Thermic Fluids Market Size, Share & Trends Analysis Report By Product (Mineral Oils, Silicone-based, Aromatics, Glycols), By Application (Oil & Gas, Food & Beverages, Chemical Industry, CSP, HVAC), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-113-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Thermic Fluids Market Size & Trends

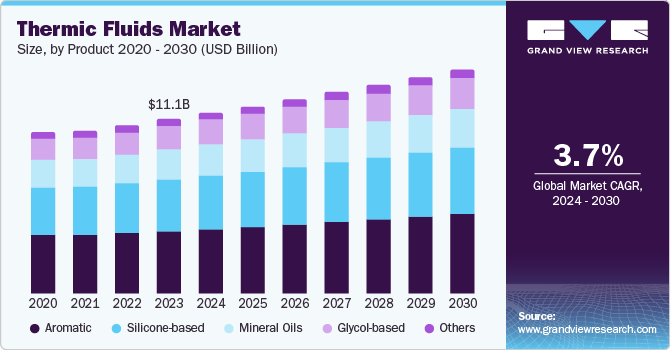

The global thermic fluids market size was valued at USD 11.06 billion in 2023 and is anticipated to grow at a CAGR of 3.7% from 2024 to 2030. This growth is driven by the increasing demand from the concentrated solar power (CSP) industry, where thermic fluids are essential for heat transfer and storage. The expansion of the oil and gas sector significantly boosts the market, as these fluids are crucial for temperature regulation during extraction and processing.

The chemical and petrochemical industries contribute to market growth due to their extensive use of thermic fluids for heating, cooling, and temperature control. Furthermore, advancements in the performance of heat transfer fluids (HTFs) enhance their efficiency and reliability, making them more attractive for various industrial applications.

With growing environmental concerns and stricter regulations, industries are seeking more sustainable options with lower environmental impact, reduced toxicity, and improved biodegradability compared to traditional fluids. Manufacturers are investing in R&D to develop advanced bio-based and synthetic formulations that offer high performance while minimizing environmental harm.

There is a growing need for thermic fluids that can function effectively at high temperatures, driven by industries such as chemical processing, oil and gas, and food processing. These sectors require fluids that endure intense heat while maintaining stability and efficiency. Manufacturers are developing advanced formulations to meet the rigorous requirements of these industries, leading to expansion in the high-temperature thermic fluid sector.

Product Insights

The aromatic segment accounted for 36.3% of the revenue share in 2023. Aromatic thermic fluids are highly valued for their excellent thermal stability and high boiling points. They are ideal for high-temperature applications such as chemical processing, oil and gas, and pharmaceuticals. Their ability to maintain performance under extreme conditions without significant degradation contributes to this widespread adoption. The dominance of the aromatic segment can be attributed to the growing demand for efficient heat transfer fluids in industries that require precise temperature control and reliability.

The glycol-based segment is expected to grow at a CAGR of 4.1% from 2024 to 2030. Glycol-based thermic fluids, which include ethylene glycol and propylene glycol, are known for their low toxicity and biodegradability, making them suitable for applications where environmental and safety considerations are paramount. These fluids are commonly used in HVAC, food and beverage processing, and solar energy systems. The anticipated growth in this segment is driven by increasing environmental regulations and the shift towards sustainable and eco-friendly solutions. Additionally, the rising adoption of renewable energy sources and the expansion of the food and beverage industry are expected to fuel the demand for glycol-based thermic fluids further.

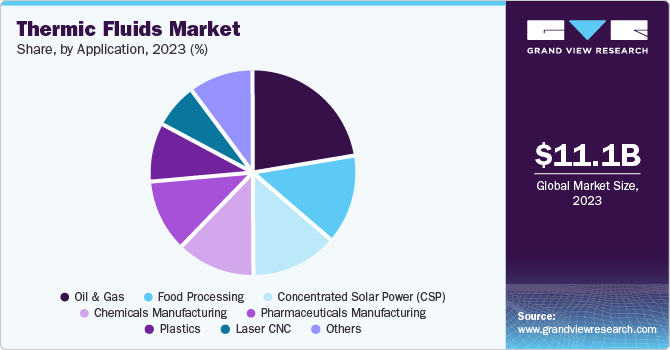

Application Insights

The oil & gas segment dominated the market in 2023 largely due to the extensive use of thermic fluids in various processes within the oil & gas industry, such as refining, processing, and transportation. Thermic fluids are crucial in maintaining temperature control for efficient operation and safety in these high-stakes environments. The industry’s reliance on thermic fluids for heat transfer applications, including heating pipelines and equipment, underscores their importance.

