Thermoformed Plastics Market Size, Share & Trends Analysis Report By Product, By Process, By Application (Healthcare, Food Packaging, Electrical & Electronics, Automotive, Construction, Consumer Goods), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-474-1

- Number of Report Pages: 128

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Thermoformed Plastics Market Size & Trends

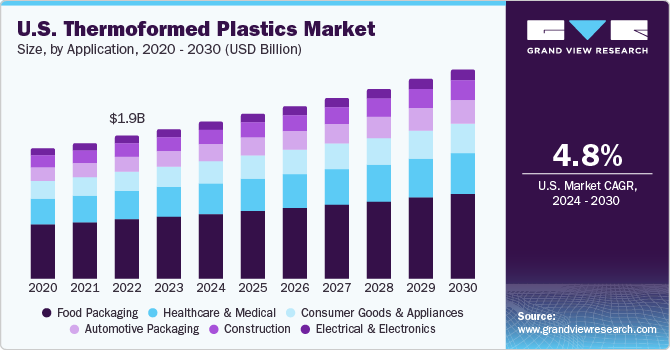

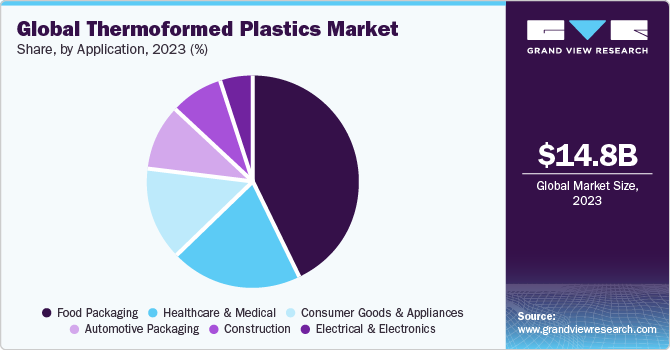

The global thermoformed plastics market size was estimated at USD 14.79 billion in 2023 projected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030. Globally, increasing demand in healthcare and pharmaceutical packaging sector is projected to be a key factor driving market growth over the forecast period. The thermoforming process involves the fabrication of plastic sheets heating them, to convert them into a bendable form that can be molded into the desired shape as per the customer’s specifications. In recent developments, thermoformed plastics are used as metal replacements using a heavy gauge process which provides applications in industries such as transportation, industrial equipment, aerospace, kiosks, and medical devices.

In the medical industry, thermoformed plastics are used in the manufacturing of diagnostic systems, accessories, and medical plants. Thermoforming includes a manufacturing process of converting a two-dimensional thermo-polymer into a three-dimensional shape. In the pharmaceutical industry, thermoformed plastic is used for products such as prefilled syringes, pharmaceutical bottles, and medical electronics as well as for capsules and tablet packaging such as blister packaging.

Thermoformed plastics are widely used to produce lightweight vehicles due to their properties such as lightweight, durability, and strength. The growing automotive industry, coupled with the regulations favoring light vehicle usage, is expected to benefit the thermoformed plastics demand across the globe. However, volatile raw material costs associated with thermoformed plastics are anticipated to pose hindrances in terms of profitability.

In 2023, food packaging dominated the application segment of the thermoformed plastic market. The growing demand for packaged mineral water, milk, carbonated drinks, and fruit juice is projected to boost the growth. In addition, a large number of consumers are moving from unpacked to packaged food items propelling the growth. In addition, increasing retail store businesses such as convenience stores, hypermarkets, and supermarkets are projected to propel the food packaging industry, which is expected to fuel the demand for thermoformed plastics.

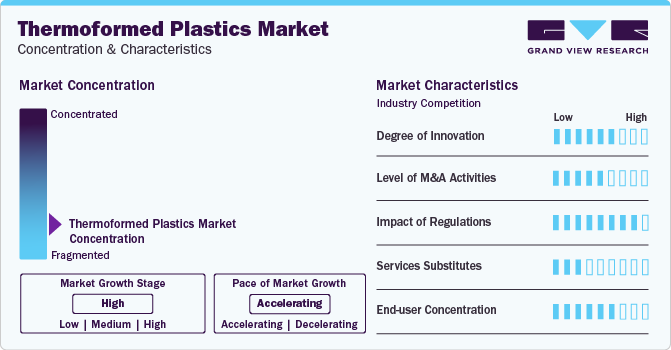

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is moderately competitive owing to the presence of a large number of players operating in the thermoformed plastics market. The competition in the market is based on the product quality offered and the technology used by the manufacturers to produce thermoformed plastics. Major players compete based on application development capability and form strategic partnerships with regional players to minimize the risk of expanding into a new marketplace.

