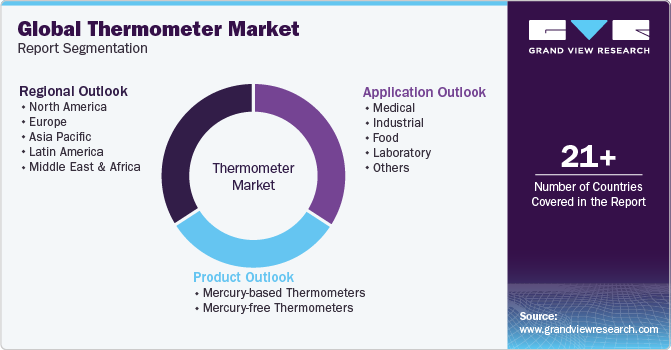

Thermometer Market Size, Share & Trends Analysis Report By Product (Mercury-based, Mercury-free Thermometer), By Application (Medical, Industrial, Food, Laboratories), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-420-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Thermometer Market Size & Trends

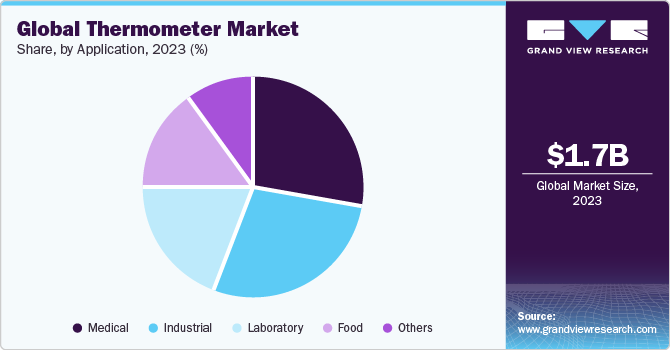

The global thermometer market size was estimated at USD 1.7 billion in 2023 and is projected to grow at compounded annual growth rate (CAGR) of 8.2% from 2024 to 2030. A rise in the prevalence of infectious diseases and medical conditions such as dengue and malaria as well as a surge in public awareness about the significance of body temperature monitoring are the major factors expected to drive the market. In addition, increasing applications of such devices in temperature monitoring for medical, industrial, laboratory, and imaging purposes are a few other factors supporting towards market growth.

For instance, the Centers for Disease Control and Prevention (CDC) report that approximately 2,000 malaria cases are identified in the U.S. each year. Moreover, according to 2022 data from the World Health Organization (WHO), almost half of the global population is exposed to the risk of malaria. Notably, the WHO African Region accounts for 95% of worldwide malaria cases and an even higher 96% of malaria-related deaths originating from this region. This underscores the critical role of temperature-monitoring devices in addressing health challenges on a global scale.

In addition, the surge in health consciousness and increase in patient awareness are among the major factors contributing to the market growth. With growing demand for a self-healthcare, companies such as Terumo Corporation and Nexcare introduced portable products, which are user-friendly and also can be easily adopted by any patient. Moreover, an increasing dependency of healthcare practitioners on the usage of thermometers for checking health status of patients is expected to boost the market. Awareness among other end users such as pharmaceutical, food, and chemical industries is also increasing. Maintenance of specific temperatures in various stages of product development is an essential requirement in these industries. These factors are estimated to boost market growth over the forecast period.

Moreover, the rapid technological advancements has led to the launch of innovative product launch, which is anticipated to accelerate market growth during the forecast period. Advancements include a temporal thermometer, TAT-2000C by Exergen Corporation, which can be used to check body temperature level by rolling it on a child’s forehead. In addition, the American Diagnostics Corporation offers Adtemp 429 thermometer that measures temperature without skin contact, thus, minimizing the risk of cross-contamination. Thus, an increasing demand for easy-to-use, sensitive, and rapid thermometers, is also expected to drive the market. In addition, in food industry, thermometers are required to check temperatures to avoid contamination and degradation of food and beverages. Companies, such as TEL-TRU, provide a range of NSF-certified poultry/meat, food testing, and barbeque thermometers. Thus, these thermometers help maintain the quality of temperature-sensitive eatables, thus boosting market growth.

