Thailand Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Hemp, Marijuana), By Derivatives (CBD, THC), By Cultivation, By End Use (Industrial Use, Recreational Use), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-989-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Thailand Legal Cannabis Market Size & Trends

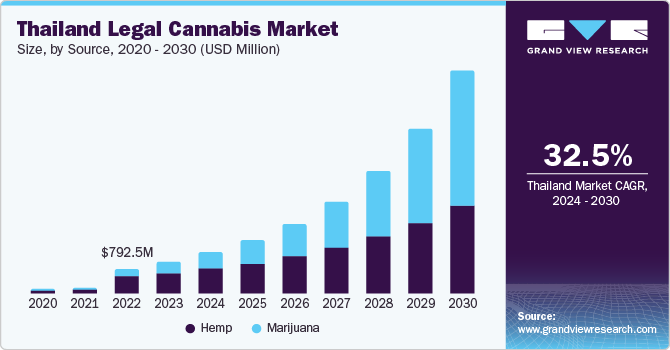

The Thailand legal cannabis market size was estimated at USD 1.31 billion in 2024 and is expected to grow at a CAGR of 33.0% from 2025 to 2030. Market growth can be attributed to the legalization of cannabis, growing awareness about the therapeutic benefits of cannabis-based products, and increasing use of cannabis for recreational & medical purposes. In addition, it is useful to treat neurologic problems, such as epilepsy, depression, and anxiety. For instance, according to Bumrungrad International Hospital, in Thailand, approximately 700,000 people are suffering from epilepsy.

Furthermore, there is a high demand for various cannabidiol (CBD)-infused products, such as beauty products, cannabis oil, beverages, gummies, capsules, etc. in the market. CBD can be consumed through various means, such as vaping, smoking, ingesting, and transdermal routes. CBD is utilized to produce personal care products and medical drugs. Legalizing cannabis-based products has opened up significant opportunities for various end-use industries to expand their product offerings. For instance, in April 2023, SAPPE or Sappe PCL, a provider of functional drinks in Thailand, introduced CBD water under the brand name “SAPPE Keaf” in two flavors such as CBD Water Vitamin B Complex with peach flavor, which enhances work attention with essential ingredients such as vitamin B complex, including B5, B3, B6, & B12 and honey-yuzu flavored CBD Water Chamomile sour-sweet in taste, which helps in relaxation. Thus, a surge in the launch of new products is anticipated to propel market growth.

Moreover, hemp-derived CBD has several medical benefits. Medical CBD is most commonly used for pain control. It helps relieve nerve pain and pain of multiple sclerosis in addition to being used as a muscle relaxant. These health benefits have contributed to the popularity of medical CBD in the pharmaceutical industry. For example, SEYA Relief, Bloom and Mellow Organic are some of the CBD oil brands available in Thailand. A favorable regulatory framework for hemp cultivation and growing demand for hemp-based CBD products are projected to drive this segment over the forecast period.

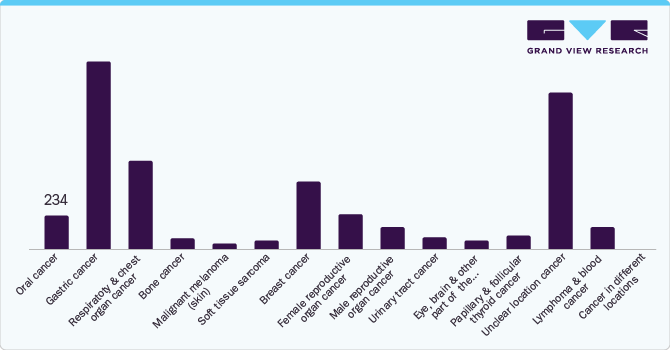

The demand for medical marijuana is expected to grow significantly over the forecast period due to various factors. One of the key drivers is the high prevalence of cancer. For instance, according to the Global Cancer Observatory, Thailand recorded 190,636 cancer cases in 2020. In addition, the growing burden of chronic pain and the increasing demand for pain management therapies are expected to contribute to the rise in demand for cannabis over the forecast period.

The Thai government's Public Health Policy ensures that every patient who requires medical cannabis has equal access to all possible forms of treatment. This includes traditional Thai medicine, modern drugs, traditional remedies suggested by local healers, and drugs not yet registered but of high quality and made available through the Special Access Scheme (SAS). Thus, such initiatives are expected to boost the demand for medical cannabis in Thailand.