Global thermoformed plastic manufacturers are engaged in mergers and acquisitions to increase their market share. For instance, in January 2023, Lacerta Group, a provider of thermoformed packaging services, acquired all of the assets of Portage Plastics Corp. and PPC Investments LLC. Based in Portage, Wisconsin, Portage Plastics produces thermoformed packaging products. With this acquisition, Lacerta Group aims to invest to grow capacity and establish a strong workforce in this location.

The market for thermoformed plastics is expected to witness a moderate threat of substitutes owing to the presence of various materials such as glass, aluminum, and steel. Glass is anticipated to be a major substitute to thermoformed plastics in the building & construction industry due to the absence of harmful chemicals compared to plastics. In addition, metals such as aluminum and steel also pose a threat to thermoformed plastics owing to their superior characteristics, including high resistance and enhanced strength. These aforementioned plastics are anticipated to fuel the demand for metals in various end-use industries during the forecast period.

Product Insights

Polypropylene dominated the product segment in 2023, with a revenue share of over 21.0%. This trend is expected to continue through the forecast period. Commonly used resins in thermoformed plastic production include polyethylene (PE), polystyrene (PS), and polypropylene (PP).

PP is a thermoplastic polymer and is widely used to produce food packaging products such as cups, trays, margarine tubs, sandwich packs, disposable products, beverage glasses, and microwaveable containers. A growing number of manufacturers using polypropylene for packaging products would subsequently drive the overall demand for thermoformed plastics.

Polymethyl methacrylate (PMMA) is expected to register the highest CAGR over the forecast period. This is attributed to the advantages it offers, such as light transmission, high surface hardness, and extended service life, along with certain properties such as high resistance to weathering and UV light. It is also completely recyclable and is hence environment-friendly, further driving the segment growth.

Increasing innovations, product developments, and investments in PMMA have been observed, particularly in the Middle Eastern region. For instance, Mitsubishi Rayon and SABIC announced a new joint venture for building a PMMA plant in Saudi Arabia. Key industry players that account for a major share of the overall manufacturing of PMMA include Mitsubishi Rayon Co. Ltd, Evonik Industries AG, and Altuglas International.

Process Insights

The thin gauge thermoformed plastic segment dominated the market in 2023 with more than 35.0% revenue share and is expected to remain the largest process segment through the forecast period. Thermoformed plastics are manufactured through contact, radiant, and hot air heating techniques. Increasing demand for thin gauge thermoformed plastics for products such as medical device packaging trays in the healthcare sector is anticipated to drive the segment’s growth over the forecast period.

Thick gauge thermoforms are sturdy and rigid enclosures that are used to pack electronic equipment. Thick gauge thermoformed plastics are used in a wide range of applications including front and rear bumpers and interior trim components in the heavy trucks industry. They are also used in enclosures for treadmills and weights in fitness equipment; large decorative signs in signage; cowlings, dash components, and fenders in the agricultural sector; and cab interiors & engine covers in the construction equipment industry.

Plug-assist forming is projected to be the fastest-growing process segment over the forecast period. The rising use of plug assist forming products in food packaging is projected to boost the market growth. Packaging materials formed using this method have a uniform wall thickness with a reduced starting gauge and hence help protect the product within the packaging.

AMUT Group manufactured a thermoforming machine whose properties include servo-driven plug assist on lower and upper mold platens, good mold clamping and cutting force performance, and various heat oven configurations. This machine is designed to handle materials such as PVC, PLA, PP, EPS, PS, HIPS, OPS, CPET, RPET, APET, and PET.

Application Insights

Food packaging was the leading application segment in 2023 with over 42% revenue share. Thermoformed plastics are widely used in the food industry for the packaging of fruits, vegetables; confectionery products; meat, poultry, and fish; and prepared meals. Thermoformed plastic packaging is also suitable for use in the medical and healthcare sector as it comprises a range of materials that help enhance the appearance of the final product. Also, food packaging requires high-quality packaging materials to ensure the protection from moisture, odor, and bacteria provided by thermoplastics, their demand in the food industry is very high. Packaging products used in the healthcare and medical sector include medical devices, medical trays, procedure trays, pharmaceutical packaging, and protective packaging.

Automotive is projected to be the fastest-growing application segment over the forecast period. Thermoformed plastics are preferred for electric vehicles as they are durable and lightweight. Increasing demand for automotive panels, liners, and vehicle parts is further expected to drive the segment growth over the forecast period. The University of Delaware Center for Composite Materials (UD-CCM), in partnership with the National Center for Manufacturing Sciences (NCMS), effectively designed a product to meet structural and crash safety requirements using thermoplastic composites.

Regional Insights

Asia Pacific dominated the global market with a share of around 46.0% in terms of revenue in 2023. Rapid industrialization and advancements in the packaging industry are projected to drive the growth over the forecast period. The growing number of manufacturers and suppliers of thermoformed plastic products in this region is further expected to drive the regional market’s growth.

