Thermoelectric Generator Market Size, Share & Trends Analysis Report By Application (Waste Heat Recovery, Energy Harvesting), By Temperature, By Wattage, By Type, By Material, By Vertical, By Component, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-268-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Thermoelectric Generator Market Trends

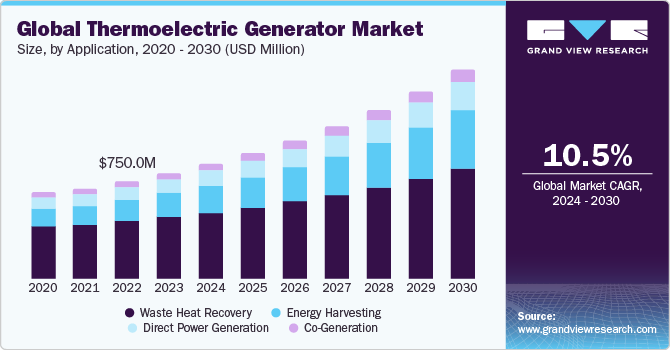

The global thermoelectric generator market size was estimated at USD 813.38 million in 2023 and is projected to grow at a CAGR of 10.5% from 2024 to 2030. The global market has experienced notable growth in recent years, driven by increasing demand for energy-efficient and sustainable power generation solutions.

TEGs utilize the Seebeck effect to convert waste heat from various sources, such as industrial processes, automotive exhaust, and renewable energy systems, into electricity. This technology offers significant advantages, including scalability, reliability, and low maintenance requirements, making it attractive for a wide range of applications across industries.

One of the primary drivers of the global TEG market is the growing emphasis on energy recovery and waste heat utilization to enhance overall energy efficiency and reduce greenhouse gas emissions. Industries such as automotive, manufacturing, and power generation are increasingly adopting TEG systems to capture and utilize waste heat, thereby lowering operational costs and environmental impact. In addition, advancements in TEG materials and manufacturing techniques have improved the efficiency and performance of TEG modules, expanding their applicability in both stationary and portable power generation applications.

Furthermore, government initiatives and regulations promoting renewable energy and energy efficiency have spurred market growth by incentivizing the adoption of TEG technology. Subsidies, tax incentives, and research funding aimed at developing efficient TEG systems have encouraged investment in research and development, driving innovation and technological advancements in the market. As concerns about climate change and energy security continue to escalate, the global TEG market is poised for further expansion, with opportunities opening in emerging economies and niche applications such as remote power generation and IoT devices.

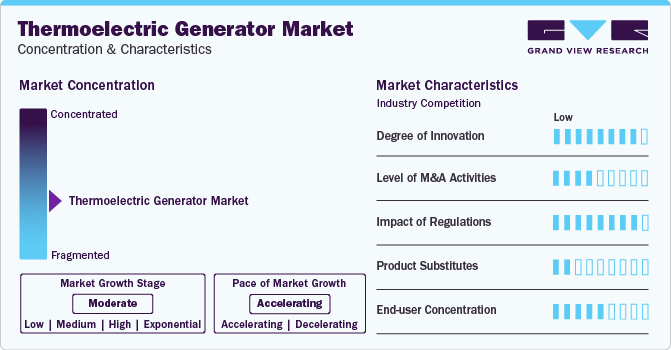

Market Concentration & Characteristics

The market for thermoelectric generator is a dynamic and competitive space with established players and innovative newcomers vying for dominance. The industry is facing fierce competition from established players in various sectors. Leading companies like Gentherm Inc., Coherent Corp., Ferrotec Holdings Corporation, Komatsu Ltd., Yamaha Corporation C0., Ltd., and Global Power Technologies have been in the industry for years, boasting extensive experience and established customer bases. Startups and smaller companies are entering the fray with innovative technologies and disruptive business models.

Companies are increasingly focusing on new product launches to increase their foothold in the market. For instance, in July 2023, ISRO announced a collaboration with BARC to develop radio thermoelectric generators (RTGs) for rockets. The radio thermoelectric generator use radioactive materials such as plutonium-238 or strontium-90, which release heat on decaying.

