Thermal Paper Market Size, Share & Trends Analysis Report By Width (57mm, 80mm), By Application (POS, Tags & Label, Lottery & Gaming, Ticketing, Medical), By Technology (Direct Transfer, Thermal Transfer), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-690-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Thermal Paper Market Size & Trends

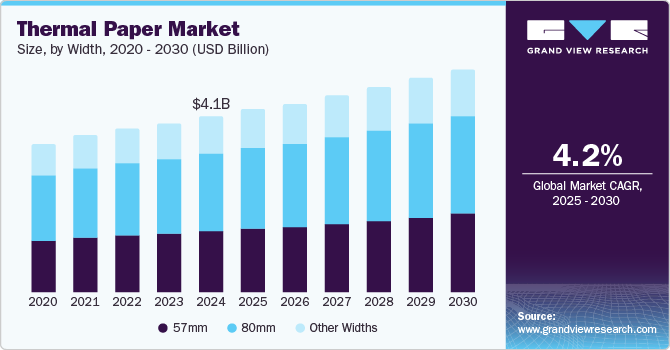

The global thermal paper market size was estimated at USD 4.07 billion in 2024 and is projected to grow at a CAGR of 4.2% from 2025 to 2030. The rapid expansion of the retail and e-commerce sectors is a significant driver for the market growth. Thermal paper is extensively used for point-of-sale (POS) receipts, labels, and tags in these industries. With the rise of online shopping, there is an increasing demand for shipping labels and tracking tags, which are primarily made from thermal paper. Retail outlets and logistics providers rely on thermal paper for its cost-effectiveness, reliability, and efficiency in providing quick printouts, further boosting market demand.

Technological advancements in thermal printing are making thermal printers more efficient, durable, and capable of handling high-speed printing tasks. These improvements have encouraged businesses to adopt thermal printing over traditional printing methods, driving the demand for thermal paper. Innovations such as color thermal printing and enhanced image durability have expanded the applications of thermal paper beyond conventional uses, such as for event tickets, lottery tickets, and medical charts.

Thermal paper plays a vital role in the healthcare industry, particularly for printing medical reports, diagnostic images, and prescription labels. The increasing focus on digital healthcare solutions and patient record-keeping has not diminished the demand for physical prints in critical applications, where thermal paper offers high-resolution and durable printouts. In addition, the growing prevalence of chronic diseases necessitates diagnostic and monitoring equipment, which often uses thermal paper for data printing. Thermal paper is widely used for labeling in the food and beverage sector, particularly for perishable products that require accurate and clear labeling of expiry dates, batch numbers, and storage instructions. The rise in global food consumption and stringent labeling regulations have significantly contributed to the demand for thermal paper. Furthermore, the adoption of thermal paper in self-checkout systems in supermarkets and fast-food restaurants has gained traction.

Width Insights

The 80mm segment accounted for 46.0% of the revenue share in 2024. The 80mm segment is the most widely used thermal paper width in retail and hospitality industries due to its compatibility with standard point-of-sale (POS) systems. Retailers and restaurants prefer 80mm thermal paper rolls for their ability to produce detailed receipts, including logos, promotional messages, and transaction information, enhancing the customer experience. The increasing penetration of advanced POS systems in these industries continues to drive the demand for 80mm thermal paper.

The 57mm segment is expected to grow at the fastest CAGR of 4.7% over the forecast period. The 57mm thermal paper segment is driven by the increasing popularity of mobile and compact printers used in applications such as on-the-go billing, ticketing, and delivery receipt generation. These portable printers are widely used by delivery personnel, parking attendants, and small vendors due to their convenience and compatibility with 57mm thermal rolls. The growth of e-commerce and last-mile delivery services has further fueled the demand for this segment.

Application Insights

The Point-of-Sale (POS) segment accounted for 61.11% of the revenue share in 2024. The modernization of POS systems with advanced features, such as touchscreens and wireless connectivity, has broadened their application across various industries. These systems rely on thermal paper for quick and efficient printing, minimizing delays in customer service. The increasing availability of compact and portable POS terminals in retail outlets and small businesses has further accelerated thermal paper adoption.

