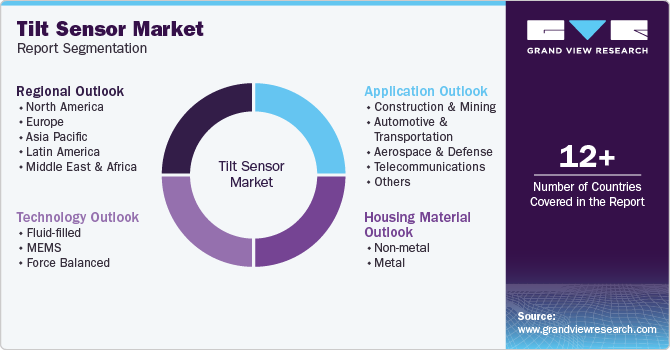

Tilt Sensor Market Size, Share & Trends Analysis Report By Housing Material Type (Non-metal, Metal), By Technology (Fluid-filled, MEMS, Force Balanced), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-720-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Tilt Sensor Market Size & Trends

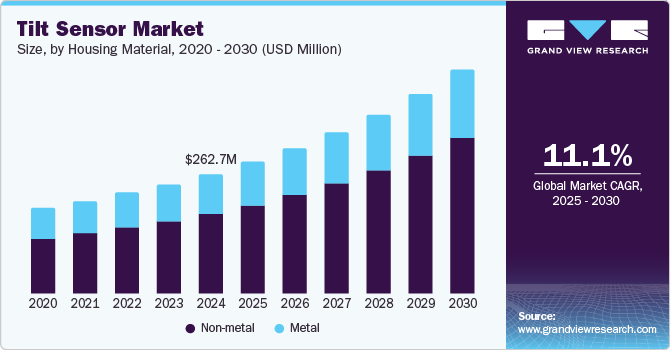

The global tilt sensor market size was valued at USD 262.7 million in 2024 and is projected to grow at a CAGR of 11.1% from 2025 to 2030. The increasing demand for tilt sensors in the automotive sector has been a primary driver of market growth. This surge can be attributed to the rising need for advanced safety features and stability control systems in vehicles, particularly with the shift toward Electric Vehicles (EVs) and autonomous driving technologies. In addition, the growing focus on enhancing vehicle performance and compliance with safety regulations is expected to further boost the adoption of tilt sensors in automotive applications.

Several factors are expected to drive growth in the tilt sensor industry. The ongoing advancement of technology, including improvements in Micro-Electro-Mechanical Systems (MEMS) sensor design, will enhance performance and reduce costs. Moreover, the rising adoption of industrial automation across sectors such as construction and agriculture creates a significant demand for tilt sensors. These sensors are essential for monitoring equipment stability and ensuring operational safety in environments where precision is critical. As industries continue to embrace automation, the reliance on tilt sensors is anticipated to increase, contributing to sustained growth in the tilt sensor industry.

Furthermore, the development of smart technologies and the Internet of Things (IoT) is set to influence the tilt sensor market positively. The proliferation of connected devices requires reliable sensors that provide real-time data for various applications, from smart homes to robotics. Tilt sensors play a crucial role in this ecosystem by enabling devices to adjust their operations based on orientation data. In addition, as more industries adopt IoT solutions to enhance efficiency and connectivity, the demand for tilt sensors is expected to grow, reinforcing their significance in future technological advancements across multiple sectors.

Housing Material Insights

The non-metal segment of the tilt sensor industry dominated the market with a revenue share of 66.6% as of 2024. This dominance can be attributed to the high demand for tilt sensors that utilize advanced plastic materials, which offer benefits such as lightweight construction and ease of installation. In addition, non-metal tilt sensors offer excellent ingress protection, making them ideal for use in industries such as automotive, construction, and robotics. Moreover, the growing trend toward automation and smart technologies enhances the appeal of non-metal tilt sensors, which are being increasingly integrated into IoT devices for improved functionality. Furthermore, as industries prioritize safety and efficiency, the tilt sensor industry is expected to witness sustained growth in this segment.

The metal segment is anticipated to witness a significant CAGR over the forecast period. This growth can be attributed to the increasing demand for durable, robust sensors that withstand harsh environmental conditions. In addition, metal tilt sensors are favored in applications requiring high precision and reliability, such as aerospace and industrial machinery. Moreover, advancements in metal sensor technology are enhancing performance and expanding its range of applications. Hence, the metal segment is expected to substantially contribute to the overall expansion of the tilt sensor market in the coming years.