Application Insights

Waste heat recovery emerged as the largest application segment, with a market share of 58.32% in 2023, and is expected to witness robust growth over the forecast period. This significant share underscores the increasing adoption of TEG technology for harnessing and converting waste heat into usable electricity across various industries. Waste heat recovery systems offer a compelling solution for improving energy efficiency and reducing operational costs by capturing and utilizing thermal energy that would otherwise be lost during industrial processes, automotive exhaust, and power generation.

Moreover, the waste heat recovery segment is poised for robust growth over the forecast period, driven by the escalating demand for sustainable energy solutions and the imperative to minimize greenhouse gas emissions. Industries worldwide are increasingly investing in waste heat recovery technologies, including thermoelectric generators, to optimize energy utilization, comply with stringent environmental regulations, and enhance their competitiveness. As technological advancements continue to enhance the efficiency and cost-effectiveness of waste heat recovery systems, the segment is expected to remain a key driver of growth in the global TEG market, presenting lucrative opportunities for manufacturers and stakeholders.

Vertical Insights

The industrial segment held the largest market share of 48.94% in 2023 and is expected to witness robust growth over the forecast period. This dominance highlights the widespread adoption of TEG technology by industries seeking to optimize energy efficiency and reduce operational costs. Industrial applications of thermoelectric generators encompass a broad range of sectors, including manufacturing, chemical processing, oil and gas, and mining, where significant amounts of waste heat are generated as a byproduct of various processes. TEG systems offer a compelling solution for harnessing this waste heat and converting it into usable electricity, thereby improving overall energy sustainability and reducing environmental impact.

Furthermore, the industrial segment is poised for robust growth over the forecast period, fueled by increasing awareness of energy efficiency, stringent environmental regulations, and the imperative for industries to enhance their competitiveness. As companies strive to minimize energy consumption, mitigate greenhouse gas emissions, and achieve sustainability goals, the demand for thermoelectric generator solutions in the industrial sector is expected to surge. Technological advancements in TEG materials, design, and integration are further driving adoption, enabling industries to effectively leverage waste heat recovery as a means of enhancing operational efficiency and driving cost savings.

Type Insights

The single-stage type segment held the largest market share of 45.96% in 2023 and is expected to witness robust growth over the forecast period. This prominence underscores the preference for single-stage TEG systems due to their simplicity, reliability, and cost-effectiveness. Single-stage TEGs are characterized by their straightforward design, consisting of a single pair of thermoelectric modules that efficiently convert waste heat into electricity. This simplicity makes them well-suited for various applications across industries, including automotive, manufacturing, and electronics, where the focus is on capturing and utilizing waste heat efficiently.

Moreover, the single-stage TEG segment is poised for robust growth over the forecast period, driven by increasing demand for energy-efficient solutions and advancements in TEG technology. As industries strive to optimize energy utilization, reduce greenhouse gas emissions, and comply with regulatory requirements, single-stage TEGs offer an attractive option for waste heat recovery. Their scalability, reliability, and ease of integration make them particularly appealing for a wide range of applications, from small-scale power generation in remote locations to large-scale industrial processes. With ongoing innovations and enhancements in single-stage TEG performance and efficiency, this segment is expected to continue witnessing strong growth, presenting opportunities for manufacturers and stakeholders to capitalize on the expanding market.

Temperature Insights

Low-temperature (<80°C) emerged as the largest temperature segment with a market share of 48.50% in 2023 and is expected to witness robust growth over the forecast period. This dominance reflects the increasing demand for propulsion systems that operate efficiently at lower temperatures, catering to a wide range of applications across industries such as automotive, aerospace, and marine. With the emphasis on energy efficiency and sustainability, there's a growing need for propulsion technologies that can perform optimally without a need for high operating temperatures.

