- Home

- »

- Advanced Interior Materials

- »

-

Textile Recycling Market Size & Share, Industry Report, 2033GVR Report cover

![Textile Recycling Market Size, Share & Trends Report]()

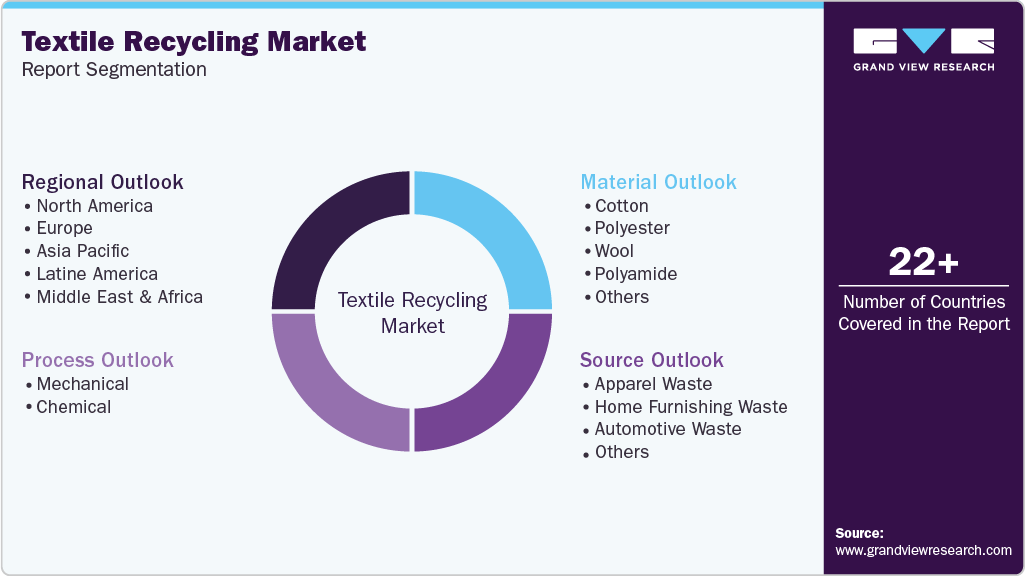

Textile Recycling Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Cotton, Polyester, Wool, Polyamide), By Source (Apparel Waste, Home Furnishing Waste), By Process (Mechanical, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-969-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Textile Recycling Market Summary

