Time-of-Flight (ToF) Sensor Market Size, Share & Trends Analysis Report By Product Type, By Display Resolution, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-396-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

ToF Sensor Market Size & Trends

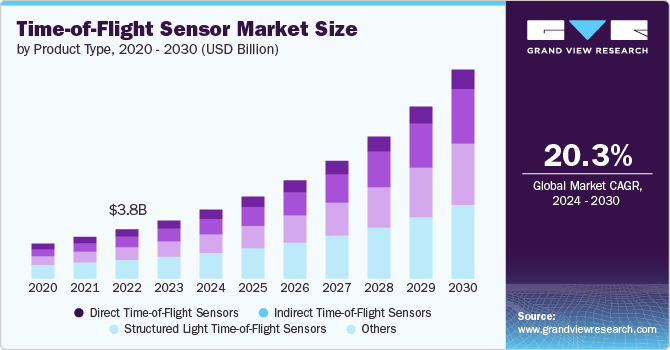

The global time-of-flight (ToF) sensor market size was estimation at USD 4.43 billion in 2023 and is projected to grow at a CAGR of 20.32% from 2024 to 2030. The rapid development of advanced driver-assistance systems (ADAS) and autonomous driving technology is significantly driving the market growth. These sensors help enhance vehicle safety by providing accurate distance measurements for collision avoidance, parking assistance, and adaptive cruise control. As the integration of sensors in various industries, including automotive, consumer electronics, and industrial automation, becomes more prevalent for enhanced safety and automation, the demand for ToF sensors is expected to rise.

The increasing integration of sensors in consumer electronics, such as smartphones, tablets, and gaming devices, is a major growth driver. These sensors enable features like facial recognition, augmented reality (AR), and precise gesture control. As consumer electronics continue to evolve with enhanced capabilities and immersive experiences, the demand for sensors in these devices grows. Innovations in AR and VR technologies further boost the adoption of sensors, driving market growth in the consumer electronics segment.

The rise in industrial automation and robotics is significantly contributing to the growth of the sensor market. Sensors are used in various industrial applications, including object detection, quality control, and automation of manufacturing processes. Their ability to provide accurate distance measurements and facilitate precise operations makes them valuable in modern industrial settings. As industries increasingly adopt automation to enhance efficiency and productivity, the demand for sensors in industrial applications is expected to grow, driving market expansion.

Market Concentration & Characteristics

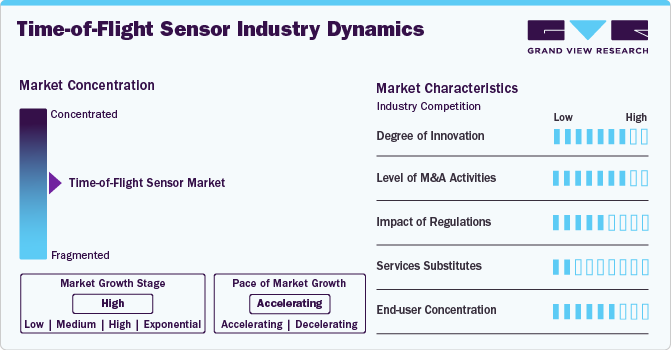

The market is characterized by a high degree of innovation, with continuous advancements enhancing sensor capabilities and applications. Emerging technologies are driving improvements in accuracy, range, and integration, enabling new use cases across various sectors. Innovations such as miniaturization, enhanced processing power, and advanced algorithms are expanding the functionality of ToF sensors. This dynamic environment fosters rapid growth and adaptation, positioning ToF sensors at the forefront of technological progress and market evolution.

The market is seeing an increasing number of merger and acquisition (M&A) activities, underscoring its exponential growth stage and ever-expanding potential. This trend reflects the market's exponential development and the strategic efforts of companies to enhance their technological capabilities and market presence. M&A activities are driven by the need to integrate advanced technologies, acquire new capabilities, and capitalize on emerging opportunities, signaling robust growth and a competitive landscape in the sensors industry.

