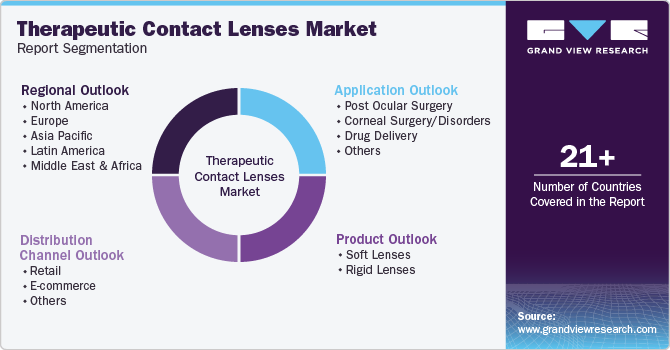

Therapeutic Contact Lenses Market Size, Share & Trends Analysis Report By Product (Soft Lenses, Rigid Lenses), By Application (Corneal Surgery/Disorders, Post Ocular Surgery, Drug Delivery), By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-945-8

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Therapeutic Contact Lens Market Trends

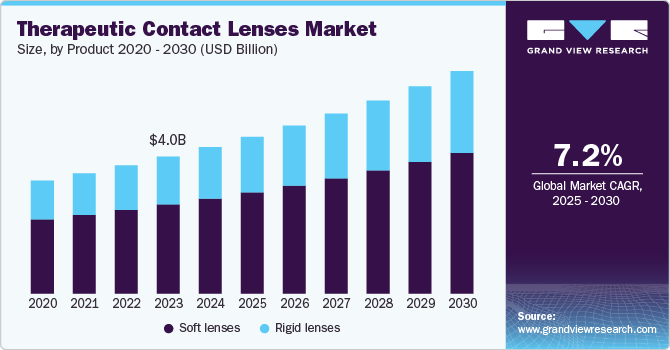

The global therapeutic contact lenses market size was estimated at USD 4.7 billion in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The therapeutic contact lenses market is experiencing significant growth, driven by advancements in technology and an increasing prevalence of eye-related conditions. These specialized lenses are designed to provide treatment for various ocular disorders, offering both comfort and improved vision. For instance, conditions such as keratoconus, dry eye syndrome, and ocular surface diseases benefit from the use of therapeutic lenses, which help in managing symptoms and promoting healing.

Innovations in lens technology are also propelling market expansion. The introduction of dynamic soft therapeutic contact lenses, which adapt to changes in the eye’s surface and provide enhanced comfort, is a notable advancement. These lenses incorporate advanced materials that allow for better oxygen permeability and moisture retention, significantly improving wearability. Companies such as Johnson & Johnson and Alcon are leading the way in developing such innovative products. Johnson & Johnson's Acuvue Oasys, for instance, is known for its high moisture content, making it suitable for individuals with dry eyes.

Government support and healthcare reimbursement policies play a crucial role in market growth. This growth is fueled by rising awareness of eye health and the growing incidence of vision impairment. For example, the World Health Organization estimates that 2.7 billion people globally suffer from vision impairment, which highlights the need for effective treatment options. Many countries are increasing funding for eye health initiatives and providing reimbursements for therapeutic treatments, making them more accessible to patients. In the U.S., for instance, Medicare and Medicaid cover certain therapeutic lenses, reducing the financial burden on patients and encouraging more people to seek treatment.

Furthermore, the rise of online platforms for purchasing contact lenses has made it easier for consumers to access therapeutic options. E-commerce sales have surged, particularly following the COVID-19 pandemic, as more individuals turned to online shopping for their healthcare needs. This trend is expected to continue, with a growing number of retailers offering specialized lenses, thus expanding their reach to a broader audience.

Demographic trends also contribute to market growth. An aging population is more prone to eye diseases, leading to an increased demand for therapeutic contact lenses. According to the U.S. Census Bureau, the number of Americans aged 65 and older is projected to reach 95 million by 2060, creating a larger market for vision-related products. In addition, the rise of digital device usage has led to a surge in conditions such as digital eye strain, prompting consumers to seek therapeutic solutions.

