Tidal Energy Market Size, Share & Trends Analysis Report, By Method (Tidal Barrage, Floating Tidal Power Platform, Tidal Stream Generation, Dynamic Tidal Power), By Installation Depth, By Energy Converters, By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455971

- Number of Report Pages: 100

- Format: PDF

- Historical Data: ---

- Forecast Period: 1 - 2030

- Industry: Energy & Power

Tidal Energy Market Size & Trends

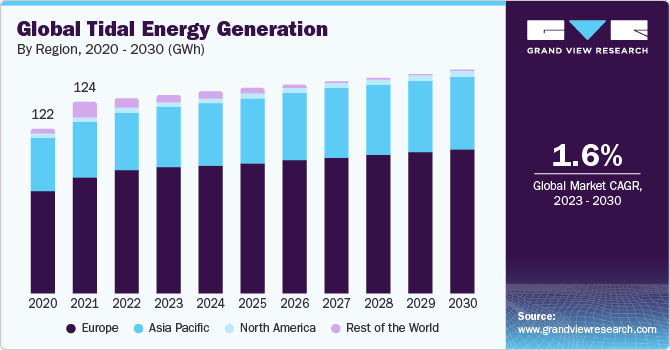

The global tidal energy market was estimated at 127 GWh in 2022, with tidal energy generation expected to grow at a CAGR of 1.64% from 2023 to 2030. Increasing investments in tidal farms and demonstration projects across Europe, Canada, and South Korea is driving power generation through ocean tides. However, the industry has been facing a slow rate of installations due to challenges faced during the COVID-19 pandemic. It's important to note that this reduction reflects a deviation from the initially projected installation figures. It's noteworthy that despite this decrease, there were no project cancellations. Moreover, the projects originally scheduled for deployment in 2020 became operational in 2021. This underscores the resilience of ocean energy in the face of global challenges, demonstrating its ability to adapt and continue progressing even during periods of shocks and slowdowns.

In 2020, the production of electricity from tidal farms and demonstration projects in Europe remained consistent, contributing to a cumulative production total of 60 gigawatt-hours (GWh). Leading the way were prominent European pilot farms, including Meygen, EnFAIT, and Oosterschelde, which collectively generated nearly 12 GWh during the year. This ongoing increase in electricity generation from tidal energy highlights the reliability and efficiency of the projects currently in operation. Despite the challenges posed by limited access to workshops and offshore devices during the year, tidal turbines demonstrated their durability, even when subjected to reduced maintenance schedules.

The Sihwa Lake Tidal Power Station in South Korea boasts the highest electricity generation capacity, standing at 254 megawatts (MW). Following closely, the second-largest operational tidal power facility, located in La Rance, France, has a capacity of 240 MW for electricity generation. Meanwhile, in Nova Scotia, Canada, the Annapolis Royal tidal power plant ranks as the next largest, with a capacity to generate 20 MW of electricity. Additionally, there are smaller tidal power plants in countries such as China, Russia, and South Korea.

Method Insights

Based on the power generation methods, the market is segmented on the basis of tidal barrages, floating tidal power platforms, tidal stream generation plants, and dynamic tidal power plants. Tidal barrages held the largest share in 2022, and power generation through barrages is expected to remain dominant over the forecast period.

Tidal stream generation plants are gaining prominence in Europe. Despite the lockdowns, Europe saw a deployment of 260 kW of tidal stream capacity, which marked a decrease from the 1.52 MW deployed in 2019. In Europe, a total of 27.9 MW of tidal stream technology has been installed since 2010. Presently, 10.1 MW of this capacity is in active operation, while the remaining 17.8 MW has been decommissioned, marking the successful completion of their testing programs.

Some of the key tidal stream projects and their capacities between 2020 and 2022 are as follows,

