Timing Devices Market Size, Share & Trends Analysis Report By Type (Oscillators, Atomic Clocks, Clock Generators, Jitter Attenuators), By Material (Crystal, Silicon, Ceramic), By Vertical (Consumer Electronics, BFSI), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-394-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Timing Devices Market Size & Trends

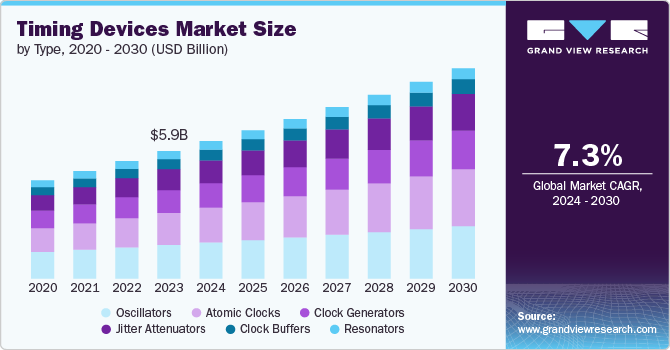

The global timing devices market size was estimated at USD 5.85 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. The demand for precise timing devices is driven by the proliferation of consumer electronics, advancements in automotive technologies, and the expansion of 5G networks. Additionally, the rise of Industry 4.0 and increasing automation in industrial sectors, along with the emergence of IoT devices in various sectors, are boosting market growth. These applications require accurate timing solutions for synchronization, clocking, and frequency control, contributing to the market's expansion.

Technological innovations, such as high-performance MEMS-based timing devices, are enhancing efficiency and broadening the scope of applications for timing technology. The growth of data centers, driven by cloud computing, requires precise timing solutions for managing data transfer and synchronization. Additionally, aerospace and defense sectors are driving demand for high-precision timing devices essential for navigation, communication, and surveillance. The healthcare industry also relies on accurate timing for medical devices and equipment, emphasizing the critical role of timing devices in diagnostics and treatment.

The rise of smart grids is fostering the adoption of advanced timing solutions for synchronization and control within integrated electricity networks. Energy-efficient timing devices are gaining importance as industries focus on reducing carbon footprints and enhancing energy efficiency. Globalization and supply chain integration further increase the need for precise timing solutions to improve coordination and performance. Similarly, smart manufacturing, leveraging technologies such as IoT and AI, relies on accurate timing for process automation and real-time monitoring.

Type Insights

The oscillators segment led the market and accounted for over 25% of the global revenue in 2023 due to their essential role in generating precise frequency signals across various electronic devices and systems. The growing demand for high-precision timing, driven by advancements in technology and the expansion of communication networks such as 5G, has further boosted the need for oscillators. Innovations such as MEMS oscillators have enhanced their reliability and cost-effectiveness, contributing to their widespread use in automotive, aerospace, industrial automation, and IoT applications. Their ability to provide consistent performance in diverse conditions emphasizes their importance in modern technology.

The atomic clocks segment within the market is experiencing significant growth, due to their unparalleled precision and accuracy, essential for satellite navigation systems, scientific research, and telecommunications. As satellite-based navigation systems such as GPS and Galileo expand, atomic clocks are vital for synchronizing satellite constellations and ensuring reliable positioning. Advances in atomic clock technology, including miniaturization and innovations such as optical lattice clocks, are driving their increased adoption in various sectors. These clocks are vital for precision timekeeping in finance, defense, and aerospace, as well as necessary infrastructure such as power grids and transportation networks. Moreover, the rising demand for quantum technologies boosts the need for atomic clocks.

