Texture Paints Market Size, Share & Trends Analysis Report By Product, By Technology (Water-based, Solvent-based), By Application (Residential, Non-residential), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-356-1

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Texture Paints Market Size & Trends

“2030 Texture Paints Market value to reach USD 16,816.5 million”

The global texture paints market size was estimated at USD 12,357.21 million in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. The market growth is attributed to the increasing demand from end-use industries, such as construction industry. These paints are used for interior design in both residential and non-residential spaces. In addition, the demand for residential structural paints for decoration or repainting drives the market growth.

Texture paints are special coatings used to create a surface texture on roofs, walls, or other surfaces, adding depth and visual interest to the finish. They contain additives such as silica, sand, or other granular materials to achieve different textures or textured effects. Texture paints often cover wall imperfections, enhance aesthetic appeal, and provide a tactile experience in outdoor and indoor spaces.

Drivers, Opportunities & Restraints

The market is expected to be supported by growing construction activities and government investments in public infrastructure projects. There is a rising demand for aesthetic enhancements in building structures, which provide decorative appeal and serve functional purposes such as covering imperfections and adding durability.

Texture paints are commonly used in residential and non-residential settings. However, these chemicals can lead to respiratory issues due to the release of Volatile Organic Compounds (VOCs) during application and drying. Continuous exposure to these compounds can contribute to indoor air pollution and worsen respiratory conditions. In addition, some of these paints contain allergens or irritants, which can pose risks to individuals with sensitivities or allergies. To address these health concerns, manufacturers can develop low-VOC or VOC-free alternatives, aligning with the preferences of health-conscious consumers and promoting market growth for texture paints.

Rapid urbanization and infrastructure development: The increasing pace of urbanization, particularly in developing countries, is creating a significant demand for paints and coatings for construction and renovation activities. This trend is expected to be a major driver of market growth in the coming years.

Product Insights

“Acrylic emerged as the fastest growing application with a CAGR of 5.0%”

The acrylic segment led the market with the largest revenue share of 46.8% in 2023. Acrylic texture paints are a type of paint that combines acrylic paint with materials to create a textured finish on various surfaces. These paints are known for their durability and versatility, as they adhere well to most surfaces without cracking or fading over time. They are particularly popular in creating artistic effects and adding dimension to artwork, walls, and furniture. The texture in these paints can range from fine to coarse, offering a wide array of tactile and visual finishes.

Epoxy texture paints are a unique blend incorporating epoxy resin with various texturizing materials to provide a durable, hard-wearing, and textured finish. This type of paint is highly resistant to chemicals, water, and abrasion, making it ideal for surfaces that require added protection and a distinctive look. It's widely used in industrial and commercial settings, as well as for residential floors and walls, to add both aesthetic appeal and long-lasting durability. The texture achieved with epoxy paints can vary greatly, allowing for customization in design from smooth to highly textured surfaces, suitable for a wide range of applications.

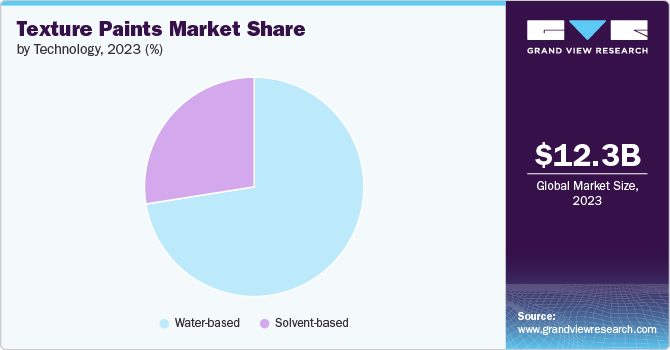

Technology Insights

“Water-based dominated the market with a market share of 72.5% in 2023”

Based on technology, the water-based segment led the market with the largest revenue share of 72.5% in 2023. Water-based texture paints feature a blend of water-soluble bases with texturizing agents. This makes them more environmentally friendly and easier to clean up, merely requiring water instead of harsh chemicals. They're versatile, allowing for various finishes ranging from subtle to dramatic textures. These paints dry quickly and emit lower levels of VOCs, making them a safer choice for indoor environments. Plus, their ease of application appeals to DIY enthusiasts and professionals seeking efficient yet visually striking textural finishes.

