- Home

- »

- Clinical Diagnostics

- »

-

Tissue Diagnostics Market Size, Share, Growth Report, 2030GVR Report cover

![Tissue Diagnostics Market Size, Share & Trends Report]()

Tissue Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Immunohistochemistry, In Situ Hybridization), By Application (Breast Cancer), By Modality, By End-use (Hospital, Diagnostic Center), By Region, And Segment Forecasts

- Report ID: 978-1-68038-399-7

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tissue Diagnostics Market Summary

The global tissue diagnostics market size was estimated at USD 8.72 billion in 2024 and is projected to reach USD 14.03 billion by 2030, growing at a CAGR of 8.41% from 2025 to 2030. The growth is driven by the rising cancer prevalence, advances in diagnostic technologies, and increasing demand for personalized medicine.

Key Market Trends & Insights

- North America tissue diagnostics market accounted for a 44.76% share in 2024.

- Asia Pacific tissue diagnostics market is experiencing significant growth driven by several factors.

- Based on application, the breast cancer segment held the largest market share of 50.45% in 2024.

- In terms of modality, the clinical market segment dominated the market in 2024 and is anticipated to grow at the fastest CAGR of 8.83% over the forecast period.

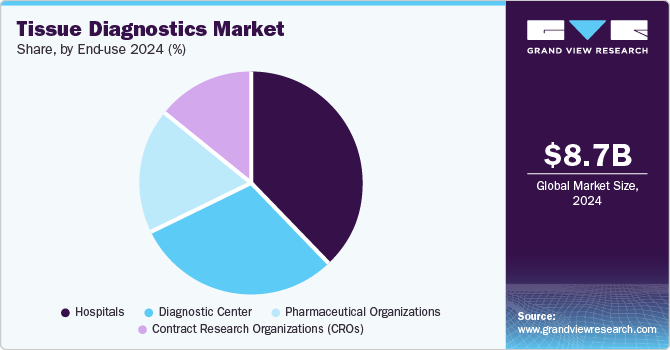

- Based on end-use, the hospitals dominated the market with the largest revenue share of 37.82% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.72 Billion

- 2030 Projected Market Size: USD 14.03 Billion

- CAGR (2025-2030): 8.41%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the Pan American Health Organization (PAHO), approximately 20 million new cancer cases and 10 million cancer-related deaths were anticipated in 2023, with annual reported cases projected to reach 30 million by 2040. Factors such as aging populations, the need for early disease detection, and advancements in immunohistochemistry and in situ hybridization techniques also contribute to market expansion. Additionally, increased healthcare spending and awareness about cancer screening programs globally further drive market growth.

Cancer remains a significant threat, with statistics indicating that one in six women and one in five men are likely to develop the disease during their lifetimes. The 5-year prevalence rate stood at approximately 50.5 million in 2020. According to the WHO, over 35 million new cancer cases are projected to be diagnosed by 2050, marking a 77% increase from the estimated 20 million cases in 2022. Moreover, the American Cancer Society highlighted lung cancer as one of the most diagnosed cancers, with over 234,580 new cases expected in the U.S. in 2024.

Digital pathology is revolutionizing traditional histopathology workflows by boosting efficiency, enabling deeper analysis, and fostering collaboration within pathology practices. The transformation begins with the digitalization of conventional workflows, from slide scanning to visualization and analysis, using advanced digital tools. This shift is enhancing diagnostic precision, improving laboratory operations, and expanding access to high-quality care. In January 2024, Kobe University and CarbGeM Inc. introduced the PoCGS-Pro, an automated gram stainer that sets a new benchmark for staining technology. Officially recognized as a specified maintenance controlled medical device, the PoCGS-Pro is now marketed by CarbGeM Inc. as a general medical device requiring specialized maintenance. Developed in collaboration with the National Center for Global Health and Medicine, this innovative device provides CarbGeM and its partners with a competitive edge in the market. These advancements in tissue diagnostics are expected to drive further growth by enhancing diagnostic precision, improving workflow efficiency, and expanding access to advanced care across various healthcare settings.