Technology Insights

The MEMS segment of the tilt sensor industry held the largest market share as of 2024. This segment is favored due to its compact size, high accuracy, and low power consumption, making MEMS tilt sensors ideal for integration into various devices, including smartphones and automotive systems. In addition, the growing demand for advanced technology in consumer electronics and automotive applications has significantly contributed to the expansion of the MEMS segment. Moreover, innovations in MEMS technology continue to enhance performance and reliability, making these sensors increasingly suitable for a wide range of industrial applications. Consequently, the MEMS segment is expected to experience significant growth in the coming years.

The fluid-filled segment is expected to witness a significant CAGR from 2025 to 2030. This growth is expected to be driven by the increasing demand for highly accurate and reliable sensors in various applications, including automotive and industrial machinery. Fluid-filled tilt sensors offer advantages such as enhanced sensitivity and resistance to environmental factors, making them suitable for challenging conditions. In addition, fluid technology advancements are improving these sensors' performance and durability. As a result, the fluid-filled segment is expected to witness significant growth in the coming years.

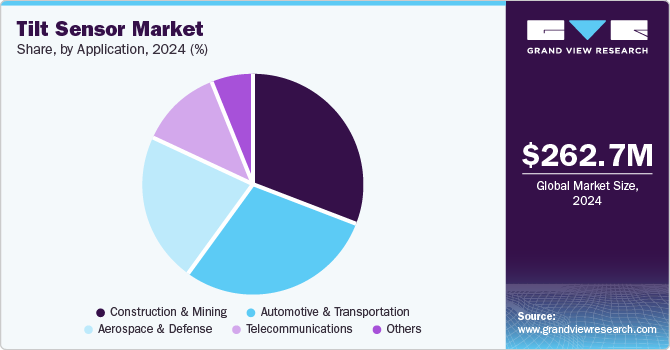

Application Insights

The construction & mining segment held the largest market share in the tilt sensor market as of 2024. This dominance is attributable to the increasing use of tilt sensors to ensure the stability and safety of heavy machinery on construction sites. Tilt sensors are essential for measuring the angle of equipment, helping prevent tipping and accidents during operations. In addition, the growing emphasis on precision and efficiency in construction projects drives the demand for advanced tilt sensor technology. Moreover, with the ongoing development of infrastructure globally, the segment is expected to witness significant growth in the market.

The automotive and transportation segment is anticipated to grow at the highest CAGR over the forecast period. This growth can be attributed to the increasing integration of tilt sensors in vehicle stability control systems and advanced driver assistance technologies. In addition, the rising demand for enhanced safety features in vehicles propels the adoption of tilt sensors for applications such as parking assistance and theft protection. Moreover, the extensive use of tilt sensors in the railway industry for track alignment and maintenance further supports this growth.

Regional Insights

The North America tilt sensor market held a significant share as of 2024. This growth can be attributed to the high demand for tilt sensors used in diverse applications such as automotive, construction, and industrial automation. The region benefits from advanced technological infrastructure and substantial investments in research and development to enhance sensor accuracy and reliability. In addition, the expanding construction sector in Canada is expected to support the market growth further. Consequently, North America is expected to continue contributing to the expansion of the global tilt sensor market in the coming years.

U.S. Tilt Sensor Market Trends

The U.S. tilt sensor market dominated the regional market in 2024. This dominance can be attributed to the increasing demand for tilt sensors in various applications, including automotive, construction, and industrial automation. The country benefits from advanced technological infrastructure and substantial investments in research and development to enhance sensor accuracy and reliability. In addition, the expanding construction sector in the U.S. is expected to bolster the overall tilt sensor market. As a result, the U.S. market is expected to thrive in the coming years.

Europe Tilt Sensor Market Trends

The Europe tilt sensor market held a significant share as of 2024. This growth is driven by the increasing demand for tilt sensors across various applications, particularly in the automotive and industrial sectors. The European market is projected to experience steady growth due to a strong focus on enhancing automotive safety and automation efficiency, which supports the adoption of advanced sensor technologies. In addition, Western and Eastern European countries are expected to contribute to this growth, supported by technological advancements and regulatory frameworks that encourage innovation in sensor technologies.

