Third-party Risk Management Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Mode (Cloud, On-premises), By Organization Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-379-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Third-party Risk Management Market Trends

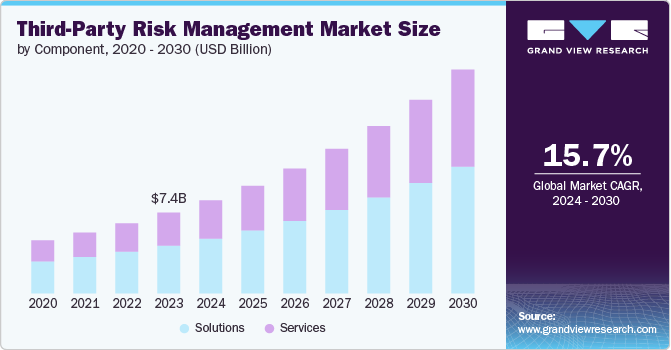

The global third-party risk management market size was estimated at USD 7.42 billion in 2023 and is expected to grow at a CAGR of 15.7% from 2024 to 2030. The market is experiencing significant growth due to the increasing complexity of business ecosystems and the rising number of cyber threats. Organizations are recognizing the importance of assessing and mitigating risks associated with their third-party relationships to ensure the security and compliance of their operations. This market is characterized by the adoption of advanced technologies such as AI and machine learning for risk assessment, along with a growing focus on regulatory compliance.

Market players offer comprehensive solutions that include continuous monitoring, vendor risk assessment, and compliance management. These solutions address enterprises' evolving needs to proactively mitigate and manage risks from their extended network of third-party relationships. As enterprises across various industries prioritize risk management, the market is expected to expand over the forecast period.

As organizations expand their networks of vendors, suppliers, and partners, the need to assess and mitigate associated risks becomes paramount. Stringent regulatory requirements and the potential for significant financial and reputational damage from third-party incidents further amplify this need. Advanced technologies, particularly AI and machine learning, are playing a critical role in this space, enabling more sophisticated risk assessments and continuous monitoring. AI-driven analytics can quickly identify vulnerabilities and predict potential threats, providing organizations with actionable insights to address risks preemptively.

The market's expansion is also fueled by growing awareness among businesses about the importance of comprehensive risk management strategies, leading to increased investments in TPRM solutions. These solutions offer end-to-end capabilities, from initial vendor assessments and onboarding to ongoing monitoring and compliance management, ensuring that organizations can maintain a resilient and secure operational framework. As the digital landscape continues to evolve, the TPRM market is expected to sustain its upward trajectory, driven by the relentless pursuit of security and compliance in an interconnected world.

Component Insights

The solution segment led the market in 2023, accounting for over 59% share of the global revenue. This high share is attributed to the increasing adoption of advanced technological solutions that offer robust risk assessment, continuous monitoring, and compliance management functionalities. Organizations are gravitating towards these integrated solutions to efficiently manage and mitigate risks posed by their extended networks of vendors, suppliers, and partners. The rise in cyber threats and stringent regulatory requirements have further propelled the demand for sophisticated TPRM solutions that provide real-time insights and proactive risk mitigation strategies.

The services segment is predicted to foresee significant growth in the coming years. Organizations are increasingly turning to specialized service providers to help them implement robust TPRM frameworks, conduct thorough risk assessments, and ensure continuous monitoring and compliance. This reliance is driven by the need for tailored solutions that address unique risk profiles and regulatory requirements across various industries. Additionally, the scalability and flexibility of managed services allow businesses to efficiently manage third-party risks without the need for extensive in-house resources.

Deployment Mode Insights

The cloud segment accounted for the largest market revenue share in 2023. Organizations increasingly prefer cloud-based TPRM solutions because they offer seamless integration, real-time updates, and accessibility from anywhere, enhancing the efficiency of risk management processes. The surge in remote work and digital transformation initiatives further amplified the adoption of cloud-based platforms as businesses sought to ensure robust risk management practices in a distributed work environment. Cloud solutions also facilitate advanced data analytics and AI-powered risk assessments, providing organizations with deeper insights and more accurate predictions of potential third-party risks.

