- Home

- »

- Network Security

- »

-

Threat Intelligence Market Size, Share & Growth Report 2030GVR Report cover

![Threat Intelligence Market Size, Share & Trends Report]()

Threat Intelligence Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premises), By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-672-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Threat Intelligence Market Summary

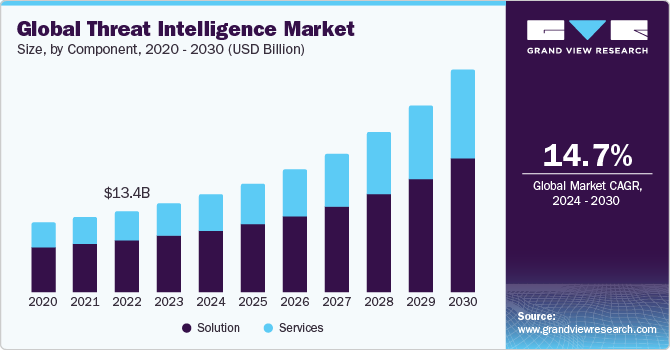

The global threat intelligence market size was estimated at USD 14.59 billion in 2023 and is projected to reach USD 36.53 billion by 2030, growing at a CAGR of 14.7% from 2024 to 2030. There is an emerging threat landscape across both developed and emerging economies.

Key Market Trends & Insights

- North America accounted for the largest market share of 35.1% in 2023.

- The threat intelligence market in U.S. is expected to grow significantly at a CAGR of 12.0% from 2024 to 2030

- Based on components, the solution segment dominated the market with the largest revenue share of 64.1% in 2023

- Based on end-use, the BFSI segment accounted for the second largest market share in 2023

- Based on deployment, the cloud segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.59 Billion

- 2030 Projected Market Size: USD 36.53 Billion

- CAGR (2024-2030): 14.7%

- North America: Largest market in 2023

Governments, as well as many large organizations, are working toward bridging the gap between the spending in cyber security systems and seeking out an optimum result with the gathered threat artifacts to mitigate or reduce arising threats. The applicability and usefulness of threat intelligence have led organizations to integrate contextual information and data points to determine relevant threats to the business and thus provide actionable strategy towards the same, thereby driving market growth.

Cloud computing has emerged as an ally for businesses with the advent of remote work and collaboration. The COVID-19 pandemic fueled a surge in demand for threat intelligence solutions, which resulted in an increase in email phishing crimes. The increase in distant activities, such as teleworking, increased reliance on email for communication, creating an ideal environment for email fraud schemes.

As nations are moving toward digitalization, data and security breaches have grown in higher numbers, resulting in cyber-crime activities. The evidence of advanced technologies in the digital era has increased vulnerability in an organization’s network. The data breaches in the majority of enterprises have a financial, data theft, and espionage motive, which results in disruption of business, downtime in sites, and loss of revenue. The significance of security breaches in an organization has shifted from an external source to an insider threat, which has raised concern amongst IT professionals. Privacy threats are increasing, thereby compromising on personal information of an individual in the organization. Data breaches across education, government, and industry sectors have made headlines repeatedly - over the past years, with no signs of slowing down.

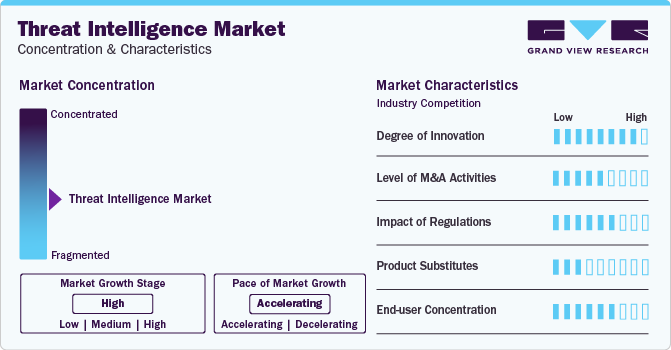

Market Concentration & Characteristics

One of the main growth opportunities in the market is the rising need for advanced cybersecurity measures across various sectors such as finance, healthcare, and government. With the increasing frequency and sophistication of cyberattacks, organizations are prioritizing the implementation of robust threat intelligence solutions to detect and mitigate potential threats proactively. These solutions offer enhanced capabilities for threat detection, analysis, and response, thereby improving overall security posture.

In addition, as technology evolves and cyber threats become more complex, the demand for comprehensive threat intelligence platforms is expected to grow, driven by the necessity for real-time data and actionable insights to safeguard critical infrastructure and sensitive information. This expanding need for cutting-edge security solutions fosters significant market growth and innovation in the threat intelligence domain.