The rise of targeted and personalized therapies is driving the demand for companion diagnostics to accurately identify suitable patient populations. This trend is accelerating the adoption of companion tests in tissue diagnostics. A key example is the FDA approval of Agilent Technologies, Inc.'s PD-L1 IHC 22C3 pharmDx assay in January 2024. This assay serves as a companion diagnostic for Jemperli (dostarlimab-gxly), an immunotherapy used to treat endometrial cancer. Developed in collaboration with GlaxoSmithKline, the assay provides essential insights into PD-L1 expression levels in tumor tissues, helping guide treatment decisions. The approval highlights the increasing significance of precise diagnostic tools in oncology, enabling more accurate diagnoses and personalized treatment plans, ultimately improving patient outcomes.

Technology Insights

The immunohistochemistry segment dominated the market in terms of revenue share of 25.79% in 2024. Immunohistochemistry (IHC) is a special staining test in which a diagnostic antibody is bound to a specific target protein present in cell membranes or cells on slides containing tissue samples. The diagnostic antibody binds only if the target protein is found in or on the tumor cells. This biophysical interaction is visualized by a color reaction on the tissue slide, which is further examined under a microscope. IHC is crucial in deciding the drug therapy type to which a patient will respond. IHC technology is widely used for clinical research and cancer diagnostics and therapeutics development. IHC is one of the most important tools/technologies used for examining tissues/specimens for early diagnosis of disease, prognosis, and prediction of therapy response in cancer patients. It is a special staining process that uses enzymes or fluorescent dyes in biopsies performed on tissues or specimens obtained from cancer patients. With the help of IHC technology, it becomes easier for the technician to identify if the tumor is benign or malignant along with the stage of the tumor.

The digital pathology and workflow segment is anticipated to grow at the fastest CAGR of 12.22%. Digital pathology and workflow integration have revolutionized the application of ISH by enhancing imaging, data management, and analysis. Digital pathology employs high-resolution imaging systems to capture detailed views of tissue samples, facilitating precise visualization of ISH results and accurate localization of nucleic acid targets. This high-quality imaging supports advanced data analysis and interpretation. The digital workflow streamlines the management of ISH data, making it easier to store, retrieve, and share images & results, thus improving organization and collaboration among researchers & pathologists.

Application Insights

The breast cancer segment held the largest market share of 50.45% in 2024 and is anticipated to grow at the fastest CAGR. The increasing incidence of breast cancer due to lifestyle changes and rapidly aging global population provide lucrative growth opportunities for the segment. Breast cancer is classified into three types: Hormone Receptor (HR), Human Epidermal Growth Factor Receptor (HER2), and Triple Negative Breast Cancer (TNBC). Technologies such as MarginProbe system aid in the identification of cancer cells in the margins of excised tissue that are removed during surgical intervention. The launch of novel products is expected to strengthen the existing market portfolio. Advancements in genomic testing kits for a better understanding of the genetic markup of a tumor contribute to segment growth.

The non-small cell lung cancer segment is expected to grow significantly. Most people who are suffering from lung cancer have Non-Small Cell Lung Cancer (NSCLC). Its subtypes are squamous cell carcinoma, large cell carcinoma, and adenocarcinoma. According to American Cancer Society, approximately 14% of all new cases are lung cancer. The increase in the number of lung cancer patients is leading to an increase in R&D activities by pharmaceutical and biotechnology companies for its prevention & treatment. Unlike other cancer types, such as breast or colon cancer, there are no specific commercialized diagnostic tests for NSCLC detection. The disease is diagnosed with the help of a biopsy. Hence, the development of specific tests and tools for the detection of NSCLC poses high growth opportunities for new players in the market.

Modality Insights

The clinical market segment dominated the market in 2024 and is anticipated to grow at the fastest CAGR of 8.83% over the forecast period, driven by advancements in medical technology, increasing disease prevalence, and a rising demand for precise & personalized medicine. As the complexity of diseases such as cancer continues to increase, there is a heightened need for sophisticated diagnostic tools that can provide accurate, detailed analysis of tissue samples. Innovations in tissue diagnostics, including advanced imaging techniques, molecular profiling, and digital pathology, are enhancing the ability to detect & characterize diseases at earlier stages, leading to improved patient outcomes. The integration of AI and machine learning in tissue diagnostics further contributes to this growth by automating image analysis, improving diagnostic accuracy, and enabling more efficient workflows.