In addition, the increasing number of patients opting for medical cannabis, farmers choosing cannabis as a new cash crop, and better government initiatives for increasing economic opportunities for home cultivators, as well as licensed producers, are among the factors anticipated to boost the cannabis industry in Thailand over the forecast period. For instance, according to a deputy government spokesperson, Traisulee Traisoranakul, as of February 2021, around 251 provincial hospitals and 2,500 households had cultivated 15,000 cannabis plants.

Thailand is emerging as a popular cannabis tourism destination across the globe. Although cannabis tourism is still in its initial stage in Thailand, it is already gaining popularity among tourists who desire unique experiences and adventures. Cannabis has been easily available in Bangkok and Chiang Mai. However, the southern islands of Thailand, such as Krabi, Railay, Koh Lanta, Koh Phangan, and Koh Lanta, have popular cannabis cafes & rasta bars. These places offer numerous relaxing spots for cannabis consumers, which can drive the market.

Furthermore, recently, in February 2024, Thailand's Health Minister, Cholnan Srikaew, stated that by the end of 2024, the recreational use of cannabis will be prohibited in the country. However, the use of cannabis for medical purposes will still be permitted. The minister further added, "Without the law to regulate cannabis, it will be misused, and the misuse of cannabis has a negative impact on Thai children." The proposed ban poses challenges for the cannabis industry in Thailand, including growers, dispensaries, and consumer-agro firms.

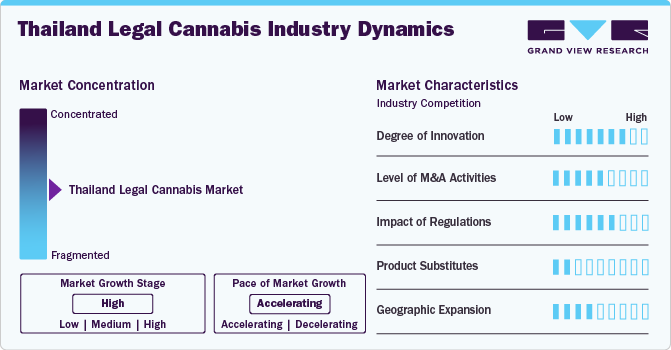

Market Concentration & Characteristics

The Thailand legal cannabis market is characterized by a high degree of innovation owing to increased product demand due to its therapeutic benefits without intoxication, growing preference for cannabis extracts such as tinctures and oils, and rising R&D activities on the use of cannabis and its medicinal properties. For instance, in May 2022, Charoen Pokphand Produce (CPP) and Charoen Pokphand Foods (CPF), under the umbrella of agribusiness and food conglomerate CP Group, collaborated with Gunkul Engineering, a construction and renewable energy developer company, to develop cannabidiol-infused beverage products and food.

Thailand legal cannabis market is characterized by a medium level of merger and acquisition (M&A). Companies adopt various growth strategies to strengthen their market positions and revenues, which further helps drive market growth. For instance, in February 2024, Teera Holding Co., Ltd., a Thai medicinal herb operator, acquired Golden Triangle Group Co., Ltd., a cultivation facility and Thailand’s first CUMCS/GACP certified cultivator in Chiang Rai, Thailand.

The cannabis industry in Thailand is flourishing due to a structured regulatory framework for the cultivation and sale of cannabis. The Thai FDA is the primary regulatory authority for cannabis- and hemp-related products in Thailand. These products are subject to monitoring and regulation under the Narcotics Act, especially extracts of cannabis and hemp containing more than 0.2% Tetrahydrocannabinol (THC) by weight. Furthermore, cannabis cultivation is regulated and categorized by the Cannabis and Hemp Act drafting committee. Similarly, in February 2024, the Thai Health Minister announced the ban of recreational consumption of cannabis by the end of 2024. However, the ambiguity surrounding the current allowances, is hampering the recreational cannabis business scenario in Thailand.

Some non-cannabis cannabinoids are considered to have similar health benefits as cannabis derivatives. These include ginger root, magnolia, black pepper, clove oil, echinacea, and peony. However, despite their comparable medicinal properties, their use in medicinal applications is limited.

Several market players are expanding their business into new regional countries to strengthen their market position and product portfolio. For instance, in December 2023, Sunderstorm, Inc. announced its plan to expand the KANHA brand by launching operations into Thailand's cannabis market.