Asia Pacific Mobile Computer Market Trends

The Asia Pacific tilt sensor market dominated the global market with a revenue share of 53.1% in 2024. This dominance can be attributed to significant investments in infrastructure development, particularly in countries such as China, Japan, and South Korea. The region's robust semiconductor industry and increasing demand for automation across various sectors, including automotive and industrial applications, further contribute to this growth. In addition, the rapid urbanization and industrialization in Asia Pacific countries are fueling the need for advanced sensor technologies. As a result, the Asia Pacific market is expected to maintain its leading position in the tilt sensor market in the coming years.

The India tilt sensor market is anticipated to experience the fastest CAGR over the forecast period. This growth can be attributed to the increasing demand for precision sensors in various sectors, including construction, automotive, and industrial automation. The country's rapid urbanization and infrastructure development projects significantly boost the need for construction equipment and machinery tilt sensors. In addition, India's robust mining sector, which produces a wide range of minerals, further supports the demand for tilt sensors to monitor equipment stability and safety. Consequently, India is expected to become a key player in the global tilt sensor market in the coming years.

Key Tilt Sensor Company Insights

Some key companies in the tilt sensor market are TE Connectivity; Murata Manufacturing Co., Ltd.; SICK AG; Pepperl+Fuchs SE; and Level Developments Ltd. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. In order to achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies.

-

Murata Manufacturing Co., Ltd. specializes in the tilt sensor market, offering advanced Micro-Electro-Mechanical Systems (MEMS) technology. The company provides high-precision tilt sensors, such as the SCL3300 series, designed for automotive and industrial applications. These sensors are known for their reliable performance, ultra-low noise density, and extensive self-diagnostic capabilities. Murata's products cater to the growing demand for automation and safety across various industries.

-

SICK AG provides sensor solutions for industrial automation, including tilt sensors, to monitor equipment stability and safety. The company's tilt sensors are designed to perform effectively in demanding manufacturing and logistics environments. SICK AG focuses on providing durable and high-performance products that address the needs of various industrial applications while enhancing operational efficiency and safety.

Key Tilt Sensor Companies:

The following are the leading companies in the tilt sensor market. These companies collectively hold the largest market share and dictate industry trends.

- TE Connectivity

- Murata Manufacturing Co., Ltd.

- SICK AG

- Pepperl+Fuchs SE

- Level Developments Ltd.

- The Fredericks Company

- ifm electronic gmbh

- Balluff ApS

- Jewell Instruments

- elobau GmbH & Co. KG.

Recent Development

-

In November 2024, Murata Manufacturing Co., Ltd. introduced SCH1633-D01, a Six-Degrees-of-Freedom (6DoF) sensor with tilt sensing capabilities. This sensor is designed for automotive applications, providing critical data for vehicle stability and safety in systems such as Autonomous Driving and Advanced Driver-Assistance Systems (ADAS). Its advanced features enhance the performance of modern vehicles by accurately measuring orientation. SCH1633-D01 exemplifies Murata's commitment to innovation in sensor technology.

-

In June 2024, elobau announced the launch of its new tilt sensor duo, the N6 static and N7 dynamic, intended for the off-highway sector. These sensors use non-contact MEMS technology to monitor angles of inclination accurately and feature cab level control and automatic slope compensation to enhance safety and productivity in mobile machinery. The N6 is designed for static applications, while the N7 is optimized for dynamic environments.

Tilt Sensor Market Report Scope

|

Report Attribute |

Details |

|

Marketsize value in 2025 |

USD 288.7 million |

|

Revenue forecast in 2030 |

USD 489.7 million |

|

Growth Rate |

CAGR of 11.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in thousand units, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Housing material, technology, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa |

|

Key companies profiled |

TE Connectivity; Murata Manufacturing Co., Ltd.; SICK AG; Pepperl+Fuchs SE; Level Developments Ltd.; The Fredericks Company; ifm electronic gmbh; Balluff ApS; Jewell Instruments; and elobau GmbH & Co. KG. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Tilt Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tilt sensor market report based on housing material, technology, application, and region.

-

Housing Material Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Non-metal

-

Metal

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Fluid-filled

-

MEMS

-

Force Balanced

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Construction & Mining

-

Automotive & Transportation

-

Aerospace & Defense

-

Telecommunications

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."