The on-premises segment is predicted to foresee significant growth in the coming years. Many organizations, particularly those in highly regulated industries such as finance and healthcare, preferred on-premises solutions to maintain direct oversight of their data and risk management processes. This preference is driven by the need to meet stringent regulatory requirements and ensure the highest levels of data protection, which on-premises deployments can provide. Additionally, on-premises solutions offer greater customization to fit specific organizational needs and integrate seamlessly with existing IT infrastructure.

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2023. BFSI companies handle vast amounts of sensitive data, making robust risk management essential to safeguard against breaches and ensure compliance with regulatory standards. The complexity and interconnectivity of the BFSI sector's third-party relationships further necessitate comprehensive TPRM solutions that provide thorough vendor assessments, continuous monitoring, and proactive risk mitigation. Additionally, the financial impact of potential security incidents in the BFSI sector is substantial, driving these organizations to invest heavily in advanced TPRM technologies, including AI and ML, to enhance their risk management capabilities.

The healthcare segment is anticipated to exhibit the highest CAGR over the forecast period. Healthcare organizations handle vast amounts of sensitive patient information, making them prime targets for cyberattacks and data breaches. The industry's adherence to strict regulations such as HIPAA (Health Insurance Portability and Accountability Act) mandates robust risk management practices to protect patient data and ensure operational integrity. Additionally, the complexity of healthcare ecosystems, which involves numerous third-party vendors for services ranging from billing to medical device management, heightens the risk landscape. As a result, healthcare providers and organizations increasingly seek comprehensive TPRM solutions to manage and mitigate these risks effectively.

Organization Size Insights

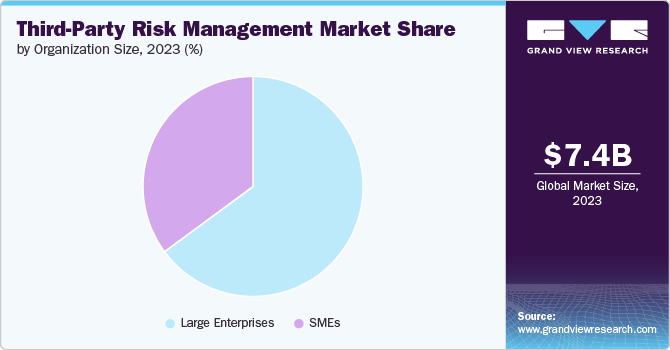

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises typically manage extensive networks of vendors, suppliers, and partners, necessitating robust TPRM solutions to mitigate associated risks effectively. These organizations face heightened regulatory scrutiny and significant financial and reputational risks, driving the adoption of comprehensive risk management frameworks. Additionally, large enterprises have the resources to invest in advanced TPRM technologies and services that provide in-depth risk assessments, continuous monitoring, and compliance management.

The SMEs segment is anticipated to witness significant growth in the coming years. SMEs often operate with limited resources, making them attractive targets for cyberattacks. This vulnerability has driven SMEs to adopt TPRM solutions to protect their operations and data. Additionally, as SMEs expand their networks of vendors and partners, the need for effective risk management becomes more pronounced to avoid disruptions and ensure business continuity. The availability of cost-effective and scalable TPRM solutions tailored to the needs of SMEs has also facilitated this adoption.

Regional Insights

The third-party risk management market of North America dominated with a revenue share of over 38.0% in 2023. The region is home to numerous large enterprises and financial institutions that face complex risk management challenges due to extensive third-party networks. Additionally, the region's strong emphasis on data security and privacy, coupled with significant investments in technology, including AI and ML, enhances its ability to manage and address third-party risks effectively.

U.S. Third-party Risk Management Market Trends

The U.S. third-party risk management market is expected to grow at a CAGR of 13.6% from 2024 to 2030 due to its large number of multinational corporations, stringent regulatory requirements, and high focus on cybersecurity. The country's extensive and complex third-party networks necessitate robust risk management solutions to address regulatory compliance and mitigate potential security threats.

Europe Third-party Risk Management Market Trends

The third-party risk management market of Europe is expected to witness significant growth over the forecast period. Europe's diverse and complex business landscape, coupled with increasing cyber threats, has driven the demand for advanced TPRM technologies. The region's emphasis on safeguarding sensitive information and managing third-party relationships effectively has solidified its position in the TPRM market.