The solvent-based texture paints are a formulation where the pigment and binder are dissolved in an organic solvent. This type of paint is known for its durable and hard-wearing finish, making it suitable for exterior applications and high-traffic areas. The solvent aids the paint's application, allowing it to spread evenly and create various surface textures. As the solvent evaporates, it leaves a robust textured coating that can withstand environmental elements. However, its high VOC content requires adequate ventilation during application and curing.

Application Insights

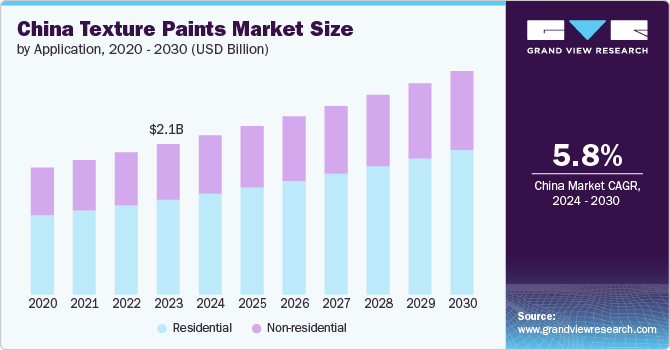

“Residential emerged as the fastest growing application with a CAGR of 5.9%”

Based on application, the residential segment led the market with the largest revenue share of 59.5% in 2023. Texture paints add a vibrant and unique dimension to residential interiors, elevating the space's aesthetic appeal. They are known for their ability to provide tactile quality to walls, offering a range of finishes from smooth to coarse, depending on the application technique. These paints not only enhance the visual interest through various effects such as stucco, sand, or popcorn textures but also help conceal imperfections on the walls, making them a practical choice for new and renovation projects. In addition, texture paints offer a durable coating, making them ideal for high-traffic areas in homes.

The non-residential segment also plays a significant role, imparting unique aesthetic and functional benefits. In commercial spaces, these paints can transform mundane walls into visually appealing surfaces, enhancing brand image and creating a dynamic work environment. Various textures can emulate materials like stone or wood, providing cost-effective alternatives to actual materials. The durable nature of texture paints makes them well-suited for areas with high public footfall, offering long-lasting performance with minimal maintenance. Their ability to conceal wall imperfections is particularly valued in older buildings, aiding renovation efforts to modernize spaces without extensive structural changes.

Regional Insights

“China is expected to dominate the Asia-Pacific market with a market share of 33.5% in 2030”

The texture paints market in North America is expected to witness at a significant CAGR over the forecast period, owing to high demand for non-residential construction projects such as hospitals, commercial buildings, and colleges. The implementation of the "Affordable Healthcare Act" in 2023 is also expected to stimulate the construction of a greater number of health care units and hospitals, which, in turn, is expected to boost the demand for architectural and decorative paints and coatings in the region over the forecast period.

Asia Pacific Texture Paints Market Trends

Asia Pacific dominated the texture paints market with the largest revenue share of 45.60% in 2023. Rising construction activities and growing demand for the product market from the residential and non-residential sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.

The texture paints market in China is expected to be one of the promising markets in the region on account of the government’s support to promote investments in the manufacturing sector. Several companies are expanding or setting up new manufacturing facilities owing to low labor costs and ease of raw material procurement in the country. The growing manufacturing sector is expected to propel the demand for texture paints in construction industries.

Europe Texture Paints Market Trends

The texture paints market in Europe plays a significant role, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rising demand for construction projects in the region, leading to rise in demand for texture paints.

Key Texture Paints Company Insights

Some of the key players operating in the global market include

-

Akzo Nobel N.V. is involved in manufacturing and marketing paints & performance coatings. It operates through three business segments specialty chemicals, performance coatings, and decorative paints. Major products offered by the company are industrial chemicals, functional chemicals, pulp & performance chemicals, powder coatings, and automotive & aerospace coatings. It caters its services to various industries including aerospace, automotive, chemicals, household appliances, safety, furniture & flooring, marine, mining, oil & gas, packaging, and energy. The performance coatings segment includes protective coatings, marine coatings, vehicle refinishes, metal coatings, specialty coatings, powder coatings, wood coatings, and industrial coatings. The company has a global presence

