- Home

- »

- Renewable Energy

- »

-

Tire Derived Fuel Market Size, Share, Industry Report, 2030GVR Report cover

![Tire Derived Fuel Market Size, Share & Trends Report]()

Tire Derived Fuel Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Whole Tire, Shredded Tire), By End Use (Pulp & Paper Mills, Utility Boilers, Cement Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-532-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tire Derived Fuel Market Size & Trends

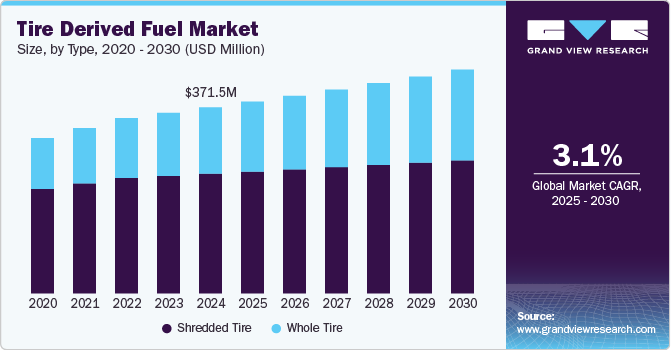

The global tire derived fuel market size was estimated at USD 371.50 million in 2024 and is projected to grow at a CAGR of 3.1% from 2025 to 2030. This growth is driven by the increasing demand for sustainable and cost-effective alternative fuels, particularly in energy-intensive industries such as cement manufacturing, power generation, and pulp and paper production. TDF, derived from recycled waste tires, offers a high calorific value and serves as a viable substitute for traditional fossil fuels like coal and oil. The growing emphasis on waste management and circular economy practices has further accelerated the adoption of TDF, as it provides an environmentally friendly solution for disposing of end-of-life tires while reducing reliance on non-renewable energy sources.

Governments and industries worldwide are increasingly adopting TDF as a cleaner and more efficient alternative to conventional fuels. Stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable waste management practices are driving the demand for TDF. Companies are investing in advanced tire recycling technologies to enhance the efficiency and sustainability of TDF production. Innovations in shredding, processing, and combustion technologies are improving the quality and accessibility of TDF, making it a viable option for a wide range of industrial applications. These developments are aligning the TDF market with global sustainability goals and driving its growth across regions.

Technological advancements in tire recycling and TDF production are playing a pivotal role in market expansion. Modern techniques, such as pyrolysis and cryogenic grinding, are increasing the efficiency of tire recycling and TDF production. The integration of digital technologies, such as IoT and data analytics, is enabling real-time monitoring and optimization of TDF production processes, reducing operational costs and improving output quality. Furthermore, the rise of renewable energy integration and the development of cleaner combustion technologies are creating new opportunities for market growth, as industries seek to balance energy demand with environmental responsibility.

The growing awareness of the economic and environmental benefits of TDF is another key driver of market growth. TDF offers a cost-effective and sustainable energy solution, particularly in regions with abundant waste tire resources. Its use as an alternative fuel helps reduce greenhouse gas emissions and supports efforts to lower reliance on fossil fuels. As global energy demand continues to rise and the transition toward cleaner energy sources gains momentum, the TDF market is poised to play a crucial role in ensuring energy security and supporting sustainable development worldwide.

Type Insights

Based on type, the shredded tire segment held a significant market share of over 64.0% in 2024. This dominance is primarily driven by the efficiency and versatility of shredded tires as a fuel source. Shredded tires are easier to handle, transport, and combust compared to whole tires, making them a preferred choice for industrial applications such as cement kilns, power plants, and pulp and paper mills. The uniform size and higher surface area of shredded tires allow for more efficient combustion, resulting in better energy output and reduced emissions. Additionally, shredded tires can be easily mixed with other fuels, such as coal or biomass, to optimize combustion processes and meet specific energy requirements, further enhancing their appeal to industries.

Another key factor contributing to the dominance of the shredded tire segment is the growing adoption of advanced tire recycling technologies, which have made the shredding process more efficient and cost-effective. Shredded tires are also easier to store and feed into industrial boilers and kilns, reducing operational complexities and costs. The environmental benefits of using shredded tires, such as reducing landfill waste and lowering greenhouse gas emissions, align with global sustainability goals and stringent environmental regulations. These factors, combined with the increasing demand for alternative fuels in energy-intensive industries, have solidified the shredded tire segment's leading position in the global TDF market.