The tags & label segment is anticipated to grow at the fastest CAGR of 5.4% over the forecast period. Retail businesses are major consumers of thermal paper tags and labels, which are essential for pricing, barcode printing, and product information. The growth of organized retail formats, supermarkets, and hypermarkets has amplified the need for cost-effective and high-quality labeling solutions. Thermal paper labels provide quick printing capabilities, making them ideal for real-time price changes and inventory updates, which are critical in the dynamic retail environment.

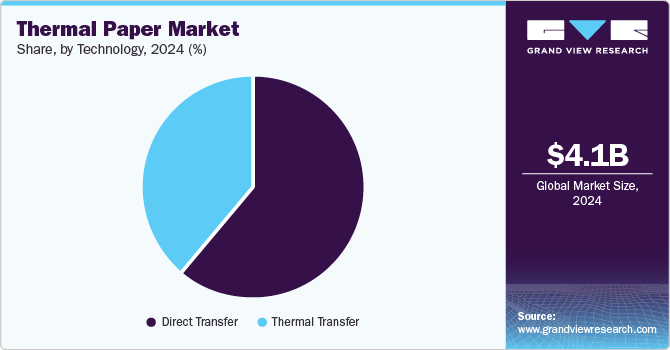

Technology Insights

The direct thermal segment accounted for 61.0% of the revenue share in 2024. Direct thermal technology is widely utilized in logistics and supply chain management for printing shipping labels, warehouse tags, and inventory labels. Its ability to provide clear, durable prints suitable for short-term use aligns perfectly with the fast-paced nature of the logistics industry. As global trade expands and businesses increasingly adopt advanced supply chain solutions, the demand for direct thermal printing continues to grow.

The thermal transfer segment is expected to grow at the fastest CAGR of 4.8% over the forecast period. The thermal transfer segment benefits from regulatory requirements mandating clear and durable labeling in industries such as food and beverage, pharmaceuticals, and chemicals. For instance, in the pharmaceutical sector, thermal transfer labels are widely used to meet stringent regulatory standards for traceability and compliance. The ability of thermal transfer labels to maintain print integrity over extended periods makes them indispensable in such regulated environments.

Regional Insights

The North America thermal paper market growth is driven by the stringent regulations and labeling standards for thermal paper, particularly in the food and pharmaceutical sectors. The Food and Drug Administration (FDA) and other regulatory bodies require clear and accurate labeling, including the use of batch numbers, expiration dates, and safety instructions. As a result, thermal paper is a preferred option for compliance due to its ability to print durable, high-quality labels that meet regulatory standards. The continuous evolution of regulatory requirements, especially in food safety and pharmaceuticals, ensures sustained demand for thermal paper products.

U.S. Thermal Paper Market Trends

The thermal paper market in the U.S. is driven by the increasing adoption of self-checkout kiosks in retail stores, supermarkets, and fast-food chains, which contribute significantly to the demand for thermal paper. These self-service systems rely on thermal printers to produce receipts and labels quickly. As retailers focus on enhancing customer experience and reducing labor costs, the use of thermal paper for such systems is expected to continue rising, driving further growth in the market.

Central & South America Thermal Paper Market Trends

The thermal paper market in CSA is anticipated to grow due to the adoption of advanced thermal printing technology that is creating new opportunities in the market. Enhanced printer reliability, lower maintenance costs, and the ability to handle high-volume printing have made thermal printing an attractive option for businesses. Innovations such as color thermal printing and heat-sensitive paper with longer shelf life are increasing thermal paper's appeal across various applications, including event tickets, parking tickets, and medical reports.

Asia Pacific Thermal Paper Market Trends

The Asia Pacific thermal paper market dominated globally and accounted for 33.2% of global revenue share in 2024. The Asia-Pacific region has witnessed a remarkable expansion in the retail and e-commerce sectors, driven by rising disposable incomes, urbanization, and a growing middle-class population. Countries like China, India, and Southeast Asian nations are leading this growth, with thermal paper being widely used for point-of-sale (POS) systems, receipts, and shipping labels. The rapid adoption of online shopping platforms and increased reliance on logistics and supply chain operations further amplify the demand for thermal paper in this region.