Moreover, the low-temperature propulsion segment is poised for robust growth over the forecast period, driven by advancements in materials, engineering, and design that enable efficient operation at lower temperature ranges. As industries continue to prioritize eco-friendly and energy-efficient solutions, the demand for low-temperature propulsion systems is expected to surge further. Innovations in electric propulsion, fuel cells, and hybrid systems are contributing to the development of more efficient and versatile low-temperature propulsion solutions, fostering sustained market growth and adoption.

Wattage Insights

Low power (<10 W) emerged as the largest propulsion type segment, with a market share of 56.11% in 2023, and is expected to witness robust growth over the forecast period. This dominance underscores the increasing demand for low-power propulsion solutions across various industries, including aerospace, automotive, and marine. With the growing emphasis on energy efficiency and environmental sustainability, there's a heightened focus on developing propulsion systems that operate within the low-power range, catering to applications such as small unmanned aerial vehicles (UAVs), electric bicycles, and portable electronics.

Furthermore, the low-power propulsion segment is poised for robust growth over the forecast period, driven by technological advancements, expanding applications, and regulatory initiatives promoting cleaner and more efficient propulsion solutions. As industries continue to explore alternatives to traditional combustion engines and high-power propulsion systems, the demand for low-power solutions is expected to surge. Innovations in lightweight materials, electric drivetrains, and energy storage technologies are facilitating the development of more efficient and compact low-power propulsion systems, paving the way for sustained market growth and adoption.

Component Insights

Thermoelectric module emerged as the largest component segment with a market share of 42.83% in 2023 and is expected to witness robust growth over the forecast period. This large share is attributed to the crucial role played by thermoelectric modules in the construction of thermoelectric generators, serving as the core component responsible for converting waste heat into usable electricity. As industries across various sectors increasingly prioritize energy efficiency and sustainability, the demand for thermoelectric modules is expected to surge, driving robust growth in this segment over the forecast period.

Furthermore, the thermoelectric module segment is poised for continued expansion fueled by advancements in materials, design, and manufacturing processes. Ongoing research and development efforts are focused on improving the performance, efficiency, and reliability of thermoelectric modules, making them more attractive for a wide range of applications, including automotive, industrial, and aerospace. With the growing adoption of thermoelectric technology as a means of waste heat recovery and power generation, the thermoelectric module segment is positioned to play a pivotal role in driving innovation and growth in the global market.

Material Insights

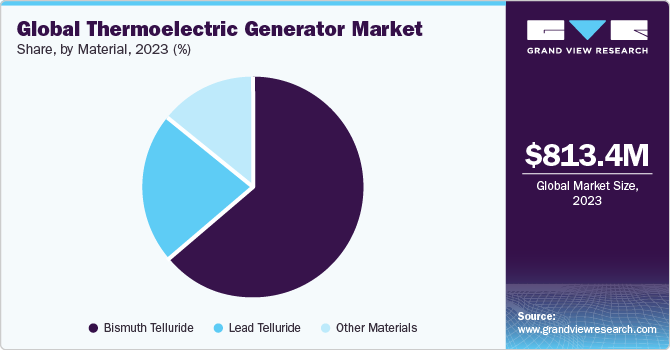

Bismuth telluride emerged as the largest material segment, with a market share of 63.60% in 2023, and is expected to witness robust growth over the forecast period. The dominance underscores the widespread adoption of bismuth telluride in thermoelectric applications due to its favorable thermoelectric properties, including high thermoelectric efficiency and stability over a wide temperature range. As industries increasingly seek efficient solutions for waste heat recovery and energy conversion, bismuth telluride stands out as a preferred material choice for thermoelectric generator modules.

The bismuth telluride material segment is poised for robust growth over the forecast period, driven by ongoing research and development efforts aimed at enhancing its performance and reducing production costs. Advances in materials science and manufacturing techniques are contributing to the optimization of bismuth telluride-based thermoelectric modules, making them more attractive for various applications across industries such as automotive, aerospace, and power generation. With its promising attributes and continued innovation, Bismuth Telluride is expected to maintain its leading position and contribute significantly to the growth of the global market.