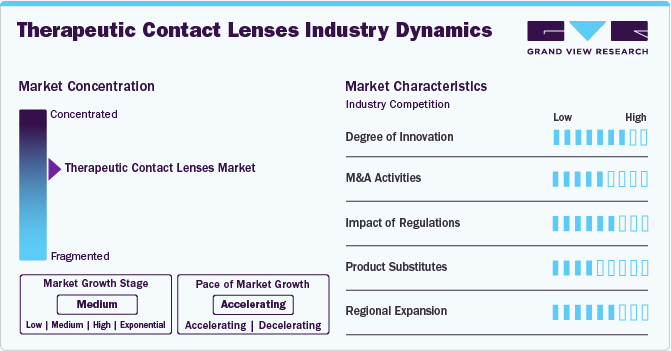

Market Concentration & Characteristics

The therapeutic contact lenses industry exhibits moderate concentration, with several key players such as Johnson & Johnson, Alcon, and Bausch + Lomb dominating the market. These companies invest heavily in research and development to drive innovation and improve product offerings. Characteristics of the industry include rapid technological advancements, a growing focus on comfort and customization, and increasing consumer awareness of eye health. The market is also influenced by favorable government regulations and reimbursement policies, which enhance accessibility. In addition, the rise of e-commerce is transforming distribution channels, making therapeutic lenses more readily available to consumers.

The therapeutic contact lenses industry showcases significant innovation, especially with the rise of smart contact lenses. As reported in September 2020, these lenses are being developed for diverse applications, including health monitoring and medical treatments for allergies, burns, and conditions such as glaucoma and AMD. Researchers at the University of New Hampshire have created a new hydrogel material to treat severe corneal injuries by reducing harmful matrix metalloproteinases. The Queensland University of Technology is also working on a bandage lens containing limbal mesenchymal stroma cells to aid in healing ocular surface injuries, underscoring the industry's progressive advancements.

Regulations play a crucial role in the therapeutic contact lenses industry by ensuring product safety and efficacy. Regulatory bodies such as the FDA in the U.S. set stringent guidelines for the approval of new lenses, which can slow down the introduction of innovative products. However, these regulations also enhance consumer trust and promote industry standards. Compliance with these regulations ensures that lenses meet quality benchmarks, reducing the risk of complications. In addition, supportive policies and reimbursement frameworks can encourage the development and adoption of advanced therapeutic lenses, ultimately benefiting both manufacturers and patients in the long run.

Mergers and acquisitions (M&A) in the therapeutic contact lenses industry is rapidly increasing as companies aim to bolster their technological capabilities and market reach. For instance, in January 2023, it was announced that CooperVision, Inc. completed its acquisition of SynergEyes, Inc., finalizing a deal initiated in November 2022. This acquisition enhances CooperVision's product offerings by integrating SynergEyes' specialty contact lenses, including proprietary hybrid lenses. This strategic move complements CooperVision's existing Onefit scleral lenses, allowing the company to expand its portfolio for treating keratoconus and irregular corneas. The acquisition broadens CooperVision's range of products and services and reinforces its position in the specialty lens market, ultimately benefiting patients with unique vision needs.

In the therapeutic contact lenses industry, product substitutes include a range of alternatives designed to address similar eye health issues. These substitutes encompass rigid gas permeable lenses, eyeglasses, and surgical interventions such as corneal transplants or LASIK procedures. While these alternatives can provide vision correction and some therapeutic benefits, they may not offer the same level of comfort or convenience as therapeutic contact lenses. In addition, advances in eye drops and other medical treatments for conditions such as dry eye and allergic conjunctivitis serve as substitutes, though they often lack the continuous therapeutic effect that contact lenses can provide.