The CSP segment is expected to experience the fastest growth over the forecast period driven by the increasing global emphasis on renewable energy sources and the need to reduce carbon emissions. Governments and private sectors are investing heavily in CSP projects to meet renewable energy targets and combat climate change. The superior heat transfer capabilities and thermal stability of thermic fluids make them indispensable in CSP applications, thereby propelling the rapid expansion of the segment.

Regional Insights

North America accounted for a significant market share in the global thermic fluids market revenue in 2023 driven by the robust industrial base in the region, particularly in sectors such as oil & gas, chemical processing, and manufacturing. The demand for efficient heat transfer solutions in these industries underpins the market growth in North America.

U.S. Thermic Fluids Market Trends

The U.S. held substantial revenue share of the North American thermic fluids market in 2023. The country’s advanced industrial infrastructure and continuous investments in technological advancements in sectors such as renewable energy and pharmaceuticals have bolstered the demand for high-performance thermic fluids.

Asia Pacific Thermic Fluids Market Trends

The Asia Pacific region held the largest revenue share of 47.9% in the global thermic fluids market in 2023 attributed to the rapid industrialization and urbanization in countries such as China and India. The expanding chemical, automotive, and food processing industries in the region are key drivers of the market growth.

China dominated the Asia Pacific thermic fluids market in 2023, reflecting its massive industrial output and extensive use of thermic fluids in various applications. The country’s focus on expanding its manufacturing capabilities and increasing investments in renewable energy projects have significantly contributed to its leading position in the market.

Europe Thermic Fluids Market Trends

The European thermic fluids market is projected to grow at a CAGR of 2.8% from 2024 to 2030 owing to the stringent environmental regulations and the push towards sustainable industrial practices in the region. The increasing adoption of renewable energy sources and advancements in industrial processes are expected to drive the demand for thermic fluids in Europe.

Key Thermic Fluids Company Insights

The global thermic fluids market is driven by several key companies, including Eastman Chemical Company, ExxonMobil, Huntsman Corporation, Parathem Corporation, Royal Dutch Shell, and Clariant AG, among others.

-

Eastman Chemical Company offer their Therminol brand of heat transfer fluids, that are widely used across various industries, including chemical processing, oil and gas, and renewable energy.

-

ExxonMobil offers a range of high-performance products under its Mobiltherm brand. These fluids are designed to provide reliable and efficient heat transfer in industrial processes, including manufacturing, chemical processing, and power generation.

Key Thermic Fluids Companies:

The following are the leading companies in the thermic fluids market. These companies collectively hold the largest market share and dictate industry trends.

- Eastman Chemical Company

- ExxonMobil

- Huntsman Corporation

- Parathem Corporation

- Royal Dutch Shell

- Clariant AG

- British Petroleum Plc

- HPCL

- Thermic Fluids Pvt. Ltd.

Recent Developments

-

In June 2024, Global Heat Transfer announced the launch of Globaltherm 55, a synthetic heat transfer fluid designed for moderate-temperature applications that offers superior cost-effectiveness over traditional mineral oil-based fluids throughout its service life.

-

In February 2024, Castrol introduced a revitalized brand identity with a contemporary aesthetic. Aligned with this strategic shift, Castrol is actively pursuing diversification opportunities to augment its core lubricants business. The company is establishing a robust portfolio of advanced EV Fluids, encompassing EV Transmission Fluids, EV Thermal Fluids, and EV Greases under the Castrol ON brand.

-

In February 2024, SK Enmove, in collaboration with global precision liquid cooling provider Iceotope Technologies and SK Telecom, signed a Memorandum of Understanding (MOU) to explore next-generation cooling solutions for data centers. The partnership was expected to focus on integrating SK Enmove's thermal fluids into Iceotope's PLC solutions and testing their applicability within SK Telecom's AI Data Center Testbed.

Thermic Fluids Market Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.46 billion |

|

Revenue forecast in 2030 |

USD 14.23 billion |

|

Growth rate |

CAGR of 3.7% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Turkey; China; India; Japan; South Korea; Thailand; Malaysia; Australia; Brazil; Argentina; Colombia; UAE; Oman; Kuwait; Qatar; South Africa |

|

Key companies profiled |

Eastman Chemical Company, ExxonMobil, Huntsman Corporation, Parathem Corporation, Royal Dutch Shell, Clariant AG, British Petroleum Plc, HPCL, Thermic Fluids Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Thermic Fluids Market Report Segmentation

This report forecasts revenue & volume growth of the thermic fluids market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermic fluids market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Mineral Oils

-

Silicone-based

-

Aromatic

-

Glycol-based

-

Others

-

-

Application Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Oil & Gas

-

Food Processing

-

Chemicals Manufacturing

-

Laser CNC

-

Pharmaceuticals Manufacturing

-

Plastics

-

Concentrated Solar Power (CSP)

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Malaysia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Oman

-

Kuwait

-

Qatar

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."