Thailand Medical Tourism Market Size, Share & Trends Analysis Report By Treatment Type (Neurosurgery And Spine Surgery, ENT Surgery, Dentistry, Oncology), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-312-7

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Thailand Medical Tourism Market Trends

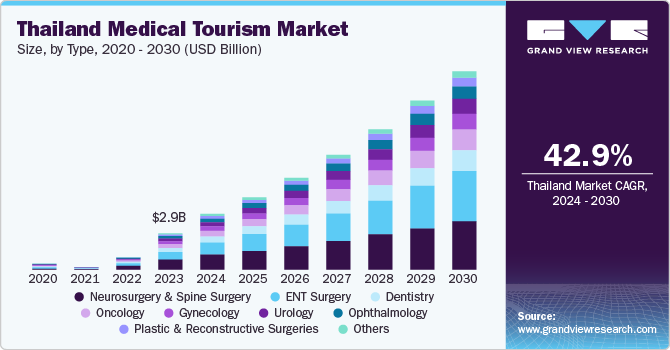

The Thailand medical tourism market size was estimated at USD 2.9 billion in 2023 and is projected to grow at a CAGR of 42.9% from 2024 to 2030. As healthcare technology advances, affordability increases and the demand for specialized treatments abroad increases, the Thailand medical tourism market is projected to expand. Additionally, increasing demand for uninsured procedures such as gender reassignment surgeries, fertility treatments, dental reconstruction and cosmetic surgery is driving the industry.

In developing countries such as Thailand, high-quality care can be obtained at a lower cost than in developed countries such as the U.S. For instance, coronary angioplasty costs about USD 55,000 to USD 57,000 per person in the U.S., while it costs about USD 4,500 to USD 10,600 in Thailand. People travel from countries such as the U.S. and Europe for treatments to Singapore, and Thailand, saving between 55% and 70% on medical costs.

The country has a well-connected transportation network, making it easy for international patients to reach Thailand. Additionally, many airlines offer direct flights to major cities in the country. Moreover, the people are known for their warm hospitality and excellent customer service, which extends to the healthcare sector. The country has developed a strong healthcare system with well-trained medical professionals, state-of-the-art facilities, and advanced medical technology. This ensures that patients receive high-quality medical care.

In addition, developing countries are known to have well-known surgeons who attract millions of patients every year for various medical procedures. Medical prices in Thailand are 30-40 percent lower than in the U.S., UK and other European countries. Many foreigners seek surgeries in these countries such as facial aesthetic procedures, dental implants, breast implants, facelifts, and liposuction. Improvement in healthcare infrastructure and availability of high-quality healthcare services at an affordable price is anticipated to propel the market growth.

Medical tourism has offered the opportunity to avoid long queues for treatments by traveling abroad for treatment. Therefore, many international patients turn to medical tourism to save time and avoid aggravating medical problems by traveling abroad, where immediate procedures are offered.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. Medical tourism in Thailand has experienced significant growth over the years. The country has become one of the top destinations for international patients seeking high-quality medical treatments at affordable costs. The country has numerous internationally accredited hospitals and specialized centers that offer a wide range of medical procedures and services. Moreover, this cost advantage has attracted many patients from countries where healthcare is expensive or inaccessible. Some of the hospitals in Thailand serving the purpose are Bangkok Hospital, Bumrungrad Hospital, Phyathai Hospitals, Ramkhamhaeng Hospital, Samitivej Sukhumvit Hospital and much more.

The country has well-developed infrastructure and several international airports, making it convenient for patients to reach their desired medical facilities.

Additionally, Thailand's reputation as a popular tourist destination plays a role in the growth of medical tourism. According to the Nation Thailand, in October 2023, Thailand's medical tourism industry had ranked 5th globally. Moreover, it generated approximately 11.9 billion baht in revenue from foreign patients which accounted for over 47% increase as compared to the pre-covid days.

Many hospitals and healthcare facilities in Thailand have sought strategic partnerships with international healthcare providers to enhance their capabilities and attract more international patients. These partnerships often involve the exchange of knowledge, technology, and best practices. Some M&A activities in the Thailand medical tourism market have aimed to strengthen the competitive position of participating entities. By consolidating resources and expertise, organizations can enhance their market presence and competitive advantage. Moreover, the government of Thailand has been introducing favorable policies to support the medical tourism in the country. For instance, according to the eTurbo News, in February 2024, Thailand launched USD 14,000 medical coverage for tourists. This step reassured the patient’s safety in the Asian country, ensuring proper care.