-

PPG Industries, Inc. manufactures and supplies paints, coatings, chemicals, and specialty materials. The company operates its business in two segments, namely Performance Coatings and Industrial Coatings. PPG Industries, Inc. offers its products to various end-use industries such as aerospace, automotive, marine, construction, packaging, petrochemicals, and consumer goods. Its products are also used in industrial manufacturing applications. The company markets its products under several brand names, including PPG, Glidden, Comex, Olympic, Dulux (in Canada), Sikkens, and PPG Pittsburgh Paints. The company has about 156 manufacturing facilities spread across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa, along with research and development headquarters located in Allison Park, Pennsylvania in the U.S. It has architectural coating facilities located in the U.S., Canada, Australia, and China

Evonik Industries and Hempel A/S are some of the emerging market participants in the market.

-

Jotun formulates, produces, and distributes decorative paints and performance coatings for residential, commercial, and industrial applications. These coatings are also used in the marine, energy, and oil & gas industries. The company operates through four business segments, namely Decorative Paints, Protective Coatings, Marine Coatings, and Powder Coatings. The company extends its reach to other countries through a network of subsidiaries, joint ventures, associated companies, sales offices, and distributors. It has 40 production facilities in 23 countries and has a presence in about 100 countries through a network of distributors, agents, and sales offices

-

Hempel A/S is engaged in manufacturing and supplying paints and coatings under various brand names including Hempaguard, Hempadur Avantguard, Crown Paints, Neogard, and Versiline. The company’s product portfolio includes protective, marine, decorative, container, yacht, and industrial coatings. The company caters its products to various end-use industries including construction, oil & gas, energy, infrastructure, logistics, industrial manufacturing, and automotive. The company operates through 26 factories and 17 R&D centers globally

Key Texture Paints Companies:

The following are the leading companies in the texture paints market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- PPG Industries

- Asia Paints Limited

- Kansai Paint Co. Ltd.

- Berger Paints India Limited

- Nippon Paint Holdings Group

- The Sherwin-Willams Company

- Hempel A/S

- Jotun A/S

- SK Kaken Co., Ltd.

Recent Developments

-

In June 2023, AkzoNobel announced investing in a new water-based texture paints production line at its China site. This investment will boost the capacity to supply more sustainable products. This site is one of four water-based decorative paint plants in China and is one of the company’s most significant globally. The new 2,500-square-meter facility will produce Dulux products for various markets, including architecture, interior decoration, and leisure.

-

In November 2022, JSW Paints announced the launch of an environmentally friendly paint company based in India and part of the USD 22 billion JSW Group, which has launched the Vogue range of finishes. This new range offers curated wall effects designed to enhance home decor. The company delivers its promise of 'Think Beautiful' by providing luxurious effects that create stylish walls for the modern, cosmopolitan Indian consumer. The Vogue range draws inspiration from the latest fashion and cultural trends to bring life to home walls.

Texture Paints Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 12,913.28 million |

|

Revenue forecast in 2030 |

USD 16,816.46 million |

|

Growth rate |

CAGR of 4.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Kilotons, revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Akzo Nobel N.V.; PPG Industries; Asia Paints Limited; Kansai Paint Co. Ltd.; Berger Paints India Limited; Nippon Paints Holdings Group; The Sherwin-Williams Company; Hempel A/S; Jotun A/S; and SK Kaken Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Texture Paints Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global texture paints market report based on product, technology, application and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Others

-

-

Technology Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Water-based

-

Solvent-based

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global texture paints market size was estimated at USD 12,357.2 million in 2023 and is expected to reach USD 12,913.3 million in 2024.

b. The global texture paints market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 16,816.5 million by 2030.

b. Asia Pacific dominated the texture paints market with a share of 45.60%. This growth is attributable to rising construction activities and growing demand for the product market from the residential and non-residential sectors in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period

b. Some key players operating in the texture paints market include Akzo Nobel N.V.; PPG Industries; Asia Paints Limited; Kansai Paint Co. Ltd.; Berger Paints India Limited; Nippon Paints Holdings Group; The Sherwin-Williams Company; Hempel A/S; Jotun A/S; and SK Kaken Co., Ltd.

b. Key factors driving market growth include the increasing demand from end-use industries, such as the construction industry. These paints are used for interior design in both residential and non-residential spaces. Additionally, the demand for residential structural paints for decoration or repainting drives the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."