Thin Client Market Size, Share & Trends Analysis Report By Type (Hardware, Software, Services), By Form Factor (Standalone, With Monitor, Mobile), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-268-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Thin Client Market Size & Trends

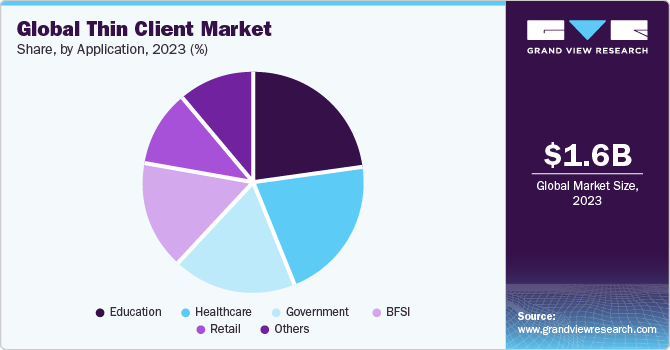

The global thin client market size was estimated at USD 1.60 billion in 2023 and is expected to grow at a CAGR of 3.0% from 2024 to 2030. It can be attributed to the new revenue engine for business growth. As modernization applications work on different technologies and platforms, it’s relatively challenging for businesses to integrate data and meet modern compliance standards. Lack of data integration impacts the visibility/availability of data and the decision-making capability of the organization.

The COVID-19 pandemic positively impacted the market, reshaping dynamics and driving changes in adoption patterns. The pandemic-induced economic uncertainties have driven organizations to seek cost-effective IT solutions, further driving interest in thin client technology. Thin clients typically have a lower upfront cost than traditional PCs and laptops, and their centralized management capabilities result in lower ongoing maintenance and support costs.

Thin clients often involve the processing and storage of data on centralized servers. Adherence to data protection and privacy regulations, such as GDPR in the European Union, is crucial to ensure the secure handling of user information. Specific industries, such as healthcare and finance, have specific regulations governing the handling of sensitive data. Compliance with HIPAA (Health Insurance Portability and Accountability Act) regulations in healthcare or PCI DSS (Payment Card Industry Data Security Standard) in finance may be essential. Thin clients rely heavily on network connectivity. Compliance with network security standards, such as those outlined by ISO 27001, ensures data protection during transmission and reception. Thin client vendors must know export control regulations to ensure international compliance when selling their products.

Despite its growth, the market faces constraints such as limited processing power on individual devices, which may be a drawback for applications demanding intensive computing resources. The dependence on network connectivity poses a challenge, as thin clients heavily rely on a stable and high-speed connection to access centralized servers. Additionally, some industries or specific use cases may still require traditional PCs' raw processing power and autonomy, hindering widespread adoption.

Market Concentration & Characteristics

The market is significantly fragmented in nature. The concentration of the thin client industry globally is low, and the pace of market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid evolution of technologies such as machine learning, artificial intelligence, and the Internet of Things (IoT).

Regulations significantly impact the thin client industry, influencing product development, adoption, and compliance requirements. The rise in government support for promoting thin clients is fueling the industry's growth. Conventional applications are often at risk of security threats, and maintaining compliance with changing regulations is challenging. Modernization enables organizations to ensure adherence to regulatory requirements and execute robust security measures, mitigating potential risks.

The level of mergers and acquisitions (M&A) activities in the thin client industry is moderate. While there is collaboration and partnerships among companies and research institutions to leverage collective expertise, large-scale acquisitions are relatively limited. For instance, in January 2023, Delta Electronics, Inc. acquired Atrust Computer Corp. for USD 950 Million. Atrust specializes in advanced and tailored computing systems, such as thin clients, zero clients, and system integration services. This acquisition is expected to generate substantial collaboration by combining both firms' strengths and R&D expertise, thereby strengthening Delta's extensive ICT infrastructure solutions.