End Use Insights

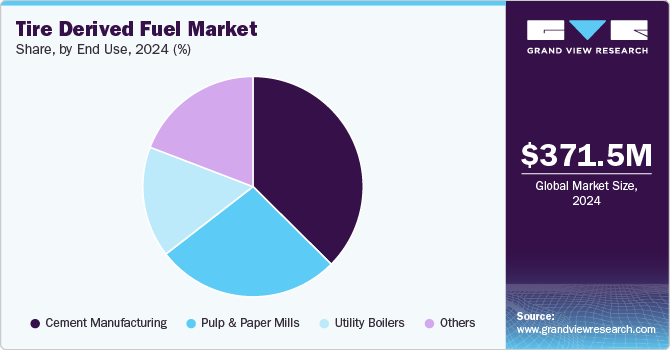

Based on end-use, the cement manufacturing segment held over 51.0 % of the market share in 2024. This segment's dominance is attributed to the high energy requirements of cement production and the suitability of TDF as a cost-effective and efficient alternative to traditional fossil fuels. Cement manufacturing is an energy-intensive process that requires significant heat, and TDF, with its high calorific value, provides a reliable and sustainable energy source. The use of TDF in cement kilns not only reduces operational costs but also helps lower greenhouse gas emissions, aligning with the industry’s growing focus on sustainability and environmental compliance. Additionally, the ability of cement kilns to fully combust tires without leaving residual waste makes TDF an ideal fuel choice for this sector.

Another key factor driving the dominance of the cement manufacturing segment is the stringent environmental regulations and policies aimed at reducing carbon emissions and promoting waste-to-energy solutions. Cement manufacturers are increasingly adopting TDF as part of their efforts to meet regulatory requirements and improve their environmental footprint. The use of TDF also supports the circular economy by providing a sustainable solution for disposing of end-of-life tires. Furthermore, the availability of shredded tires, which are easier to handle and combust, has made TDF a practical and efficient fuel option for cement plants. These factors, combined with the economic and environmental benefits of TDF, have solidified the cement manufacturing segment’s leading position in the global TDF market.

Regional Insights

North America tire derived fuel market is experiencing significant growth, driven by the region’s robust industrial infrastructure and focus on sustainability. The United States, in particular, is a global leader in TDF production, thanks to its advanced tire recycling technologies and well-established waste management systems. The region’s cement manufacturing and power generation industries are major consumers of TDF, as it provides a cost-effective and environmentally friendly fuel alternative. Additionally, stringent environmental regulations and government incentives for waste-to-energy solutions are further boosting the demand for TDF, solidifying North America’s dominance in the global TDF market.

U.S. Tire Derived Fuel Market Trends

The tire derived fuel market in the U.S. is fueled by the country’s focus on sustainable waste management and energy recovery. The U.S. is one of the largest producers and consumers of TDF, with industries such as cement manufacturing and power generation driving demand. The country’s advanced tire recycling infrastructure and technological innovations in shredding and processing are enhancing the efficiency of TDF production. Additionally, government policies promoting waste-to-energy solutions and reducing landfill waste are further boosting the market, positioning the U.S. as a key player in the global TDF industry.

Asia Pacific Tire Derived Fuel Market Trends

The tire derived fuel market in Asia Pacific dominated the global industry in 2024, accounting for the largest revenue share of over 40.0%. This dominance is largely driven by rapid industrialization, urbanization, and increasing demand for sustainable waste management solutions. Countries like China, India, and Japan are major contributors to market growth, as their expanding industrial sectors require cost-effective and environmentally friendly fuel alternatives. The region’s focus on reducing landfill waste and promoting circular economy practices is also boosting the demand for TDF. Additionally, investments in tire recycling infrastructure and the development of advanced processing technologies are further propelling the market, positioning Asia Pacific as a key growth hub in the global TDF industry.

China tire derived fuel market is growing rapidly, driven by the country’s booming industrial sector and increasing focus on sustainable waste management. The Chinese government’s stringent environmental regulations and policies aimed at reducing carbon emissions have led to a surge in the adoption of TDF as an alternative fuel. China’s large volume of waste tires and its commitment to recycling and energy recovery are further supporting market growth. Additionally, advancements in tire shredding and processing technologies are enhancing the efficiency and cost-effectiveness of TDF production, positioning China as a key player in the global TDF market.

Europe Tire Derived Fuel Market Trends

The tire derived fuel market in Europe is growing steadily, supported by the region’s commitment to sustainability and circular economy practices. Countries like Germany, France, and the UK are investing in tire recycling infrastructure and promoting the use of TDF as an alternative fuel. The region’s stringent environmental regulations and focus on reducing carbon emissions are driving the adoption of TDF in industries such as cement manufacturing and power generation. Additionally, the growing demand for sustainable waste management solutions is further propelling the market, making Europe a significant player in the global TDF industry.

