Flight Simulator Market Size, Share & Trends Analysis Report By Product (Full Flight Simulator (FFS), Fixed Flight Training Devices (FTD)), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-264-8

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Flight Simulator Market Size & Trends

The global flight simulator market size was valued at USD 5.18 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. The benefits offered by flight simulator devices include mission-critical training programs that ensure effective aircraft operation, low operational costs, and visual systems. These benefits offer near real-world experience and are anticipated to create new growth avenues for market growth over the next few years. Rising demand for better and more effective pilot training is anticipated to catapult growth. The growing importance of aircraft safety and the need for substantial training is anticipated to spur demand over the forecast period.

The need for flight handling and safety operations, such as situational awareness and skill competency, promotes industry growth. The industry is witnessing unprecedented R&D efforts in aerospace technology and technological advancements, resulting in the development of highly advanced flight simulators. These products offer high efficiency and can save fuel costs. Additionally, advancements in computing technology have significantly resulted in the incorporation of better visual and motion systems for enhanced fidelity and smoothness, which is also anticipated to drive the market flight simulators market over the forecast period.

High manufacturing costs coupled with ongoing operation and maintenance costs are some of the factors expected to hamper product demand. Additionally, flight simulators' limited physical environment and behavioral challenges may negatively impact the market over the forecast period. However, the rising concerns over pilot training costs, fluctuating fuel prices, and cost-saving on basic aircraft maintenance and repair favorably impact the industry growth. The development of realistic aircraft flying simulation systems with overhead and ECAM displays using aircraft system logic has significantly resulted in the high adoption of these devices.

The flight simulators are built to replicate the actual aircraft's cockpit and cabin. The dashboard of the flight simulator is fixed with motion and visual systems to create realistic environments for the pilots. It allows the pilots to feel the movement in the aircraft precisely, and the visual systems help them to work out the approach procedures at the airports. The visual systems are designed to offer the pilots a satellite-quality 180-degree view.

Technological advancements resulting in the development of highly advanced flight simulator is expected to drive market growth. Lockheed Martin Corporation offers a flight simulator named Prepar3D, which can recreate the cityscape and night flying illustrations. They have kept it as an open source for private users and software developers to create new applications and environments, thus ensuring the constant evolution of the program. Additionally, advancements in computing technology have significantly resulted in better visual systems offering near-real-world experience, which are likely to drive industry growth over the forecast period.

The rapidly increasing civil aviation industry and escalating government funding to the defense aviation sector worldwide are expected to increase flight simulator demand significantly over the next eight years. Further, rising passenger air travel elevates demand for trained pilots, which positively impacts the flight simulator adoption. Additionally, the development of realistic aircraft system logic with overhead and ECAM displays has significantly resulted in the high adoption of flight simulators.

Rising demand for air travel is expected to propel the global flight simulator market growth over the forecast period. The need to effectively replicate real flying training using motion and visual systems has resulted in the evolution of sophisticated flight simulators in the market. An increase in government spending and growing security concerns, particularly in the military sector, is expected to escalate growth significantly.

The growing importance of aircraft safety and the need for substantial flight training and simulation is anticipated to spur demand over the coming years. Stringent government norms and regulations pertaining to passenger safety are further expected to elevate product demand. The need for flight handling and safety operations, such as situational awareness and flight skill competency, are expected to fuel industry growth. Additionally, increasing demand for better and more effective pilot training is anticipated to catapult growth.

Technological advancements resulting in the development of highly advanced flight simulator is expected to drive market growth. R&D efforts in aerospace technology coupled with performance evaluation of pilots are likely to stimulate market growth over the next few years. The high efficiency of simulation technology and the ability to save fuel costs are expected to serve as key drivers for the market.

The development of simulators for Unmanned Aerial Vehicles (UAVs) is expected to offer alternative opportunities for the global market. Advancements in computing technology have significantly resulted in better visual systems offering near real-world experience, which are expected to drive industry growth over the next seven years.

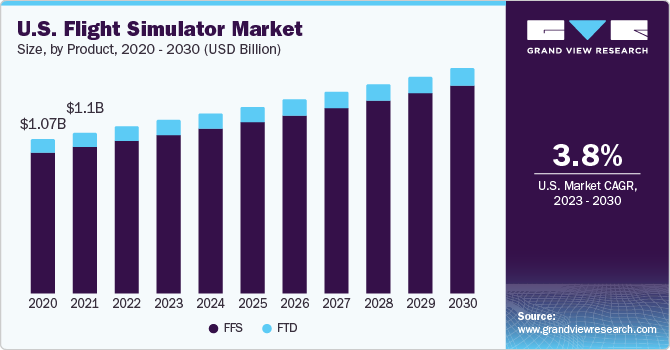

Product Insights

The FFS segment accounted for over 92.0% of the market share in 2022. FFS refers to high-technical flight simulators that offer high fidelity and reliability. FFS accurately stimulates the aircraft and the environment in which it operates. These devices create motion, sound, visuals, and all other aircraft operations to create a realistic training environment, which ensures thorough training for the pilots.