The thermal paper market in China is driven by the rapidly expanding food delivery and logistics industries, which contribute significantly to the demand for thermal paper. These sectors rely on thermal paper for labeling, packaging information, and real-time printing of receipts and invoices. The growth of online-to-offline (O2O) services in urban areas has also added to the consumption of thermal paper in labeling solutions for streamlined operations.

Europe Thermal Paper Market Trends

Europe thermal paper market is witnessing significant advancements in retail technology, particularly in point-of-sale (POS) systems. Retailers across Europe are increasingly adopting thermal printers for receipt generation, inventory management, and ticketing, owing to their speed, cost-efficiency, and reliability. As more retailers upgrade their systems and deploy self-checkout kiosks, the demand for thermal paper continues to rise. The widespread use of mobile POS systems and the shift toward cashless transactions also favor the adoption of thermal printing technologies in European markets.

Key Thermal Paper Company Insights

Some of the key players operating in the market include Oji Holdings Corporation, Appvion Inc. Others

-

Oji Holdings offers a wide range of high-quality thermal papers used in point-of-sale receipts, labels, and tickets. Their product offerings include eco-friendly, BPA-free thermal paper options that meet global sustainability standards, as well as advanced thermal papers for specialized applications like medical records, barcode labels, and lottery tickets.

-

Appvion's product offerings include high-quality thermal papers used for point-of-sale receipts, labels, tickets, and other applications. They offer a range of thermal paper products, such as coated and uncoated rolls, custom-printed thermal papers, and eco-friendly BPA-free thermal papers. The company emphasizes sustainable production practices and consistently adapts its product portfolio to meet the evolving demands of global markets, with an increasing focus on providing durable, high-performance, and environmentally responsible solutions.

Key Thermal Paper Companies:

The following are the leading companies in the thermal paper market. These companies collectively hold the largest market share and dictate industry trends.

- Oji Holdings Corporation

- Appvion Inc

- Koehler Group

- Mitsubishi Paper Mills Limited

- Hansol Paper Co. Ltd.

- Gold Huasheng Paper Co. Ltd.

- Henan Province JiangHe Paper Co. Ltd.

- Thermal Solutions International Inc.

- Iconex LLC

- Twin Rivers Paper Company

- Rotolificio Bergamasco Srl

- Jujo Thermal Limited

View a comprehensive list of companies in the Thermal Paper Market

Thermal Paper Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.23 billion |

|

Revenue forecast in 2030 |

USD 5.22 billion |

|

Growth Rate |

CAGR of 4.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Actual estimates/Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Regional Scope |

North America; Europe; Asia Pacific; Central and South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Russia; China; India; Japan; South Korea; Australia; New Zealand; Brazil; Argentina; Saudi Arabia; UAE; Qatar; South Africa |

|

Segments covered |

Width, technology, application, region |

|

Key companies profiled |

Oji Holdings Corporation; Appvion Inc; Koehler Group; Mitsubishi Paper Mills Limited; Hansol Paper Co. Ltd.; Gold Huasheng Paper Co. Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Thermal Paper Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermal paper market based on width, technology, application, and region:

-

Width Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

57mm

-

80mm

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

POS

-

Tags & Label

-

Lottery & Gaming

-

Ticketing

-

Medical

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct Transfer

-

Thermal Transfer

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Itay

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the thermal paper market include Oji Holdings Corporation, Appvion Inc, Koehler Group, Mitsubishi Paper Mills Limited, Hansol Paper Co. Ltd., and Gold Huasheng Paper Co. Ltd.

b. The key factors that are driving the thermal paper market are increasing usage of POS terminals for monetary transactions due to the expansion of the e-commerce and packaging industries.