Asia Pacific is expected to be the fastest-growing regional market over the forecast period. Emerging economies in the region such as India and China have been experiencing strong economic growth. China is the largest producer and supplier of thermoformed plastic equipment using various types of technologies in this region. Rapid urbanization and increasing per capita disposable income are projected to drive thermoformed plastic market in China. In addition, the growth of the automotive market and the subsequent demand for lightweight components to improve the efficiency of the vehicle are anticipated to drive the regional demand for thermoformed plastics.

Key Companies & Market Share Insights

The global players face intense competition from each other and regional players who have strong distribution networks and good knowledge about suppliers and regulations. To overcome these challenges, in October 2021, Placon purchased Sonoco Products Company’s production facility in Wilson, North Carolina to increase its production capacity to meet the growing demand for sustainable packaging products.

The market competition is based on the product quality offered and the technology used for the production of thermoformed plastics by the manufacturers. Major players compete based on the application development capability and form strategic partnerships with regional players to minimize the risk of expanding into a new marketplace. Global manufacturers are investing in technology to increase their market offerings, giving them a competitive edge over the other players.

-

In April 2023, Greiner Packaging GmbH developed thin-walled plastic cups with thermoformed plastics as a processing method in cooperation with Engel and Brink BV. These cups are lightweight since they are made with r-PET material, thus contributing towards sustainable packaging.

-

In December 2022, Placon Corporation launched Crystal Seal Cravings product which is an innovative thermoformed packaging solution. This is made with recycled PET material that will keep all kinds of food items safe, thus meeting the requirement of sustainability goals.

Key Thermoformed Plastic Companies:

The following are the leading companies in the thermoformed plastics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these thermoformed plastics companies are analyzed to map the supply network.

- Pactiv LLC

- Genpak LLC

- Sonoco Products Company

- CM Packaging

- Placon Corporation

- Anchor Packaging LLC

- Brentwood Industries

- Greiner Packaging GmbH

- Dongguan Ditai Plastic Products Co., Ltd

- Palram Americas Ltd.

Thermoformed Plastic Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 15.51 billion |

|

Revenue forecast in 2030 |

USD 20.66 billion |

|

Growth Rate |

CAGR of 4.9% from 2024 to 2030 |

|

Historical data |

2019 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilo tons, revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, process, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, South America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Saudi Arabia; UAE; South Africa; Brazil; Argentina |

|

Key companies profiled |

Pactiv LLC; Genpak LLC; Sonoco Products Company; CM Packaging; Placon Corporation; Anchor Packaging LLC; Brentwood Industries; Greiner Packaging GmbH; Dongguan Ditai Plastic Products Co., Ltd; Palram Americas Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Thermoformed Plastic Market Report Segmentation

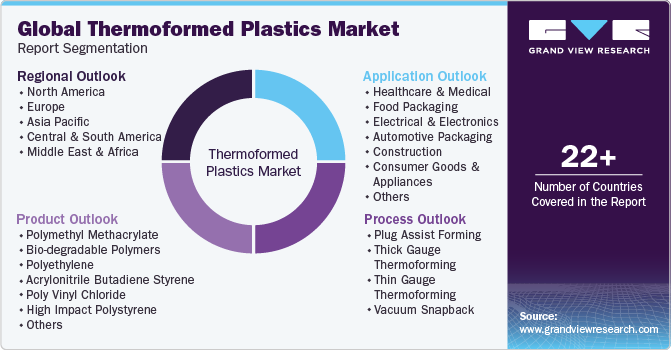

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global thermoformed plastics market on the basis of product, process, application, and region:

-

Product Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

Polymethyl Methacrylate (PMMA)

-

Bio-degradable polymers

-

Polyethylene (PE)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Poly Vinyl Chloride (PVC)

-

High Impact Polystyrene (HIPS)

-

Polystyrene (PS)

-

Polypropylene (PP)

-

-

Process Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

Plug assist forming

-

Thick gauge thermoforming

-

Thin gauge thermoforming

-

Vacuum snapback

-

-

Application Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

Healthcare & medical

-

Food packaging

-

Electrical & electronics

-

Automotive packaging

-

Construction

-

Consumer goods & appliances

-

Others

-

-

Regional Outlook (Volume, KiloTons; Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thermoformed plastic market size was estimated at USD 14.10 billion in 2022 and is expected to reach USD 14.79 billion in 2023.

b. The global thermoformed plastics market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 20.66 billion by 2030.

b. The polypropylene segment dominated the thermoformed plastic market with a share of 21.9% in 2022. Polypropylene is a thermoplastic polymer and is widely used to produce food packaging products such as cups, tubs, trays, and others.

b. Some key players operating in the thermoformed plastic market include Pactiv LLC, D&W Fine Pack LLC, Genpak LLC, and Sonoco Plastics, Placon Corporation, Anchor Packaging, Spencer Industries, Brentwood Industries, Greiner Packaging, and Silgan Plastics.