The FTD segment is expected to expand significantly during the forecast period. FTDs are training modules with limited visual display. The primary purpose of these devices is to train where all indicators and switches are on the deck. These devices are extensively used for their low purchase cost and operations. Furthermore, the use of UAV drones has increased the need for the training of drone pilots, which, in turn, is projected to drive market growth.

Application Insights

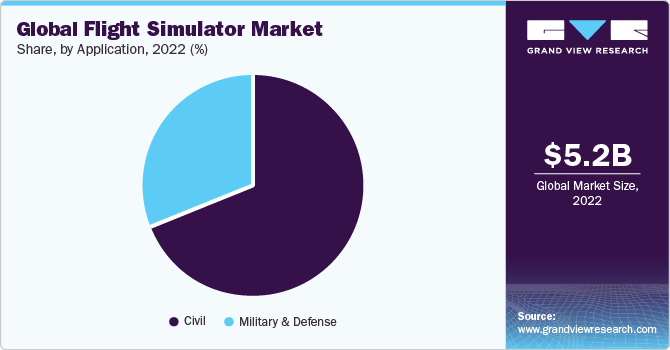

Based on application, the market for flight simulators has been segregated into military, Defense, and civil. The civil segment held the highest market share of 69.2% in 2022. Military and defense include simulators for training and mission rehearsals for armed forces. Further, live, virtual, and constructive training offered by flight simulators enables armed forces pilots to perform better in real-world tasks or missions, resulting in increased product installation.

Manufacturers have realized the importance of improving Aircraft Simulation Technology (AST) to offer a realistic aircraft system. Therefore, they focus on mergers and acquisitions for greater financial, technical, marketing, manufacturing, and distribution resources. For example, Textron, L-3 Communications, and Lockheed Martin have acquired commercial aircraft simulator competitors to reduce their overall exposure to defense markets and seek growth in civil aviation.

The military & defense sector is expected to expand at the fastest CAGR of 4.4% during the forecast period due to the advanced technology, realistic training environments, and cost-effectiveness. Flight simulators provide a safe and controlled training environment for pilots to practice various scenarios and emergency procedures, improving their skills and operational readiness. The complexity of modern military aircraft and the need for extensive training drive the demand for highly immersive simulators. Moreover, simulators help reduce costs associated with live training and contribute to sustainability efforts.

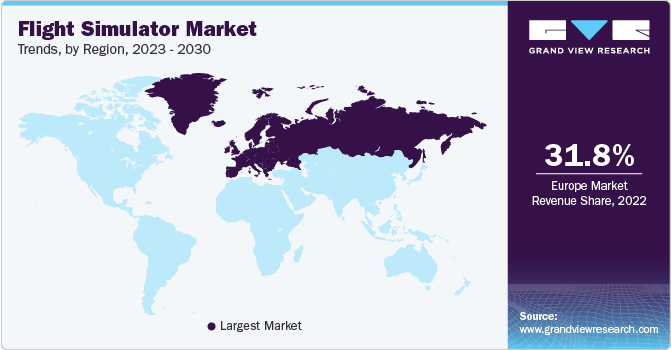

Regional Insights

North America emerged as a key market for flight simulators, accounting for a significant global revenue share in 2022. This is attributable to early technology adoption by manufacturers and consumers. In addition, stringent regulations enforced by the Federal Aviation Administration (FAA) and Federal Aviation Regulations, including Sec. 61.64 for using flight simulators for training purposes, further spur regional growth. Further, advanced military and commercial infrastructure availability is also expected to bolster the market growth for flight simulators in this region.

Europe accounted for the highest revenue share of 31.8% in 2022. This is attributed to the growing demand for flight simulation products for pilot training. Also, the growing emphasis of the European aviation industry on safety and rigorous pilot training is further boosting market growth in the region.

The Asia Pacific is estimated to exhibit high growth over the forecast period owing to increasing demand for these devices, particularly in developing countries such as India and China. The growth in the Asia Pacific region is accredited to the high demand for air travel concerning increased trade and tourism. North America is likely to witness slow growth, primarily due to the apprehensions regarding air safety and strict air safety standards enforced by the FAA in the U.S.

The pandemic hit the aviation industry hard due to restrictions imposed on air travel. The Canadian flight simulator company CAE Inc. reported a decline of 35.8% in the profit from flight simulators during the first quarter of 2020. However, by the end of the second quarter of 2020, the sales of commercial flight simulators experienced an uptick, with demand generated from cargo airlines and carriers. Additionally, civil aviation travel witnessed a substantial growth of approximately 60% across the U.S., Europe, and Latin American regions during the first quarter of 2022.