Type Insights

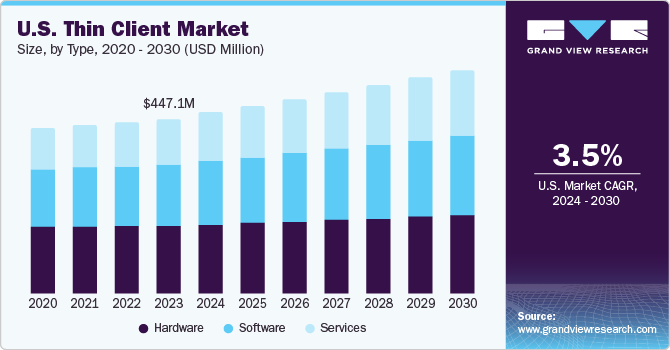

Based on type, the market is further bifurcated into hardware, software, and services. The hardware segment accounted for the largest revenue share of 38.4% in 2023 and is expected to continue to dominate the industry over the forecast period. The trend towards remote work and virtual desktop infrastructure (VDI) solutions has accelerated the adoption of thin client hardware. As organizations transition to remote and hybrid work models, there is a growing need for endpoint devices that seamlessly connect remote workers to centralized computing resources. Thin client hardware, with its ability to access virtual desktops and applications hosted in data centers or cloud environments, addresses this need for flexible and scalable remote computing solutions.

Moreover, advancements in cloud computing and virtualization technologies are driving innovation in the thin client hardware segment. Modern thin client devices offer increased processing power, improved graphics capabilities, and support for multimedia-rich applications, catering to the growing demands of users for a seamless computing experience.

Services are expected to grow at the fastest CAGR during the forecast period. The trend towards remote work and distributed workforces has accelerated demand for remote support and monitoring services in the market. With more employees working remotely or in hybrid work models, organizations require remote support solutions that enable IT teams to troubleshoot issues, perform maintenance tasks, and monitor thin client environments from anywhere. Remote support services leverage remote access technologies and monitoring tools to provide timely assistance and ensure optimal performance of thin client devices and infrastructure.

Form Factor Insights

Based on form factor, the market is segmented into standalone, with monitor and mobile. The mobile segment held the largest revenue share in 2023 and is expected to witness the fastest CAGR during the forecast period. Mobile technology and connectivity advancements have expanded the capabilities of thin client solutions in the mobility segment. Modern thin client devices offer enhanced processing power, improved graphics capabilities, and support for high-speed wireless connectivity technologies such as 5G. As mobile devices become increasingly powerful and versatile, thin client solutions continue to evolve to meet mobile users' demands, driving adoption and innovation in the mobility segment of the thin client market.

The standalone segment is expected to witness significant growth during the forecast period. The increasing demand for cost-effective computing solutions that offer simplicity and ease of management is driving the segment's growth. Standalone thin clients, which operate independently without reliance on server infrastructure, provide a streamlined and efficient computing experience for organizations to simplify their IT environments.

Application Insights

Based on application, the market is further bifurcated into healthcare, retail, education, government, and others. The education segment accounted for the largest revenue share in 2023. Thin client usage is prevalent in the education sector for several reasons. Thin clients are generally more affordable than traditional PCs, making it feasible for educational institutions, especially those with budget constraints, to deploy them in large numbers. Centralized management is another significant benefit. Thin clients reduce the risk of data breaches or unauthorized access as most computing processes occur on centralized servers, limiting the exposure of sensitive information on individual devices. Additionally, the simplicity and ease of form factor contribute to the demand of thin clients in educational institutions, where there may be a need for quick and scalable solutions to accommodate many users, such as students and faculty members.

The healthcare segment is expected to grow fastest during the forecasted period. One crucial factor is the emphasis on data security and privacy. Thin clients facilitate centralized data management, reducing the risk of sensitive patient information being compromised on individual devices, which aligns with the stringent security requirements in healthcare. Moreover, the healthcare sector often involves complex applications and data-intensive tasks, and thin clients allow healthcare professionals to access powerful computing resources from various devices without the need for high-end local hardware. This flexibility is crucial for healthcare professionals needing to access patient data on the go or from different locations within a healthcare facility. Centralized management of software updates and system configurations is also essential in healthcare, where maintaining a consistent and up-to-date computing environment is critical for patient care and compliance with regulations.

Regional Insights

North America dominated the thin client market with a market share of 35.7% in 2023. The growing trend towards remote desktop services (RDS) and desktop as a service (DaaS) models is driving the adoption of thin client technology in North America. RDS and DaaS solutions enable organizations to virtualize desktop environments and deliver them to end-users as a service, reducing hardware costs and simplifying IT management. Thin clients serve as endpoints for accessing virtual desktops hosted in the data center or cloud, providing users with a consistent and secure computing experience from any location. This shift towards desktop virtualization aligns with the need for flexible and scalable IT solutions in North America, where businesses seek to optimize resource utilization and improve workforce productivity. In February 2022, IGEL announced an expansion of its partnership with Nutanix Frame. As a component of Nutanix Ready, the Frame Ready program allows thin client manufacturers to validate the harmony of their operating systems and hardware with Nutanix Frame and the Frame App. Through collaborative compatibility testing, IGEL OS attains Nutanix Frame Ready accreditation, streamlining the setup and management of IGEL OS-driven devices within the Nutanix Frame Desktop-as-a-Service platform.

