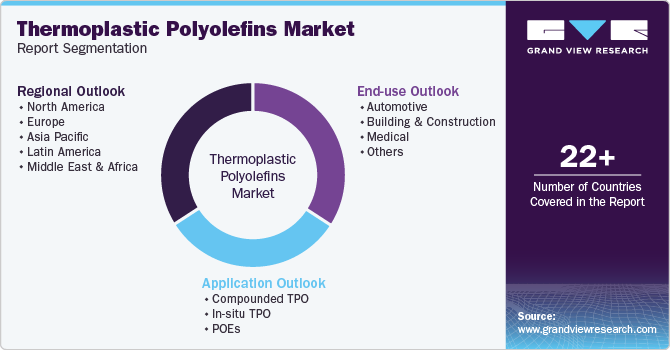

Thermoplastic Polyolefins Market Size, Share & Trends Analysis Report By Application (Compounded TPO, In-situ TPO), By End-use (Automotive, Building & Construction, Medical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-054-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Thermoplastic Polyolefins Market Trends

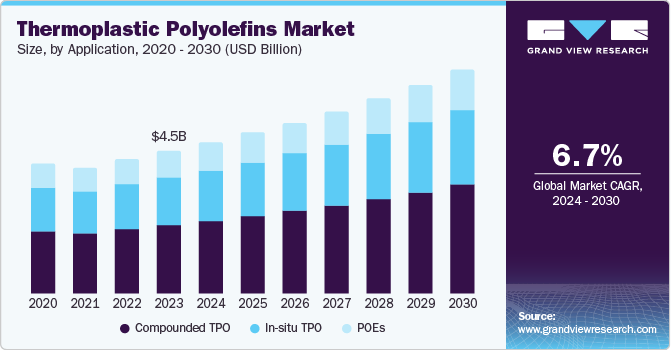

The global thermoplastic polyolefins market size was valued at USD 4.52 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030. This growth is driven by the increasing demand for lightweight and durable materials in the automotive and construction industries. Thermoplastic polyolefins (TPOs) are favored for their ability to reduce vehicle weight, which enhances fuel efficiency and reduces emissions. Additionally, the construction sector’s expansion, particularly in developing regions, is boosting the demand for TPOs due to their durability and weather resistance. Furthermore, the growing emphasis on sustainable and recyclable materials is encouraging the adoption of TPOs, which are known for their recyclability and environmental benefits.

The market is expected to see significant growth driven by advancements in recycling technologies and the rising demand for sustainable materials. Innovations in bio-based TPOs are also anticipated to gain traction as industries seek to reduce their carbon footprint. Furthermore, the expansion of TPO applications in emerging markets and regulatory support for eco-friendly materials will likely propel the market forward.

Application Insights

The compounded TPO segment accounted for 48.4% of the market revenue in 2023. This segment is particularly significant in the automotive industry, where compounded TPOs are used extensively for manufacturing bumpers, dashboards, and interior trims. The ability to tailor the properties of compounded TPOs to meet stringent automotive standards makes them highly desirable. Additionally, the construction industry benefits from compounded TPOs in applications such as roofing membranes and waterproofing solutions, where their weather resistance and longevity are critical.

The in-situ TPO segment is expected to grow at a CAGR of 6.7% from 2024 to 2030. This segment is gaining traction due to its cost-effectiveness and the ability to produce large volumes efficiently. The construction sector is adopting in-situ TPOs for applications such as geomembranes and sealing systems, where their excellent mechanical properties and ease of installation are advantageous. The ongoing advancements in polymerization technologies and the rising demand for sustainable and high-performance materials are expected to further propel the growth of the in-situ TPO segment in the coming years.

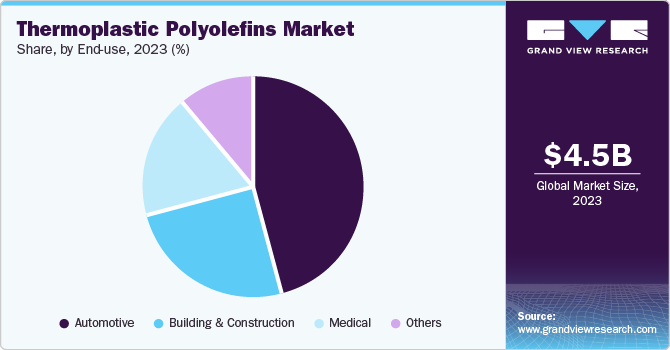

End-use Insights

The automotive segment dominated the market in 2023, driven by the increasing demand for lightweight and durable materials in vehicle manufacturing. TPOs are extensively used in the automotive industry for both interior and exterior applications. Their lightweight nature helps in reducing the overall weight of vehicles, which in turn enhances fuel efficiency and reduces emissions, aligning with the stringent environmental regulations and consumer demand for eco-friendly vehicles. Additionally, TPOs offer excellent impact resistance, UV stability, and aesthetic appeal, making them a preferred choice for automotive manufacturers.

The building and construction segment is expected to witness the fastest CAGR over the forecast period primarily attributed to the increasing adoption of TPOs in roofing membranes, waterproofing systems, and insulation materials. TPOs are favored in the construction industry for their excellent weather resistance, durability, and energy efficiency. The rising focus on sustainable building practices and energy-efficient construction materials is also driving the demand for TPOs.

