- Home

- »

- Automotive & Transportation

- »

-

Tire Pressure Monitoring System Market Size Report, 2030GVR Report cover

![Tire Pressure Monitoring System Market Size, Share & Trends Report]()

Tire Pressure Monitoring System Market Size, Share & Trends Analysis Report By Type (Direct TPMS, Indirect TPMS), By Vehicle Type, And Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-360-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

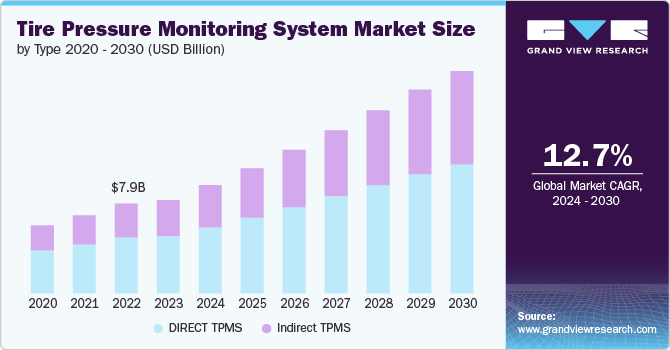

The global tire pressure monitoring system market size was estimated at USD 8.24 billion in 2023 and is anticipated to grow at a CAGR of 12.7% from 2024 to 2030. The proliferation of IoT (Internet of Things) and AI (Artificial Intelligence) has enabled the development of more advanced TPMS, which not only monitor tire pressure but also predict potential tire failures by analyzing patterns and trends in tire performance data. Besides, rising consumer demand for smart and connected vehicles is accelerating the adoption of tire pressure monitoring system (TPMS). Modern consumers expect their vehicles to offer more than just transportation; they want enhanced safety, efficiency, and connectivity. TPMS fits perfectly into this paradigm by providing real-time monitoring and alerts, thus enhancing the overall driving experience.

The rise in the adoption of electric vehicles (EVs) is significantly driving the growth of the tire pressure monitoring systems market. EVs demand efficient energy management, where tire pressure plays a pivotal role. Manufacturers of electric vehicles are majorly focusing on maximizing range and efficiency, are increasingly integrating TPMS as an essential component. This integration is crucial as it helps maintain optimal tire pressure, ensuring better energy usage and extending the vehicle's range. Moreover, considering the higher initial investment in EVs, consumers are more inclined to invest in features like TPMS that enhance tire longevity and improve overall vehicle efficiency.

Government regulations and safety standards in many countries mandate the use of TPMS in vehicles. For instance, according to the TREAD Act the manufacturers of passenger cars and light truck in the U.S. need to equip all vehicles with TPMS. Such favorable regulations are driving the demand for the TPMS as manufacturers comply with these legal requirements. Furthermore, governments and safety organizations worldwide are actively conducting campaigns to educate drivers on the hazards of underinflated tires, which can lead to dangerous blowouts and accidents. This increasing awareness is driving the integration of TPMS as a standard feature in both new and existing vehicles. In addition, insurance companies are beginning to offer incentives and discounts for vehicles equipped with TPMS, providing financial motivation for consumers to adopt this technology. These initiatives collectively contribute to the growing prevalence of TPMS in the automotive market.

Advancements in sensor technology and wireless communication are also propelling the TPMS market forward. The development of more accurate, reliable, and cost-effective sensors has made it possible to equip even budget vehicles with TPMS. These technological advancements ensure precise monitoring of tire pressure, thereby enhancing safety and performance. Furthermore, improvements in wireless communication technologies facilitate seamless integration with vehicle systems and external devices, boosting the overall functionality and attractiveness of TPMS. This technological progress is making TPMS a more accessible and desirable feature for a broader range of vehicles.

The aftermarket for TPMS is burgeoning, driven by the increasing need for replacement and upgrading of existing systems. As the global vehicle fleet ages, the demand for aftermarket TPMS solutions is expected to rise, particularly true in regions where older vehicles still dominate the roads, and retrofitting these vehicles with modern TPMS can significantly enhance their safety and efficiency. The aftermarket segment provides a significant opportunity for TPMS manufacturers to expand their market presence and cater to a diverse customer base.

Type Insights

Among the type segment, the direct TPMS segment accounted for the largest market share of 61.7% in 2023. Direct TPMS measures the actual air pressure inside the tire through sensors mounted on the wheel. This real-time, precise monitoring allows for immediate alerts to the driver when tire pressure falls below optimal levels, enhancing safety and vehicle performance. The reliability of these systems in providing accurate readings is a significant factor propelling their adoption.

Besides, continuous advancements in sensor technology and wireless communication have significantly improved the performance and integration of Direct TPMS. Innovations such as battery-less sensors, improved durability, and enhanced data transmission capabilities make Direct TPMS more attractive to both manufacturers and consumers. The ongoing development of more sophisticated and cost-effective solutions contributes to the widespread adoption of Direct TPMS.