U.S. Thin Client Market Trends

The U.S. accounted for a market share of 28.0% in the global thin client market in 2023. Increasing focus on cybersecurity and data protection is driving the market growth. With the rise of cyber threats and data breaches, U.S. organizations prioritize secure computing solutions. Thin client technology offers centralized data storage and processing, reducing the risk of unauthorized access and enhancing data security. By minimizing the attack surface and centralizing computing resources, thin clients help organizations in the U.S. strengthen their cybersecurity posture and comply with regulatory requirements such as HIPAA and PCI-DSS.

Asia Pacific Thin Client Market Trends

The thin client market in Asia Pacific is expected to grow significantly during the forecast period. The rising adoption of remote learning and digital education initiatives is driving demand for thin client solutions in the Asia Pacific. Thin clients provide cost-effective and secure computing solutions for schools, colleges, and universities, enabling students and educators to access educational resources and applications from anywhere, on any device. By centralizing computing resources and providing remote access to virtual desktops, thin client solutions support online learning initiatives and facilitate collaboration among students and educators in the Asia Pacific region. This focus on digital education drives the adoption of thin client technology as educational institutions enhance access to quality education and adapt to changing learning environments.

The China thin client market is expected to dominate during the forecast period. The expansion of e-commerce and online retailing is driving the adoption of thin client technology in China's retail sector. With the rapid growth of online shopping and digital commerce platforms, retailers are adopting efficient and secure endpoint solutions that enable seamless access to e-commerce applications and customer data. Thin clients provide a reliable and cost-effective means of delivering virtual desktops to retail employees, facilitating tasks such as inventory management, point-of-sale transactions, and customer service. Adopting thin client technology in the retail sector aligns with China's broader digital transformation goals and the increasing demand for omnichannel retail experiences.

The thin client market in Australia is expected to witness substantial growth during the forecast period. Increasing adoption of green IT initiatives and sustainable business practices is driving the market growth. Thin client solutions are inherently more energy-efficient than traditional desktop PCs, as they rely on centralized server infrastructure for processing and storage. It reduces energy consumption, lowers operational costs for organizations, and aligns with corporate sustainability goals and environmental regulations. As businesses in Australia prioritize environmental responsibility and reduce their carbon footprint, the energy-efficient nature of thin client technology is driving the adoption of thin clients across various industries.

Latin America Thin Client Market Trends

The thin client market in Latin America is expected to grow significantly during the forecast period. The trend towards digital transformation and the adoption of BYOD (Bring Your Own Device) policies is driving demand for thin client technology among organizations in Latin America. As employees increasingly use personal devices for work-related tasks, organizations adopt secure and cost-effective solutions to accommodate BYOD initiatives. Thin client solutions provide a secure and controlled environment for accessing corporate data and applications on personal devices, enabling organizations to adopt BYOD without compromising data security or regulatory compliance. This flexibility and compatibility with BYOD policies drive the adoption of thin client technology in Latin America.

Key Thin Client Company Insights

Accenture, IBM, and Infosys are some key players operating in the market. Accenture's thin client excel in driving digital transformation for businesses. Accenture emphasizes microservices architecture and containerization for improved agility and resource utilization. The integration of DevOps practices ensures accelerated development cycles and collaboration between teams. Security is crucial, and data modernization strategies are being implemented to enhance analytics and compliance. Accenture's expertise extends to seamless legacy system integration, offering organizations a phased and strategic approach to modernization, reducing technical debt, and positioning them for sustained success in today's dynamic digital landscape.

-

IBM emphasizes a DevOps culture, fostering collaboration and efficiency in software development. Their approach includes thorough security measures, ensuring robust protection for applications and data. With a commitment to user experience, IBM modernization services offer revamped interfaces and intuitive interactions. Incorporating analytics and data modernization strategies further solidifies IBM's role in empowering organizations to navigate the complexities of modern digital landscapes while optimizing legacy systems integration.

