- Home

- »

- Plastics, Polymers & Resins

- »

-

Tire Recycling Market Size And Share, Industry Report, 2030GVR Report cover

![Tire Recycling Market Size, Share & Trends Report]()

Tire Recycling Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rubber, Tire-derived Fuel, Tire-derived Aggregate, Carbon Black, Steel Wires), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-520-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tire Recycling Market Summary

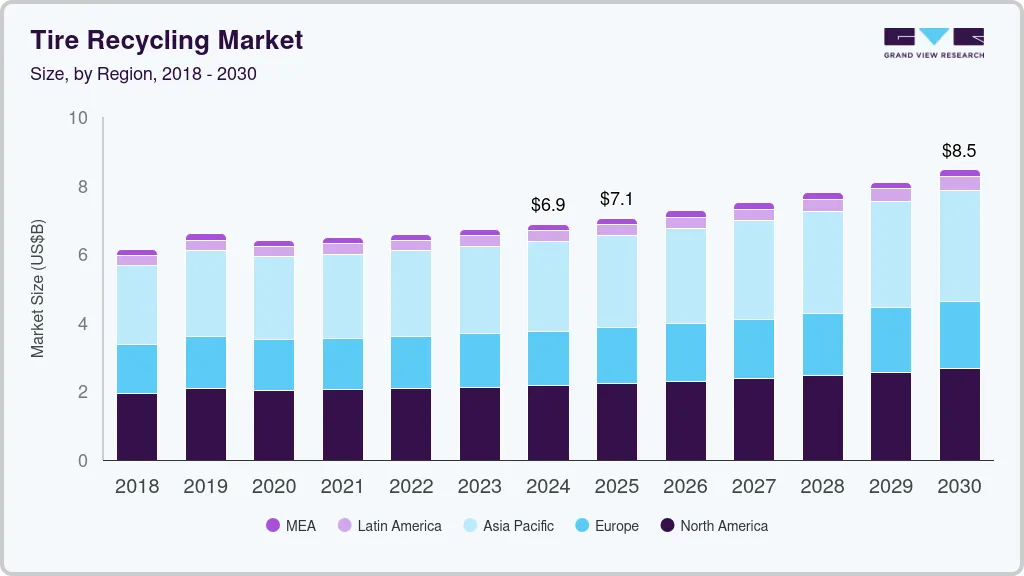

The global tire recycling market size was estimated at USD 6.87 billion in 2024 and is projected to reach USD 8.46 billion by 2030, growing at a CAGR of 3.71% from 2025 to 2030. Governments and construction companies are using recycled tire materials in road paving, sound barriers, and playground surfaces to enhance durability and sustainability, driving steady demand for tire-derived products.

Key Market Trends & Insights

- The Asia Pacific accounted for the largest revenue share of 37.98% in 2024.

- By product, the rubber segment dominated the industry with the largest revenue share of 37.63% in 2024.

- By application, the building & construction segment dominated the industry with the largest revenue share of 42.64% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.87 Billion

- 2030 Projected Market Size: USD 8.46 Billion

- CAGR (2025-2030): 3.71%

- Asia Pacific: Largest market in 2024

The industry is witnessing a notable shift as recycled rubber finds increasing use in high-value applications, such as asphalt modification, automotive components, and sports surfaces. This shift is driven by advancements in processing technologies, which enable finer and more purified rubber powders that meet stringent industry standards. Governments and private companies are actively investing in research to enhance the performance of recycled rubber, making it a viable alternative to virgin materials. As sustainability gains prominence, manufacturers in sectors like construction and transportation are integrating recycled rubber into their products to reduce environmental impact while maintaining performance, further driving demand for innovative tire-derived materials.

Drivers, Opportunities & Restraints

Governments worldwide are implementing stricter waste management policies, compelling tire manufacturers and recyclers to adopt sustainable disposal and recycling practices. Regulatory frameworks, such as the European Union’s Waste Directive and extended producer responsibility (EPR) programs, mandate responsible end-of-life tire management, pushing companies toward closed-loop recycling solutions. Additionally, rising landfill costs and bans on landfilling scrap tires in various regions are accelerating investments in tire recycling infrastructure. These regulations not only drive compliance but also create a structured market for tire-derived products, supporting long-term sustainability goals and reducing the environmental footprint of discarded tires.