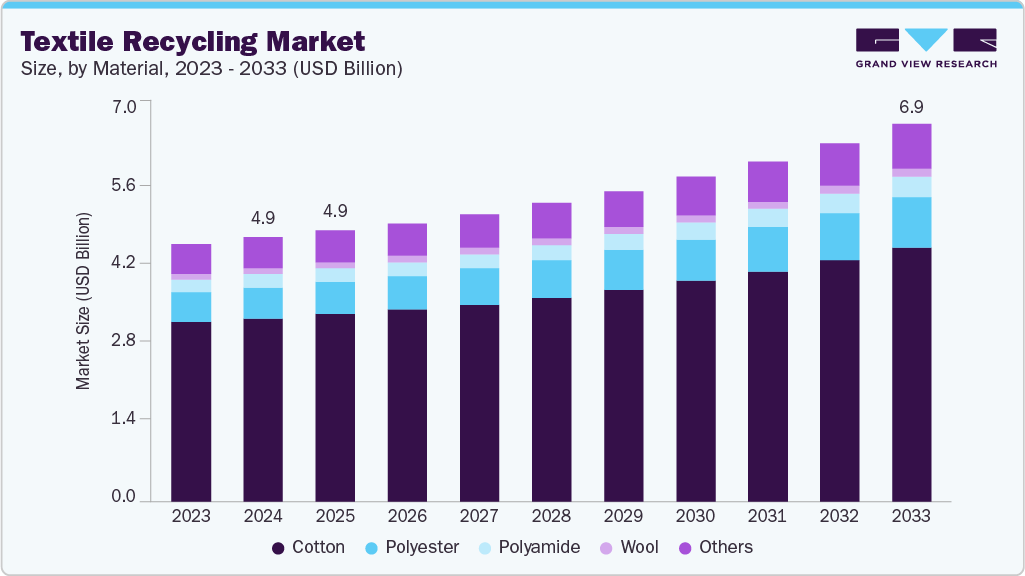

The global textile recycling market size was estimated at USD 4,850.6 million in 2024 and is projected to reach USD 6,938.4 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The rising environmental concern about textile waste production and growing social awareness about textile recycling are expected to propel the market growth.

Key Market Trends & Insights

- Europe dominated the textile recycling market with the largest revenue share of 29.4% in 2024.

- The textile recycling market in India is expected to grow at a substantial CAGR of 5.7% from 2025 to 2033.

- By material, the polyester segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By source, the apparel waste segment is expected to grow at a considerable CAGR of 4.7% from 2025 to 2033 in terms of revenue.

- By process, the chemical segment is expected to grow at a considerable CAGR of 4.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4,850.6 Million

- 2033 Projected Market Size: USD 6,938.4 Million

- CAGR (2025-2033): 4.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the Environmental Protection Agency (EPA), 5% of landfill space is occupied by textile waste. According to the National Council of Textile Organizations of the U.S., the textile industry in the U.S. is one of the largest producers of textile-related products in the world. Moreover, the waste generated from discarded textiles amounts to a large quantity in the U.S. According to the Council for Textile Recycling, the average citizen throws away approximately 70 pounds of textiles annually in the country. These factors above are expected to propel the demand for textile recycling in the coming years.

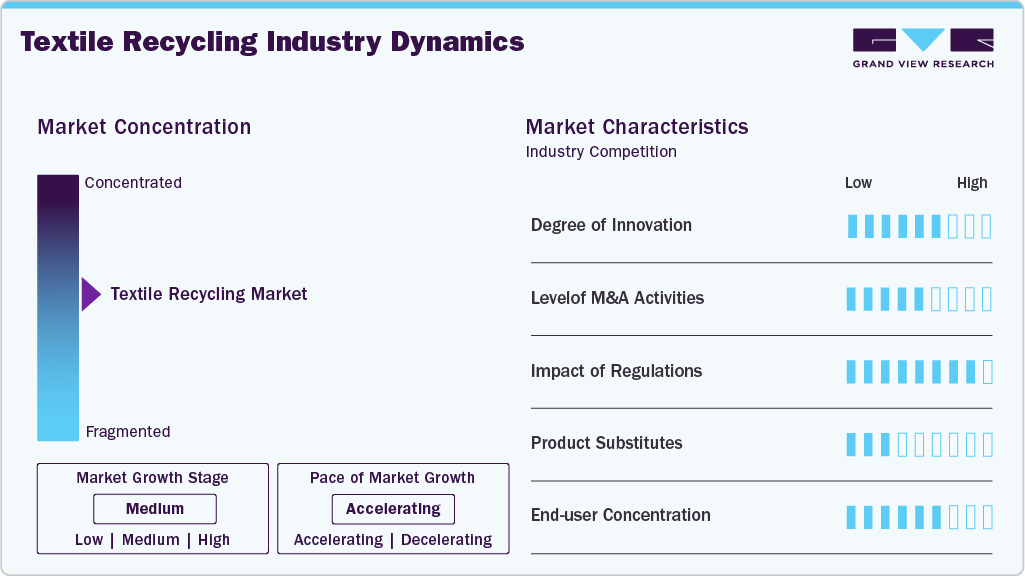

Market Concentration & Characteristics

The global market for textile recycling is moderately concentrated, with a few leading companies. These key players hold a substantial portion of the market share, reflecting a somewhat consolidated industry. Major firms are focusing on innovative recycling technologies and strategic collaborations to strengthen their positions. Alongside these leaders, emerging startups and local companies are also actively contributing to market growth.