Key Companies & Market Share Insights

Manufacturers in the market focus on entering into considerable inventory procurement contracts with subcontractors and suppliers that specify determinable products, quantities, and long-term delivery timeframes. Companies focus on mergers and acquisitions to expand their presence as part of expansion strategies.

Key industry participants emphasize integrating with technology providers to enhance product offerings and reduce time-to-market. Suppliers continuously improve Aircraft Simulation Technology (AST) to offer superior products. Notable companies in the market integrate with technology providers to enhance product offerings and reduce product time to market.

Companies also support an interface to the third-party flight simulator, an open-source software generally available through a GNU General Public License (GPL). For instance, in May 2023, miniCOCKPIT, a company specializing in flight simulator accessories, introduced a new autopilot control interface called miniFCU. The interface aims to provide unparalleled realism and compatibility with different flight simulators, including the popular Microsoft Flight Simulator. With its innovative features and expertise-driven design, miniFCU promises to enhance the simulation experience for aviation enthusiasts.

Key Flight Simulator Companies:

- Leonardo S.p.A.

- Boeing

- CAE Inc.

- AIRBUS

- The DiSTI Corporation

- Fidelity Technologies Corporation

- Havelsan Air Electronic Industry

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Meggitt PLC

- Collins Aerospace

- Saab AB

- Teledyne Brown Engineering

- Thales

- VirTra, Inc

Recent Developments

-

In June 2023, the Microsoft Flight Simulator team announced the latest City Update II: France, a free addition that showcases the stunning landscapes of five cities: Angers, Amiens, Nîmes, Nantes, and Reims. As a special highlight for the Paris Air Show, this update also features the renowned Paris-Le Bourget Airport (LFPB) in both festival and standard configurations, adding to the immersive experience for players.

-

In July 2022, L3Harris Technologies was chosen by Airbus to deliver a cutting-edge full-flight simulator for its Toulouse Training Center, specifically for the A320 family. The Reality7e simulator represents the pinnacle of L3Harris' advanced training technology, offering unparalleled fidelity and realism. Additionally, this partnership enabled early access to training devices, ensuring the industry's growing demand for training capacity.

-

In July 2022, CAE introduced its latest innovation in pilot training, the CAE 700MXR Flight Simulator, at the Farnborough International Air Show 2022. This advanced simulator is designed for the emerging eVTOL market and offers a transformative training experience for navigating complex urban environments. The compact mini-motion platform and immersive 360⁰ field of view visuals provide highly realistic and physics-based simulations specifically tailored to single-pilot operations. With the CAE 700MXR Flight Simulator, CAE aims to revolutionize flight training and meet the unique demands of the evolving aviation industry.

Flight Simulator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 5.40 billion |

|

Revenue forecast in 2030 |

USD 7.19 billion |

|

Growth Rate |

CAGR of 4.2% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa |

|

Key companies profiled |

Leonardo S.p.A.; Boeing; CAE Inc.; AIRBUS; The DiSTI Corporation; Fidelity Technologies Corporation; Havelsan Air Electronic Industry; Kratos Defense & Security Solutions, Inc.; L3Harris Technologies, Inc.; Lockheed Martin Corporation; Meggitt PLC; Collins Aerospace; Saab AB; Teledyne Brown Engineering; Thales; VirTra, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Flight Simulator Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyses the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flight simulator market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Full Flight Simulator (FFS)

-

Fixed Flight Training Devices (FTD)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military & Defense

-

Civil

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flight simulator market size was estimated at USD 5.18 billion in 2022 and is expected to reach USD 5.40 billion in 2023.

b. The global flight simulator market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 7.19 billion by 2030

b. The full Flight Simulator (FFS) segment dominated the flight simulator market with a share of 92.0% in 2022. FFS accurately stimulates the aircraft and the environment in which it operates. These devices create motion, sound, visuals, and all other aircraft operations to create a realistic training environment, which ensures thorough training for the pilots.

b. Some key players operating in the flight simulator market include Leonardo S.p.A., Boeing, CAE Inc., AIRBUS, The DiSTI Corporation, Fidelity Technologies Corporation, Havelsan Air Electronic Industry, Kratos Defense & Security Solutions, Inc., L3Harris Technologies, Inc., Lockheed Martin Corporation, Meggitt PLC, Collins Aerospace, Saab AB, Teledyne Brown Engineering, Thales, VirTra, Inc.

b. Key factors that are driving the market growth include the unprecedented R&D efforts in aerospace technology and technological advancements, resulting in the development of highly advanced flight simulators. These products offer high efficiency and can save fuel costs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."