b. The global thermal paper market size was estimated at USD 4.08 billion in 2024 and is expected to reach USD 4.23 billion in 2025.

b. The global thermal paper market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 5.22 billion by 2030.

b. POS dominated the thermal paper market with a share of 62.04% in 2024 due to the expansion of retail chain stores in countries, resulting in increased monetary transactions.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources

1.3.4. Third-Party Perspectives

1.3.5. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Thermal Paper Market Variables, Trends & Scope

3.1. Parent Market Outlook

3.2. Thermal Paper Market - Value Chain Analysis

3.2.1. Manufacturing Trends

3.2.2. Sales Channel Analysis

3.3. Technology Overview

3.4. Regulatory Framework

3.4.1. Analyst Perspective

3.5. Thermal Paper Market - Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Opportunity Analysis

3.5.4. Industry Challenges

3.5.5. Industry Analysis - Porter's

3.5.5.1. Threat from New Entrant

3.5.5.2. Bargaining Power of Buyers

3.5.5.3. Competitive Rivalry

3.5.5.4. Threat of Substitutes

3.5.5.5. Bargaining Power of Suppliers

3.5.5.6. Substitute Material Analysis

3.5.6. PESTEL Analysis by SWOT

3.5.6.1. Political Landscape

3.5.6.2. Environmental Landscape

3.5.6.3. Social Landscape

3.5.6.4. Technology Landscape

3.5.6.5. Economic Landscape

3.5.6.6. Legal Landscape

3.5.7. Market Disruption Analysis

Chapter 4. Thermal Paper Market: Width Estimates & Trend Analysis

4.1. Key Takeaways

4.2. Product Market Share Analysis, 2024 & 2030

4.3. 57mm

4.3.1. 57mm Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.4. 80mm

4.4.1. 80mm Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.5. Others

4.5.1. Others Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Thermal Paper Market: Application Estimates & Trend Analysis

5.1. Key Takeaways

5.2. Application Market Share Analysis, 2023 & 2030

5.3. Point-of-Sale (POS)

5.3.1. Thermal Paper Market Estimates and Forecasts, for Point-of-Sale (POS), 2018 - 2030 (Kilotons) (USD Million)

5.4. Tags & Label

5.4.1. Thermal Paper Market Estimates and Forecasts, for Tags & Label, 2018 - 2030 (Kilotons) (USD Million)

5.5. Lottery & Gaming

5.5.1. Thermal Paper Market Estimates and Forecasts, for Lottery & Gaming, 2018 - 2030 (Kilotons) (USD Million)

5.6. Ticketing

5.6.1. Thermal Paper Market Estimates and Forecasts, for Ticketing, 2018 - 2030 (Kilotons) (USD Million)

5.7. Medical

5.7.1. Thermal Paper Market Estimates and Forecasts, for Medical, 2018 - 2030 (Kilotons) (USD Million)

5.8. Other Applications

5.8.1. Thermal Paper Market Estimates and Forecasts, for Other Applications, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Thermal Paper Market: Technology Estimates & Trend Analysis

6.1. Key Takeaways

6.2. Vehicle Type Market Share Analysis, 2023 & 2030

6.3. Direct Thermal

6.3.1. Thermal Paper Market Estimates and Forecasts, for Direct Thermal, 2018 - 2030 (Kilotons) (USD Million)

6.4. Thermal Transfer

6.4.1. Thermal Paper Market Estimates and Forecasts, for Thermal Transfer, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Thermal Paper Market: Regional Estimates & Trend Analysis

7.1. Key Takeaways

7.2. Regional Market Share Analysis, 2023 & 2030

7.3. North America

7.3.1. Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.3.2. U.S.