The market is fragmented, with a mix of large and small players competing for market share. However, the market is experiencing a trend toward consolidation as companies choose strategic initiatives such as mergers, acquisitions, partnerships, and product launches to strengthen their market position. For instance, in April 2023, IBM introduced the IBM Security QRadar Suite, a new security suite designed to enhance the experience of security analysts. It covers threat detection, investigation, and response and is built for hybrid cloud environments. The suite features a unified user interface with advanced AI and automation to empower analysts to work more efficiently.

The market experiences mergers and acquisitions, which are influenced by the market environment. These transactions often occur due to the evolving threat landscape, increased cybercrime activities, and the need for organizations to enhance their cybersecurity posture. For instance, in April 2024, BAE Systems, a British multinational aerospace, defense, and information security company, acquired Topaz Intelligence as a component of the Ball Aerospace acquisition into its operations. BAE Systems aims to the Modeling & Simulation Solutions division of the company, delivering intelligence-as-a-service to support dynamic decision-making processes. This division of M&SS is known for its wargaming capabilities and planning services for operational readiness, catering specifically to military clients in the intelligence & security domain.

The market is heavily influenced by government initiatives and regulations, which shape its future growth. Strict regulations for data protection are a key driver of the global threat intelligence platform market. Governments are working toward bridging the gap between cybersecurity spending and seeking optimum results with gathered threat artifacts to mitigate arising threats. As more nations move towards digitalization, data, and security breaches have grown in higher numbers, resulting in increased cybercrime activities. The significance of security breaches in organizations has shifted from external sources to insider threats, raising concerns among IT professionals.

The market has a low level of product substitutes available. Customers have limited alternatives to threat intelligence solutions, as these platforms provide specialized capabilities for identifying, analyzing, and mitigating cyber threats. The unique value proposition and lack of comparable substitute products make the threat intelligence market less competitive and increase the profit potential for firms in this industry.

Component Insights

Based on components, the solution segment dominated the market with the largest revenue share of 64.1% in 2023owing to the effective security standards for authentication and authorization of users based on access levels. Moreover, as organizations shift their business to cloud services, IAM forms a vital part of managing and accessing applications and data by employees without compromising on security protocols. IAM improves security and reduces the IT cost of an organization through increased productivity of the security systems and eliminating the cost of an internal help desk. It allows the user to authenticate from anywhere on a real-time basis, which is one of the key factors for businesses working on a global platform, proving ease of scale operation.

The services segment is expected to grow at the highest CAGR of 16.4% over the forecast period. The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into threat intelligence services is driving market expansion. These technologies enable more accurate threat detection, predictive analytics, and automated responses, enhancing the effectiveness of threat intelligence services. In addition, the increasing adoption of cloud-based solutions allows for more scalable and flexible service delivery, meeting the diverse needs of organizations across various industries. As cyber threats continue to evolve, the demand for sophisticated and adaptable threat intelligence services is expected to rise, driving sustained growth in the services segment of the market.

End-use Insights

Based on end-use, the BFSI segment accounted for the second largest market share in 2023 as the sector is a prime target for cybercriminals due to the sensitive nature of the data it holds, including financial records and personal information. As a result, there is a heightened awareness within the industry of the importance of cybersecurity, leading to increased investment in advanced threat intelligence solutions. Moreover, regulatory compliance requirements, such as GDPR and PCI DSS (Payment Card Industry Data Security Standard), compel BFSI organizations to implement comprehensive security measures, further fueling demand for threat intelligence platforms and services.

The retail segment is expected to grow at the highest CAGR over the forecast period. As retail operations become more digitally integrated, with the proliferation of online stores, mobile apps, and IoT devices, the attack surface for cybercriminals expands significantly. Therefore, retailers are investing in robust threat intelligence platforms to detect and mitigate various cyber threats, including payment fraud, data breaches, and supply chain attacks. Moreover, with the growing adoption of omnichannel retailing, where customers expect a seamless shopping experience across online and offline channels, retailers rely on threat intelligence to safeguard customer data and maintain brand reputation within evolving cybersecurity threats.

Deployment Insights

Based on deployment, the cloud segment dominated the market with the largest revenue share in 2023. As organizations migrate their operations to the cloud, they face new security challenges and require robust threat intelligence solutions tailored for cloud security. Cloud-based threat intelligence offers several advantages, including scalability, flexibility, and the ability to access and analyze threat data in real-time from any location. These capabilities are crucial for organizations looking to enhance their security posture without the constraints of on-premises infrastructure.