The indirect TPMS segment is experiencing robust growth due to cost-effectiveness compared to Direct TPMS, making it an attractive option for budget-conscious consumers and manufacturers. This system uses the vehicle's ABS (Anti-lock Braking System) and ESC (Electronic Stability Control) sensors to estimate tire pressure, eliminating the need for additional hardware. The lower cost of implementation and maintenance is a significant driver for the growth of Indirect TPMS, especially in entry-level and mid-range vehicle segments.

Vehicle Type

Amongst the vehicle types, the passenger vehicle segment dominated the market in 2023. Stringent government regulations mandating the use of TPMS in vehicles to enhance road safety have significantly contributed to the adoption of these systems. For instance, regulations in the United States and the European Union require TPMS in all new passenger cars, ensuring that tire pressure is continuously monitored to prevent accidents caused by under-inflated tires.

Additionally, the growing awareness among consumers about the benefits of maintaining optimal tire pressure, such as improved fuel efficiency, reduced tire wear, and enhanced vehicle handling, has further propelled the demand for TPMS. The increasing production and sales of passenger cars globally, particularly in emerging markets, also play a crucial role in the widespread adoption of TPMS.

The tremendous growth of commercial TPMS is the need for enhanced fleet management software efficiency. Commercial vehicles, such as trucks and buses, often cover extensive distances and operate under varying load conditions, making tire maintenance crucial. TPMS helps fleet operators monitor and maintain optimal tire pressure, leading to significant cost savings through reduced tire wear, improved fuel economy, and minimized downtime.

Furthermore, stringent regulatory requirements aimed at ensuring road safety and reducing vehicular emissions have mandated the use of TPMS in commercial vehicles in many regions. The advent of advanced telematics and IoT technologies has also facilitated the integration of TPMS with fleet management systems, allowing real-time data collection and analytics for proactive maintenance and operational efficiency.

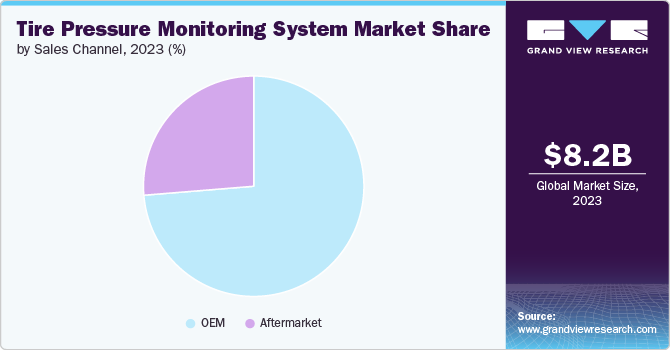

Sales Channel Insights

Among the sales channels, the OEM segment held the largest market share in 2023.The rising consumer awareness regarding vehicle safety and maintenance plays a crucial role. Car buyers are increasingly prioritizing advanced safety features, including TPMS, when purchasing new vehicles. OEMs are capitalizing on this trend by offering TPMS as part of their standard and optional safety packages. Furthermore, the technological advancements in TPMS, such as the development of intelligent and connected systems that provide real-time tire pressure data and alerts, are driving OEM adoption.

The aftermarket segment has experienced significant expansion due to increasing demand from owners of older vehicle models. These consumers are increasingly acknowledging the advantages of TPMS in improving safety, fuel efficiency, and tire longevity, which drives the need for aftermarket solutions. Moreover, growing awareness of tire maintenance benefits and potential cost savings from avoiding tire-related issues are prompting customers to invest in aftermarket TPMS. The market is further propelled by the availability of diverse, cost-effective TPMS kits that are simple to install.

Regional Insights

North America tire pressure monitoring system market is expected to grow at a CAGR of 12.6% from 2024-2030. The North American market for tire pressure monitoring systems is primarily driven by stringent government regulations and safety standards. Furthermore, the increasing awareness among consumers about vehicle safety and the benefits of maintaining optimal tire pressure, such as improved fuel efficiency and extended tire life, has fuelled the demand for TPMS. The presence of major automotive manufacturers and a strong aftermarket sector in North America also contribute to the growth of the TPMS market in this region.

U.S. Tire Pressure Monitoring System Market Trends

The tire pressure monitoring systems market of the U.S. is heavily influenced by regulatory requirements and consumer awareness. The implementation of the TREAD Act, which mandates TPMS in all new vehicles, has been a major driver for market growth. Additionally, the U.S. has a mature automotive market with a strong focus on safety and performance, leading to high consumer demand for TPMS. The presence of leading automotive manufacturers and a robust aftermarket industry further supports the growth of the TPMS market in the U.S. The increasing trend of connected and smart vehicles is also contributing to the adoption of advanced TPMS technologies in the country.