-

Infosys Limited is a consulting and technology company. Within its extensive service portfolio, Infosys offers expertise in thin client technology. This computing model centralizes the processing and storage of applications and data on a server, with client devices accessing these resources remotely over a network. Furthermore, Infosys provides ongoing support and maintenance services to ensure the smooth operation and continued optimization of thin client environments.

Key Thin Client Companies:

The following are the leading companies in the thin client market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Accenture

- Infosys

- Cognizant

- Capgemini

- Tata Consultancy Services

- DXC Technology

- HCL Technologies

- Wipro

- NTT DATA Corporation

Recent Developments

-

In November 2023, Amazon launched new thin client devices priced at USD 195 to enable enterprise users to access virtual desktop environments via the Internet. These thin clients will significantly undercut their pricing despite offering fewer capabilities than dedicated PCs. They are equipped with USB and HDMI ports for connecting peripherals such as dual monitors, a mouse, a keyboard, a camera, and a headset. Additionally, the thin clients support on-device authentication and integration with Amazon's suite of virtual desktop services.

-

In September 2023, Kaspersky and Centerm entered into an original equipment manufacturer (OEM) agreement to launch worldwide distribution of software products utilizing KasperskyOS. Unlike conventional Kaspersky software, these products provide tailored solutions that guarantee device security via Cyber Immunity technology. As per the terms of this agreement, Centerm will incorporate Kaspersky Thin Client software onto the Centerm F620 thin client, a hardware platform, and subsequently distribute the integrated product through local distributors and partners.

-

In March 2023, Stratodesk announced the certification of a range of LG Business Solutions' Thin Clients with Stratodesk NoTouch OS. Through the automation of application and web technology delivery, Stratodesk simplifies the process for joint customers to maintain productivity from any location, utilizing familiar Windows or non-Windows business software. With LG Thin Clients running Stratodesk NoTouch OS, enterprises across various sectors, such as healthcare, financial services, and more, can benefit from numerous advantages and advancements.

-

In September 2022, Stratodesk launched its top-tier Managed Service Provider (MSP) program tailored for MSPs and system integrators. The program offers a compelling subscription model, enabling partners to unlock fresh, distinctive services and seize growth opportunities. With Stratodesk's NoTouch OS, partners can assist clients in seamlessly implementing virtual desktop and thin client strategies according to their unique business requirements. By adopting Stratodesk's adaptable approach to enhancing workforce productivity, IT teams effortlessly transform a range of devices, be it laptops, thin clients, desktop computers, or hybrid devices, into secure enterprise edge and cloud workspaces.

-

In February 2022, IGEL announced that Getech opted for its endpoint software, deployed on LG Cloud Device thin client devices, as part of a comprehensive shift towards cloud desktop virtualization and a modernization initiative for their aging desktop hardware. Leveraging their expertise with Microsoft Windows server platforms and applications, Getech transitioned to Azure Virtual Desktops (AVD), deploying six Windows 10 multi-session hosts and adopting CL600 thin clients running IGEL OS.

Thin Client Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.65 billion |

|

Revenue forecast in 2030 |

USD 1.97 billion |

|

Growth rate |

CAGR of 3.0 % from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, form factor, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

IBM; Accenture; Infosys; Cognizant; Capgemini; Tata Consultancy Services; DXC Technology; HCL Technologies; Wipro; NTT DATA Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Thin Client Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global thin client market report based on type, form factor, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Form Factor Outlook (Revenue, USD Million, 2017 - 2030)

-

Standalone

-

With Monitor

-

Mobile

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Retail

-

Education

-

BFSI

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thin client market size was estimated at USD 1.60 billion in 2023 and is expected to reach USD 1.65 billion in 2024

b. The global thin client market is expected to grow at a compound annual growth rate of 3.0% from 2024 to 2030 to reach USD 1.97 billion by 2030

b. North America dominated the thin client market, with a share of 35.7% in 2023. The growing trend towards remote desktop services (RDS) and desktop as a service (DaaS) models is driving the adoption of this market.

b. Some key players operating in the thin client market include IBM, Accenture, Infosys, Cognizant, Capgemini, Tata Consultancy Services, DXC Technology, HCL Technologies, Wipro, NTT DATA Corporation

b. Factors such as the rising need for enhanced cybersecurity measures, the proliferation of Internet of Things (IoT) devices, and the need for seamless integration with existing infrastructure are driving the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."