The on-premise segment is expected to grow at the highest CAGR during the forecast period. With the adoption of on-premise threat intelligence solutions, organizations can maintain complete control over their data while adhering to industry rules. Organizations with legacy systems prefer on-premise threat intelligence solutions to enable integration. This is critical for ensuring companies’ continuity and minimizing interruption during the transition. On-premise systems provide enhanced customization and control over the software environment. Companies can customize threat intelligence solutions to their business processes and combine them with other on-premise applications.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment dominated the market with the largest revenue share in 2023. The surge in data breaches and cyberattacks targeting large enterprises has emphasized the need for robust cybersecurity measures and advanced threat intelligence solutions to ensure compliance and mitigate risks. For instance, in 2023, Brunswick Corporation suffered an USD 85 Billion to cyber-attack that disrupted operations for 9 days. The attack took many automated systems offline, including those used by large retailers such as Walmart and Target. The fallout cost Clorox USD 356 Billion due to a 20% decline in sales and a steep drop in stock price.

The SMEs segment is expected to grow at the highest CAGR during the forecast period owing to the growing need for SMEs to secure their critical infrastructure. As SMEs increasingly rely on digital technologies for data security, the demand for cloud-based threat intelligence tools has witnessed a rise over the last few years. The integration of cloud and threat intelligence allows SMEs to minimize attack surface by leveraging the global threat community and blocking cyber threats to detect unidentified threats and ultimately stop them before occurring.

Application Insights

Based on application, the security information and event management (SIEM) segment dominated the market with the largest revenue share in 2023. Due to the increasing cyber threats, organizations need advanced solutions for real-time monitoring and incident response to safeguard their data and infrastructure. SIEM systems collect and analyze security data, correlate events, and generate actionable insights to swiftly identify and mitigate potential threats. Integrating AI and machine learning enhances their capability to detect anomalies and predict potential security incidents, contributing to their growing popularity and adoption.

The governance segment is expected to grow at the highest CAGR of 16.5% during the forecast period owing to the increasing regulatory pressure and compliance requirements across various industries that requires robust governance frameworks. Organizations are mandated to adhere to stringent data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., which require comprehensive threat intelligence solutions to ensure compliance and avoid hefty fines. These regulations compel organizations to implement advanced threat intelligence and governance measures to protect sensitive information and maintain the integrity of their operations.

Regional Insights

North America accounted for the largest market share of 35.1% in 2023 owing to the maximum presence of vendors of threat intelligence and service providers focused on innovation. The region's strong financial situation provides chances to spend extensively on the implementation of innovative technologies and tools to ensure efficient corporate operations.

U.S. Threat Intelligence Market Trends

The threat intelligence market in U.S. is expected to grow significantly at a CAGR of 12.0% from 2024 to 2030 owing to stringent regulatory requirements, such HIPAA (Health Insurance Portability and Accountability Act) for healthcare and GLBA (Gramm-Leach-Bliley Act) for financial institutions, mandate robust cybersecurity measures and threat intelligence practices. Compliance with these regulations necessitates the implementation of comprehensive threat intelligence solutions to mitigate risks and protect sensitive data from cyber threats, thus driving market growth.

Asia Pacific Threat Intelligence Trends

The threat intelligence market in Asia Pacific is expected to grow significantly at a CAGR of 17.2% from 2024 to 2030. Large enterprises and several SMEs in China, Japan, and India have been investing in security systems due to growing major issues of data theft and increased cyber-attacks. The increasing number of threat and cyber-crime activities in software applications, growing demand for mobile & web applications, and rising government & legislation by-laws are anticipated to further drive the growth of the threat intelligence market in the Asia-Pacific.

China threat intelligence market is expected to grow significantly at a CAGR of 15.3% from 2024 to 2030. The Chinese government's focus on cybersecurity and data protection regulations is driving the adoption of threat intelligence solutions. The implementation of strict data privacy laws, such as the Cybersecurity Law and the Personal Information Protection Law compelled organizations to enhance their security posture and comply with regulatory requirements.

The threat intelligence market in India is expected to grow significantly at a CAGR of 20.2% from 2024 to 2030. The rapid digitization has increased cyber threats. Organizations invest in threat intelligence to detect and mitigate security risks and ensure regulatory compliance. The growing awareness is driving the adoption of such solutions.