The textile recycling industry is marked by significant innovation, especially in developing advanced recycling technologies like chemical and mechanical processes. Companies are investing in research to improve fiber recovery and fabric quality. Innovations aim to reduce environmental impact and increase efficiency. This drives sustainable solutions and attracts investment in eco-friendly materials.

M&A activity in the textile recycling industry is moderate but growing, as companies seek to expand capabilities and market reach. Larger firms often acquire startups with innovative technologies to accelerate growth. Strategic partnerships and acquisitions help enhance supply chain integration and technology access. This consolidation supports competitive positioning and industry scalability.

Regulatory frameworks globally are becoming stricter, promoting sustainability and waste reduction in textiles. Governments are encouraging recycling initiatives through policies and incentives. Compliance with environmental standards is driving companies to adopt greener processes. These regulations boost demand for recycled textiles and foster industry growth while ensuring accountability.

Drivers, Opportunities & Restraints

Rising environmental awareness is a key driver, pushing consumers and companies toward sustainable textile options. Increasing textile waste and the need for circular economy solutions create strong demand for recycling. Technological advancements make recycling processes more efficient and cost-effective. Government regulations and incentives also encourage industry growth. In addition, the growing fashion industry pressures to reduce carbon footprints fuel market expansion.

There is a significant opportunity in developing advanced chemical recycling techniques that improve fabric quality. Expansion in emerging markets with rising apparel consumption offers new customer bases. Collaboration between brands and recyclers can create innovative, sustainable products. Increasing consumer preference for eco-friendly and recycled textiles opens new revenue streams. Moreover, investments in infrastructure and automation can enhance recycling capacity and reduce costs.

High initial investment and operational costs limit the adoption of advanced recycling technologies. Variability in textile waste quality challenges consistent recycling outputs. Lack of consumer awareness and willingness to pay premium prices slows market penetration. Complex supply chains and limited collection systems hinder efficient material recovery. In addition, regulatory inconsistencies across regions create compliance challenges for companies.

Material Insights

The cotton segment held the largest revenue share of 69.3% in 2024. This large share is attributed to its extensive use in clothing, home textiles, and industrial fabrics. Its natural fiber composition makes mechanical recycling processes more straightforward and cost-effective. Recycled cotton is highly valued for producing sustainable apparel and reducing landfill waste. In addition, consumer preference for natural fibers supports its continued dominance. The established infrastructure for cotton collection and processing further strengthens its market position.

The polyester segment is expected to register the fastest CAGR over the forecast period, driven by its widespread use in fashion and sportswear. Its synthetic nature allows for chemical recycling methods that recover high-quality fibers suitable for new fabric production. Rising demand for durable and lightweight textiles fuels polyester consumption globally. Advances in recycling technologies have made polyester recovery more efficient and scalable. This growth supports industry efforts to reduce reliance on virgin polyester and lower environmental impact.

Source Insights

The home furnishing waste segment held a significant share of 32.4% in 2024. The growth of this segment is attributed to the increasing volume of textile waste generated by the fashion industry, driven by fast fashion trends and shorter garment lifespans. Technological advancements in sorting and recycling processes are enhancing the efficiency of recycling apparel waste. Initiatives like Extended Producer Responsibility (EPR) laws are encouraging brands to take accountability for their products' end-of-life, promoting recycling efforts.

The apparel waste segment is expected to grow at a significant CAGR of 4.7% from 2025 to 2033 in terms of revenue, owing to increased consumer spending and frequent replacement of household textiles. The diverse range of materials in home furnishings presents both challenges and opportunities for recycling processes. Efforts to improve sorting technologies and recycling methods are essential to handle this complex waste stream efficiently. As living standards rise globally, the volume of home furnishing waste is expected to grow, necessitating advancements in recycling infrastructure and consumer awareness.