b. Key factors that are driving the market growth include increasing demand from the healthcare and pharmaceutical sectors and growing utilization as a metal replacement using the heavy gauge process.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Information Procurement

1.1.1. Purchased Database

1.1.2. GVR’s Internal Database

1.1.3. Secondary Sources & Third-Party Perspectives

1.1.4. Primary Research

1.2. Information Analysis

1.2.1. Data Analysis Models

1.3. Market Formulation & Data Visualization

Chapter 2. Executive Summary

2.1. Market Snapshot

Chapter 3. Thermoformed Plastics Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Global Plastics Market Outlook

3.1.2. Global Thermoformed Plastics Market Outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Raw Material Trends

3.3.2. Major Raw Materials Analysis

3.4. Technology Trends

3.5. Regulatory Framework

3.5.1. Standard & Compliances

3.5.2. Safety

3.6. Market Dynamics

3.6.1. Market Driver Analysis

3.6.2. Market Restraint Analysis

3.7. Business Environment Analysis: Thermoformed Plastics Market

3.7.1. Industry Analysis - Porter’s

3.7.1.1. Supplier Power

3.7.1.2. Buyer Power

3.7.1.3. Substitution Threat

3.7.1.4. Threat from New Entrant

3.7.1.5. Competitive Rivalry

3.8. PESTEL Analysis

3.8.1. Political Landscape

3.8.2. Environmental Landscape

3.8.3. Social Landscape

3.8.4. Technology Landscape

3.8.5. Economic Landscape

3.8.6. Legal Landscape

Chapter 4. Thermoformed Plastics Market: Product Estimates & Trend Analysis

4.1. Movement Analysis & Market Share, 2023 & 2030

4.2. Polymethyl Methacrylate (PMMA)

4.2.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

4.3. Bio-degradable polymers

4.3.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

4.4. Polyethylene (PE)

4.4.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

4.5. Acrylonitrile Butadiene Styrene (ABS)

4.5.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

4.6. Poly Vinyl Chloride (PVC)

4.6.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

4.7. High Impact Polystyrene (HIPS)

4.7.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

4.8. Polystyrene (PS)

4.8.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

4.9. Polypropylene (PP)

4.9.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

Chapter 5. Thermoformed Plastics Market: Process Estimates & Trend Analysis

5.1. Movement Analysis & Market Share, 2023 & 2030

5.2. Plug assist forming

5.2.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

5.3. Thick gauge thermoforming

5.3.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

5.4. Thin gauge thermoforming

5.4.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

5.5. Vacuum snapback

5.5.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

Chapter 6. Thermoformed Plastics Market: Application Estimates & Trend Analysis

6.1. Movement Analysis & Market Share, 2023 & 2030

6.2. Healthcare & medical

6.2.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

6.3. Food packaging

6.3.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

6.4. Electrical & electronics

6.4.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

6.5. Automotive packaging

6.5.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

6.6. Construction

6.6.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

6.7. Consumer goods & appliances

6.7.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

6.8. Others

6.8.1. Market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

Chapter 7. Thermoformed Plastics Market: Regional Estimates & Trend Analysis

7.1. Regional Movement Analysis & Market Share, 2023 & 2030

7.2. North America

7.2.1. North America Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.2.2. North America Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.2.3. North America Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.2.4. North America Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.2.5. U.S.

7.2.5.1. U.S. Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.2.5.2. U.S. Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.2.5.3. U.S. Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.2.5.4. U.S. Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.2.6. Canada

7.2.6.1. Canada Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.2.6.2. Canada Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.2.6.3. Canada Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.2.6.4. Canada Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.2.7. Mexico

7.2.7.1. Mexico Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.2.7.2. Mexico Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.2.7.3. Mexico Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.2.7.4. Mexico Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.3. Europe

7.3.1. Europe Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.3.2. Europe Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.3.3. Europe Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.3.4. Europe Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.3.5. UK

7.3.5.1. UK Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.3.5.2. UK Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.3.5.3. UK Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.3.5.4. UK Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.3.6. Germany

7.3.6.1. Germany Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.3.6.2. Germany Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.3.6.3. Germany Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.3.6.4. Germany Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.3.7. France

7.3.7.1. France Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.3.7.2. France Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.3.7.3. France Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.3.7.4. France Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.3.8. Italy

7.3.8.1. Italy Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.3.8.2. Italy Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.3.8.3. Italy Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.3.8.4. Italy Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.4. Asia Pacific

7.4.1. Asia Pacific Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.4.2. Asia Pacific Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.4.3. Asia Pacific Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.4.4. Asia Pacific Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.4.5. China

7.4.5.1. China Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.4.5.2. China Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.4.5.3. China Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.4.5.4. China Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.4.6. Japan

7.4.6.1. Japan Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.4.6.2. Japan Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.4.6.3. Japan Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.4.6.4. Japan Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.4.7. India