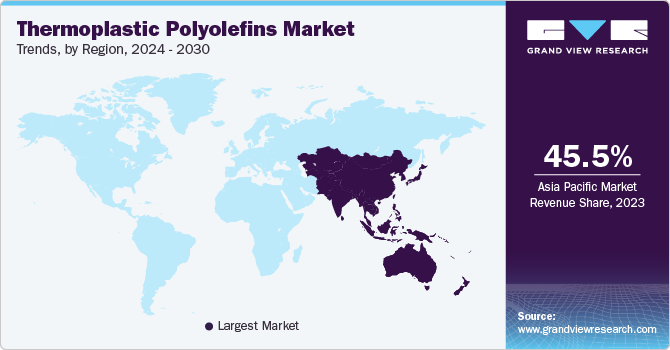

Regional Insights

The North America accounted for 21.2% of the global market revenue in 2023. This dominance is driven by the robust automotive and construction industries. The demand for lightweight and durable materials in region for vehicle manufacturing and infrastructure projects is a significant growth driver. Additionally, the presence of key market players and technological advancements in polymer production contribute to the market's strength in this region.

U.S. Thermoplastic Polyolefins Market Trends

The U.S. dominated the North America thermoplastic polyolefins market in 2023. The country's leadership in automotive manufacturing and construction activities fuels the demand for TPOs. Moreover, stringent environmental regulations and the push for sustainable materials have accelerated the adoption of TPOs in various applications, including automotive parts and building materials.

Asia Pacfic Thermoplastic Polyolefins Market Trends

The Asia Pacific region held the largest revenue share of 45.5% in the global TPO market in 2023. This dominance is attributed to the rapid industrialization and urbanization in countries such as China, India, and Japan. The booming automotive and construction sectors in these countries drive the demand for TPOs. Additionally, the region benefits from lower production costs and a large consumer base, making it a lucrative market for TPO manufacturers. The increasing focus on sustainable and recyclable materials also supports market growth in APAC.

China accounted for a significant share of the Asia Pacific TPO market. The country's extensive automotive manufacturing industry and large-scale construction projects are primary drivers of TPO demand. China's commitment to reducing carbon emissions and promoting sustainable materials further boosts the market. Additionally, government initiatives to support domestic production and innovation in polymer technologies contribute to the strong market presence of TPOs in China.

Europe Thermoplastic Polyolefins Market Trends

The European thermoplastic polyolefins market is expected to grow at a CAGR of 6.4% over the forecast period. The region's market growth is driven by stringent environmental regulations and the increasing adoption of sustainable materials in various industries. Additionally, the construction industry in Europe is increasingly utilizing TPOs for roofing and waterproofing applications due to their durability and weather.

The UK is expected to play a significant role in the growth of the European thermoplastic polyolefins market. The country's focus on sustainable construction practices and the adoption of eco-friendly materials are key factors driving the demand for TPOs. The automotive industry in the UK also contributes to market growth, with a strong emphasis on reducing vehicle weight and improving fuel efficiency. Furthermore, government initiatives and regulations promoting the use of recyclable and sustainable materials support the expansion of the TPO market in the UK.

Latin America Thermoplastic Polyolefins Market Trends

The Latin America region is projected to grow at a significant CAGR over the forecast period driven by the expanding automotive and construction industries. Countries such as Brazil and Mexico are key contributors to the market, with increasing investments in infrastructure projects and automotive manufacturing. The rising awareness of sustainable materials and the adoption of TPOs in various applications further support market growth in Latin America.

Key Thermoplastic Polyolefins Company Insights

The global thermoplastic polyolefins market is driven by major companies such as Johns Manville, S&E Specialty Polymers, SABIC, Noble Polymers, and Exxon Mobil, among others.

-

SABIC offers a diverse range of high-quality TPO materials. SABIC’s TPOs are utilized in various industries, including automotive and construction.

-

Exxon Mobil is known for its robust production capabilities and extensive product portfolio. Exxon Mobil’s TPOs are used in a variety of applications, from automotive components to roofing membranes. The company’s global presence and strong distribution network ensure the availability of its TPO products across different regions.

Key Thermoplastic Polyolefins Companies:

The following are the leading companies in the thermoplastic polyolefins market. These companies collectively hold the largest market share and dictate industry trends.

- Johns Manville

- S&E Specialty Polymers

- SABIC

- Noble Polymers

- INEOS Olefins & Polymers

- Exxon Mobil Corporation

- A Berkshire Hathaway Company

- The Hexpol group of companies

- Sumitomo Chemical Co., Ltd.

- Arkema SA

- LyondellBasell

- RTP Company

Recent Developments

-

In April 2024, Versalis, Eni's chemical subsidiary, finalized the acquired Tecnofilm S.p.A., a family-owned Italian company specializing in compounding, manufactures functionalized polyolefins and thermoplastic compounds primarily for the footwear and technical goods sectors.

-

In March 2024, McClarin Plastics LLC successfully integrated Materia Inc.'s polyolefin thermoset molding facilities into its operations. This strategic move leverages McClarin's expertise in advanced materials and Materia's innovative resin technology, expanding the company's capabilities in high-performance composites and molded thermosets.

Thermoplastic Polyolefins Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.80 billion |

|

Revenue forecast in 2030 |

USD 7.08 billion |

|

Growth rate |

CAGR of 6.7% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030, Volume in Kilotons |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use. region |

|

Key companies profiled |

Johns Manville, S&E Specialty Polymers, SABIC, Noble Polymers, INEOS Olefins & Polymers, Exxon Mobil Corporation, A Berkshire Hathaway Company, The Hexpol group of companies, Sumitomo Chemical Co., Ltd., Arkema SA, LyondellBasell, RTP Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Thermoplastic Polyolefins Market Report Segmentation

This report forecasts revenue & volume growth of the thermoplastic polyolefins market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report based on application, end-use and region:

-

Application Outlook (Revenue, USD Million; 2018 - 2030) (Volume in Kilotons)

-

Compounded TPO

-

In-situ TPO

-

POEs

-

-

End Use (Revenue, USD Million; 2018 - 2030) (Volume in Kilotons)

-

Automotive

-

Building & Construction

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."