Time-Sensitive Networking Market Size, Share & Trends Analysis Report By Component, By Standard, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-380-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Time-Sensitive Networking Market Trends

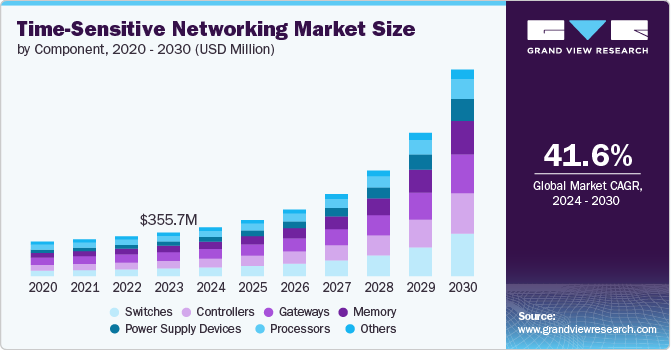

The global time-sensitive networking market size was estimated at USD 355.7 million in 2023 and is projected to grow at a CAGR of 41.6% from 2024 to 2030. The market is experiencing significant growth due to rapid technological advancements. Innovations in Industrial Internet of Things (IIoT) and Industry 4.0 are driving the need for reliable and time-critical data communication. Time sensitive networking (TSN) technology provides enhanced network performance, reducing latency and jitter, which is crucial for industrial automation. The integration of TSN in autonomous vehicles and smart factories is propelling its adoption across various sectors. Major companies, such as Cisco Systems, Inc., Intel Corporation, and Siemens, are investing heavily in TSN to ensure seamless and efficient operations. This has led to the development of new standards and protocols, further enhancing the capabilities of TSN. As industries continue to digitize, the demand for time sensitive networking is expected to surge, contributing to market expansion.

The growing need for synchronized and deterministic communication in industries such as automotive, aerospace, and manufacturing is boosting the time sensitive networking market. Automotive industries are utilizing TSN for advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems, ensuring safety and reliability. In the aerospace sector, TSN helps in managing complex avionics networks with precision timing. Manufacturing industries utilize TSN for real-time control and monitoring of machinery, improving efficiency and productivity. The healthcare sector is also adopting TSN for critical medical applications, where data accuracy and timing are paramount. The versatility of TSN across diverse applications highlights its market potential. As these industries continue to innovate, the integration of TSN will become increasingly prevalent.

The market growth is also driven by regulatory support and standardization efforts. Various international and regional bodies are working to establish standards for TSN, ensuring interoperability and compatibility across different devices and networks. Organizations such as the IEEE have developed key TSN standards, including IEEE 802.1Qbv for scheduled traffic and IEEE 802.1AS for timing and synchronization. These standards provide a robust framework for implementing TSN in diverse applications, facilitating broader adoption. Governments and regulatory agencies are also supporting TSN through policies and funding for smart city projects, which rely on TSN for efficient infrastructure management. This regulatory backing is crucial for building trust and confidence among stakeholders, further accelerating market growth. As standardization efforts continue to advance, the market is expected to expand even more rapidly.

Component Insights

The switches segment led the market and accounted for 20.0% of the global revenue in 2023. The switches manage network traffic with precise timing and synchronization. TSN switches enable deterministic data transmission, which is essential for applications requiring real-time communication, such as industrial automation and autonomous vehicles. The demand for advanced network infrastructure in smart factories and IIoT environments is driving the adoption of TSN switches. Moreover, major technological advancements in switch design, including enhanced processing capabilities and support for TSN standards, are boosting their market presence. As industries increasingly prioritize reliable and time-sensitive data communication, the need for robust TSN switches continues to rise.

The processors segment is projected to grow significantly over the forecast period. The processor segment is expanding in the TSN market due to its vital role in managing complex computations and ensuring precise timing for real-time data transmission. TSN processors are essential for executing sophisticated algorithms required for synchronization and low-latency communication in industrial automation and autonomous vehicles. The growth of IIoT and smart manufacturing necessitates high-performance processors to handle increased data traffic and real-time processing demands. Advancements in processor design, including improved processing power and energy efficiency, are fueling their adoption in TSN applications. As the need for reliable and deterministic communication grows across various sectors, the demand for advanced TSN processors is also on the rise.

Standard Insights

The IEEE 802.1AS (Timing and Synchronization) segment accounted for the largest revenue share in 2023. IEEE 802.1AS (Timing and Synchronization) has become dominant in the market by providing precise timing and synchronization essential for deterministic communication. It ensures that all network devices are accurately synchronized, which is crucial for applications requiring real-time data transfer, such as industrial automation and autonomous vehicles. The standard's ability to deliver low-latency communication has made it a preferred choice for industries needing reliable and timely data exchange. Its integration into a wide range of network devices and systems has facilitated seamless interoperability and widespread adoption. Furthermore, IEEE 802.1AS's support for high-precision time protocols has strengthened its position as a critical component in the time sensitive networking ecosystem.