The rise of sustainable manufacturing practices is opening new opportunities for tire recyclers, particularly in supplying eco-friendly raw materials to industries focusing on carbon reduction. Recycled rubber is increasingly being explored for applications in sustainable consumer goods, construction materials, and industrial adhesives, driven by the need for low-carbon alternatives. With major corporations committing to net-zero emissions and integrating circular economy principles, the demand for high-quality recycled tire materials is expected to rise. Moreover, the potential for developing bio-based additives and hybrid recycled rubber compounds can further expand the market, creating lucrative opportunities for recyclers to diversify their revenue streams.

Despite growing demand, the industry faces significant cost challenges due to the energy-intensive nature of rubber processing and the need for advanced equipment to ensure product quality. Mechanical and chemical recycling methods require substantial capital investment, and variations in tire composition make standardization difficult, impacting overall efficiency. Additionally, market penetration is hindered by the lack of uniformity in recycled rubber quality, which limits its use in high-performance applications. The slow pace of innovation in cost-effective recycling technologies further constrains scalability, making it difficult for smaller recyclers to compete with established players that have access to better processing capabilities.

Product Insights & Trends

The rubber segment dominated the industry with the largest revenue share of 37.63% in 2024. The increasing demand for durable and cost-effective alternatives to virgin rubber is driving growth in the recycled rubber segment. Industries such as manufacturing, manufacturing, and defense are integrating high-performance recycled rubber into seals, gaskets, and vibration-damping components due to its improved resilience and sustainability benefits. Innovations in devulcanization technologies are further enhancing the quality of recycled rubber, making it comparable to virgin rubber in elasticity and durability. With global efforts to reduce dependence on fossil-based raw materials, companies are strategically investing in advanced recycling processes to meet the rising need for sustainable rubber solutions across industrial sectors.

The industry is seeing a surge in demand for recovered carbon black (rCB) as industries seek eco-friendly reinforcement materials for rubber and plastic applications. Regulatory pressures to reduce carbon emissions in manufacturing are pushing companies to replace virgin carbon black with rCB, which significantly cuts CO₂ output during production. Major tire and rubber manufacturers are forming partnerships with recyclers to integrate rCB into their supply chains, improving product sustainability while maintaining performance standards. Additionally, technological advancements in refining processes are enhancing the consistency and purity of rCB, making it a competitive alternative in high-performance applications such as coatings, plastics, and specialty chemicals.

Application Insights & Trends

The building & construction segment dominated the industry with the largest revenue share of 42.64% in 2024. The automotive industry is accelerating the use of recycled tire materials as part of its broader circular economy strategy. With leading automakers committed to reducing their environmental footprint, recycled rubber and carbon black are being incorporated into tire manufacturing, underbody components, and interior applications. Automakers are also responding to consumer demand for sustainable vehicles by integrating eco-friendly materials that enhance vehicle performance while reducing waste. Additionally, regulatory standards on vehicle emissions and sustainable sourcing are pushing suppliers to adopt tire-derived materials, ensuring a stable growth trajectory for recycled products within the automotive sector.

The construction sector is experiencing a shift toward sustainable building practices, driving demand for tire-derived materials in roadways, sound barriers, and insulation applications. Governments and infrastructure developers are incorporating recycled rubber into asphalt to improve road durability and reduce maintenance costs, while also lowering environmental impact. The noise reduction and shock-absorbing properties of recycled tire materials make them ideal for sports surfaces, pedestrian walkways, and structural reinforcements. With growing investments in green building initiatives, the use of recycled tire products in construction is expected to expand, offering long-term cost benefits and environmental advantages.

Regional Insights & Trends

North America tire recycling market is witnessing significant investments in next-generation tire recycling technologies, driven by the need for sustainable waste management solutions and circular economy initiatives. Governments and private companies are funding research into chemical and thermal recycling methods, such as pyrolysis and devulcanization, to extract high-value raw materials from end-of-life tires.

U.S. Tire Recycling Market Trends

The tire recycling market in the U.S. is driven by stringent federal and state-level policies that are pushing businesses toward sustainable tire disposal and recycling practices. The Environmental Protection Agency (EPA) and individual states have implemented regulations that encourage the use of recycled tire materials in infrastructure projects, including rubberized asphalt for road construction and artificial turf for sports fields. Additionally, government incentives and grants are fostering the development of waste-to-energy projects that convert scrap tires into alternative fuels, further strengthening the market. With increasing corporate sustainability commitments and a rising focus on carbon footprint reduction, major tire manufacturers and recyclers in the U.S. are actively integrating recycled materials into their production cycles to align with national and global sustainability goals.

