- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Glazing Market Size, Industry Report, 2030GVR Report cover

![Automotive Glazing Market Size, Share & Trends Report]()

Automotive Glazing Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Windscreen, Sidelite, Backlite, Others), By End Use (Passenger Vehicles, LCV, HCV), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-258-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Glazing Market Size & Trends

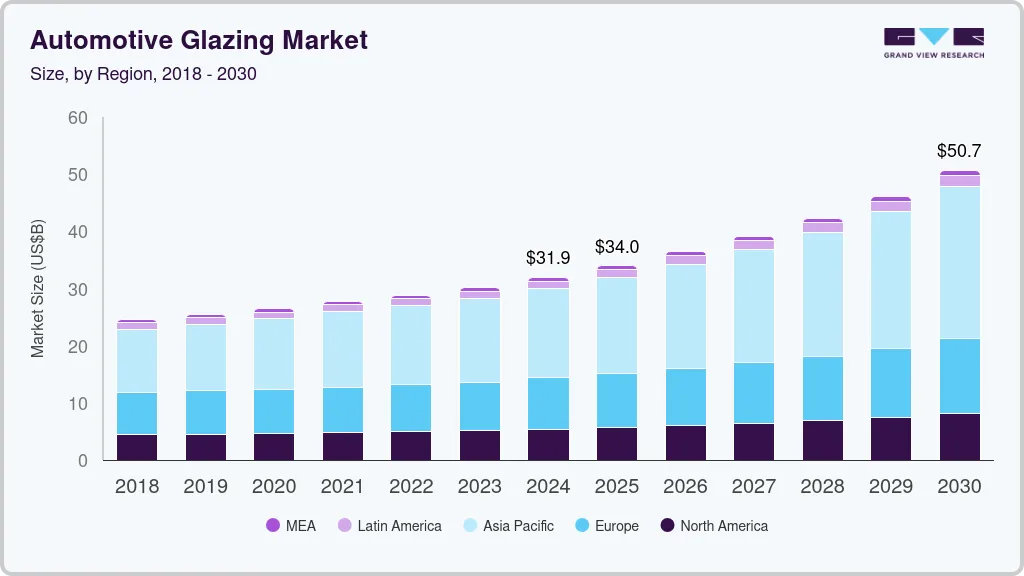

The global automotive glazing market size was valued at USD 31,943.2 million in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. The increasing demand for lightweight automobile parts with enhanced impact resistance and corrosion protection characteristics is anticipated to drive growth for this industry during forecast period. Moreover, the growth of the market is also driven by the increased use of polycarbonates, the adoption of sustainable fuel-efficient vehicles, and the rising demand for vehicles equipped with sunroofs.

In recent years, the automotive glass sector has made significant progress, transitioning from regular, unsafe automotive glass to laminated, tempered glass that offers better safety and other properties. Increasing acceptance of polycarbonate has also been contributing to the growth of this industry. According to the American Chemistry Council, Polycarbonate window glazing is 40-60% lighter than laminated or tempered automotive glass. The decrease in weight leads to improved fuel efficiency in automotive. Moreover, the rise in the need for sustainability-based automotive parts has influenced the development of the automotive glazing industry, prompting manufacturers to focus on viable solutions to improve autonomous vehicle efficiency.

Rising concerns about carbon emissions, which lead to global climate change, have paved the way for increasing focus on low-carbon emission glazing solutions. Therefore, the automotive industry strives to improve automotive components by making them more efficient, less heavy, and more secure. Manufacturers are increasing the use of lightweight materials in car parts to reduce the overall weight of vehicles. The rise in demand for advanced design choices and glazing technologies is anticipated to drive growth in the automotive glazing market.

Application Insights

Based on the applications, the windscreen segment dominated the global industry and accounted for the revenue share of 35.6% in 2023 owing to the demand for smart glass technology integrated into windshields. For instance, Laminated LCG smart glass, integrated with high-quality Polymer Dispersed Liquid Crystal (PDLC) technology by Gauzy, offers the option to control light. In addition, emerging technology trends such as growing inclusion of Advanced Driver-Assistance Systems (ADAS), use of lightweight materials, sustainability initiatives embraced by key market participants, availability of enhanced safety features and design flexibility features are expected to drive growth for this industry.