Japan threat intelligence market is expected to grow significantly at a CAGR of 16.2% from 2024 to 2030. The increasing digitization and interconnectedness of Japanese businesses and society at large have heightened the vulnerability to cyber threats, necessitating robust threat intelligence solutions. Moreover, the evolving regulatory landscape, including data protection laws and cybersecurity regulations, drives organizations to invest in comprehensive threat intelligence platforms to ensure compliance and mitigate risks.

Europe Threat Intelligence Market Trends

The threat intelligence market in Europe is expected to grow significantly at a CAGR of 15.1% from 2024 to 2030. Regulatory frameworks such as the General Data Protection Regulation (GDPR) have compelled businesses to prioritize cybersecurity and invest in threat intelligence solutions to ensure compliance and protect customer data. The growing adoption of cloud computing, IoT devices, and digital transformation initiatives further amplifies the demand for threat intelligence, as these technologies introduce new vulnerabilities and attack surfaces.

The UK threat intelligence market is expected to grow significantly at a CAGR of 12.5% from 2024 to 2030. The growing adoption of cloud computing, Internet of Things (IoT) devices, and mobile technologies has expanded the attack surface, making organizations more vulnerable to cyber threats. As a result, there is a heightened emphasis on threat intelligence platforms that can provide comprehensive visibility and protection across diverse IT environments.

The threat intelligence market in Germany is expected to grow significantly at a CAGR of 14.6% from 2024 to 2030. Heightened awareness of cybersecurity risks among German enterprises and government entities fuels the adoption of threat intelligence solutions. As stakeholders become more knowledgeable about emerging threats and attack methodologies, they prioritize investments in advanced threat intelligence platforms and services to enhance their cyber resilience and incident response capabilities.

France threat intelligence market is expected to grow significantly at a CAGR of 18.9% from 2024 to 2030. The emergence of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is transforming the threat intelligence landscape in France. These technologies empower organizations to analyze vast amounts of data rapidly, identify patterns indicative of cyber threats, and automate response mechanisms to mitigate risks proactively. In addition, collaborations between government agencies, cybersecurity firms, and industry stakeholders foster information sharing and collaboration, enhancing the effectiveness of threat intelligence efforts.

Middle East & Africa Threat Intelligence Market Trends

The threat intelligence market in the Middle East & Africais expected to grow significantly at a CAGR of 13.5% from 2024 to 2030. The threat intelligence market in the MEA region faces unique challenges, including the shortage of skilled cybersecurity professionals, limited cybersecurity budgets among small and medium-sized enterprises (SMEs), and the presence of sophisticated threat actors. However, these challenges also present opportunities for market players to offer tailored solutions and services to address the evolving threat landscape effectively. As organizations increasingly recognize the importance of proactive cybersecurity measures, the demand for threat intelligence solutions is expected to continue its upward trajectory in the MEA region.

Saudi Arabia threat intelligence market is expected to grow significantly at a CAGR of 18.9% from 2024 to 2030. The growth is attributed to increased cybersecurity threats, government initiatives such as Vision 2030 promoting digital transformation, and significant investments in technology and infrastructure to protect sensitive data and critical sectors.

Key Threat Intelligence Company Insights

Some of the key players operating in the market include IBM Technology Corporation, Cisco Systems, Inc., and Trend Micro Inc.

-

IBM Technology Corporation is one of the leading players in the threat intelligence market, offering a comprehensive suite of solutions and services to help organizations prevent, detect, and respond to cyber threats. One of IBM's key offerings in the threat intelligence space is the IBM X-Force Threat Intelligence service. This service leverages a team of world-class intelligence analysts to provide detailed, actionable threat information for preventing and fighting cybersecurity threats. In addition to its threat intelligence services, IBM also provides IBM Security X-Force Incident Response Services, which help organizations reduce the business impact of a breach and improve resiliency to attacks through planning and testing. These services offer a holistic approach to incident response, including containment, eradication, recovery, and post-incident activities.

-

Cisco Systems, Inc. is a prominent player in the market, offering advanced cybersecurity solutions to address the evolving cyber threats faced by organizations globally. Cisco's threat intelligence solutions leverage the expertise of Cisco Talos experts, who analyze malware samples and vast amounts of data to provide real-time threat intelligence to their Advanced Malware Protection (AMP) platform. This intelligence enables organizations to enhance breach prevention, continuously monitor malicious behavior, detect malware rapidly, and remove threats effectively. Cisco's AMP solution integrates global threat intelligence, advanced sandboxing capabilities, and real-time malware blocking to fortify organizations against cyber threats and ensure robust cybersecurity defenses.