The market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. Compliance with regulations related to safety, data privacy, and technology standards is essential for market participants. These regulatory requirements can affect product development, market entry, and operational strategies. Companies must navigate these regulations carefully to ensure adherence while pursuing growth opportunities, impacting their strategic decisions and overall market dynamics in the sensors industry.

Time-of-flight (ToF) sensor face minimal competition from product substitutes in the market. This is due to their unique capabilities in providing precise distance measurements and 3D imaging. While other technologies like laser rangefinders and radar exist, they often do not offer the same level of accuracy and versatility for applications like gesture recognition, automotive safety, and industrial automation. The specialized nature of sensors and their integration into advanced systems reduce the threat of direct substitutes in the market.

End-user concentration is high in the global market. This demand from sectors such as automotive, consumer electronics, and industrial automation drives the majority of demand. The market's growth and dynamics are heavily influenced by the needs and innovations of these primary end-users. High dependency on a few large industries can lead to market volatility, as shifts in their technological requirements or investment patterns directly impact the overall demand and development of sensors.

Product Type Insights

The direct time-of-flight (ToF) sensor led the market with the largest revenue share of 37.77% in 2023. The market is driven by their ability to provide highly accurate distance measurements and fast response times. This technology is essential in applications like LiDAR systems for autonomous vehicles and precision measurement tools. The increasing demand for precise environmental mapping and obstacle detection in autonomous driving, along with advancements in sensor technology, fuels the adoption of direct sensors, promoting their growth in various high-precision applications.

The structured light time-of-flight (ToF) sensor are expected to register at the fastest CAGR from 2024 to 2030. The market is growing due to their ability to capture detailed 3D data by projecting light patterns onto objects and analyzing the distortions. This technology is crucial for applications in 3D scanning, facial recognition, and gesture control. The expanding use of 3D imaging in industrial automation, robotics, and consumer electronics, coupled with advancements in structured light technology, drives the demand for these sensors, enhancing their market presence.

Display Resolution Insights

Based on display resolution, the low resolution segment led the market with the largest revenue share of 29.37% in 2023. The market is benefits from their cost-effectiveness and sufficient performance for applications where ultra-high precision is not required. These sensors are commonly used in basic gesture recognition, presence detection, and simple object tracking. Their affordability and adequacy for entry-level applications drive their adoption in consumer electronics and low-end industrial applications, contributing to their market growth.

The high resolution segment is expected to register at the fastest CAGR of 26.0% from 2024 to 2030. The market growth is driven by the increasing demand for detailed and accurate 3D imaging in applications such as advanced robotics, autonomous vehicles, and high-quality depth sensing. Their ability to capture fine details and precise measurements makes them essential for applications requiring high fidelity and performance. The growth in sectors like industrial automation, autonomous driving, and premium consumer electronics fuels the demand for high-resolution sensors.

Application Insights

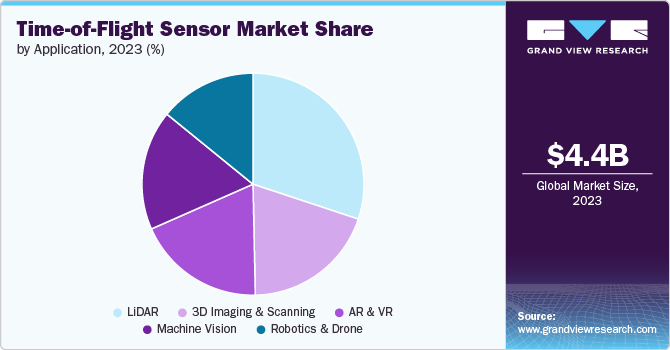

Based on application, the LiDAR segment led the market with the largest market revenue share of 30.09% in 2023. The market growth is driven by its critical role in autonomous vehicles, topographic mapping, and environmental monitoring. LiDAR sensors provide high-resolution 3D mapping and precise distance measurements, essential for applications like self-driving cars, urban planning, and natural disaster assessment. Advances in LiDAR technology, including improved accuracy, range, and cost-effectiveness, coupled with increasing investments in autonomous systems and smart city infrastructure, are propelling the growth of LiDAR in various industries.