The pharma / CRO / research market segment is expanding rapidly due to several key drivers. Pharmaceutical companies and CROs are increasingly reliant on advanced tissue diagnostics to support drug discovery, development, and clinical trials. The growing complexity of drug targets and the need for precise biomarker identification have heightened the demand for sophisticated tissue analysis technologies. Tissue diagnostics facilitate detailed examination of cellular and molecular interactions, providing critical insights into drug efficacy & safety. Innovations such as high-resolution imaging, multiplexed assays, and integration of AI are enhancing the capabilities of tissue diagnostics, enabling more accurate & efficient data analysis. The shift toward personalized medicine further fuels market growth, as tailored therapies require precise tissue-based assessments to identify patient-specific biomarkers and predict treatment responses. .

End-use Insights

The hospitals dominated the market with the largest revenue share of 37.82% in 2024. The usage of tissue diagnostic systems and services in hospitals & clinics has increased over the years. In several hospitals and clinics, physicians are switching to tissue diagnostic tests from conventional testing procedures. The long turnover time associated with conventional processes is boosting the adoption of tissue diagnostic tests as these aid in reducing the timelines.

The CRO segment is expected to grow at the fastest CAGR over the forecast period, due to their essential role in supporting pharmaceutical and biotechnology companies throughout the drug development lifecycle. CROs offer specialized services that include preclinical and clinical testing, where tissue diagnostics play a key role. They provide expert analysis using advanced technologies that may not be available in-house, ensuring high-quality and accurate data for drug development. During preclinical studies, CROs use tissue diagnostics to assess the pharmacokinetics, pharmacodynamics, and toxicity of new compounds, while in clinical trials, these diagnostics are vital for monitoring treatment effects and validating drug efficacy. In addition, CROs help pharmaceutical companies meet regulatory requirements by providing detailed tissue analyses necessary for regulatory submissions. By outsourcing tissue diagnostics to CROs, companies can enhance efficiency and cost-effectiveness, avoiding the need for significant investments in specialized equipment & technology. Overall, CROs are integral to advancing drug development, providing expert tissue diagnostics, ensuring compliance, & streamlining research processes.

Regional Insights

North America tissue diagnostics market accounted for a 44.76% share in 2024, driven by a rising demand for advanced diagnostic tools due to the increasing prevalence of cancer and other diseases. The need for an accurate, early diagnosis is expected to fuel innovation in technologies, such as digital pathology & biomarker analysis. In addition, the region’s robust healthcare infrastructure and significant investment in R&D are further accelerating the market’s expansion.

U.S. Tissue Diagnostics Market Trends

The U.S. tissue diagnostics market is anticipated to grow over the forecast period. The rising prevalence of cancer and other chronic diseases is fueling demand for precise diagnostic tools, making tissue diagnostics a critical component of early disease detection & treatment planning. According to a report published in breastcancer.org in July 2024, about 13% of U.S. women, or roughly one in eight, will develop invasive breast cancer during their lifetime. Incidence has risen by 0.5% annually in recent years. Similarly, in 2023, the U.S. was projected to have 1,958,310 new cancer cases and 609,820 deaths. Technological innovations in digital pathology can enhance tissue analysis accuracy, speed, and efficiency, enabling better patient outcomes.

Europe Tissue Diagnostics Market Trends

The Europe tissue diagnostics market is anticipated to experience significant growth during the forecast period. Technological advancements in diagnostic tools, such as digital pathology & AI-driven imaging solutions, are enhancing accuracy and efficiency in cancer detection. Increased research funding can foster innovation and development in diagnostic technologies, further driving the market. For instance, in February 2024, Roche announced a partnership with PathAI to advance its digital pathology capabilities for CDx. Through this collaboration, PathAI will exclusively support Roche Tissue Diagnostics (RTD) in developing AI algorithms for digital pathology. These cutting-edge image analysis algorithms will be incorporated into Roche’s navify Digital Pathology platform, facilitating seamless integration into pathology laboratories worldwide. In addition, heightened awareness of cancer and the importance of early detection is boosting the demand for advanced diagnostic solutions.

UK tissue diagnostics market fueled by technological advancements and increased government funding. This focus on innovation can foster the growth of the tissue diagnostics market, particularly in digital pathology & molecular diagnostics. For instance, in May 2023, the Institute of Cancer Research announced the launch of the country’s first Integrated Pathology Unit dedicated to clinical trial research. This state-of-the-art facility would leverage innovative technology to diagnose cancer more quickly and cost-effectively. As more research initiatives are launched, the demand for precise and early detection tools is rising, leading to the development of advanced tissue diagnostics solutions.