Material Insights

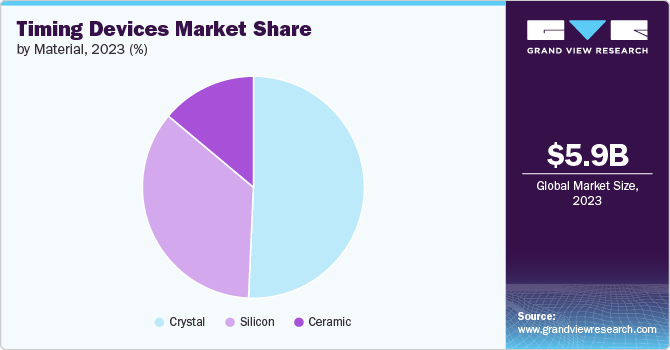

The crystal segment led the market in 2023 due to the wide usage of quartz crystals in electronic devices for precise timing and frequency control. Quartz crystals are cost-effective, reliable, and stable, making them a favored option across various applications, from consumer electronics to industrial equipment. Their mature technology and well-established supply chain support their leading position, while their versatility allows for adaptation to diverse frequency and stability requirements. The growth of the consumer electronics market and advancements in crystal technology, such as miniaturization and improved precision, further drive the demand for crystal materials.

The silicon segment is experiencing substantial growth driven by advancements in MEMS technology, which provides smaller, more reliable, and cost-effective timing solutions compared to traditional quartz crystals. The growing adoption of miniaturization in electronic devices further boosts demand for silicon-based timing devices, as they align well with the need for compact components. The expansion of consumer electronics, including smartphones and wearables, is increasing the need for silicon-based oscillators and resonators. Silicon’s cost efficiency and technological innovations, such as improvements in silicon-on-insulator and silicon-germanium materials, enhance its performance and application range.

Vertical Insights

The consumer electronics segment accounted for the largest market revenue share in 2023 due to the high demand for timing devices in portable devices such as smartphones, tablets, and smartwatches. Technological advancements and miniaturization trends drive the need for precise timing components to support advanced features and compact designs. The rise in functionality of modern electronics, including high-definition displays and advanced sensors, further increases the demand for accurate timing solutions. Additionally, the growth of wearable technology, such as fitness trackers and smartwatches, emphasizes the need for reliable timing in various functions.

The BFSI segment is poised for significant growth driven by the need for precise timing devices to meet stringent regulatory requirements for transaction timestamps and synchronization. Accurate timing is essential for data center operations, blockchain and cryptocurrency applications, and cybersecurity measures, ensuring data integrity and fraud prevention. High-speed trading systems and the rise of digital banking further increase the demand for reliable timing solutions to support real-time transactions and online services. The integration of advanced technologies such as AI and machine learning in the BFSI sector also requires accurate timing for effective data analysis and decision-making. Additionally, ongoing infrastructure modernization in financial institutions is fueling the adoption of advanced timing solutions to enhance efficiency and performance.

Regional Insights

North America timing devices market represented a significant share of over 42% in 2023, driven by its leadership in technological innovation across electronics, telecommunications, and consumer electronics. The region's substantial consumer electronics market, featuring high demand for smartphones, tablets, and wearables, significantly contributes to its market share. North America's strong presence of major tech companies and advancements in communication networks, including 4G, 5G, and future 6G technologies, further drive the need for precise timing solutions. Additionally, the growth of data centers, cloud computing, and the automotive and aerospace industries, along with the BFSI sector's requirements for high-precision timing, supports the region's dominance in the market.

U.S. Timing Devices Market Trends

The timing device market in the U.S. is poised for substantial growth due to the country's leadership in technological innovation, mainly in consumer electronics, telecommunications, and automotive technology. The expansion of 5G networks necessitates high-precision timing devices for efficient communication system synchronization. A strong demand for consumer electronics, including smartphones and wearables, further boosts the market. Advancements in automotive technologies, such as autonomous driving and ADAS, also contribute to the increased demand for reliable timing solutions.

Europe Timing Devices Market Trends

Europe timing device market is gaining significant traction, driven by the European Union's digital strategy to enhance connectivity and infrastructure, including the deployment of 5G networks that require precise timing for synchronization. Europe's automotive industry, in Germany and France, is advancing ADAS and autonomous vehicle technologies that rely on high-precision timing for navigation and safety functions. European smart city initiatives also drive demand for timing devices to manage traffic systems, energy grids, and public transportation effectively. Investments in smart grids and renewable energy sources further emphasize the need for accurate timing in energy management and integration.