Furthermore, the coronavirus outbreak has positively impacted the medical industry with an increased demand for thermometers. This is likely to drive the market during the forecast period. The need for thermal screening at public places, offices, and hospitals has increased the demand for infrared thermometers.

In recent years, the market has experienced a substantial transformations driven by regulatory interventions, technological advancements, and a surge in focus on environmental well-being. While mercury thermometers were once extensively utilized across various industries for their accuracy in temperature measurement, concerns over their adverse effects on human health and the environment have spurred a global initiative to phase out these instruments. However, the governments and regulatory bodies worldwide have taken firm measures to impose strict restrictions on using and producing mercury-containing devices, including thermometers.

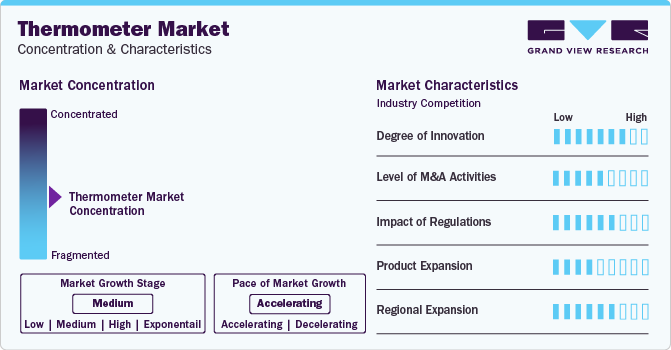

Market Concentration & Characteristics

An increased body temperature is the first sign that the body is preparing to fight infection, therefore, doctors everywhere make their first assumption about the disease based on thermometer readings. Thus, the spread of highly infectious diseases are resulting in demand for thermometers in medical settings globally. For instance, in January 2022, WHO reported a significant surge in global dengue cases over the past decade, with an estimated annual incidence of 100-400 million infections. This escalating incidence of infectious diseases is projected to increase the demand for thermometers, consequently propelling market growth.

Prohibiting traditional mercury-filled thermometers in 13 U.S. states has propelled the demand for mercury-free thermometers. Legislative actions have been implemented to ban the manufacturing and sale of mercury thermometers, aiming to eliminate the dangers linked to broken glass thermometers and the release of ecologically harmful mercury vapors in households. As a result, the transition from mercury thermometers to mercury-free thermometers has gained significant momentum, with the increased adoption of digital and infrared thermometers further accelerating this shift.

Novel product introductions are projected to boost market growth in this country. For example, in February 2022, Calera launched a wearable thermometer. Enabled with a tiny sensor and an AI-based system. Such innovative and expanding product introductions are likely to contribute to the thermometer market’s growth throughout the forecast period.

Product Insights

The mercury-free thermometers segment led the market in 2023 with the largest revenue share of 69.1% and is anticipated to grow at the fastest CAGR of 10.5% during the forecast period. The segment is further segmented into digital thermometers, infrared radiation thermometers, and others. Adoption of mercury-free thermometers such as IR radiation thermometers and digital thermometers are anticipated to gain significant market share as they provide more accurate readings and are not associated with the environmental hazards of mercury.

Whereas, mercury-based thermometers are easy-to-use and are employed in laboratories. However, since 2001, almost 20 states have banned the use of mercury-based thermometers, especially for medical use, due to the poisonous effects of mercury. More stringent regulations on the usage of these devices are expected to be implemented in the coming years, restraining the use of mercury-based thermometers in various fields. For instance, Analytical Technology and Control Limited (ATCT) will stop supplying customers with ASTM approved mercury-based thermometers and instead will supply spirit-filled thermometers to their customers.

Application Insights

The medical segment led the market with the largest revenue share of 28.1% in 2023. This can be attributed to presence of well-established healthcare infrastructure and high incidence of diseases requiring body temperature assessment. One of the major reasons for the growth of this segment is technological advancements in thermometers. For instance, Instant Read Digital Ear thermometer of A&D Company, Limited, markets a thermometer with one-button operation and it has 10 memory recalls. It aids in easy measurements in 1 second and has an LCD display.