7.3.2.1. U.S. Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.3.3. Canada

7.3.3.1. Canada Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.3.4. Mexico

7.3.4.1. Mexico Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.4. Europe

7.4.1. Europe Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.4.2. Germany

7.4.2.1. Germany Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.4.3. UK

7.4.3.1. UK Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.4.4. France

7.4.4.1. France Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.4.5. Spain

7.4.5.1. Spain Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.4.6. Italy

7.4.6.1. Spain Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.4.7. Russia

7.4.7.1. Russia Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.5. Asia Pacific

7.5.1. Asia Pacific Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.5.2. China

7.5.2.1. China Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.5.3. India

7.5.3.1. India Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.5.4. South Korea

7.5.4.1. South Korea Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.5.5. Australia

7.5.5.1. Australia Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.5.6. New Zealand

7.5.6.1. New Zealand Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.5.7. Vietnam

7.5.7.1. Vietnam Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.6. Central & South America

7.6.1. Central & South America Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.6.2. Brazil

7.6.2.1. Brazil Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.6.3. Argentina

7.6.3.1. Argentina Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.7. Middle East & Africa

7.7.1. Middle East & Africa Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.7.2. Saudi Arabia

7.7.2.1. Saudi Arabia Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.7.3. South Africa

7.7.3.1. South Africa Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.7.4. UAE

7.7.4.1. UAE Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

7.7.5. Qatar

7.7.5.1. Qatar Thermal Paper Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 8. Competitive Landscape

8.1. Key Players, their Recent Developments, and their Impact on Industry

8.2. Key Company/Competition Categorization

8.3. Company Market Position Analysis

8.4. Company Heat Map Analysis

8.5. Company Market Share Analysis, 2023

8.6. Strategy Mapping

8.7. Company Listing

8.7.1. Oji Holdings Corporation

8.7.1.1. Company Overview

8.7.1.2. Financial Performance

8.7.1.3. Product Benchmarking

8.7.1.4. Strategic Framework

8.7.2. Appvion Inc

8.7.2.1. Company Overview

8.7.2.2. Financial Performance

8.7.2.3. Product Benchmarking

8.7.2.4. Strategic Framework

8.7.3. Koehler Group

8.7.3.1. Company Overview

8.7.3.2. Financial Performance

8.7.3.3. Product Benchmarking

8.7.3.4. Strategic Framework

8.7.4. Mitsubishi Paper Mills Limited

8.7.4.1. Company Overview

8.7.4.2. Financial Performance

8.7.4.3. Product Benchmarking

8.7.4.4. Strategic Framework

8.7.5. Hansol Paper Co. Ltd.

8.7.5.1. Company Overview

8.7.5.2. Financial Performance

8.7.5.3. Product Benchmarking

8.7.5.4. Strategic Framework

8.7.6. Gold Huasheng Paper Co. Ltd.

8.7.6.1. Company Overview

8.7.6.2. Financial Performance

8.7.6.3. Product Benchmarking

8.7.6.4. Strategic Framework

8.7.7. Henan Province JiangHe Paper Co. Ltd.

8.7.7.1. Company Overview

8.7.7.2. Financial Performance

8.7.7.3. Product Benchmarking

8.7.7.4. Strategic Framework

8.7.8. Thermal Solutions International Inc.

8.7.8.1. Company Overview

8.7.8.2. Financial Performance

8.7.8.3. Product Benchmarking

8.7.8.4. Strategic Framework

8.7.9. Iconex LLC

8.7.9.1. Company Overview

8.7.9.2. Financial Performance

8.7.9.3. Product Benchmarking

8.7.9.4. Strategic Framework

8.7.10. Twin Rivers Paper Company

8.7.10.1. Company Overview

8.7.10.2. Financial Performance

8.7.10.3. Product Benchmarking

8.7.10.4. Strategic Framework

8.7.11. Rotolificio Bergamasco Srl

8.7.11.1. Company Overview

8.7.11.2. Financial Performance

8.7.11.3. Product Benchmarking

8.7.11.4. Strategic Framework

8.7.12. Jujo Thermal Limited

8.7.12.1. Company Overview

8.7.12.2. Financial Performance

8.7.12.3. Product Benchmarking

8.7.12.4. Strategic Framework

List of Tables

Table 1 Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 2 Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 3 Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 4 Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 5 Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 6 Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 7 North America Thermal paper market estimates and forecasts, 2018 - 2030 (USD Million)