Source Insights

By source, the hemp segment dominated the market with the highest revenue share of 61.9% in 2024. Due to the legalization of hemp and the increasing awareness of the levels of CBD present in it, there has been a surge in demand for hemp extracts across various industries, such as cosmetics, personal care, nutraceuticals, and pharmaceuticals. For instance, beauty brands such as Element Apothec, derived from hemp are available in Thailand. Moreover, the rising trend for using organic and sustainable clothing has impelled growth opportunities for adopting hemp-based textiles in the textile & clothing industry. For instance, Prestige Creations Co. Ltd., a Thai manufacturer of packaging bags, offers modern printed hemp cushions for home decoration, durable hemp cosmetic bags, and medium-sized hemp handbags.

The marijuana segment is expected to grow at fastest CAGR over the forecast period. The demand for marijuana in Thailand is expected to increase due to growing awareness about its therapeutic applications, such as appetite enhancement, pain management, and eye pressure reduction, further changing consumer behavior toward recreational marijuana. Moreover, smoking cannabis is much more economical than purchasing oral products or tinctures, and hence, most people prefer smoking. In addition, the onset of action post-smoking cannabis is rapid. For instance, according to several studies conducted in Thailand, 41% of individuals with cancer expressed a desire to use cannabis-based products, which included cannabis flowers and buds. This increases the growth potential of the segment.

Cultivation Insights

By cultivation, the indoor cultivation segment accounted for the largest revenue share of 54.7% in 2024 and is expected to register a fastest growth over the forecast period. Indoor cultivation refers to growing cannabis in an enclosed area, which could be a room, tent, or designated area mimicking nature. Thai and foreign investors are greatly interested in the Thailand cannabis market. The country has seen a rise in investment in indoor farming from various countries such as the U.S., Russia, Australia, Singapore, and Europe. For instance, in April 2022, Medicana Lab Co planned to spend USD 3.36 million (120 million baht) to boost its medical hemp business by manufacturing CBD oil from its hemp farm via a closed system.

The outdoor cultivation segment is expected to grow significantly over the forecast period. The cost of cultivating cannabis outdoors is comparatively cheaper than other cultivation methods due to the natural environment providing most of the essential growing factors for cannabis plants. This results in a rise in the number of outdoor cultivation farms, as it eliminates the need for expensive growing equipment and lowers the overall cost of operation, thereby boosting the segment's growth.

Derivatives Insights

By derivatives, the CBD segment dominated the market with the largest revenue share of 79.6% in 2024, and the segment is registered for the fastest CAGR growth over the forecast period. Increased use of CBD in nutraceutical products, is positively impacting the industry growth. Numerous nutraceutical companies are incorporating CBD into supplements and functional foods and offering them in different packaging forms. For instance, in China, MGC Pharmaceuticals offers a range of nutraceutical-based products such as BCAA CBD hemp powder, CBD capsules, CBD herbal V-pen, and water-soluble CBD solution. They have plans to expand their operations in Thailand, Japan, Vietnam, and South Korea. In addition, some companies have introduced CBD-based pet food to the market.

The THC segment held a significant market share in 2024 and is expected to show lucrative growth over the forecast period. The legal landscape of cannabis in Thailand has recently undergone a transformative shift, and more people are accepting THC. The Thai government allows controlled levels of THC in various cannabis products. This change highlights the increasing recognition of the therapeutic potential of THC and its positive effect on medical conditions, resulting in a significant expansion of segment growth in Thailand.

End Use Insights

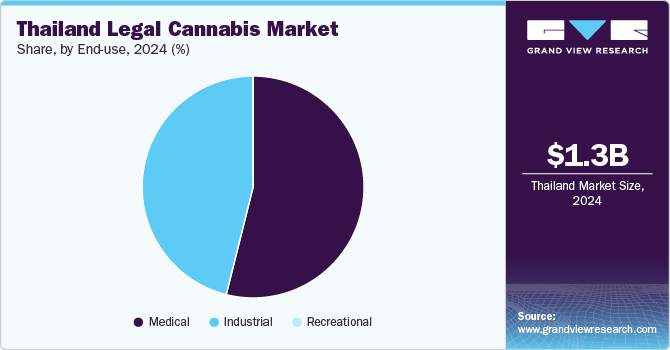

The medical use segment dominated the market with a revenue share of 53.9% in 2024. Currently, marijuana is used on a large scale for the treatment of chronic pain, mental disorders, such as anxiety, and sleep disorders. The growing prevalence of cancer and the application of cannabis for medical use is increasing as the demand for cannabis and cannabis-based products is rising. For instance, according to the American Society of Clinical Oncology (ASCO) 2022 estimates, approximately 200,000 people are diagnosed with cancer every year in Thailand.

