects have been sanctioned by the Saudi government, further developing the infrastructure sector in the country.

Key Titanium Dioxide Company Insights

Some of the key players operating in the market include The Chemours Company, The Tronox Holdings plc, Evonik Industries AG., and KRONOS Worldwide Inc. among others.

-

Established players compete and outplay the regional players by strategically integrating across the value chain to ensure seamless supply chain activities and reducing production & operating costs. In addition, companies involved in the manufacturing of TiO2 develop new products and production technologies. Companies are also backwardly integrating to save the operations cost involved in raw material procurement.

-

For instance,In February 2022, the Powder Coating Manufacturing Business in Arsonsisi was acquired by PPG to get benefited from backward integration due to this acquisition.

Key Titanium Dioxide Companies:

The following are the leading companies in the titanium dioxide market. These companies collectively hold the largest market share and dictate industry trends.

- The Chemours Company

- The Tronox Holdings plc

- LB Group

- Venator Materials PLC

- KRONOS Worldwide Inc.

- Evonik Industries AG

- Ishihara Sangyo Kaisha, Ltd.

- CNNC HUAN YUAN Titanium Dioxide Co., Ltd.

- The Kerala Minerals & Metals Limited

- CATHAY INDUSTRIES

- TOR Minerals International, Inc.

Recent Developments

-

In July 2023, Chemours, a global chemical company, has announced the closure of its titanium dioxide plant in Taiwan. The decision to close the plant is part of a comprehensive strategy to improve the earnings quality of Chemours' Titanium Technologies (TT) segment, which produces the popular Ti-Pure brand of titanium dioxide.

-

In September 2021, LB Group promoted its range of high-performance titanium dioxide pigments for coatings and inks in the Middle East Coatings Show in Dubai. Since the construction industry in Middle East is known for its architectural designs, the titanium the BILLION BLR-995 pigment is expected to witness a demand in architectural coatings.

-

In 2022, a new 200ktpa titanium dioxide (TiO2) pigment finishing plant will be built at the Xiangyang site owing to an investment of CNY 1 billion (USD 157.6 million) by LB Group. ThCopany e construction of two TiO2 pigment finishing lines with a combined processing capacity of 100ktpa TiO2 pigment intermediate product is planned.

Titanium Dioxide Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 21.64 billion |

|

Revenue forecast in 2030 |

USD 31.79 billion |

|

Growth rate |

CAGR of 6.6% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Grade, carrier production process, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Itay; France; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

The Chemours Company; The Tronox Holdings plc LB Group; Venator Materials PLC; KRONOS Worldwide Inc.; Evonik Industries AG; Ishihara Sangyo Kaisha, Ltd.; CNNC HUAN YUAN Titanium Dioxide Co., Ltd.; The Kerala Minerals & Metals Limited; CATHAY INDUSTRIES; TOR Minerals International, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Titanium Dioxide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global titanium dioxide market report based on grade, carrier production process, application & region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Anatase

-

Rutile

-

-

Carrier Production Process Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Sulfate

-

Chloride

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Paints & coatings

-

Plastics

-

Inks

-

Paper and Pulp

-

Cosmetics

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global titanium dioxide market size was valued at USD 20.43 billion in 2023 and is expected to reach USD 21.64 billion in 2024.

b. The global titanium dioxide market is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030 to reach USD 31.79 billion by 2030

b. Asia Pacific dominated the market segment with a revenue share of 42.6% in 2023 owing to rapid modernization and recent economic expansion have accelerated the market throughout Asia and the Pacific.

b. Some key players operating in the titanium dioxide market include The Chemours Company, The Tronox Holdings plc LB Group, Venator Materials PLC, KRONOS Worldwide Inc., Evonik Industries AG, Ishihara Sangyo Kaisha, Ltd., CNNC HUAN YUAN, Titanium Dioxide Co., Ltd., The Kerala Minerals & Metals Limited, CATHAY INDUSTRIES, and TOR Minerals International, Inc. among others.

b. Key factors that are driving the TiO2 market growth include Increasing investments in the chloride production processes and the flourishing construction industry worldwide are anticipated to contribute to the growth of the market for titanium dioxide in the coming years.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."