Table 8 North America Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 9 North America Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 10 North America Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 11 North America Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 12 North America Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 13 North America Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 14 U.S. Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 15 U.S. Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 16 U.S. Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 17 U.S. Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 18 U.S. Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 19 U.S. Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 20 U.S. Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 21 Canada. Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 22 Canada Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 23 Canada Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 24 Canada Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 25 Canada Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 26 Canada Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 27 Canada Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 28 Mexico. Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 29 Mexico Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 30 Mexico Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 31 Mexico Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 32 Mexico Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 33 Mexico Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 34 Mexico Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 35 Europe Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 36 Europe Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 37 Europe Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 38 Europe Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 39 Europe Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 40 Europe Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 41 Europe Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 42 Germany Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 43 Germany Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 44 Germany Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 45 Germany Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 46 Germany Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 47 Germany Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 48 Germany Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 49 UK Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 50 UK Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 51 UK Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 52 UK Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 53 UK Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 54 UK Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 55 UK Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 56 France Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 57 France Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 58 France Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 59 France Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 60 France Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 61 France Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 62 France Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 63 Italy Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 64 Italy Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 65 Italy Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 66 Italy Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 67 Italy Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 68 Italy Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 69 Italy Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 70 Spain Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 71 Spain Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 72 Spain Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 73 Spain Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 74 Spain Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 75 Spain Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 76 Spain Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 77 Russia Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 78 Russia Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 79 Russia Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 80 Russia Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 81 Russia Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 82 Russia Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 83 Russia Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 84 Asia Pacific Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 85 Asia Pacific Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 86 Asia Pacific Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 87 Asia Pacific Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 88 Asia Pacific Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 89 Asia Pacific Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 90 Asia Pacific Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 91 China Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 92 China Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 93 China Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 94 China Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 95 China Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 96 China Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 97 China Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 98 India Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 99 India Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 100 India Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 101 India Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 102 India Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 103 India Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 104 India Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 105 Japan Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 106 Japan Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 107 Japan Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 108 Japan Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 109 Japan Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 110 Japan Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 111 Japan Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 112 South Korea Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 113 South Korea Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 114 South Korea Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 115 South Korea Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 116 South Korea Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 117 South Korea Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 118 South Korea Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 119 Australia Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 120 Australia Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 121 Australia Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 122 Australia Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 123 Australia Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 124 Australia Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 125 Australia Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 126 New Zealand Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 127 New Zealand Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 128 New Zealand Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 129 New Zealand Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 130 New Zealand Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 131 New Zealand Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 132 New Zealand Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 133 Central & South America Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 134 Central & South America Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 135 Central & South America Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 136 Central & South America Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 137 Central & South America Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 138 Central & South America Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 139 Central & South America Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 140 Brazil Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 141 Brazil Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 142 Brazil Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 143 Brazil Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 144 Brazil Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 145 Brazil Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 146 Brazil Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 147 Argentina Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 148 Argentina Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 149 Argentina Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 150 Argentina Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 151 Argentina Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 152 Argentina Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 153 Argentina Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 154 Middle East & Africa Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 155 Middle East & Africa Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 156 Middle East & Africa Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 157 Middle East & Africa Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 158 Middle East & Africa Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 159 Middle East & Africa Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 160 Middle East & Africa

Table 161 Saudi Arabia Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 162 Saudi Arabia Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 163 Saudi Arabia Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 164 Saudi Arabia Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 165 Saudi Arabia Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 166 Saudi Arabia Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 167 Saudi Arabia Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 168 UAE Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 169 UAE Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 170 UAE Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 171 UAE Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 172 UAE Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 173 UAE Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 174 UAE Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 175 Qatar Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 176 Qatar Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 177 Qatar Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 178 Qatar Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 179 Qatar Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 180 Qatar Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 181 Qatar Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 182 South Africa Thermal paper market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 183 South Africa Thermal paper market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 184 South Africa Thermal paper market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 185 South Africa Thermal paper market estimates and forecasts, by width, 2018 - 2030 (Kilotons)

Table 186 South Africa Thermal paper market estimates and forecasts, by width, 2018 - 2030 (USD Million)

Table 187 South Africa Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (Kilotons)

Table 188 South Africa Thermal paper market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Primary Research Process