7.4.7.1. India Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.4.7.2. India Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.4.7.3. India Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.4.7.4. India Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.4.8. South Korea

7.4.8.1. South Korea Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.4.8.2. South Korea Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.4.8.3. South Korea Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.4.8.4. South Korea Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.4.9. Australia

7.4.9.1. Australia Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.4.9.2. Australia Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.4.9.3. Australia Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.4.9.4. Australia Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.5. Middle East & Africa

7.5.1. Middle East & Africa Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.5.2. Middle East & Africa Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.5.3. Middle East & Africa Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.5.4. Middle East & Africa Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.5.5. Saudi Arabia

7.5.5.1. Saudi Arabia Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.5.5.2. Saudi Arabia Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.5.5.3. Saudi Arabia Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.5.5.4. Saudi Arabia Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.5.6. UAE

7.5.6.1. UAE Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.5.6.2. UAE Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.5.6.3. UAE Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.5.6.4. UAE Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.5.7. South Africa

7.5.7.1. South Africa Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.5.7.2. South Africa Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.5.7.3. South Africa Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.5.7.4. South Africa Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.6. Central & South America

7.6.1. Central & South America Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.6.2. Central & South America Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.6.3. Central & South America Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.6.4. Central & South America Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.6.5. Brazil

7.6.5.1. Brazil Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.6.5.2. Brazil Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.6.5.3. Brazil Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.6.5.4. Brazil Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

7.6.6. Argentina

7.6.6.1. Argentina Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

7.6.6.2. Argentina Thermoformed Plastics market estimates and forecast, by product, 2019 - 2030 (Kilotons) (USD Billion)

7.6.6.3. Argentina Thermoformed Plastics market estimates and forecast, by process, 2019 - 2030 (Kilotons) (USD Billion)

7.6.6.4. Argentina Thermoformed Plastics market estimates and forecast, by application, 2019 - 2030 (Kilotons) (USD Billion)

Chapter 8. Competitive Landscape

8.1. Key global players & recent developments & their impact on the industry

8.2. Key Company/Competition Categorization (Key innovators, Market leaders, Emerging players)

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.4. Public Companies

8.4.1. Company market position analysis

8.4.2. Market Differentiators

8.4.3. Synergy Analysis: Major Deals & Strategic Alliances

8.5. Private Companies

8.5.1. List of key emerging companies/application disruptors/innovators

Chapter 9. Company Profiles

9.1. Pactiv LLC

9.1.1. Company Overview

9.1.2. Financial Performance

9.1.3. Product Benchmarking

9.1.4. Strategic Initiatives

9.2. Sonoco Products Company

9.2.1. Company Overview

9.2.2. Financial Performance

9.2.3. Product Benchmarking

9.2.4. Strategic Initiatives

9.3. Peninsula Packaging, LLC

9.3.1. Company Overview

9.3.2. Financial Performance

9.3.3. Product Benchmarking

9.3.4. Strategic Initiatives

9.4. C.M. Packaging

9.4.1. Company Overview

9.4.2. Financial Performance

9.4.3. Product Benchmarking

9.4.4. Strategic Initiatives

9.5. Placon Corporation

9.5.1. Company Overview

9.5.2. Financial Performance

9.5.3. Product Benchmarking

9.5.4. Strategic Initiatives

9.6. Genpak, LLC

9.6.1. Company Overview

9.6.2. Financial Performance

9.6.3. Product Benchmarking

9.6.4. Strategic Initiatives

9.7. Anchor Packaging

9.7.1. Company Overview

9.7.2. Financial Performance

9.7.3. Product Benchmarking

9.7.4. Strategic Initiatives

9.8. ClearLam Packaging, Inc.

9.8.1. Company Overview

9.8.2. Financial Performance

9.8.3. Product Benchmarking

9.8.4. Strategic Initiatives

9.9. Brentwood Industries, Inc.

9.9.1. Company Overview

9.9.2. Financial Performance

9.9.3. Product Benchmarking

9.9.4. Strategic Initiatives

9.10. Greiner Packaging International GmbH

9.10.1. Company Overview

9.10.2. Financial Performance

9.10.3. Product Benchmarking

9.10.4. Strategic Initiatives

List of Tables

1. Global Thermoformed Plastics market- Key market driver analysis

2. Global Thermoformed Plastics market- Key market restraint analysis

3. Global Thermoformed Plastics market estimates and forecast in Polymethyl Methacrylate (PMMA), 2019 - 2030 (Kilotons) (USD Billion)

4. Global Thermoformed Plastics market estimates and forecast in Bio-degradable polymers, 2019 - 2030 (Kilotons) (USD Billion)

5. Global Thermoformed Plastics market estimates and forecast in Polyethylene (PE), 2019 - 2030 (Kilotons) (USD Billion)

6. Global Thermoformed Plastics market estimates and forecast in Acrylonitrile Butadiene Styrene (ABS), 2019 - 2030 (Kilotons) (USD Billion)