The 3D imaging & scanning segment is expected to register at the fastest CAGR from 2024 to 2030. The market is driven by their ability to create detailed three-dimensional representations of objects and environments. This technology is widely used in applications such as digital twin creation, advanced manufacturing, and virtual reality. The increasing need for accurate 3D models in various industries, along with advancements in technology, promotes the adoption and growth of 3D imaging and scanning solutions.

End-use Insights

Based on end use, the automotive segment led the market with the largest revenue share of 21.78% in 2023. The market is driven by the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. sensors provide critical functions such as collision avoidance, parking assistance, and adaptive cruise control. The push towards enhanced vehicle safety, automation, and autonomous features accelerates the demand for sensors, making them a key component in modern automotive systems.

The gaming & entertainment segment is expected to grow at the fastest CAGR from 2024 to 2030. The market is driven by use of immersive and interactive experiences. Sensors enable precise motion tracking, gesture recognition, and spatial interaction, enhancing gameplay and user engagement. The expansion of VR and AR gaming, along with innovations in interactive entertainment, boosts the demand for sensors, supporting their growth in this dynamic and evolving market segment.

Regional Insights

North America dominated the time-of-flight (ToF) sensor market with the largest revenue share of 27.62% in 2023, driven by advancements in automotive technology, including autonomous vehicles and ADAS, along with strong investments in industrial automation and robotics. The region's robust tech ecosystem and early adoption of innovative technologies further bolster demand, particularly in sectors like consumer electronics, healthcare, and gaming.

U.S. Time-of-Flight (ToF) Sensor Market Trends

The time-of-flight (ToF) sensor market in the U.S. is expected to grow at a notable CAGR from 2024 to 2030. The market benefits from significant investment in research and development, leading to innovations in autonomous driving, smart home devices, and entertainment technologies. The strong presence of leading tech companies and automotive manufacturers, coupled with government support for advanced manufacturing and technology initiatives, drives market growth.

Asia Pacific Time-of-Flight (ToF) Sensor Market Trends

The time-of-flight (ToF) sensor market in Asia Pacific accounted for a significant revenue share in 2023. The market growth is due to increasing demand in consumer electronics, industrial automation, and automotive sectors. The region's large consumer base, along with strong manufacturing capabilities and technological advancements in countries like China, Japan, and South Korea, drives adoption. The rise of smart cities and IoT applications also contributes to market expansion.

The Japan time-of-flight (ToF) sensor market is estimated to grow at a significantly from 2024 to 2030. The growth is driven by the country's focus on robotics, automotive innovation, and advanced manufacturing. The strong presence of major electronics and automotive companies, along with government initiatives to promote automation and smart technologies, fosters the development and adoption of sensors in various applications, including healthcare and entertainment.

The time-of-flight (ToF) sensor market in India is estimated to record at a notable CAGR from 2024 to 2030. The market growth is propelled by the increasing adoption of smartphones, smart devices, and automotive technologies. The expanding middle class and growing tech-savvy population drive demand for advanced consumer electronics and smart home solutions. In addition, India's push towards digitalization and smart cities contributes to the rising demand for ToF sensors in various sectors.

The China time-of-flight (ToF) sensor market had the largest revenue share of Asia Pacific in 2023. The market is driven by rapid growth in consumer electronics, automotive, and industrial automation. The country's strong manufacturing base, coupled with significant investments in technology and innovation, fuels the adoption of sensors. The development of smart cities, the expansion of 5G infrastructure, and the rise of autonomous driving technologies further accelerate market growth.