The industrial segment is expected to witness a significant CAGR of 8.6% during the forecast period, as pharmaceuticals, chemical, and biotechnology companies require specific temperature maintenance during various stages of product development. Industrial thermometers are selected depending on their type, size, configurations, display options, features, applications, and operating environments. Moreover, the presence of key players such as Microtemp Electrics Co., Ltd.; Endress+Hauser Management AG; and LumaSense Technologies, Inc. is expected to aid overall market growth. These factors are anticipated to boost the segment growth during the forecast period.

Regional Insights

North America dominated the market with a revenue share of 34.4% in 2023. Growing geriatric population and higher healthcare expenditure are some of the key contributing factors. Healthcare camps and government initiatives for spreading awareness about infectious diseases and helping maintain better health status, are anticipated to further boost the market growth. Furthermore, the availability of technologically advanced products and the presence of major key players such as 3M, Medline Industries, Welch Allyn, Inc. America Diagnostics Corporation, A&D Medical are also contributing towards the market growth.

U.S. Thermometer Market Trends

The U.S. market is expected to grow at the fastest CAGR over the forecast period, due to increasing prevalence of various diseases, including dengue, malaria, swine flu, is anticipated to expand the use of thermometer during the forecast period. According to as per the CDC, it was estimated that there have been nearly 18 million illnesses cases, about 210,000 hospitalizations, and nearly 13,000 deaths from flu in the U.S. in 2023.

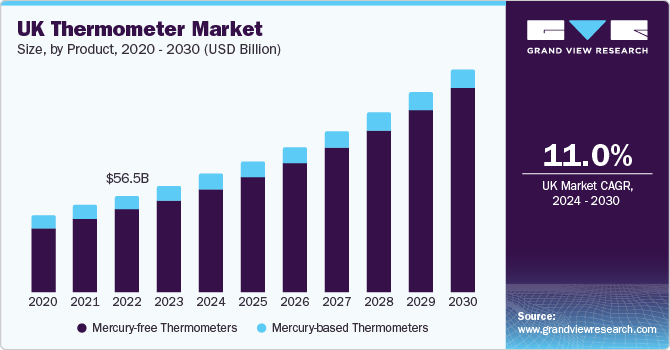

UK Thermometer Market Trends

The UK market is expected to grow at the fastest CAGR over the forecast period, due to several compelling factors that have fueled the demand for these devices across diverse healthcare settings. The UK has a sizable healthcare system, creating a consistent demand for medical products and a receptive attitude toward innovative technologies.

France Thermometer Market Trends

The France market is expected to grow at the fastest CAGR over the forecast period, due to the rising demand for thermometers, driven by several key factors, including the increasing geriatric population and the growing burden of chronic diseases. According to the World Bank, the geriatric population in France has risen from 18% in 2012 to 20.8% in 2020. This demographic shift has contributed to a significant prevalence of chronic diseases in the country.

Germany Thermometer Market Trends

The Germany market is expected to grow at the fastest CAGR over the forecast period, due to the presence of key manufacturers and a number of research and academic institutes using thermometers for laboratory purposes along with rising concerns regarding self-healthcare management are expected to boost the market growth.

The Asia Pacific market is anticipated to witness a significant CAGR over the forecast period. This growth can be attributed to the presence of high growth opportunities to cater to the unmet needs of the target population, in this region. Moreover, growing number of chronic diseases, as well as surge in demand for advanced thermometer in India and other Asian countries, also driving the market growth. Japan and China have a large elderly population, which is at a high risk of chronic conditions. Chronic illness is more common in the geriatric population, and it is expected to boost the demand for thermometer in the Asia Pacific. According to the WHO, in 2021, nearly 1.7% of the global malaria cases and about 1.2% of global malaria deaths were registered in India.

China Thermometer Market Trends

The China market is expected to grow at the fastest CAGR over the forecast period, due to strong government support and substantial investments in R&D have played a pivotal role in advancing China's thermometer devices. Also, increasing demand for self-healthcare products and healthcare establishments catering to the elderly is also expected to drive the market over the forecast period in China.