|

Country |

Location |

Device Developer |

Device Name |

Type |

Capacity (kW) |

Number of Turbines |

|

Faroe Islands |

Vestmannasund |

Minesto |

DG100 |

Kite |

100 |

1 |

|

Scotland |

Orkney |

Design Pro |

DPR60 |

Vertical Axis |

100 |

1 |

|

Scotland |

Shetlands |

Nova Innovation |

M100 |

Horizontal Axis |

100 |

1 |

|

France |

Bordeaux |

Hydrokinetic |

Evo 25 |

Vertical Axis |

25 |

1 |

|

France |

Brest |

EEL Energy |

EEL |

Undulating membrane |

30 |

1 |

|

Northern Ireland |

Strangford Lough |

Gkinetic |

Gkinetic |

Vertical Axis |

12 |

1 |

|

China |

Shengsi island |

Hann Ocean |

Drakoo |

Wave Rotor |

15 |

1 |

|

U.S. |

Washington State |

C Power |

TigerRA |

Rotating mass |

1 |

1 |

|

Israel |

Tel Aviv |

Eco Wave Power |

EWP-EDF WEC |

Attenuator |

100 |

1 |

Installation Depth Insights

On the basis of installation depth, the market has been segmented into shallow waters, transitional waters, and deep waters. Tidal energy systems that generate electricity economically would require a tidal range of at least 10ft. The choice of water depth depends on several factors, including the strength and consistency of tidal currents, environmental considerations, grid connectivity, and the specific technology being employed.

Tidal energy can be effectively harnessed in shallow coastal areas where there are strong tidal currents. Shallow waters are often found near coastlines and can be conducive to certain types of tidal turbines, such as horizontal axis turbines. Shallow waters are typically less challenging in terms of installation and maintenance.

Transitional waters refer to areas between coastal waters and open ocean, including estuaries, bays, and river mouths. These areas can have complex tidal flow patterns and are suitable for various tidal energy technologies, including tidal stream turbines and tidal range technologies (such as tidal lagoons and tidal barrages).

Tidal energy can also be harnessed in deep waters using technologies like vertical axis turbines and tidal kites. Deep water installations are often located farther offshore, where tidal currents can be strong and more consistent. While deep-water installations can be more challenging and costly to deploy and maintain, they may have access to more substantial tidal resources.

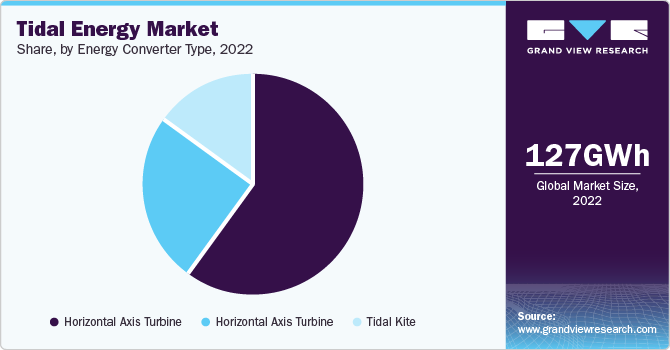

Energy Converter Insights

Based on energy converter types, the market is segmented into horizontal axis turbines, vertical axis turbines and tidal kites. The UK and Denmark are leading in terms of new capacity installations in the European region using turbines and kites as their key energy converters. Such projects are taking shape under Power Purchase Agreements (PPA) and European funding programmes, thereby attracting investments from private developers.

Regional Insights

Europe is the leader in tidal energy, with power generation estimated at over 80.6 GWh in 2022.The region’s longstanding position as a leader in ocean energy is facing growing challenges. The year 2022 marked a notable decline in tidal and wave energy installations in Europe, making it the least productive year in this regard. Concurrently, competition has intensified, with innovative devices now being deployed in American and Chinese waters, supported by significant funding and fresh policy initiatives. Over the past three years, China has emerged as the leader in new capacity installations.

Key Companies & Market Share Insights

Key players operating in the market include, SIMEC Atlantis Energy, Magallanes, Minesto, Verdant Power, Nova Innovation, Ocean Renewable Power Co., Sustainable Marine Energy, MeyGen, Pelamis Wave Power, Aquamarine Power, Alstom, EEL Energy, Norwegian Ocean Power, Tenax, and AWS Ocean Energy among others

In 2022, the world’s second-largest tidal farm, at a capacity of 3.3 MW at Hangzhou LHD, with the support of the Chinese govt., in Zhoushan was operationalized after new capacity additions.

Notable investments in tidal energy in 2022 include,

-

SEAQURRENT: closed a EUR 4.8 million funding round from existing & new shareholders to develop its tidal energy converter, the TidalKite

-

ORBITAL MARINE POWER: secured EUR 4.5 million from individual investors through the Abundance Investment platform to finance its O2 turbine operations

-

SABELLA: raised EUR 2.5 million through bond issues to support its development projects and commercialize its plant operations

-

QED NAVAL: raised EUR 1.7 million for building its Subhub community demonstration platforms, that are designed to support testing, installation, and commissioning of tidal turbines

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."