Europe Time-of-Flight (ToF) Sensor Market Trends

The time-of-flight (ToF) sensor market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030. The market is driven by the region's focus on automotive safety, industrial automation, and environmental monitoring. The presence of leading automotive and electronics manufacturers, along with strong regulatory support for technological innovation, fosters the adoption of sensors. In addition, Europe's emphasis on sustainability and smart infrastructure development supports the market growth.

The France time-of-flight (ToF) sensor market accounted for a significant revenue share in 2023. The market growth is influenced by the country's advanced automotive industry and strong emphasis on innovation in smart technologies. The increasing adoption of autonomous vehicles, smart home devices, and advanced industrial automation solutions contributes to the demand for ToF sensors. Government support for digital transformation initiatives further drives market expansion.

The time-of-flight (ToF) sensor market in the UK is estimated to grow at the fastest CAGR from 2024 to 2030. The market benefits from advancements in automotive technology, particularly in autonomous driving and ADAS. The country's strong tech ecosystem, combined with growing investments in smart cities and industrial automation, drives the adoption of sensors. In addition, the UK's focus on healthcare innovation and the entertainment industry's use of AR/VR technologies contribute to market growth.

The Germany time-of-flight (ToF) sensor market is estimated to grow at a moderate CAGR from 2024 to 2030. The market is bolstered by the country's strong automotive industry and leadership in industrial automation. The focus on advanced manufacturing, precision engineering, and automotive safety technologies drives the demand for sensors. Germany's commitment to innovation and sustainability, along with investments in smart infrastructure, supports the market's growth.

Middle East & Africa (MEA) Time-of-Flight (ToF) Sensor Market Trends

The time-of-flight (ToF) sensor market in the Middle East and Africa (MEA) region is estimated to grow at a significant CAGR from 2024 to 2030. The market is driven by the adoption of smart technologies in urban development, healthcare, and security. The increasing investment in smart city initiatives and the rising demand for consumer electronics and automotive innovations contribute to market expansion. In addition, the region's focus on enhancing industrial automation and infrastructure development supports the growth of sensors.

The time-of-flight (ToF) sensor market in Saudi Arabia accounted for a considerable revenue share in 2023. The market is influenced by the country's Vision 2030 initiative, which promotes diversification and technological advancement. The focus on smart city development, digital transformation, and automation in industries such as oil and gas, healthcare, and security drives the demand for sensors. The government's investment in technology and infrastructure projects further accelerates market growth.

Key Time-of-Flight (ToF) Sensor Company Insights

Some of the key players operating in the market include Texas Instruments Inc., STMicroelectronics NV, and Infineon Technologies.

-

Texas Instruments Inc. is driving growth in the time-of-flight (ToF) sensors market through its advancements in sensor technology and integration capabilities. TI's development of compact, power-efficient sensors with high accuracy and low latency supports diverse applications, including automotive safety, industrial automation, and consumer electronics. The company's strong focus on innovation and partnerships with leading technology firms enable it to deliver solutions that meet the evolving demands of autonomous systems, smart devices, and 3D imaging. TI's extensive experience and global reach further enhance its market position in the sensor segment

-

STMicroelectronics NV is driving growth in the time-of-flight (ToF) sensors market through its leadership in developing advanced 3D sensing technologies. The company offers a wide range of sensors that provide precise distance measurements and robust performance in various lighting conditions. STMicroelectronics' are widely used in smartphones, industrial automation, and automotive applications, benefiting from the company's strong focus on miniaturization and integration. By leveraging its expertise in semiconductor technology and global manufacturing capabilities, STMicroelectronics continues to expand its market presence and meet the growing demand for sensors in emerging applications

Sentric Controls Sdn Bhd, and BECOM Systems are some of the emerging market participants in the global market.