Japan Thermometer Market Trends

The Japan market is expected to grow at the fastest CAGR over the forecast period, due to favorable government initiatives, including increased awareness of chronic diseases, promotion of patient safety, and availability technological advanced products, are contributing to the market growth.

Saudi Arabia Thermometer Market Trends

The Saudi Arabia market is expected to grow at the fastest CAGR over the forecast period, due to growing geriatric population and rise in prevalence of infectious diseases and other medical conditions such as malaria and dengue.

Kuwait Thermometer Market Trends

The Kuwait Market is expected to grow at the fastest CAGR over the forecast period, due to the increasing cases of infectious diseases may offer new opportunities for the thermometer industry in Kuwait. Moreover, the increasing applications of such devices in temperature monitoring for industrial, medical, and laboratory is expected to further boost the market growth.

Key Thermometer Company InsightsSome of the key players operating in the market include Medline Industries, Inc.; OMRON Corporation; and 3M Company.

-

Medline Industries, Inc. is a medical technology company with operations in more than 75 countries. The company provides innovative medical, surgical, neurotechnology-related, orthopedic, & spine products and services that enhance healthcare outcomes for patients. The company sells products through its subsidiaries, distributors, and third-party dealers

-

OMRON Corporation provides innovative products with advanced technologies across varied sectors. Its business segments include Industrial Automation Business (IAB), Automotive Electronic Components Business (AEC), Healthcare Business (HCB), Electronic and Mechanical Components Business (EMC), and Social Systems. It has developed digital thermometers, blood pressure monitors, pedometers, and nebulizers in the healthcare domain

Welch Allyn, Exergen Corporation, and Medtronic are some of the emerging market participants.

-

Welch Allyn is a medical device manufacturing company that provides various products in different categories, such as blood pressure measurement, thermometry, animal health, medical lighting, physical exam, cardiopulmonary management, and others

-

Medtronic is engaged in researching, designing, manufacturing, and selling products that help alleviate pain, restore health, & improve life expectancy. It serves patients, clinicians, physicians, and hospitals in over 140 countries

Key Thermometer Companies:

The following are the leading companies in the thermometer market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these thermometer companies are analyzed to map the supply network.

- Medline Industries, Inc.

- Welch Allyn

- Medtronic

- OMRON Corporation

- America Diagnostics Corporation

- 3M Company

- Microlife Corporation

- Briggs Healthcare

- Exergen Corporation

- Terumo Corporation

Recent Developments

-

In November 2023, CHEF iQ launched wireless smart thermometer with hub made to store & charge three or two ultra-thin probes

-

In June 2022, Exergen Corporation introduced the TAT-2000C for consumers and TAT-2000 for professionals at the medical fair in Mumbai, India

-

In October 2021, Telli Health launched a new contactless connected 4G digital thermometer

Thermometer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.9 billion |

|

Revenue forecast in 2030 |

USD 3.0 billion |

|

Growth rate |

CAGR of 8.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

February 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Medline Industries, Inc.; Medtronic; Welch Allyn; OMRON Corporation; America Diagnostics Corporation; 3M Company; Exergen Corporation; Microlife Corporation; Terumo Corporation; Briggs Healthcare |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Thermometer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermometer market report based on the product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mercury-based Thermometers

-

Mercury-free Thermometers

-

Infrared Radiation Thermometers

-

Digital Thermometers

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Industrial

-

Food

-

Laboratory

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global thermometer market size was estimated at USD 1.7 billion in 2023 and is expected to reach USD 1.9 billion in 2024.

b. The global thermometer market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 3.0 billion by 2030.

b. North America dominated the thermometer market with a share of 34.4% in 2023. This is attributable to the presence of a high number of research and academic institutes using thermometers for laboratory and industrial purposes.

b. Some of the key players operating in the thermometer market include Medline Industries, Inc.; Medtronic; Welch Allyn; OMRON Corporation; America Diagnostics Corporation; 3M Company; Exergen Corporation; Microlife Corporation; Terumo Corporation; and Briggs Healthcare

b. Key factors that are driving the thermometer market growth include increasing growing demand for self healthcare and end-user awareness, growing prevalence of target diseases, and rapid technological advancements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."