The IEEE 802.1Qch (Cyclic Queuing and Forwarding) segment is predicted to foresee significant growth in the forecast period. IEEE 802.1Qch (Cyclic Queuing and Forwarding) is growing in the time sensitive networking market as it provides a method to manage data traffic efficiently in time-sensitive applications. It offers deterministic transmission by scheduling and forwarding data packets in cyclic intervals, ensuring timely delivery. This capability is particularly beneficial for industrial automation and automotive applications where precise timing is critical. The standard's ability to minimize latency and jitter in network communications makes it an attractive solution for industries requiring high reliability. Moreover, IEEE 802.1Qch's compatibility with existing network infrastructure facilitates its adoption, contributing to its market growth.

Application Insights

The industrial automation segment accounted for the largest revenue share in 2023. Industrial automation dominates the market by enabling precise synchronization and deterministic communication crucial for real-time applications. TSN standards ensure low-latency, reliable data transmission in industrial environments, meeting the stringent timing requirements of automation systems. This technology facilitates seamless integration of diverse industrial devices and systems, enhancing interoperability and flexibility. Manufacturers benefit from improved efficiency, reduced downtime, and enhanced safety through TSN-enabled automation solutions. As industries increasingly prioritize real-time data and responsiveness, time sensitive networking continues to help in advancing industrial automation capabilities.

The automotive segment is projected to grow significantly over the forecast period. The automotive industry is increasingly adopting Time sensitive networking to address the growing demand for advanced connectivity and real-time communication in vehicles. TSN enables precise synchronization and low-latency data transmission, which is crucial for supporting autonomous driving, vehicle-to-vehicle (V2V) communication, and advanced driver assistance systems (ADAS). Automakers utilize TSN to enhance vehicle safety, reliability, and efficiency by ensuring timely and accurate data exchange between onboard systems and external infrastructure. This technology also supports the integration of high-bandwidth applications such as in-vehicle multimedia and infotainment systems, providing a seamless user experience. As TSN standards continue to evolve and mature, automotive manufacturers are poised to integrate these capabilities into next-generation vehicles further, driving innovation and differentiation in the market.

Regional Insights

North America dominated the market and accounted for 36.2% share in 2023. North America possesses a well-developed infrastructure that supports the deployment and integration of advanced networking technologies such as time sensitive networking. This includes high-speed internet connectivity, reliable data centers, and extensive telecommunications networks that are essential for real-time communication. The region is a hub for technological innovation, with numerous research institutions, universities, and tech companies driving advancements in networking and communication technologies. This environment promotes the development of advanced solutions that utilize TSN for improved efficiency, reliability, and performance in various applications.

U.S. Time-Sensitive Networking Market Trends

The Time sensitive networking market in the U.S. is expected to grow significantly over the forecast period. Time sensitive networking is crucial in the deployment of 5G networks in the U.S., ensuring low-latency and deterministic communication for mission-critical applications. Telecom providers are adopting TSN to support the convergence of IT and operational technology networks, optimizing the management of network resources and services efficiently.

Europe Time-Sensitive Networking Market Trends

European automotive manufacturers are increasingly adopting Time sensitive networking to enhance autonomous driving capabilities, facilitate vehicle-to-vehicle (V2V) communication, and integrate advanced driver assistance systems (ADAS). TSN's capability to deliver precise timing and low-latency data transmission is crucial for ensuring the safety and efficiency of next-generation vehicles. By utilizing TSN, European automakers aim to improve real-time decision-making processes, enhance vehicle responsiveness, and enable seamless communication between vehicles and infrastructure. This integration supports the development of safer and more reliable automotive systems that comply with stringent regulatory requirements and meet evolving consumer expectations for connectivity and automation in vehicles.

Asia Pacific Time-Sensitive Networking Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. TSN adoption in manufacturing and industrial automation across the Asia Pacific is on the rise. It is driven by its potential to enhance operational efficiency, minimize latency, and improve synchronization among machines and systems within factories. The region's strong emphasis on Industry 4.0 initiatives fuels the deployment of TSN-enabled solutions, aiming to achieve greater productivity and flexibility in manufacturing processes. This integration allows for real-time data exchange and precise control, optimizing production workflows and supporting agile manufacturing practices. As industries in the Asia Pacific embrace digital transformation, TSN enables smart factories that are capable of meeting the evolving demands of global markets efficient.