Asia Pacific Tire Recycling Market Trends

The tire recycling market in Asia Pacific accounted for the largest revenue share of 37.98% in 2024. Asia Pacific is experiencing rapid growth in the tire recycling market, primarily driven by the booming automotive industry and increasing vehicle ownership. Countries such as India, Japan, and South Korea are witnessing rising demand for cost-effective and sustainable raw materials, leading manufacturers to integrate recycled rubber and tire-derived products into their supply chains.

China tire recycling market is expanding rapidly due to the government’s strict crackdown on illegal tire dumping and pollution control measures. The country’s latest environmental policies, including stricter waste management laws and incentives for green manufacturing, are pushing industries to adopt sustainable recycling practices. Additionally, China’s aggressive push toward electric vehicles (EVs) and sustainable mobility solutions is driving demand for eco-friendly materials, including recycled tire-derived products. The government is also investing in large-scale pyrolysis projects to extract valuable fuels and chemicals from scrap tires, creating new revenue streams for recyclers. With ongoing industrial reforms aimed at reducing carbon emissions and waste pollution, China’s tire recycling industry is set for substantial long-term growth.

Europe Tire Recycling Market Trends

The tire recycling market in Europe is driven by its strict circular economy policies and aggressive implementation of extended producer responsibility (EPR) programs. The European Union’s Waste Framework Directive and Green Deal initiatives mandate that tire manufacturers take responsibility for the entire lifecycle of their products, driving investments in recycling infrastructure and sustainable material recovery.

Key Tire Recycling Company Insights

The tire recycling market is highly competitive, with several key players dominating the landscape. Major companies include Davis Rubber Company Inc., TIRE DISPOSAL & RECYCLING LLC, Tyre Recycling Solution, Liberty Tire Recycling, Genan Holding A/S, ResourceCo, GRP LTD, and Lehigh Technologies, Inc. The tire recycling market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Tire Recycling Companies:

The following are the leading companies in the tire recycling market. These companies collectively hold the largest market share and dictate industry trends.

- Davis Rubber Company Inc.

- TIRE DISPOSAL & RECYCLING LLC

- Tyre Recycling Solution

- Liberty Tire Recycling

- Genan Holding A/S

- ResourceCo

- GRP LTD

- Lehigh Technologies, Inc.

Recent Developments

-

In May 2024, The U.S. Tire Manufacturers Association (USTMA) and the Tire Industry Association (TIA) launched the Tire Recycling Foundation to boost tire recycling efforts in the U.S. The goal is to achieve a 100% recycling rate for end-of-life tires by funding research and projects that address gaps in the tire recycling supply chain.

-

In February 2024, Michelin partnered with Antin and Enviro in a joint venture to build tire recycling plants across Europe. The first plant, located in Uddevalla, Sweden, is under construction and expected to be operational in 2025. It will recycle approximately 35,000 tons of used tires annually, creating about 40 local green jobs.

Tire Recycling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.05 billion

Revenue forecast in 2030

USD 8.46 billion

Growth rate

CAGR of 3.71% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Davis Rubber Company Inc., TIRE DISPOSAL & RECYCLING LLC, Tyre Recycling Solution, Liberty Tire Recycling, Genan Holding A/S, ResourceCo, GRP LTD, and Lehigh Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tire Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tire recycling market report on the basis of product, application, and region:

-

Product Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rubber

-

Tire-derived Fuel

-

Tire-derived Aggregate

-

Carbon Black

-

Steel Wires

-

Others

-

-

Application Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Manufacturing

-

Rubber & Plastics

-

Others

-

-

Regional Outlook (Volume Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tire recycling market size was estimated at USD 6.87 billion in 2024 and is expected to reach USD 7.05 billion in 2025.

b. The global tire recycling market is expected to grow at a compound annual growth rate of 3.71% from 2025 to 2030 to reach USD 8.46 billion by 2030.

b. Building & construction dominated the tire recycling market across the technology segmentation in terms of revenue, accounting to a market share of 42.64% in 2024. The automotive industry is accelerating the use of recycled tire materials as part of its broader circular economy strategy.

b. Some key players operating in the tire recycling market include Davis Rubber Company Inc., TIRE DISPOSAL & RECYCLING LLC, Tyre Recycling Solution, Liberty Tire Recycling, Genan Holding A/S, ResourceCo, GRP LTD, and Lehigh Technologies, Inc.

b. Governments and construction companies are using recycled tire materials in road paving, sound barriers, and playground surfaces to enhance durability and sustainability, driving steady demand for tire-derived products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.