The sidelite segment is expected to grow at the fastest CAGR over the forecast period. Increasing number of fatalities on the roads have created a demand for safer glass for automobile side windows. According to International Transport Forum’s Road Safety Annual Report 2023, road deaths in the U.S. have increased by 11.9% in first half of 2023 as compared to average of 2017 to 2019. Moreover, the incorporation of laminated glass with high impact and fire resistance properties in sidelites is expected to develop greater growth for this segment. In addition, the low cost and increased safety features of tempered glass are likely to increase its popularity in sidelite application.

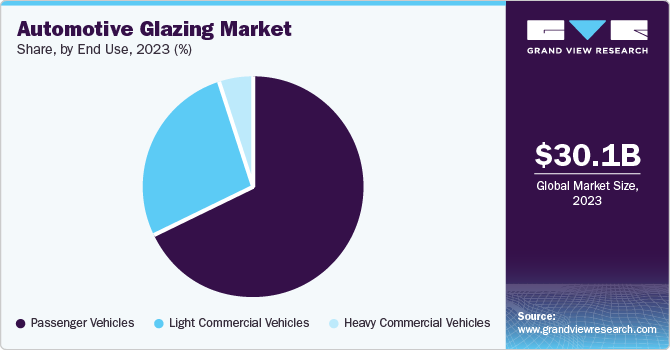

End Use Insights

The passenger vehicles segment has the largest revenue share in 2023. The market is primarily driven by the rising demand for improved car aesthetics and enhanced safety features. Moreover, the rising usage of automobiles and increasing inclination towards the use of vehicles in various regions is projected to enhance growth for this segment. The growing need for sunroofs made of glass and integrated into passenger vehicles is projected to boost the glazing industry. Changing and busy lifestyles contribute to the growing need for vehicles in daily life, driving the need for good-quality automotive glazing.

The heavy commercia vehicles segment is expected to grow at the fastest CAGR over the forecast years. The market growth is driven by the enhanced strength and rigidity of glass and polycarbonate when used in heavy commercial vehicles. Consequently, the demand for lightweight materials such as polycarbonate is anticipated to rise during the forecast period. Toughened glass is commonly found in the side and rear windows of automobiles, and laminated glazing is used for a vehicle’s windshield, driving the market growth of the automotive glazing industry.

Regional Insights

North America automotive glazing market is anticipated to witness significant growth during the forecast period. Technological advancements and innovations are the primary drivers of regional market expansion. Increasing demand for smart glass technology is expected to boost its usage in car windshields in next few years. Furthermore, the regional market is projected to experience growth due with the help of rapid urbanization, enhanced road infrastructure, and favourable regulatory policies fuelling the demand for various types of automotive vehicles.

U.S. Automotive Glazing Market Trends

The U.S. automotive glazing market dominated the regional industry in 2023. This is attributed to numerous factors such as rising focus on improving road safety, growing demand for innovative glazing solutions, rise in road accidents leading to large number oc customers seeking for safer glazing features and more. Different strategies are being employed by industry stakeholders in the country to adopt the most recent technologies in. Automakers are introducing new models equipped with smart glass and various display units developed through novel glazing technologies. Major vehicle market participants are inclined towards incorporating newly developed, innovation-backed automotive glass and associated technologies in their vehicle offerings.

Asia Pacific Automotive Glazing Market

Asia Pacific automotive glazing market dominated the global industry with a revenue share of 48.5% in 2023. The robust automotive manufacturing sector in the region primarily influences the market. Countries such as Japan, South Korea, and India are home to major automotive industry participants such as Toyota, Honda, Hyundai, Nissan, Kia, Suzuki, Tata, Mazda, and others. The automotive glazing market in the region is driven by factors such as increasing demand for cost-effective and technologically advanced glazing solutions, a rise in road accidents leading to an increase in demand for safer glazing solutions, and the entry of multiple global companies in the region. According to India Brand Equity Foundation, an Initiative of the Ministry of Commerce and Industry, Government of India, the automobile sector in the country received cumulative equity FDI inflow of nearly USD 35.65 billion during April 2000 - December 2023 and it is on its way to become largest EV market by 2030.