7. Global Thermoformed Plastics market estimates and forecast in Poly Vinyl Chloride (PVC), 2019 - 2030 (Kilotons) (USD Billion)

8. Global Thermoformed Plastics market estimates and forecast in High Impact Polystyrene (HIPS), 2019 - 2030 (Kilotons) (USD Billion)

9. Global Thermoformed Plastics market estimates and forecast in Polystyrene (PS), 2019 - 2030 (Kilotons) (USD Billion)

10. Global Thermoformed Plastics market estimates and forecast in Polypropylene (PP), 2019 - 2030 (Kilotons) (USD Billion)

11. Global Thermoformed Plastics market estimates and forecast in Plug assist forming, 2019 - 2030 (Kilotons) (USD Billion)

12. Global Thermoformed Plastics market estimates and forecast in Thick gauge thermoforming, 2019 - 2030 (Kilotons) (USD Billion)

13. Global Thermoformed Plastics market estimates and forecast in Thin gauge thermoforming, 2019 - 2030 (Kilotons) (USD Billion)

14. Global Thermoformed Plastics market estimates and forecast in Vacuum snapback, 2019 - 2030 (Kilotons) (USD Billion)

15. Global Thermoformed Plastics market estimates and forecast in Healthcare & medical, 2019 - 2030 (Kilotons) (USD Billion)

16. Global Thermoformed Plastics market estimates and forecast in Bio-degradable polymers, 2019 - 2030 (Kilotons) (USD Billion)

17. Global Thermoformed Plastics market estimates and forecast in Food packaging, 2019 - 2030 (Kilotons) (USD Billion)

18. Global Thermoformed Plastics market estimates and forecast in Automotive packaging, 2019 - 2030 (Kilotons) (USD Billion)

19. Global Thermoformed Plastics market estimates and forecast in Construction, 2019 - 2030 (Kilotons) (USD Billion)

20. Global Thermoformed Plastics market estimates and forecast in Consumer goods & appliances, 2019 - 2030 (Kilotons) (USD Billion)

21. Global Thermoformed Plastics market estimates and forecast in Others, 2019 - 2030 (Kilotons) (USD Billion)

22. North America Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

23. North America Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

24. North America Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

25. North America Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

26. U.S. Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

27. U.S. Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

28. U.S. Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

29. U.S. Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

30. Canada Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

31. Canada Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

32. Canada Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

33. Canada Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

34. Mexico Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

35. Mexico Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

36. Mexico Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

37. Mexico Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

38. Europe Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

39. Europe Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

40. Europe Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

41. Europe Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

42. UK Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

43. UK Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

44. UK Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

45. UK Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

46. UK Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

47. Germany Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

48. Germany Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

49. Germany Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

50. Germany Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

51. Germany Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

52. France Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

53. France Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

54. France Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

55. France Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

56. France Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

57. Italy Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

58. Italy Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

59. Italy Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

60. Italy Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

61. Italy Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

62. Asia Pacific Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

63. Asia Pacific Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

64. Asia Pacific Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

65. Asia Pacific Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

66. China Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

67. China Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

68. China Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

69. China Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

70. China Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

71. Japan Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

72. Japan Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

73. Japan Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

74. Japan Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

75. India Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

76. India Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

77. India Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

78. India Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

79. South Korea Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

80. South Korea Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

81. South Korea Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

82. South Korea Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

83. Australia Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

84. Australia Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

85. Australia Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

86. Australia Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

87. Middle East & Africa Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

88. Middle East & Africa Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

89. Middle East & Africa Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

90. Middle East & Africa Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

91. Saudi Arabia Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

92. Saudi Arabia Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

93. Saudi Arabia Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

94. Saudi Arabia Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

95. UAE Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

96. UAE Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

97. UAE Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

98. UAE Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

99. South Africa Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

100. South Africa Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

101. South Africa Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

102. South Africa Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

103. Central & South America Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

104. Central & South America Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

105. Central & South America Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

106. Central & South America Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

107. Brazil Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

108. Brazil Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

109. Brazil Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

110. Brazil Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

111. Argentina Thermoformed Plastics market estimates and forecast, 2019 - 2030 (Kilotons) (USD Billion)

112. Argentina Thermoformed Plastics market, by product, 2019 - 2030 (Kilotons) (USD Billion)

113. Argentina Thermoformed Plastics market, by process, 2019 - 2030 (Kilotons) (USD Billion)

114. Argentina Thermoformed Plastics market, by application, 2019 - 2030 (Kilotons) (USD Billion)

List of Figures

1. Information procurement

2. Primary research pattern

3. Primary research process

4. Primary research approaches

5. Thermoformed Plastics market snapshot

6. Thermoformed Plastics market segmentation & scope

7. Thermoformed Plastics market penetration & growth prospect mapping

8. Thermoformed Plastics value chain analysis

9. Thermoformed Plastics market: Porter’s Five Forces Analysis

10. Thermoformed Plastics market: PESTEL analysis

11. Thermoformed Plastics market dynamics

12. Thermoformed Plastics market: Product movement analysis

13. Thermoformed Plastics market: Process movement analysis

14. Thermoformed Plastics market: Application movement analysis

15. Thermoformed Plastics market: Regional movement analysis

16. Global Thermoformed Plastics market Regional snapshot

17. Global Thermoformed Plastics market: Regional movement analysis, by revenue, 2023 & 2030

18. Participant categorization

19. Thermoformed Plastics Market: Competitive dashboard analysis

Market Segmentation

- Thermoformed Plastics Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Thermoformed Plastics Process Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Thermoformed Plastics Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Thermoformed Plastics Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

- North America

- North America Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- North America Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- North America Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- U.S.