Treatment Type Insights

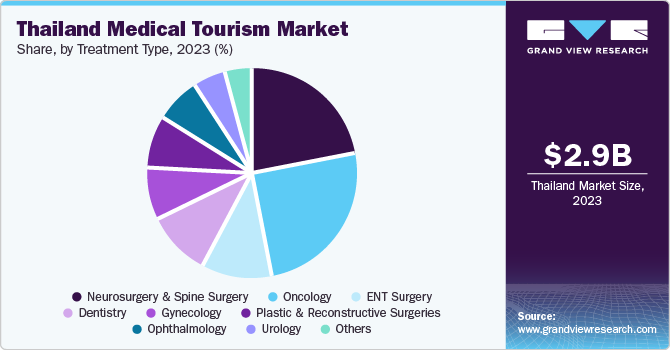

Oncology dominated the market and accounted for a share of around 25% in 2023. Thailand is known for providing high-quality oncology treatment, with many hospitals and medical institutions being equipped with advanced technology, state-of-the-art facilities, and skilled healthcare professionals specialized in cancer care. The cost of oncology treatment in Thailand is comparatively lower than in many Western countries, making it an attractive option for patients seeking affordable yet high-quality care.

Neurosurgery and spine surgery is expected to register the fastest CAGR during the forecast period. Thai hospitals offer the highest level of brain surgery care as they are equipped with the latest technology and internationally trained neurosurgeons. They are known for their world-class neuro-oncology and highly trained neurosurgeons and are a leader in the treatment of brain tumors.

Key Thailand Medical Tourism Company Insights

Some of the key companies operating in the Thailand medical tourism market include Bumrungrad International Hospital, Mount Elizabeth Hospitals, Kasemrad International Rattanatibeth Hospital; and Mission Hospital, Bangkok Hospital and Miot Hospitalnare.

Key Thailand Medical Tourism Companies:

- Bumrungrad International Hospital

- Mount Elizabeth Hospitals

- Raffles Medical Group

- Dr. B. L. Kapur Memorial Hospital

- Kasemrad Hospital International Rattanathibet

- Mission Hospital

- Bangkok Hospital

- Miot Hospital

- Penang Adventist Hospital

Recent Developments

-

In March 2024, Vejthani Hospital, a hospital in Thailand, launched its information centre in capital's Panthapath, Bangladesh, along with their local representative MediAider. This launch enabled the patients from a different location to get information about the treatments in the hospital and book doctors' appointments.

-

In January 2024, Bangkok Dusit Medical Services Public Company Limited (BDMS) partnered with CNN International Commercial (CNNIC). This partnership was performed to advance medical technology and finding solutions to health issues.

-

In October 2023, Thailand waived off visa requirements for the foreign travelers from India. This move is aimed to attract more foreign travelers to the country for treatments and tourism.

-

In November 2023, PlacidWay, a global leader in health tourism, partnered with Vega Stem Cell Clinic. This partnership was aimed in expanding health tourism and in revolutionizing the landscape of regenerative medicine in the country.

-

In June 2019, Samitivej Hospital Group has set a budget of 1.5 billion to aim and improve service quality and to buy new medical equipment for the ease in the treatment of the patients.

Thailand Medical Tourism Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 16.0 billion |

|

Growth rate |

CAGR of 42.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Treatment type |

|

Country scope |

Thailand |

|

Key companies profiled |

Bumrungrad International Hospital; Mount Elizabeth Hospitals; Raffles Medical Group; Dr. B. L. Kapur Memorial Hospital; Kasemrad Hospital International Rattanathibet; Mission Hospital; Bangkok Hospital; Miot Hospital; Penang Adventist Hospital |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Thailand Medical Tourism Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Thailand medical tourism market report based on treatment type.

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery and Spine Surgery

-

ENT Surgery

-

Dentistry

-

Oncology

-

Gynecology

-

Urology

-

Ophthalmology

-

Plastic & Reconstructive Surgeries

-

Others

-

Frequently Asked Questions About This Report

b. The Thailand medical tourism market size was valued at USD 2.9 billion in 2023.

b. The Thailand medical tourism market is projected to grow at a compound annual growth rate (CAGR) of 42.9% from 2024 to 2030 to reach USD 16.0 billion by 2030

b. Oncology dominated the market and accounted for a share of around 25% in 2023. Thailand is known for providing high-quality oncology treatment, with many hospitals and medical institutions being equipped with advanced technology, state-of-the-art facilities, and skilled healthcare professionals specialized in cancer care. The cost of oncology treatment in Thailand is comparatively lower than in many Western countries, making it an attractive option for patients seeking affordable yet high-quality care.

b. Some of the key companies operating in the Thailand medical tourism market include Bumrungrad International Hospital; Mount Elizabeth Hospitals, Kasemrad International Rattanatibeth Hospital; and Mission Hospital, Bangkok Hospital and Miot Hospitalnare.

b. Due to advances in healthcare technology, affordability, and increasing demand for specialized treatments, more people are seeking medical services abroad, which is anticipated to fuel the expansion of the Thailand medical tourism market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."