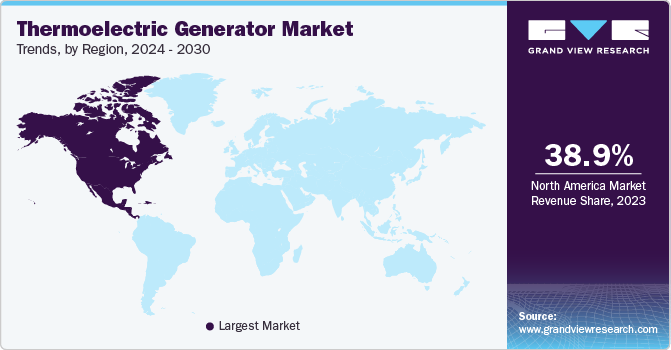

Regional Insights

The North America thermoelectric generator market held the largest global revenue share of 38.97% in 2023. This region is likely to dominate the industry over the forecast period. With its robust industrial base, technological innovation, and growing emphasis on sustainability, North America is positioned to maintain its leadership position in the industry over the forecast period. Factors such as increasing investment in renewable energy infrastructure, stringent environmental regulations, and the adoption of energy-efficient technologies are expected to further bolster North America's dominance in the market.

U.S. Thermoelectric Generator Market Trends

The thermoelectric generator market in the U.S. is anticipated to grow at a CAGR of 9.6% from 2024 to 2030. The U.S. is witnessing significant expansion in renewable energy infrastructure, including solar, wind, and geothermal power generation. TEGs are increasingly being integrated into these renewable energy systems to enhance their efficiency and maximize energy output. As the U.S. continues to transition towards a cleaner and more sustainable energy mix, the demand for TEGs as complementary power generation solutions is expected to grow.

Europe Thermoelectric Generator Market Trends

The thermoelectric generator market in Europe has been at the forefront of initiatives aimed at enhancing energy efficiency and promoting sustainability. As a result, there's a growing emphasis on waste heat recovery solutions using TEG technology. Industries across Europe are increasingly adopting TEGs to capture and utilize waste heat from various processes, contributing to both cost savings and environmental conservation efforts.

The France thermoelectric generator market is anticipated to grow at a CAGR of over 10.3%. This growth can be attributed to government support and policies, which play a significant role in driving the adoption of TEG technology in France. Subsidies, grants, and regulatory incentives encourage investment in energy-efficient technologies like TEGs. In addition, France's commitment to sustainability and carbon reduction targets creates a conducive environment for the adoption of TEGs across various industries.

Asia Pacific Thermoelectric Generator Market Trends

The thermoelectric generator market in Asia Pacific is poised for significant growth, projected to witness a significant CAGR between 2024 and 2030. The Asia Pacific region is experiencing rapid industrialization and urbanization, driving the demand for energy across various sectors. Thermoelectric generators offer a viable solution for capturing waste heat from industrial processes and converting it into usable electricity, thereby enhancing energy efficiency and reducing operational costs.

The China thermoelectric generator market held a significant share of 39.87% in the Asia Pacific region in 2023. China is among the global leaders in manufacturing and technology development. The country's advancements in thermoelectric materials, design, and manufacturing processes have led to improvements in efficiency and cost-effectiveness.

Middle East & Africa Thermoelectric Generator Market Trends

The thermoelectric generator market in the Middle East & Africa is expected to grow at a CAGR of approximately 9.4% over the forecast period. This growth is fueled by the region's increasing focus on energy diversification and efficiency improvements. Rising investments in industrial and infrastructure development, coupled with government initiatives to promote sustainable energy solutions, are driving the adoption of thermoelectric generators in various applications. In addition, the growing demand for off-grid power solutions and the need to address energy challenges in remote areas further contribute to market growth in the region.

The South Africa thermoelectric generator market held a dominant share of 32.63% in the Middle East & Africa region in 2023. This dominance reflects South Africa's proactive approach towards energy innovation and sustainability, driven by increasing industrialization and government initiatives to diversify the energy mix. With a focus on harnessing waste heat and improving energy efficiency, South Africa continues to play a pivotal role in driving market growth in the region.