Germany tissue diagnostics market is expected to grow over the forecast period. In Germany, cancer remains a significant public health challenge. The Robert Koch Institute, a federal research agency, reported that in 2020, approximately 231,400 women and 261,800 men in Germany were newly diagnosed with cancer. Consistent with trends in other European and North American cancer registries, Germany saw a decrease of about 6% in new cancer cases during the first year of the pandemic compared to the previous year. The high incidence of cancer underscores the need for advanced diagnostic technologies to improve early detection and treatment outcomes.

Asia Pacific Tissue Diagnostics Market Trends

Asia Pacific tissue diagnostics market is experiencing significant growth driven by several factors. With rising cancer prevalence across China, India, Japan, and South Korea, there is an increased demand for advanced diagnostic technologies to enable early detection & effective treatment in Asia Pacific. In 2022, WHO South-East Asia reported approximately 2.2 million new cancer cases and 1.4 million cancer-related deaths, representing over 10% of all deaths in the region. Among these cancer-related deaths, lung cancer was responsible for 10.6%, breast cancer for 9.4%, and cervical cancer for 8%. This growing burden of cancer is highlighting the need for sophisticated diagnostic tools that can accurately identify and stage tumors.

China tissue diagnostics market is experiencing significantly. The rise in cancer prevalence in China is becoming a significant public health challenge, with the National Institutes of Health (NIH) having estimated 4,824,700 new cancer cases in 2022. Of these, 2,533,900 cases were in males and 2,290,800 in females, with an Age-Standardized Incidence Rate (ASIR) of 208.58 per 100,000 people. This surge in cancer cases can drive the demand for more advanced and accurate diagnostic tools, leading to substantial growth in China’s tissue diagnostics market.

Latin America Tissue Diagnostics Market Trends

Latin America tissue diagnostics market is driven by increasing healthcare investments. As the demand for more accurate and efficient diagnostic tools grows, key players are expanding their presence through strategic partnerships & collaborations with local companies and healthcare institutions. These partnerships are crucial for market expansion as they facilitate the localization of advanced technologies, making them more accessible to healthcare providers across the region

Middle East And Africa Tissue Diagnostics Market Trends

MEA tissue diagnostics market is experiencing notable growth. Start-ups in the region are playing a crucial role in this market, with several emerging companies focused on innovative diagnostic solutions. These start-ups are attracting substantial funding for R&D, which supports the development of cutting-edge technologies such as AI-enhanced diagnostic tools and next-generation sequencing platforms. For instance, in May 2023, DataPathology, a Moroccan healthtech company, secured USD 1 million in funding from the Azur Innovation Fund. The company aims to tackle the challenges of limited and delayed cancer diagnoses, especially in medically underserved regions across Africa. Governments and private investors are increasingly recognizing the potential of tissue diagnostics, leading to enhanced funding opportunities and partnerships. This support is fueling innovation in diagnostic techniques and technologies, facilitating market growth.

The tissue diagnostics market in Saudi Arabia is expanding due to cancer prevalences and significant investments in healthcare infrastructure. According to ASCO Publications, cancer incidence in Saudi Arabia is on the rise. The number of new cancer cases is projected to increase from 27,885 in 2020 to 60,429 by 2040, reflecting a dramatic growth of 116.7%. This surge highlights a growing need for enhanced diagnostic capabilities and early detection systems. As cancer rates increase, the demand for advanced diagnostic tools and comprehensive screening programs becomes more critical to manage & treat the growing number of cases effectively

Key Tissue Diagnostics Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their technology and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Tissue Diagnostics Companies:

The following are the leading companies in the tissue diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Siemens

- Danaher

- bioMérieux SA

- QIAGEN

- BD

- Merck KGaA

- GE Healthcare

- BioGenex

- Cell Signaling Technology, Inc.

- Bio SB

- DiaGenic ASA

- Agilent Technologies

Recent Developments

-

In January 2024, QIAGEN expanded its operations in the Middle East by opening new regional headquarters in Dubai, United Arab Emirates. This strategic move aligns with the company's goal to strengthen its presence in emerging markets and improve access to its molecular diagnostics and sample preparation technologies. The new headquarters will support key projects across healthcare, research, and industrial sectors, advancing QIAGEN's mission to grow its footprint in the region and foster local partnerships.