Key Time-Sensitive Networking Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in July 2023, Advantech has launched the EKI-8510G managed TSN switch, certified by the CC-Link Partner Association for CC-Link IE TSN compatibility. This new product is designed to meet the rigorous demands of industrial automation, providing high-speed, real-time communication capabilities and facilitating the convergence of IT and OT networks. The launch highlights the increasing adoption of time sensitive networking solutions in industrial settings, supporting advancements in digital transformation across manufacturing and related sectors.

Key Time-Sensitive Networking Companies:

The following are the leading companies in the time-sensitive networking market. These companies collectively hold the largest market share and dictate industry trends.

- Advantech Co., Ltd.

- Belden Inc.

- Cisco Systems Inc.

- HMS Networks

- Microchip Technology

- Mitsubishi Electric

- Mouser Electronics

- NATIONAL INSTRUMENTS CORP.

- PROFIBUS Nutzerorganisation e.V.

- Spirent Communications.

- Texas Instruments Inc.

- TTTech Group

Recent Developments

-

In July 2024, Microchip Technology collaborated with NASA, an independent agency of the U.S. federal government and the broader aerospace industry to develop and deliver the PIC64-HPSC MPUs aimed at enhancing spaceflight computing capabilities. These processors integrate RISC-V CPUs with AI/ML support and advanced features like Time sensitive networking, designed to significantly increase computational power and reliability for space missions, including planetary exploration and deep-space expeditions to Mars.

-

In June 2024, Moxa Inc., a Taiwanese industrial network equipment manufacturer, has joined Mitsubishi Electric's e-Factory Alliance Program to enhance industrial automation through compatible network infrastructure solutions, including Time sensitive networking technologies. This collaboration aims to promote innovation and efficiency across diverse sectors, such as utilities, automotive manufacturing, and semiconductor fabrication.

-

In January 2024, Microchip Technology introduced the LAN969x Ethernet switches, which target industrial automation applications and offer Time sensitive networking and scalable bandwidths up to 102 Gbps. These switches support High-availability Seamless Redundancy (HSR) and Parallel Redundancy Protocol (PRP) for enhanced network reliability.

-

In March 2023, Mitsubishi Electric Automation launched the iQ-R Series, which supports CC-Link IE TSN Plus. This module offers enhanced flexibility and cost savings for industrial automation applications. This module enables seamless integration of different network protocols without compromising communication performance, facilitating simplified configuration and troubleshooting.

Time-Sensitive Networking Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 422.0 million |

|

Revenue forecast in 2030 |

USD 3,399.1 million |

|

Growth rate |

CAGR of 41.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, standard, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Advantech Co., Ltd.; Belden Inc.; Cisco Systems Inc.; HMS Networks; Microchip Technology; Mitsubishi Electric; Mouser Electronics; NATIONAL INSTRUMENTS CORP.; PROFIBUS Nutzerorganisation e.V.; Spirent Communications; Texas Instruments Inc.; TTTech Group. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Time-Sensitive Networking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global time-sensitive networking market report based on component, standard, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Switches

-

Controllers

-

Gateways

-

Memory

-

Power Supply Devices

-

Processors

-

Others

-

-

Standard Outlook (Revenue, USD Million, 2018 - 2030)

-

IEEE 802.1AS (Timing and Synchronization)

-

IEEE 802.1Qbv (Enhancements for Scheduled Traffic)

-

IEEE 802.1Qbu (Frame Preemption)

-

IEEE 802.1Qci (Per-Stream Filtering and Policing)

-

IEEE 802.1CB (Seamless Redundancy)

-

IEEE 802.1Qch (Cyclic Queuing and Forwarding)

-

IEEE 802.1Qcr (Asynchronous Traffic Shaping)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Automation

-

Automotive

-

Oil & Gas

-

Power & Energy

-

Aerospace

-

Consumer Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global time-sensitive networking market size was estimated at USD 355.7 million in 2023 and is expected to reach USD 422.0 million in 2024.

b. The global time-sensitive networking market is expected to grow at a compound annual growth rate of 41.6% from 2024 to 2030 to reach USD 3,399.1 million by 2030.

b. North America dominated the time-sensitive networking market with a share of 36.2% in 2023. This is attributable to a well-developed infrastructure including high-speed internet connectivity, reliable data centers, and extensive telecommunications networks that supports the deployment and integration of time sensitive networking

b. Some key players operating in the time-sensitive networking market include Advantech Co., Ltd., Belden Inc., Cisco Systems Inc., HMS Networks, Microchip Technology, Mitsubishi Electric, Mouser Electronics, NATIONAL INSTRUMENTS CORP., PROFIBUS Nutzerorganisation e.V., Spirent Communications, Texas Instruments Inc., TTTech Group.

b. Key factors that are driving the market growth include rising demand for low-latency communication, growth of IoT and edge computing, increased focus on network security, and advancements in 5G technology

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."