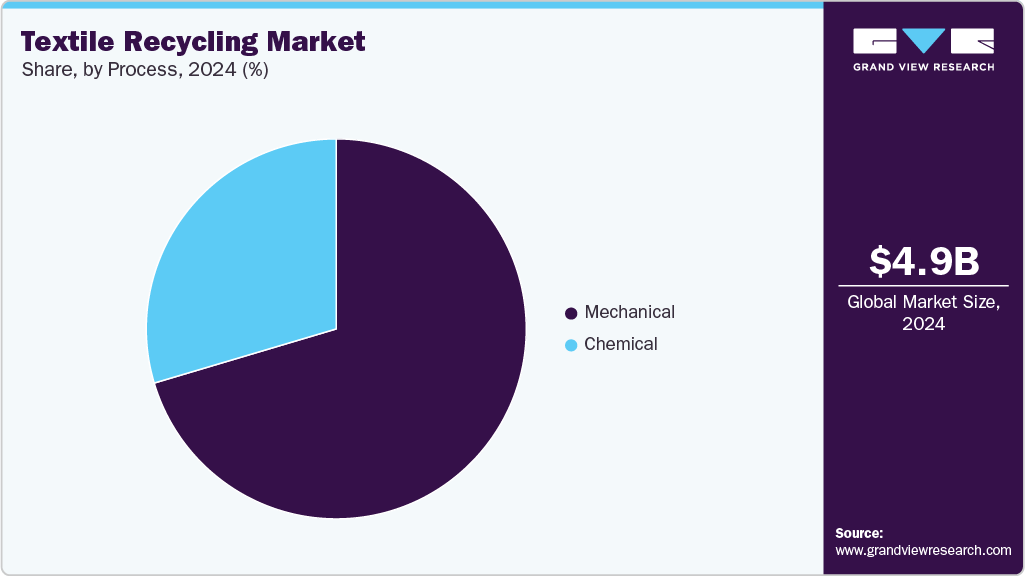

Process Insights

The mechanical segment held the largest revenue share of 70.4% in 2024. Mechanical recycling dominates the market due to its simplicity and lower operational costs. It efficiently processes a wide variety of natural and synthetic fibers due to established technologies. The method requires less energy and fewer chemicals, making it environmentally preferable. Due to its cost-effectiveness and scalability, many companies rely on mechanical recycling for large-scale operations.

Chemical recycling is anticipated to be the fastest-growing segment over the forecast period due to advancements in technology enabling better fiber recovery from blended textiles. It can recycle complex materials that mechanical methods cannot process effectively. Due to rising demand for high-quality recycled fibers, chemical recycling attracts significant investment. In addition, stricter environmental regulations drive the adoption of chemical recycling for sustainable textile management.

Regional Insights

North America textile recycling industry is expected to grow at a significant CAGR of 4.3% over the forecast period, driven by strong environmental regulations and increasing consumer awareness of sustainability. The region benefits from advanced recycling infrastructure and technological innovation. In addition, active participation by major apparel brands promotes circular economy initiatives.

U.S. Textile Recycling Market Trends

The U.S. textile recycling industry dominates the North American region with a share of 84.6%. The large share is attributed to its large textile industry and well-established recycling infrastructure. Strong environmental regulations and consumer demand for sustainable products drive growth. Major brands in the U.S. actively invest in circular economy initiatives. Due to these factors, the U.S. remains the key player in the region’s textile recycling landscape.

Canada textile recycling industry is anticipated to be the fastest-growing market over the forecast years in the North American region due to increasing government support for sustainable waste management policies. Rising consumer awareness about textile waste and eco-friendly fashion fuels demand for recycled textiles. Investments in advanced recycling technologies are accelerating in the country. Due to these initiatives, Canada’s market is expanding rapidly.