In June 2023, Bausch + Lomb launched their Infuse Multifocal silicone hydrogel (SiHy) daily disposable contact lenses in the U.S., targeting the growing presbyopia market. These lenses utilize Bausch + Lomb's ProBalance Technology and a 3-Zone Progressive design to ensure all-day comfort and smooth transitions between near, intermediate, and distance vision. With nearly 80% of individuals aged 45-55 experiencing presbyopia, this product addresses common issues such as lens dryness, which affects about 70% of multifocal wearers. This regional expansion reflects the company's commitment to meeting the evolving vision needs of an aging population, especially amid increased digital device use.

Product Insights

The soft lenses segment held the largest market share accounting for around 64.8% in 2024 due to its comfort, versatility, and ease of use. Soft lenses are widely preferred for their lightweight feel and adaptability, making them suitable for various therapeutic applications, such as managing dry eye syndrome and keratoconus. Their popularity is bolstered by advancements in materials and technology, enhancing oxygen permeability and moisture retention. In addition, the growing awareness of eye health and increased consumer demand for specialized lenses contribute to the segment's robust growth, solidifying its leading position in the overall therapeutic contact lens market.

The rigid lenses segment is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period. Rigid lenses are often used for therapeutic and optical indications. Corneal abnormalities leading to a high amount of irregular astigmatism will benefit visually only with the rigid lens. Increasing adoption of the rigid lens and rising prevalence of ocular disorders owing to its competitive advantage over the soft lens is anticipated to secure the market position. Also, increasing R&D investments for rigid lenses across the globe is predicted to augment the market progression.

Application Insights

Post ocular surgery is among the leading segments, holding around 30.4% of the market share in 2024 driven by the increasing number of surgical procedures such as cataract surgery and LASIK. These lenses play a crucial role in promoting healing and enhancing visual outcomes after surgery. They provide a protective barrier, reducing discomfort and aiding in the recovery of the corneal surface. The growing aging population, along with advancements in surgical techniques, is further propelling demand for therapeutic lenses in this segment. In addition, the focus on improving patient care and outcomes reinforces the significance of post-ocular surgery lenses within the market.

The drug delivery segment is witnessing notable growth in compound annual growth rate (CAGR) driven by innovations in drug-infused lenses. A review published in March 2023 highlights the effectiveness of GNP-loaded contact lenses in glaucoma treatment, enhancing timolol release kinetics and improving intraocular pressure (IOP) management. This method increases the bioavailability of timolol while extending its precorneal residence time, which improves treatment efficacy. Research indicates that drug absorption is significantly greater five hours post-delivery compared to 48 hours later, underscoring the potential of contact lenses as effective drug delivery systems.

Distribution Channel Insights

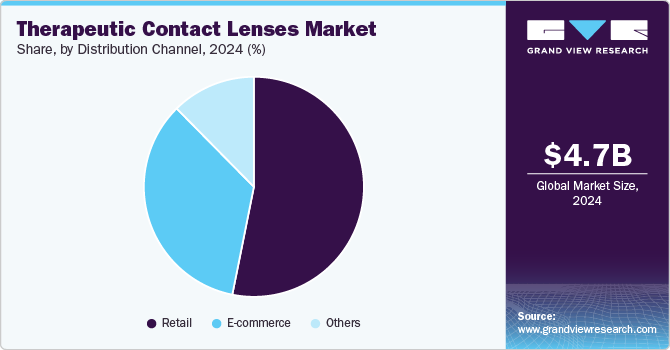

The retail segment accounted for the largest revenue share of 53.2% in 2024. The retail segment is growing owing to the manufacturer’s initiative to produce advanced therapeutic contact lenses at an affordable price at retail stores, which are also united with extra discounts provided by retail sellers. In addition, the robust growth of retail pharmacies in developed economies is anticipated to fuel the segment growth.

The e-commerce segment in the therapeutic contact lenses market has experienced significant growth, with a notable CAGR during the forecast period. This surge is driven by the increasing preference for online shopping, fueled by convenience and accessibility. Consumers are now more inclined to purchase contact lenses online due to the availability of a wider range of products and competitive pricing. In addition, the COVID-19 pandemic accelerated this trend as more individuals sought safe and efficient ways to access healthcare products. E-commerce platforms provide easy access to therapeutic lenses, enhancing customer engagement and expanding market reach.