- U.S. Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- U.S. Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- U.S. Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Canada

- Canada Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Canada Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Canada Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Mexico

- Mexico Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Mexico Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Mexico Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Europe

- Europe Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Europe Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Europe Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- U.K.

- U.K. Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- U.K. Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- U.K. Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Germany

- Germany Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Germany Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Germany Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- France

- France Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- France Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- France Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Italy

- Italy Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Italy Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Italy Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Asia Pacific

- Asia Pacific Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Asia Pacific Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Asia PacificThermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- China

- China Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- China Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- China Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Japan

- Japan Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Japan Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Japan Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- India

- India Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- India Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- India Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Central & South America

- Central & South America Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Central & South America Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Central & South America Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- Middle East & Africa

- Middle East & Africa Thermoformed Plastics Market, By Product

- Polymethyl Methacrylate (PMMA)

- Bio-degradable polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

- Middle East & Africa Thermoformed Plastics Market, By Process

- Plug assist forming

- Thick gauge thermoforming

- Thin gauge thermoforming

- Vacuum snapback

- Middle East & Africa Thermoformed Plastics Market, By Application

- Healthcare & medical

- Food packaging

- Electrical & electronics

- Automotive packaging

- Construction

- Consumer goods & appliances

- North America

Thermoformed Plastic Market Dynamics

Driver: Growing Demand From Food & Beverage Sector

Increasing demand for thermoformed plastics in the food & beverage sector to improve quality design, enhance shell life, and secure seals is anticipated to fuel market growth. Food containers are used for product protection along with quick service in bakeries, cafés, restaurants, and food processors. Furthermore, growing urbanization and surging demand for packed items. Huge demand for ready-to-eat food is anticipated to drive market growth. Packaging products manufactured by using thermoformed plastics involve blister packages, some tubs, and clamshells. Growing development in food & beverage sector coupled with a rise in number of migrations from rural to urban areas owing to better job opportunities, improved educational system, and high standard of living. These factors are projected to accelerate market growth in the coming years.

Driver: Growing Demand In Healthcare & Medical Industry

Increasing demand for thermoformed plastics in the healthcare sector for cleanliness, negligible packaging waste, compartmentalization, and cost-effectiveness are the key factors, which is predicted to fuel market growth. The concern for moisture control while packaging medical products and ensuring high quality. Furthermore, thermoformed plastics offer high-quality, low-cost, aesthetically appealing panels, covers, sidewalls, and enclosures. These advantages associated with thermoformed plastics are anticipated to fuel market growth. Thermoformed plastics are utilized in the healthcare industry for manufacturing CT scanners, X-ray machines, MRI machines, medical electronic housings, hospital bed components, sterile packaging products, and others.

Restraint: Volatile Raw Material Prices To Hamper Market Growth

Raw materials used in thermoformed plastics include hydrocarbon fuels such as natural gas, crude oil, and coal. Supply-chain disruption led to volatility in raw materials prices, which hampered the market growth. Global crude oil prices have witnessed extreme variations in recent years. Most of the raw materials such as propylene, ethylene, and others are derived from crude oils. Such, variation in crude oil prices is projected to hinder market growth.

What Does This Report Include?

This section will provide insights into the contents included in this thermoformed plastic market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Thermoformed plastic market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Thermoformed plastic market quantitative analysis

-

Market size, estimates, and forecast from 2019 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the thermoformed plastic market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for thermoformed plastic market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of thermoformed plastic market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Thermoformed Plastic Market Categorization:

The thermoformed plastic market was categorized into four segments, namely product (Polymethyl Methacrylate, Bio-degradable Polymers, Polyethylene, Acrylonitrile Butadiene Styrene, Poly Vinyl Chloride, High Impact Polystyrene, Polystyrene, Polypropylene), process (Plug Assist Forming, Thick Gauge Thermoforming, Thin Gauge Thermoforming, Vacuum Snapback), application (Healthcare & Medical, Food Packaging, Electrical & Electronics, Automotive Packaging, Construction, Consumer Goods & Appliances), and region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa).