Fig. 4 Market Research Approaches - Bottom-Up Approach

Fig. 5 Market Research Approaches - Top Down Approach

Fig. 6 Market Research Approaches - Combined Approach

Fig. 7 Market Snapshot

Fig. 8 Segment Insights

Fig. 9 Competitive Insights

Fig. 10 Penetration and Growth Prospect Mapping

Fig. 11 Thermal paper Market: Value Chain Analysis

Fig. 12 Supplier Selection Criteria: Lean and Agile Strategy

Fig. 13 Thermal paper Market: Market Dynamics

Fig. 14. Thermal paper Market: market driver impact analysis

Fig. 15. Thermal paper Market: market restraint impact analysis

Fig. 16 Thermal paper Market: Application Movement Analysis, 2023 & 2030

Fig. 17 Thermal paper Market: Regional Movement Analysis, 2023 & 2030

Fig. 18 Thermal paper Market: Competitive Dashboard Analysis

Fig. 19 SWOT Analysis

Market Segmentation

- Thermal Paper Width Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- 57mm

- 80mm

- Other Widths

- Thermal Paper Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Thermal Paper Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Direct Transfer

- Thermal Transfer

- Others

- Thermal Paper Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- North America Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- North America Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- U.S.

- U.S. Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- U.S. Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- U.S. Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- U.S. Thermal Paper Market, By Width

- Canada

- Canada Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Canada Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Canada Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Canada Thermal Paper Market, By Width

- Mexico

- Mexico Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Mexico Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Mexico Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Mexico Thermal Paper Market, By Width

- North America Thermal Paper Market, By Width

- Europe

- Europe Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Europe Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Europe Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Germany

- Germany Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Germany Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Germany Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Germany Thermal Paper Market, By Width

- UK

- UK Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- UK Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- UK Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- UK Thermal Paper Market, By Width

- France

- France Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- France Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- France Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- France Thermal Paper Market, By Width

- Itay

- Itay Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Itay Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Itay Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Itay Thermal Paper Market, By Width

- Spain

- Spain Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Spain Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Spain Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Spain Thermal Paper Market, By Width

- Russia

- Russia Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Russia Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Russia Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Russia Thermal Paper Market, By Width

- Europe Thermal Paper Market, By Width

- Asia Pacific

- Asia Pacific Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Asia Pacific Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Asia Pacific Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- China

- China Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- China Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- China Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- China Thermal Paper Market, By Width

- India

- India Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- India Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- India Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- India Thermal Paper Market, By Width

- Japan

- Japan Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Japan Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Japan Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Japan Thermal Paper Market, By Width

- South Korea

- South Korea Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- South Korea Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- South Korea Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- South Korea Thermal Paper Market, By Width

- Australia

- Australia Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Australia Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Australia Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Australia Thermal Paper Market, By Width

- New Zealand

- New Zealand Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- New Zealand Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- New Zealand Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- New Zealand Thermal Paper Market, By Width

- Vietnam

- Vietnam Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Vietnam Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Vietnam Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Vietnam Thermal Paper Market, By Width

- Asia Pacific Thermal Paper Market, By Width

- Central & South America

- Central & South America Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Central & South America Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Central & South America Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Brazil

- Brazil Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Brazil Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Brazil Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Brazil Thermal Paper Market, By Width

- Argentina

- Argentina Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Argentina Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Argentina Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Argentina Thermal Paper Market, By Width

- Central & South America Thermal Paper Market, By Width

- Middle East & Africa

- Middle East & Africa Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Middle East & Africa Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Middle East & Africa Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Saudi Arabia

- Saudi Arabia Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Saudi Arabia Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Saudi Arabia Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Saudi Arabia Thermal Paper Market, By Width

- UAE

- UAE Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- UAE Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- UAE Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- UAE Thermal Paper Market, By Width

- Qatar

- Qatar Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- Qatar Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- Qatar Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- Qatar Thermal Paper Market, By Width

- South Africa

- South Africa Thermal Paper Market, By Width

- 57mm

- 80mm

- Other Widths

- South Africa Thermal Paper Market, By Application

- POS

- Tags & Label

- Lottery & Gaming

- Ticketing

- Medical

- Others

- South Africa Thermal Paper Market, By Technology

- Direct Transfer

- Thermal Transfer

- Others

- South Africa Thermal Paper Market, By Width

- Middle East & Africa Thermal Paper Market, By Width

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply side |

|

|

|

Demand side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."