Key Thermoelectric Generator Company Insights

The thermoelectric generator industry is moderately fragmented, with the presence of a sizable number of medium and large-sized companies. Key players mainly cater to the automotive, aerospace, manufacturing, energy, electronics, and telecommunications industries. Key companies are adopting several organic and inorganic growth strategies, such as facility expansion, mergers & acquisitions, and joint ventures to maintain and expand their market share.

-

In July 2023, ISRO announced a collaboration with BARC to develop radio thermoelectric generators (RTGs) for rockets. The radio thermoelectric generator use radioactive materials such as plutonium-238 or strontium-90, which release heat when they decay.

-

In January 2023, Global Power Technologies, one of the leading off-grid power solution providers, announced the launch of a new natural gas-powered Sentinel thermoelectric generator. Sentinel is a low-maintenance, fail-safe power supply for mission-critical applications with up to 8 W DC continuous power and is certified for use in HAZLOC environments.

Key Thermoelectric Generator Companies:

The following are the leading companies in the thermoelectric generator market. These companies collectively hold the largest market share and dictate industry trends.

- Gentherm Inc.

- Coherent Corp.

- Ferrotec Holdings Corporation

- Komatsu Ltd.

- Yamaha Corporation C0., Ltd.

- Global Power Technologies

- Kyocera Corporation

- TEC Microsystems GmbH

- Laird Thermal Systems

- TECTEG MFR

Thermoelectric Generator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 885.77 million |

|

Revenue forecast in 2030 |

USD 1,610.05 million |

|

Growth rate |

CAGR of 10.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, vertical, type, temperature, wattage, material, component, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Gentherm Inc.; Coherent Corp.; Ferrotec Holdings Corporation; Komatsu Ltd.; Yamaha Corporation C0., Ltd.; Global Power Technologies; Kyocera Corporation; TEC Microsystems GmbH; Laird Thermal Systems; TECTEG MFR |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Thermoelectric Generator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermoelectric generator market report based on application, vertical, type, temperature, wattage, material, component, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Waste Heat Recovery

-

Energy Harvesting

-

Direct Power Generation

-

Co-Generation

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Marine

-

Industrial

-

Consumer

-

Healthcare

-

Oil & Gas

-

Mining

-

Telecommunication

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Stage

-

Multi-Stage

-

-

Temperature Outlook (Revenue, USD Million, 2018 - 2030)

-

Low-Temperature (<80°C)

-

Medium Temperature (80-500°C)

-

High Temperature (>500°C)

-

-

Wattage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low-Power (<10 W)

-

Medium-Power (10-1 KW)

-

High-Power (>1 KW)

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Bismuth Telluride

-

Lead Telluride

-

Other Materials

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat Source

-

Thermoelectric Module

-

Cold Side

-

Electric Load

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thermoelectric generator market size was estimated at 813.38 USD million in 2023 and is expected to reach 885.77 USD million in 2024.

b. The global thermoelectric generator market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030, reaching 1,610.05 USD million by 2030.

b. Based on application, waste heat recovery was the dominant segment in 2023, with a revenue share of about 58.32% in 2023. This is attributable to the increasing focus on energy efficiency and sustainability across industries. Thermoelectric generators offer an effective solution for capturing and converting waste heat into usable electricity, addressing environmental concerns and operational cost savings.

b. Some of the key players operating in this industry include Gentherm Inc., Coherent Corp., Ferrotec Holdings Corporation, Komatsu Ltd., Yamaha Corporation C0., Ltd., Global Power Technologies, Kyocera Corporation, TEC Microsystems GmbH, Laird Thermal Systems, TECTEG MFR

b. The key factors driving the thermoelectric generator market include increasing demand for energy efficiency and sustainability solutions across industries, coupled with advancements in thermoelectric technology enhancing efficiency and cost-effectiveness. Additionally, stringent environmental regulations and government incentives further stimulate market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."