-

In February 2024, Merck KGaA inaugurated a new $21.88 million distribution center in Cajamar, São Paulo, Brazil, aimed at improving service for its life science clients. This investment enhances Merck’s operational efficiency and responsiveness, supporting the delivery of advanced tissue diagnostics solutions to the region.

-

In February 2024, Roche partnered with PathAI to develop AI-enabled digital pathology algorithms for the companion diagnostics market. This collaboration aims to improve the demand for personalized medicines by incorporating AI-driven algorithms into digital pathology, enhancing both speed and accuracy in diagnostics.

-

In May 2024, QIAGEN, in partnership with Myriad Genetics, developed a globally scalable kit-based test to detect homologous recombination deficiency (HRD). This next-generation sequencing (NGS) test advances personalized medicine research by enabling precise identification of genetic deficiencies in various solid tumors, including ovarian cancer, ultimately boosting the accuracy and effectiveness of targeted therapies

Tissue Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.37 billion

Revenue forecast in 2030

USD 14.03 billion

Growth Rate

CAGR of 8.41% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, modality, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; Abbott Laboratories; Thermo Fisher Scientific, Inc.; Siemens; Danaher; bioMérieux SA; QIAGEN; BD; Merck KGaA; GE Healthcare; BioGenex; Cell Signaling Technology, Inc.; Bio SB; DiaGenic ASA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tissue Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tissue diagnostics market report based on technology, modality, application, end-use, and region.

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Immunohistochemistry

-

Instruments

-

Slide Staining Systems

-

Tissue Microarrays

-

Tissue Processing Systems

-

Slide Scanners

-

Cell Processors

-

Microtomes

-

Embedding Systems

-

Cover Slippers

-

Other Products

-

-

Consumables

-

H&E Stainer Coverslipper

-

IHC Stainer Coverslipper

-

Antibodies

-

Others IHC reagents

-

-

-

In Situ Hybridization

-

Instruments

-

Stainers

-

Others

-

Total

-

-

Consumables

-

Software

-

-

Primary & Special Staining

-

Digital Pathology And Workflow

-

Image Analysis Informatics

-

Information Management System Storage & Communication

-

-

Anatomic Pathology

-

Instruments

-

Microtomes & Cryostat Microtomes

-

Tissue Processors

-

Automatic Strainers

-

Other Products

-

-

Consumables

-

Reagents & Antibodies

-

Probes & Kits

-

Others

-

-

-

Molecular Pathology

-

Instruments

-

Reagents

-

Fluorescence Reagents

-

Others

-

-

Others

-

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Breast Cancer

-

Non-small Cell Lung Cancer

-

Prostate Cancer

-

Gastric Cancer

-

Other Cancers

-

-

Modality Outlook (Revenue, USD Million; 2018 - 2030)

-

Clinical

-

Pharma / CRO / Research Market

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Diagnostic Center

-

Pharmaceutical Organizations

-

Contract Research Organizations (CROs)

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tissue diagnostics market is expected to grow at a compound annual growth rate of 8.41% from 2024 to 2030 to reach USD 14.03 billion by 2030.

b. North America dominated the tissue diagnostics market with a share of 44.76% in 2024. This is attributable to the high incidence rate of cancer and the presence of several public programs that aim to minimize cancer incidence and raise the demand for cancer diagnosis supplements.

b. Some key players operating in the tissue diagnostics market include F. Hoffmann-La Roche Ltd.; Abbott Laboratories; Thermo Fisher Scientific Inc.; Siemens; Danaher;bioMérieux SA; QIAGEN; Becton, Dickinson and Company; Merck KGaA; GE Healthcare; BioGenex; Cell Signaling Technology, Inc.; Bio SB; DiaGenic ASA; and Agilent Technologies.

b. Key factors that are driving the market growth include a worldwide increase in cancer prevalence, advancements in imaging techniques and increasing affordability of diagnostics, and growth of personalized therapeutics & diagnostics.

b. The global tissue diagnostics market size was estimated at USD 8.72 billion in 2024 and is expected to reach USD 9.37 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.