Segment Market Methodology:

The thermoformed plastic market was segmented into product, process, application, and region. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The thermoformed plastic market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into ten countries, namely, the U.S.; Canada; Mexico; the UK; Germany; France; Italy; China; India; Japan.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Thermoformed plastic market companies & financials:

The thermoformed plastic market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Pactiv LLC - Pactiv LLC was founded 1965 and is headquartered in Lake Forest in the U.S. The company focuses on producing and distributing high-quality food service products. Their product offerings incorporate custom & plastic, stock foam, pressed-paperboard, aluminum, PE coated boards, and molded-fiber packing. The company largely supplies its products to food service retailers and wholesalers in North America. As of 2020, the company employed approximately 11,000 employed at its 50 producing plants, mixing and distribution centers.

-

Sonoco Products Company - Sonoco Products Company was founded in 1899 and is headquartered in South Carolina, U.S. The company is engaged in the manufacturing of industrial and consumer products. The company serves various end use markets including coffee; fresh& natural food; instant & toddler needs; and lawn & garden has a presence in more than 85 countries and had 20,500 employees, as of March 2021, working in more than 320 operations in 34 countries across the world.

-

CM Packaging - CM Packaging was founded in 1995, and is headquartered in Dronten, Netherland.The company manufactures products including enclosures for plastic & glass jars, plastic components for jars used for food & dry powder products. The plastic packaging segment includes products for industries such as health & beauty and snus. These products include jars & lids for creams, hair products, oils, dry tobacco powder, and others. The company manufactures packaging in feasible shapes including round and octagonal packaging for the preservation of the aforementioned products.

-

Placon - Placon was founded in 1966, and is headquartered in Wisconsin, the U.S. The company manufactures stock & custom-designed thin gauge thermoformed plastic and injection molded packaging. The is engaged in providing plastic packaging to industries including food & beverage, retail, and medical & healthcare. These products are characterized by properties including microwave safe and resistance towards leakage, and are used in applications such as deep-freeze appliances, holding nails & fasteners, and turnkey packaging solutions for sterile & non-sterile applications. As of 2020, Placon has an employee base of over 500 across its four facilities.

-

Genpak LLC - Genpak LLC was founded in 1969 and is headquartered in North Carolina in the U.S. Company’s product offerings incorporate plastic plates & dinnerware, safe microwave containers, go containers, supermarket containers with lids, and catering supplies. The company has 18 manufacturing facilities in the U.S. and Canada.

-

Anchor Packaging LLC - Anchor Packaging LLC was established in 1963 and is headquartered in Missouri, the U.S. the company is engaged in technologies including, extrusion, thermoforming, blown film, printing, and trim-in-place. The company is a manufacturer of frozen food containers, and all-purpose foodservice cling. The company’s packaging material segment includes, Amorphous Polyethylene Terephthalate (APET/PETE/RPET), Polypropylene (PP), Oriented Polystyrene (OPS), High-Impact Polystyrene (HIPS), Foamed Polystyrene (EPS), Foamed Polypropylene (PP-Foam), Crystalline Polyethylene Terephthalate (CPET), Polyvinyl Chloride (PVC), and Polyethylene Terephthalate (PET).

-

Brentwood Industries Inc. - The company manufactures thermoformed plastic products for industries including building & construction, medical, transportation, consumer goods, manufacturing, and environmental protection. Brentwood Industries Inc was founded in 1965 and is headquartered in Pennsylvania, the U.S. The company’s product portfolio for thermoplastics includes medical & component packaging, custom thermoforming & injection molding, thermoplastic modeling.

-

Greiner Packaging GmbH - Greiner Packaging GmbH was established in 1960 and is headquartered in Sattledt, Austria. a. The company manufactures plastic packaging for application including food; non-food; and multi-use such as baby bottles, drinking bottles, 5 G water bottles, multi-use lids, greiner visor, and plastic pallets. As of 2020, the company has an employee base of 11,494 across its facilities present in 19 countries across the globe.

-

Dongguan Ditai Plastic Products Co., Ltd - Dongguan Ditai Plastic Products Co., Ltd was established in 2010 and is headquartered in Guangdong, China.The company’s product portfolio for includes plastic sheets, plastic tray, machine & equipment, display & advertizing, plastic container, decoration parts, clear products, lampshade, auto parts, plastic sports equipment, and other outdoor products. The company develops large-scale vacuum forming machines and is engaged in rough vacuum forming and blow molding technology.

-

Palram Americas Ltd. - Palram Americas Ltd. was founded in 1963 and is headquartered in Pennsylvania, the U.S. he company provides its services to markets including construction & architecture, DIY, agriculture, sign & display, glazing, safety & security, fabrication, and transportation. The company is a subsidiary of Palram Industries. Palram Americas Ltd. is engaged in the manufacturing and distribution of thermoplastic sheets and finished products.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Thermoformed Plastic Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2022, historic information from 2019 to 2021, and forecast from 2023 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Thermoformed Plastic Market Report Assumptions:

-

The report provides market value for the base year 2022 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research