Asia Pacific Tire Pressure Monitoring System Market Trends

Asia Pacific tire pressure monitoring systems market dominated in 2023 and accounted for a revenue share of 38.7% in 2023. The Asia-Pacific TPMS market is experiencing rapid growth due to a combination of factors, including rising vehicle production, increasing disposable incomes, and growing awareness of vehicle safety. Countries like China, Japan, and India are witnessing significant growth in the automotive sector, driving the demand for advanced safety features like TPMS. Government initiatives to improve road safety and reduce vehicular emissions are also encouraging the adoption of TPMS in this region. Moreover, the presence of a large number of automotive manufacturers and suppliers in Asia-Pacific makes it a key market for TPMS development and deployment.

Europe Tire Pressure Monitoring System Market Trends

The tire pressure monitoring systems market of Europe is driven by strict regulatory frameworks and a high emphasis on vehicle safety and environmental standards. The European Union's ECE-R64 regulation requires all new passenger cars to be equipped with TPMS, leading to widespread adoption of TPMS across the region. Additionally, European consumers are increasingly conscious of the environmental impact of their vehicles, and maintaining proper tire pressure is recognized as a key factor in reducing CO2 emissions and improving fuel efficiency. The strong presence of automotive OEMs and a well-established automotive industry infrastructure further support the growth of the TPMS market in Europe.

Key Tire Pressure Monitoring System Company Insights

Key players operating in the market include ZF Friedrichshafen AG, Delphi Technologies (Phinia Inc.), DENSO CORPORATION., Continental AG, Valor (TPMS), HELLA GmbH & Co. KGaA, VALEO, Alligator Valves, Sensata Technologies, Inc., Huf Hülsbeck & Fürst GmbH & Co. KG. The companies are concentrating on several strategic initiatives, such as developing new products, forming partnerships and collaborations, and establishing agreements to achieve a competitive edge over their competitors.

Key Tire Pressure Monitoring System Companies:

The following are the leading companies in the tire pressure monitoring system market. These companies collectively hold the largest market share and dictate industry trends.

- ZF Friedrichshafen AG

- Delphi Technologies (Phinia Inc.)

- DENSO CORPORATION

- Continental AG

- Valor (TPMS)

- HELLA GmbH & Co. KGaA

- VALEO

- Alligator Valves

- Sensata Technologies, Inc.

- Huf Hülsbeck & Fürst GmbH & Co. KG

Recent Developments

-

In June 2024, Continental AG doubled its TPMS production capacity for passenger cars in India's Bangalore plant. The company introduced a new generation of TPMS to boost safety and sustainability, aligning with its commitment to Vision Zero for safer mobility.

-

In October 2022, Volvo Group, Qamcom Group, and inventor Roman Iustin joined forces to establish Fyrqom AB, a startup focusing on automated tire pressure monitoring system calibration for heavy-duty vehicles.

Tire Pressure Monitoring System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.56 billion

Revenue forecast in 2030

USD 19.64 billion

Growth rate

CAGR of 12.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion type, vehicle type, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

ZF Friedrichshafen AG; Delphi Technologies (Phinia Inc.); DENSO CORPORATION.; Continental AG; Valor (TPMS) HELLA GmbH & Co. KGaA; VALEO; Alligator Valves; Sensata Technologies, Inc.; Huf Hülsbeck & Fürst GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tire Pressure Monitoring System Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tire pressure monitoring system market report on the basis of vehicle type, type, sales channel, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct TPMS

-

Indirect TPMS

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The proliferation of IoT (Internet of Things) and AI (Artificial Intelligence) has enabled the development of more advanced TPMS, which not only monitor tire pressure but also predict potential tire failures by analyzing patterns and trends in tire performance data. Besides, rising consumer demand for smart and connected vehicles is accelerating the adoption of TPMS.

b. The global tire pressure monitoring system market size was estimated at USD 8.24 billion in 2023 and is expected to reach USD 9.56 billion in 2024.

b. The global tire pressure monitoring system market is expected to grow at a compound annual growth rate of 12.7% from 2024 to 2030, reaching USD 19.64 billion by 2030.

b. Among the type segment, the direct TPMS segment accounted for the largest market share of 61.7% in 2023. Direct TPMS measures the actual air pressure inside the tire through sensors mounted on the wheel. This real-time, precise monitoring allows for immediate alerts to the driver when tire pressure falls below optimal levels, enhancing safety and vehicle performance.

b. Some of the players operating in the tire pressure monitoring system market include ZF Friedrichshafen AG, Delphi Technologies (Phinia Inc.), DENSO CORPORATION., Continental AG, Valor (TPMS), HELLA GmbH & Co. KGaA, VALEO, Alligator Valves, Sensata Technologies, Inc., Huf Hülsbeck & Fürst GmbH & Co. KG.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."