Europe Textile Recycling Market Trends

The textile recycling industry in Europe is dominating globally with a revenue share of 29.4% due to stringent environmental regulations and ambitious sustainability targets. The presence of well-established recycling infrastructure supports the efficient collection and processing of textile waste. Consumer demand for eco-friendly products is high, driving brand initiatives toward circular fashion. Government incentives and policies further encourage recycling investments. Together, these factors solidify Europe’s leadership in textile recycling.

Germany textile recycling industry held a 26.4% share in the European market. Germany leads the European region due to its robust recycling infrastructure and strong regulatory framework. The country emphasizes circular economy practices across industries, including fashion and textiles. High public market awareness and efficient waste sorting systems support large-scale textile recovery. Major companies and government programs collaborate to promote sustainable production. Due to these strengths, Germany remains the core driver of Europe’s recycling efforts.

The UK textile recycling industry is driven by rising concern over textile waste and fast fashion’s impact. Government initiatives and proposed legislation, like extended producer responsibility (EPR), are pushing the sector forward. Consumer demand for sustainable fashion continues to grow, prompting industry action. Startups and retailers are adopting innovative recycling models and closed-loop systems. Due to this momentum, the UK is rapidly expanding its textile recycling capacity.

Asia Pacific Textile Recycling Market Trends

The Asia Pacific textile recycling industry is expected to grow rapidly over the forecast period, fueled by rising textile production and consumption. Increasing awareness about environmental impact is pushing governments to implement stricter waste management policies. The region benefits from expanding textile manufacturing hubs, creating opportunities for recycling initiatives. Rapid urbanization and growing middle-class populations boost demand for sustainable textiles. Investment in recycling technology is also accelerating to meet these demands.

China textile recycling industry held a considerable share of 37.3% in the textile industrial market,driven by government-backed sustainability targets, and recycling infrastructure has seen significant development. Mechanical recycling is widely adopted due to its efficiency and lower cost. In addition, policy support and industrial capabilities position China as the regional leader.

The textile recycling industry in India is expected to grow at a CAGR of 5.1% from 2025 to 2033, owing to rising environmental awareness and policy reforms. Due to national initiatives promoting cleanliness and waste reduction, recycling practices are gaining momentum. Circular fashion trends and collaborations with global brands are driving demand for recycled materials. Investment in recycling startups and technology is also accelerating India's growth.

Middle East & Africa Textile Recycling Market Trends

The Middle East and Africa textile recycling industry is developing, driven by increasing awareness of environmental sustainability. Governments are beginning to implement policies focused on waste management and circular economy principles. Textile waste volumes are rising due to urbanization and changing consumer lifestyles. However, infrastructure and technological adoption remain in early stages. Continued investment and education are expected to drive growth in this region.

The UAE textile recycling industry is actively advancing due to a combination of government initiatives, private sector involvement, and increasing consumer awareness. The "Integrated Textile Circularity Initiative," launched by Tadweer in collaboration with various stakeholders, aims to enhance textile waste management and promote sustainable practices across the country. This initiative focuses on increasing consumer awareness, establishing efficient collection systems, and fostering recycling innovations to achieve textile circularity.

Latin America Textile Recycling Market Trends

The Latin America textile recycling industry is emerging as a key player, supported by growing environmental consciousness. The region faces challenges like limited recycling infrastructure, but is witnessing increasing government efforts to promote waste reduction. Consumer interest in sustainable fashion is steadily rising, encouraging local brands to adopt recycled materials. Collaborations between the public and private sectors are enhancing recycling capabilities. These developments position Latin America for future market growth.

Brazil textile recycling industry is experiencing significant growth due to several key factors. The country's expanding textile and fashion industry generates a substantial volume of textile waste, providing ample feedstock for recycling efforts. Government policies, such as the National Solid Waste Policy and the Circular Economy Action Plan, incentivize waste reduction and recycling practices. In addition, the adoption of circular economy principles by companies promotes resource conservation and sustainable production. Advancements in recycling technologies enhance the efficiency and quality of recycled textiles, further driving market growth.