The UK tire derived fuel market is expanding rapidly, driven by the country’s focus on sustainable waste management and energy recovery. The UK’s cement manufacturing and power generation industries are major consumers of TDF, as it provides a cost-effective and environmentally friendly fuel alternative. The government’s commitment to reducing landfill waste and promoting circular economy practices is further boosting the demand for TDF. Additionally, advancements in tire recycling technologies and infrastructure are enhancing the efficiency of TDF production, positioning the UK as a key player in the European TDF market.

Middle East & Africa Tire Derived Fuel Market Trends

The tire derived fuel market in the Middle East and Africa is driven by the region’s focus on sustainable waste management and energy security. Countries like South Africa and the UAE are investing in tire recycling infrastructure and promoting the use of TDF as an alternative fuel. The region’s growing industrial sector and increasing demand for cost-effective energy solutions are further boosting the market. Additionally, the focus on reducing landfill waste and promoting circular economy practices is driving the adoption of TDF, positioning the Middle East and Africa as key players in the global TDF industry.

Key Tire Derived Fuel Company Insights

The competitive landscape of the tire derived fuel market is evolving rapidly, driven by the increasing demand for sustainable waste management solutions and alternative fuels. Key players range from global tire recycling giants to regional specialists, all competing to capitalize on the growing need for TDF. Market dynamics are shaped by technological advancements in tire shredding, processing, and combustion, as well as the integration of digital technologies for process optimization. Strategic partnerships with cement manufacturers, power plants, and waste management companies are becoming crucial in strengthening market positions. Additionally, the focus on sustainability and regulatory compliance is driving innovation and investment in cleaner and more efficient TDF production, further intensifying market competition.

- In May 2024, BP p.l.c. entered an 8-year offtake deal with Circtec to annually acquire 60,000 tons of HUPATM renewable marine fuel and up to 15,000 tons of circular naphtha petrochemical feedstock. These products will come from Circtec's newly built large-scale facility. The agreement also binds BP for eight years under a take-or-pay commitment once factory operations commence.

Key Tire Derived Fuel Companies:

The following are the leading companies in the tire derived fuel market. These companies collectively hold the largest market share and dictate industry trends.

- Liberty Tire Recycling

- Lakin Tire

- Emanuel Tire

- Renelux Cyprus Ltd.

- Scandinavian Enviro Systems AB

- ResourceCo Pty Ltd

- Eco Green Equipment

- Genan Holding A/S

- Tire Disposal & Recycling Inc.

- Globarket Tire Recycling

- Klean Industries Inc.

- L&S Tire Company

- Mahantango Enterprises

- Reliable Tire Disposal

- Tyre Recycling Solutions

Tire Derived Fuel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 382.88 million

Revenue forecast in 2030

USD 446.77 million

Growth rate

CAGR of 3.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue USD million/billion; and CAGR from 2025 to 2030

Report coverage

Revenue Forecast, competitive landscape, growth factors and trends

Segments covered

Type, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, UK, Italy, Spain, France, Russia, China, India, Japan, Australia, Brazil, Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Liberty Tire Recycling; Lakin Tire; Emanuel Tire; Renelux Cyprus Ltd.; Scandinavian Enviro Systems AB; ResourceCo Pty Ltd; Eco Green Equipment; Genan Holding A/S; Tire Disposal & Recycling Inc.; Globarket Tire Recycling

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tire Derived Fuel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tire derived fuel market report on the basis of type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Tire

-

Shredded Tire

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulp and Paper Mills

-

Utility Boilers

-

Cement Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key players in the market include Liberty Tire Recycling, Lakin Tire, Emanuel Tire, Renelux Cyprus Ltd., Scandinavian Enviro Systems AB, ResourceCo Pty Ltd, Eco Green Equipment, Genan Holding A/S, Tire Disposal & Recycling Inc., Globarket Tire Recycling.

b. The global tire derived fuel market is primarily driven by the growing demand for alternative fuels in cement kilns, pulp and paper mills, and utility boilers to reduce reliance on conventional fossil fuels.

b. The global tire-derived fuel market was estimated at around USD 371.50 million in 2024 and is expected to reach around USD 382.88 million in 2024.

b. The global tire-derived fuel market is expected to grow at a compound annual growth rate of 3.1% from 2025 to 2030, reaching around USD 446.77 million by 2030.

b. The cement manufacturing end-use segment had the highest revenue market share, over 51.0%, in 2024. This dominance was driven by rapid urbanization, infrastructure development, and increasing construction activities worldwide. Additionally, rising investments in smart cities and sustainable building projects further boosted demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.