Regional Insights

North America therapeutic contact lenses market dominated the overall global market and accounted for the 42.4% revenue share in 2024. The strong need for quality assurance measures for ophthalmic devices arises from the well-established healthcare infrastructure. Moreover, ongoing technological advancements, increasing awareness among end users regarding eye health, and strict regulatory standards are anticipated to drive market expansion in the future.

U.S. Therapeutic Contact Lens Market Trends

The U.S. therapeutic contact lenses market held a significant share of North America's therapeutic contact lens market in 2024. The country's growth can be attributed to advancements in contact lens manufacturing and inspection technology, alongside increasing consumer focus on eye health and convenience. With more people choosing contact lenses for vision correction, manufacturers and distributors are upgrading inspection machinery to ensure product quality and safety. For instance, in March 2022, Johnson & Johnson Vision Care, Inc. received approval from the U.S. FDA for its daily disposable contact lenses, ACUVUE Theravision with Ketotifen designed to alleviate eye itching caused by allergic conjunctivitis while providing vision correction.

Europe Therapeutic Contact Lenses Market Trends

The Europe therapeutic contact lenses market is witnessing growth fueled by increasing demand for contact lenses, driven by consumers' preference for them as a primary vision correction method. In 2023, Europe accounted for the second-largest share of revenue in the global contact lens inspection market. To meet this demand and ensure product quality and safety, manufacturers and distributors are adopting advanced inspection technology. Factors contributing to this demand include lifestyle shifts, advancements in lens materials and designs, and a growing emphasis on convenience and aesthetics in eye care.

The UK therapeutic contact lenses market is projected to expand owing to its advanced healthcare system, partnerships among major stakeholders, and the launch of novel products. Furthermore, a heightened focus on research and development for therapeutic contact lenses designed to address diverse conditions is anticipated to be a significant driver of market growth.

The Francetherapeutic contact lenses market is expected to grow over the forecast period. This growth can be attributed to advancements in technology, heightened awareness of eye health, and increased research and development efforts focused on contact lenses within the country.

The therapeutic contact lenses market in Germany is expected to expand in the foreseeable future as people become more aware of potential issues linked to contact lens use, like infections or discomfort. This growing awareness has resulted in a stronger focus on ensuring the quality and dependability of vision correction products. As a result, companies manufacturing contact lenses are investing in advanced inspection equipment to thoroughly scrutinize lenses for any defects or abnormalities.

Asia Pacific Therapeutic Contact Lenses Market Trends

The Asia Pacific therapeutic contact lenses market is experiencing robust growth, driven by rising healthcare awareness and increasing prevalence of eye disorders. The region's expanding aging population and lifestyle changes, such as increased screen time, contribute to a higher demand for corrective and therapeutic lenses. Key players are investing in innovative products tailored to local needs, enhancing comfort and efficacy. In addition, supportive government initiatives and improved healthcare infrastructure are facilitating market expansion. The growing trend of online purchasing further boosts accessibility, making therapeutic contact lenses more readily available to consumers across diverse markets in the Asia Pacific region.

The therapeutic contact lenses market in Japan is poised for substantial growth, driven by awareness of eye health and the rising adoption of therapeutic contact lenses. Furthermore, the presence of prominent players in Japan, particularly those focusing on pioneering contact lens technologies, further fuels the expansion of the market.

The therapeutic contact lenses market in China is expected to grow, driven by technological advancements and heightened research and development in the field of therapeutic contact lenses. The China National Medical Products Administration (NMPA) is responsible for overseeing medical devices, including lens inspection machines, to guarantee their safety, effectiveness, and adherence to regulatory requirements.

The therapeutic contact lenses market in India is poised for substantial growth, driven by rising therapeutic contact lens usage and growing awareness of eye health. With an annual growth rate of 15% to 20%, this trend reflects shifting preferences among Indians toward contact lenses for vision correction. Factors like increasing disposable incomes, urbanization, and evolving attitudes toward eyewear contribute to this surge. Consequently, the demand for contact lens inspection machines for quality assurance is projected to increase in India.