-

Sentric Controls likely focuses on integrating sensors into specialized industrial and automation solutions. Growth drivers may include providing customized sensor solutions for specific industrial applications, leveraging local market knowledge, and forming strategic partnerships with other technology providers. The company's expertise in control systems and automation might enable it to offer unique sensor-based solutions, driving demand in sectors like manufacturing and process control

-

BECOM Systems may drive growth in the sensors market through its focus on advanced electronics and mechatronics solutions. Key growth drivers could include the development of high-precision sensor modules for automotive, industrial, and consumer electronics applications. BECOM Systems' ability to integrate sensors with other electronic systems, along with a strong focus on innovation and quality, likely supports its growth.

Key Time-of-Flight (Tof) Sensor Companies:

The following are the leading companies in the time-of-flight (ToF) sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Texas Instruments Inc.

- STMicroelectronics NV

- Infineon Technologies AG

- Panasonic Corporation

- Teledyne Technologies Inc.

- Keyence Corporation

- pmdtechnologies ag

- Sharp Corporation

- Sony Corporation

- Melexis NV

- Sentric Controls Sdn Bhd

- BECOM Systems

Recent Developments

-

In July 2024, Infineon Technologies AG and Amkor Technology, Inc. signed a Memorandum of Understanding to promote decarbonization and sustainability in their supply chain. They aimed to leverage their Outsourced Semiconductor Assembly and Test (OSAT) business relationship to reduce emissions. This expansion marked a significant step in their joint sustainability efforts, aligning with their commitment to environmental responsibility and innovative collaboration in semiconductor manufacturing

-

In June 2023, Teledyne Controls, a subsidiary of Teledyne Technologies, announced that its ACES cabin environment monitoring system won the Crystal Cabin Award in the Health and Safety category. This prestigious award, recognizing outstanding aircraft interior innovation, was presented at the Aircraft Interiors Expo.

Time-of-Flight (ToF) Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.26 billion |

|

Revenue forecast in 2030 |

USD 15.96 billion |

|

Growth rate |

CAGR of 20.32% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, display resolution, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Texas Instruments Inc.; STMicroelectronics NV; Infineon Technologies AG; Panasonic Corporation; Teledyne Technologies Inc.; Keyence Corporation; pmdtechnologies ag; Sharp Corporation; Sony Corporation; Melexis NV; Sentric Controls Sdn Bhd; BECOM Systems |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Time-of-Flight (ToF) Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global time-of-flight (ToF) sensor market report based on product type, display resolution, application, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Time-of-Flight Sensors

-

Indirect Time-of-Flight Sensors

-

Structured Light Time-of-Flight Sensors

-

Others

-

-

Display Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Resolution

-

Medium Resolution

-

High Resolution

-

Ultra-High Resolution

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

AR & VR

-

LiDAR

-

Machine Vision

-

3D Imaging & Scanning

-

Robotics & Drone

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Gaming & Entertainment

-

Industrial

-

Healthcare

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global time-of-flight (ToF) sensor market size was estimated at USD 4.43 billion in 2023 and is expected to reach USD 5.26 billion in 2024.

b. The global time-of-flight (ToF) sensor market is expected to grow at a compound annual growth rate of 20.32% from 2024 to 2030 to reach USD 15.96 billion by 2030.

b. North America accounted for the highest market revenue share in 2023, driven by advancements in automotive technology, including autonomous vehicles and ADAS, along with strong investments in industrial automation and robotics. The region's robust tech ecosystem and early adoption of innovative technologies further bolster demand, particularly in sectors like consumer electronics, healthcare, and gaming.

b. Some key players operating in the time-of-flight (ToF) sensor market include Texas Instruments Inc., STMicroelectronics NV, Infineon Technologies, Sentric Controls Sdn Bhd, BECOM Systems and among others

b. Sensors enhance vehicle safety by providing accurate distance measurements for collision avoidance, parking assistance, and adaptive cruise control. As the integration of sensors in various industries, including automotive, consumer electronics, and industrial automation, becomes more prevalent for enhanced safety and automation, the demand is expected to increase

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."