The industrial use segment held a significant market share in 2024. Hemp is one of the oldest known textile fibers and has experienced a boost in demand after its legalization. Legalization has increased the focus on analyzing the technical properties of hemp, thereby increasing research efforts. Furthermore, consumers are increasingly adopting cannabis in various non-textile applications to reduce pollution, deforestation, and non-biodegradable waste in landfills. For instance, Hempcrete, a construction material made from hemp, is an effective insulator that can help maintain comfortable indoor temperatures in Thailand's tropical climate, thereby reducing the need for energy-intensive cooling systems.

Key Thailand Legal Cannabis Company Insights

Key companies in the market are adopting various strategies, including mergers & acquisition, partnerships & collaborations, and new product launches, to increase their market share and strengthen their position in the market. For instance, in August 2023, Go High Thai, a leading Thailand cannabis dispensary website, launched a comprehensive directory listing all legal cannabis dispensaries in Thailand. Some of the key companies operating in the market include PharmaHemp, Tilray Brands, Canopy Growth Corporation, Medipharm Labs, Cresco Labs, and Dr. CBD Innovation Center.

Key Thailand Legal Cannabis Companies:

- PharmaHemp

- Tilray Brands

- Canopy Growth Corporation

- Medipharm Labs

- Cresco Labs

- Extractas

- BOL Pharma

- Elixinol

- Dr. CBD Innovation Center

- SAPPE

- Osotspa Public Company Limited

Recent Developments

-

In December 2024, Dope, a Cannabis Dispensary in Thailand, expanded its offerings, such as THCA flower and other Farm Bill-compliant products, including Delta-9 gummies and THCA vapes, to the U.S. through its online platform, DOPETHC.COM.

-

In August 2023, CMU and Atlanta Medicare invested USD 28 million in constructing closed-system cannabis manufacturing facilities in Thailand. The facilities will be ready for production by early 2024.

-

In December 2022, Sunderstorm, a manufacturer of cannabis products, partnered with THCG Group Ltd., a Thailand-based cannabis company, to launch Kanha cannabis and hemp gummies.

-

In January 2022, Osotspa Public Company Limited joined forces with Yanhee Vitamin Water Company Limited to tap into the cannabis and hemp-based beverage market. This strategy opened up a new business opportunity and paved the way for expansion into a market with strong growth potential.

Thailand Legal Cannabis Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.70 billion |

|

Revenue forecast in 2030 |

USD 7.10 billion |

|

Growth rate |

CAGR of 33.0% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, cultivation, derivatives, end use |

|

Country scope |

Thailand |

|

Key companies profiled |

PharmaHemp; Tilray Brands; Canopy Growth Corporation; Medipharm Labs; Cresco Labs; Extractas; BOL Pharma; Elixinol; Dr. CBD Innovation Center; SAPPE; Osotspa Public Company Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Thailand Legal Cannabis Market Report Segmentation

This report forecasts revenue growth and provides at country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Thailand legal cannabis market report based on source, cultivation, derivatives, and end use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemp

-

Hemp oil

-

Industrial Hemp

-

-

Marijuana

-

Flower

-

Oil and Tinctures

-

-

-

Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Cultivation

-

Greenhouse Cultivation

-

Outdoor Cultivation

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

End Use Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Use

-

Medical Use

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Post-Traumatic Stress Disorder (PTSD)

-

Cancer

-

Migraines

-

Epilepsy

-

Alzheimer’s

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Tourette’s

-

Diabetes

-

Parkinson's

-

Glaucoma

-

Others

-

-

Recreational Use

-

Frequently Asked Questions About This Report

b. The Thailand legal cannabis market is projected to grow at a CAGR of 33.0% over the forecast period and is expected to reach USD 7.10 billion by 2030.

b. The Thailand legal cannabis market size was estimated at USD 1.31 billion in 2024 and is expected to reach USD 1.70 billion in 2025.

b. The hemp segment dominated the Thailand legal cannabis market in 2024 and accounted for the largest revenue share of 61.9%. Growing usage of hemp for industrial purposes is one of the key factors that fuels the segment’s growth.

b. The key plyers of Thailand Legal Cannabis Market are: PharmaHemp, MediPharm Labs, Inc., Cresco Labs,Elixinol Thailand Limited, Tilray, Extractas, BOL Pharma, Canopy Growth Corporation, THC Thailand Group Ltd.

b. Rising adoption rate of cannabis by various industry, growing government initiatives to support the cannabis industry, rising number of players entering the market and increasing disposable income of the region are some of the factors that are driving the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."