Latin America Therapeutic Contact Lenses Trends

The Latin American therapeutic contact lenses market is experiencing significant growth. Increasing efforts in research and development coupled with rapid technological advancements are predicted to drive market growth in the area. Domestic firms concentrate on cost-conscious market sectors by delivering economical inspection solutions. Their familiarity with local regulations and business practices could enable them to offer more customized support and services, thereby fueling market growth.

The therapeutic contact lenses market in Saudi Arabia is anticipated to expand in the forecast period. This is attributed to the government's encouragement of private sector involvement in healthcare, as outlined in the National Transformation Plan (NTP). In addition, the projected rise in disposable income from economic expansion and urban development is expected to generate favorable growth prospects.

Key Therapeutic Contact Lenses Company Insights

The competitive scenario in the therapeutic contact lenses market is highly competitive, with key players such as Bausch & Lomb Incorporated, CooperVision; and Alcon holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Therapeutic Contact Lenses Companies:

The following are the leading companies in the therapeutic contact lenses market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch & Lomb Incorporated

- Advanced Vision Technologies

- CooperVision

- VISTAKON (division of Johnson & Johnson Vision Care, Inc.)

- X-Cel Specialty Contacts

- Contamac

- Excellent Hi-Care Pvt Ltd

- Alcon

- Surgitech Innovation

- UltraVision CLPL

View a comprehensive list of companies in the Therapeutic Contact Lenses Market

Recent Developments

-

In August 2024, Kunal Doley reported on the advancements in smart contact lenses, many still in prototype stages. Researchers in Singapore developed an ultra-thin battery that charges using tears, addressing safety concerns associated with traditional lithium-ion batteries. This innovation aims to enhance early detection and monitoring of eye disorders.

-

In February 2024, XPANCEO, a technology company focusing on smart contact lenses equipped with extended reality (XR) and health monitoring functions, recently demonstrated a successful prototype of what it claims to be the first augmented reality (AR) holographic lens testing system in the world.

-

In April 2021, Menicon announced a global collaboration with Johnson & Johnson Vision to enhance products and services aimed at managing myopia progression in children. Following the 2019 launch of the Menicon Bloom Myopia Control Management System, this partnership seeks to combat the rising myopia epidemic, particularly among young populations.

Therapeutic Contact Lenses Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.0 billion |

|

Revenue forecast in 2030 |

USD 7.1 billion |

|

Growth rate |

CAGR of 7.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application and distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Bausch & Lomb Incorporated; Advanced Vision Technologies; CooperVision; VISTAKON (division of Johnson & Johnson Vision Care, Inc.); X-Cel Specialty Contacts; Contamac; Excellent Hi-Care Pvt Ltd; Alcon; Surgitech Innovation; UltraVision CLPL |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Therapeutic Contact Lenses Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global therapeutic contact lenses market report on the basis of product, application, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Soft Lenses

-

Rigid Lenses

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Post Ocular Surgery

-

Corneal Surgery/Disorders

-

Drug Delivery

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global therapeutic contact lenses market size was estimated at USD 4.7 billion in 2024 and is expected to reach USD 5.0 billion in 2025.

b. The global therapeutic contact lenses market is expected to grow at a compound annual growth rate of 7.25% from 2025 to 2030 to reach USD 7.1 billion by 2030.

b. North America dominated the global therapeutic contact lens market with a share of 42.4% in 2024. This is attributable to the rising geriatric population, and well-developed healthcare infrastructure.

b. Some key players operating in the global therapeutic contact lens market include Bausch & Lomb Incorporated, Advanced Vision Technologies, Contamac, Alcon, Surgitech Innovation, Johnson & Johnson Vision Care, CooperVision, X-Cel Specialty Contacts, UltraVision CLPL

b. Key factors that are driving the therapeutic contact lens market growth include the increasing aging population base, a rising number of corneal surgeries, and developing healthcare infrastructure across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."