India automotive glazing market is expected to grow at rapid rate during forecast period. This market is mainly influenced by the rise in vehicle production, growing embracement of technological advancements by the key market participants in automobile industry, increasing foreign investments in the country and inclination of consumer towards vehicles equipped with enhanced aesthetics, safety features and comfort at the same time. According to India Brand Equity Foundation, multiple brands such as Tata Motors, Maruti Suzuki, Hyundai Motors, Mercedes-Benz, Mahindra & Mahindra Ltd., Renault Nissan and others have announced several investments of diverse nature in India.

Europe Automotive Glazing Market Trends

Europe automotive glazing market was identified as a lucrative region in 2023. Growing investments in research and development activities, rising demand for the safer glazing solutions and technology, advancements in the technological features, increasing inclination towards use of enhanced glazing products to minimize the after-effects in case of road accidents and crashes, inclusion of innovations are some of the key growth driving factors for this industry. According to Eurostat, during end of 2022 and end of 2023, total number of battery only passenger cars (electric had increased by 49.0%) in the European Union.

Germany automotive glazing market is expected to grow at lucrative growth rate from 2024 to 2030. The projected growth of this industry is attributed to the presence of strong automotive manufacturing industry in the country. The country is home to multiple key brands from automotive industry such as Volkswagen, Mercedes-Benz, BMW,AUDI, Opel, Porsche and others. The continuous nature of innovations in Germany’s automotive sector is expected to generate greater growth for this market in approaching years.

Key Automotive Glazing Company Insights

Some of the key participants in the global automotive glazing market are Central Glass Co., Ltd., Corning Incorporated, Fuyao Group, KRD Sicherheitstechnik GmbH, Mitsubishi Electric Corporation, and others. The major market participants are adopting various strategies such as enhanced R&D effort, inclusion of innovative technologies in the products, collaborations, and others.

-

Fuyavo group, one of the prominent companies in development, design, production, supply and other services of automotive glass as well as automotive accessories, offers wide range of automotive glazing solutions such as HEAD UP DISPLAY (HUD) glass, heating glass, semi-tempered laminated glass, acoustic glass, hydrophobic glass, and others. It also offers dimming glass, antenna glass, heat insulation glass, photovoltaic glass, lightweight glass, panoramic sunroof, exterior decoration, flush styling windows, sliding window assembly and more related products.

-

Corning Incorporated, a key industry participants in materials industry, offers range of solutions related to glass, optical physics and ceramic science. The company operates in multiple business segments such as display technologies, optical communications, environmental technologies, specialty materials, life sciences and others. The automotive glass solutions of the company include dashboards and consoles, automotive windshields and windows, head-up displays, and more.

Key Automotive Glazing Companies:

The following are the leading companies in the automotive glazing market. These companies collectively hold the largest market share and dictate industry trends.

- Central Glass Co., Ltd.

- Corning Incorporated

- Fuyao Group

- KRD Sicherheitstechnik GmbH

- Mitsubishi Electric Corporation

- Pilkington (Nippon Sheet Glass Co., Ltd.)

- SABIC

- Saint-Gobain Sekurit

- SCHOTT

- Trinseo

Recent Developments

-

In June 2024, Guardian Glass, one of key companies in the glass industry, and Webasto Luxembourg (Webasto Group), manufacturer of sunroofs, battery, heating and cooling solutions, announced that two have entered an agreement, where Guardian Glass has taken up the responsibility to supply novel coated glass solution entailing the Guardian SilverGuard family for Webasto’s panoramic sunroofs.

Automotive Glazing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34, 019.4 million

Revenue forecast in 2030

USD 50,671.4 million

Growth Rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Million Meter Square, Revenue in Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Brazil, and South Africa

Key companies profiled

Central Glass Co., Ltd.; Corning Incorporated; Fuyao Group; KRD Sicherheitstechnik GmbH; Mitsubishi Electric Corporation; Pilkington (Nippon Sheet Glass Co., Ltd.); SABIC; Saint-Gobain Sekurit; SCHOTT; Trinseo

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Glazing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive glazing Market report based on application, end use, and region.

-

Application Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

Windscreen

-

Sidelite

-

Backlite

-

Others

-

-

End Use Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Regional Outlook (Volume, Million Meter Square; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.