Asia Pacific Timing Devices Market Trends

The timing device market in Asia Pacific is poised for significant growth driven by China's technological leadership and substantial investments in 5G infrastructure and consumer electronics. India's expanding electronics market, fueled by rising smartphone usage and digital services, increases the demand for timing devices. Japan's high-tech industry, with its emphasis on precision and innovation in semiconductors and robotics, also contributes to strong market demand. South Korea's leadership in 5G deployment drives the need for precise timing solutions to ensure network efficiency. Additionally, the economic growth in ASEAN countries, including Indonesia, Thailand, and Malaysia, further boosts the demand for timing devices across various sectors.

Key Timing Devices Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in January 2024, Rakon Limited launched its next-generation MercuryX product range for cloud data centers, AI, and next-generation telecom networks. The MercuryX IC-OCXO range integrates Rakon Limited's Mercury+ semiconductor chip with XMEMS1 quartz crystal resonators, enhancing its AI computing hardware portfolio.

Key Timing Devices Companies:

The following are the leading companies in the timing devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abracon

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors.

- KYOCERA Corporation

- Nihon Dempa Kogyo Co., Ltd.

- Rakon Limited

- Renesas Electronics Corporation

- Seiko Epson Corporation

- STMicroelectronics

Recent Developments

-

In May 2024, Abracon launched Rubidium Oscillators, which offer accuracy, reliability, and versatility in embedded timekeeping solutions. Leveraging advanced technology and Rubidium atoms' properties, these oscillators deliver precision and stability comparable to atomic clocks, ensuring consistent performance across various applications and environments.

-

In April 2024, Renesas Electronics Corporation expanded its timing solutions portfolio with the new ultra-low 25fs-rms FemtoClock 3 family. These jitter attenuators and clock generators and, with 8 and 12 outputs, are designed for data centers, wireline infrastructure, and industrial applications. They offer high performance, ease of use, and cost-effectiveness for next-generation, high-speed interconnect systems, targeting applications such as telecom switches, data center switches, medical imaging, and broadcast audio & video.

-

InApril 2024, SiTime Corp launched the chorus family of MEMS-based clock generators for AI data centers. These ClkSoC offerings deliver ten times higher performance than standalone oscillators and clocks. By combining clock, oscillator, and resonator technologies, the chorus family simplifies system clock architecture and reduces design time by up to six weeks.

Timing Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.32 billion |

|

Revenue forecast in 2030 |

USD 9.68 billion |

|

Growth rate |

CAGR of 7.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, material, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Abracon; Infineon Technologies AG; Microchip Technology Inc.; NXP Semiconductors.; KYOCERA Corporation; Nihon Dempa Kogyo Co., Ltd.; Rakon Limited; Renesas Electronics Corporation.; Seiko Epson Corporation; STMicroelectronics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Timing Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global timing devices market report based on type, material, vertical, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Oscillators

-

Crystal Oscillators

-

MEMS Oscillators

-

Ceramic Oscillators

-

-

Atomic Clocks

-

Resonators

-

Clock Generators

-

Clock Buffers

-

Jitter Attenuators

-

-

Material Outlook (Revenue, USD Billion, 2017 - 2030)

-

Crystal

-

Silicon

-

Ceramic

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Enterprise Electronics

-

BFSI

-

Telecommunications & Networking

-

Automotive

-

Industrial

-

Military & Aerospace

-

Others

-

Consumer Electronics

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global timing devices market was estimated at USD 5.85 billion in 2023 and is expected to reach USD 6.32 billion in 2024.

b. The global timing devices market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 9.68 billion by 2030.

b. North America dominated the market in 2023, accounting for over 42% share of the global revenue, driven by its leadership in technological innovation across electronics, telecommunications, and consumer electronics.

b. Some key players operating in the timing devices market include Abracon; Infineon Technologies AG; Microchip Technology Inc.; NXP Semiconductors.; KYOCERA Corporation; Nihon Dempa Kogyo Co., Ltd.; Rakon Limited; Renesas Electronics Corporation.; Seiko Epson Corporation; STMicroelectronics

b. Key factors driving the timing devices market growth include the growth of the telecommunications industry and the rising adoption of consumer electronics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."