DXC Technology Company, NSFOCUS Technologies Group Co Ltd, and Broadcom Inc. are some of the emerging market participants in the threat intelligence market.

-

DXC Technology is a prominent player in the global market, offering a comprehensive suite of security services and solutions. DXC's Cyber Defence services include incident response and breach management, 24/7 security monitoring and threat hunting, and tailored threat intelligence services to identify potential risks and vulnerabilities specific to the client's business and industry. The company also offers vulnerability scanning, penetration testing, and red team-blue team exercises led by experienced ethical hackers to strengthen its clients' cybersecurity posture.

-

NSFOCUS Technologies Group Co., Ltd. is one of the global cybersecurity companies that specializes in providing advanced threat intelligence solutions to organizations. The company offers a comprehensive range of security products and services, including cloud-delivered DDoS protection, web application firewalls, and next-generation intrusion prevention systems. The company's threat intelligence solutions include a subscription service that minimizes risk and enhances overall security postures, as well as attack threat monitoring for DDoS threats.

Key Threat Intelligence Companies:

The following are the leading companies in the threat intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems, Inc.

- Broadcom (Symantec Corporation)

- Broadcom (Symantec Corporation)

- Check Point Software Technology Ltd.

- Cisco Systems, Inc.

- FireEye, Inc.

- Fortinet, Inc.

- IBM Corporation

- Lockheed Martin Corporation

- LogRhythm, Inc.

- McAfee, LLC.

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trend Micro Incorporated.

Recent Developments

-

In April 2024, Broadcom Inc. expanded its collaboration with Google Cloud to improve its VMware workloads specifically for Google Cloud. This expanded partnership includes collaborative marketing strategies, the inclusion of Broadcom's offerings in the Google Cloud Marketplace, and the incorporation of Google Cloud's advanced generative AI technologies. The transition of Broadcom’s VMware workloads to Google Cloud aims to harness Google's fundamental platform functionalities and Vertex AI to improve the customer experience.

-

In March 2024, Check Point Software Technologies Ltd. announced a partnership with Microsoft, focusing on improving their Check Point Infinity AI Copilot via the Microsoft Azure OpenAI Service. This initiative aims to widen applications of AI in cybersecurity. Infinity AI Copilot, a generative AI tool, leverages automation to significantly speed up security management by up to 90% and enhances security performance by enabling quicker incident resolution and response. This partnership aligns with Check Point's commitment to developing advanced generative AI cybersecurity solutions and services.

-

In October 2023, IBM introduced enhanced managed detection and response services with new AI capabilities, automating up to 85% of alerts for faster security incident response. The Threat Detection and Response Services (TDR) provide consistent monitoring, examination, and automated remediation of security alerts across hybrid cloud settings, leveraging IBM's advanced security services platform with AI and contextual threat intelligence.

Threat Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.07 billion

Market size value in 2030

USD 36.53 billion

Growth Rate

CAGR of 14.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; Saudi Arabia; UAE; and South Africa.

Key companies profiled

BAE Systems, Inc.; Broadcom (Symantec Corporation); Centrify Corporation; Check Point Software Technology Ltd.; Cisco Systems, Inc.; FireEye, Inc.; Fortinet, Inc.; IBM Corporation; Lockheed Martin Corporation; LogRhythm, Inc.; McAfee, LLC.; Palo Alto Networks, Inc.; Proofpoint, Inc.; Sophos Ltd.; Trend Micro Incorporated.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Threat Intelligence Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global threat intelligence market report based on component, deployment, enterprise size, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Security Information and Event Management

-

Governance

-

Risk & Compliance

-

Business Continuity Planning and Management

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the threat intelligence market include BAE Systems, Inc., Broadcom (Symantec Corporation), Centrify Corporation, Check Point Software Technology Ltd., Cisco Systems, Inc., FireEye, Inc., Fortinet, Inc., IBM Corporation, Lockheed Martin Corporation, LogRhythm, Inc., McAfee, LLC., Palo Alto Networks, Inc., Proofpoint, Inc., Sophos Ltd., Trend Micro Incorporated.

b. Key factors that are driving the market growth include the need for organizations to understand the threats based on available data points and rising security concerns with increasing adoption of the cloud-based solution.

b. The North America region dominated the threat intelligence market, with a share of 35.1% in 2023. This is attributable to the maximum presence of threat intelligence vendors and service providers focused on innovation.

b. The global threat intelligence market size was estimated at USD 14.59 billion in 2023 and is expected to reach USD 16.07 billion in 2024.

b. The global threat intelligence market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 expected to reach USD 36.53 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.