Asia Pacific Third-party Risk Management Market Trends

Asia Pacific third-party risk management market is anticipated to register rapid growth over the forecast perioddue to its rapidly growing economies, expanding digital landscapes, and increasing regulatory focus. As businesses in this region scale and integrate more third-party services, the need for effective risk management solutions has surged. Additionally, the rise in cyber threats and data breaches has prompted organizations to adopt advanced TPRM technologies. The region’s diverse market dynamics and significant investments in digital infrastructure further drive the demand for robust risk management strategies.

Key Third-Party Risk Management Company Insights

Key companies include Aravo Solutions, Inc., BitSight Technologies, Inc., Deloitte Touche Tohmatsu Limited, Ernst & Young Global Limited, and Genpact. Companies active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ Organization Size development.

For instance, in June 2024, Riskonnect, a provider of integrated risk management software, continued its expansion by acquiring Camms, a cloud-based GRC provider. This acquisition will allow Riskonnect to offer enhanced Governance, Risk, and Compliance (GRC) capabilities, including IT risk and strategic management. Additionally, Camms' customers will benefit from an expanded range of risk and compliance services and solutions available through Riskonnect's broader platform.

Key Third-Party Risk Management Companies:

The following are the leading companies in the third-party risk management market. These companies collectively hold the largest market share and dictate industry trends.

- Aravo Solutions, Inc.

- BitSight Technologies, Inc.

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- Genpact

- MetricStream

- NAVEX Global, Inc.

- PwC

- RSA Security LLC

- Venminder, Inc

Recent Developments

-

In May 2024, Safe Security launched its new third-party risk module (TPRM) as part of the SAFE One platform, with over 100 customers already using it. The Safe TPRM uses a risk-based approach with outside-in questionnaires and inside-out telemetry to quantify risk using industry standards such as MITRE, FAIR, and ATT&CK.

-

In February 2024, BitSight Technologies, Inc. launched a fully integrated third-party risk management solution to help security leaders and enterprise risk protect the digital supply chain. This platform combines vendor risk management and continuous monitoring, enabling enterprise teams to manage onboarding, assess vendor health, respond to security incidents, and monitor security hygiene.

-

In December 2023, Drata Inc. introduced its third-party risk management (TPRM) platform, enabling customers to identify and monitor third-party risks centrally and evaluate them. The platform offers security teams comprehensive tools for continuous risk assessment and integration with internal risk profiles, providing a unified view of potential exposures across the organization to manage third-party risks effectively and efficiently.

Third-party Risk Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.57 billion |

|

Revenue forecast in 2030 |

USD 20.59 billion |

|

Growth rate |

CAGR of 15.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment mode, organization size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Aravo Solutions; Inc.; BitSight Technologies, Inc.; Deloitte Touche Tohmatsu Limited; Ernst & Young Global Limited; Genpact; MetricStream; NAVEX Global, Inc.; PwC; RSA Security LLC; Venminder; Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Third-party Risk Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global third-party risk management market report based on component, deployment mode, organization size, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

IT and Telecom

-

Healthcare and Life Sciences

-

Government, Defense, and Aerospace

-

Retail and Consumer Goods

-

Manufacturing

-

Energy and Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global third-party risk management market size was estimated at USD 7.42 billion in 2023 and is expected to reach USD 8.57 billion in 2024.

b. The global third-party risk management market is expected to grow at a compound annual growth rate of 15.7% from 2024 to 2030 to reach USD 20.59 billion by 2030.

b. North America dominated the market in 2023, accounting for 39.0% of the global revenue. The region is home to numerous large enterprises and financial institutions that face complex risk management challenges due to extensive third-party networks.

b. Some key players operating in the third-party risk management market include Aravo Solutions, Inc., BitSight Technologies, Inc., Deloitte Touche Tohmatsu Limited, Ernst & Young Global Limited, Genpact, MetricStream, NAVEX Global, Inc., PwC, RSA Security LLC, Venminder, Inc

b. Key factors driving the third-party risk management market growth include the rise in cyberattacks and data breaches, and the growing complexity of global supply chains and business networks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."