Key Textile Recycling Company Insights

Some of the key players operating in the market include Worn again technologies, Lenzing Group, Birla Cellulose.

-

Worn Again Technologies was established in 2005, and its headquarters are situated in East London, England. The company was founded in collaboration with Vivo Barefoot. It primarily repurposes scrap leather and old prison blankets from the automobile industry, as well as decommissioned Virgin Atlantic seat covers and hot air balloons, into new and desirable handbags, footwear, accessories, and jackets. The company's advanced recycling technology can decontaminate, separate, and extract polyester & cellulose from non-reusable textiles, as well as polyester packaging & bottles, to produce cellulose outputs & dual PET, reintroducing sustainable resources into manufacturing supply chains.

-

LENZING AG was established in 1938 and is headquartered in Lenzing, Austria. The company collaborates with global textile and nonwoven manufacturers and is at the forefront of many new technological developments. The business is divided into three reportable segments, namely Division Fiber, Division Pulp, and Others. Division Fiber manufactures and sells wood-based cellulosic fibers under the brand names, namely, VEOCEL, TENCEL, and LENZING ECOVERO. Products made from modal, lyocell, and viscose fibers are used to make nonwovens, textiles, and special applications.

Key Textile Recycling Companies:

The following are the leading companies in the textile recycling market. These companies collectively hold the largest market share and dictate industry trends.

- Worn Again technologies

- Lenzing Group

- Birla Cellulose

- BLS Ecotech

- The Woolmark Company

- iinouiio Ltd

- Ecotex Group

- The Boer Group

- Unifi, Inc.

- Textile Recycling International

- Renewcell

- Pistoni S.r.l.

- REMONDIS SE & Co. KG

- Martex Fiber

- HYOSUNG TNC

Recent Developments

-

In March 2025, Worn Again Technologies developed an innovative chemical recycling process that separates and purifies polyester and cotton from blended textiles. This process transforms them into high-quality, virgin-equivalent materials suitable for reuse in new products. The technology supports a circular economy by reducing textile waste and reliance on virgin resources. It has applications beyond fashion, extending to industries like automotive and packaging. Worn Again's approach aligns with regulatory pressures and growing demand for sustainable practices.

-

In May 2023, Lenzing, in collaboration with ARA, Salesianer Miettex, Caritas, and Södra, has launched Austria’s largest textile recycling project. The initiative focuses on collecting, sorting, and processing used textiles to produce pulp and fibers, utilizing the innovative OnceMore and REFIBRA technologies. Aiming to process 50,000 tonnes of textile waste annually by 2027, the project also offers employment opportunities for individuals with disabilities. This pioneering effort represents a significant step toward a circular economy in the textile industry.

Textile Recycling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,974.2 million

Revenue forecast in 2033

USD 6,938.4 million

Growth rate

CAGR of 4.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, source, process, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Worn again technologies; Lenzing Group; Birla Cellulose; BLS Ecotech; The Woolmark Company; iinouiio Ltd; Ecotex Group; The Boer Group; Unifi, Inc.; Textile Recycling International; Renewcell; Pistoni S.r.l.; REMONDIS SE & Co. KG; Martex Fiber; HYOSUNG TNC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Recycling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global textile recycling market report based on material, process, source, and region.

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Cotton

-

Polyester

-

Wool

-

Polyamide

-

Other

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Apparel Waste

-

Home Furnishing Waste

-

Automotive Waste

-

Other

-

-

Process Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanical

-

Chemical

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global textile recycling market size was estimated at USD 4,850.6 million in 2024 and is expected to be USD 4,974.2 million in 2025.

b. The global textile recycling market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 6,938.4 million by 2033.

b. Europe dominated the textile recycling market with a revenue share of 29.4% in 2024. Higher generation of textile waste, higher collection rate, and strong presence of key players in the region are attributable to the large market revenue share.

b. Some of the key players operating in the textile recycling market include: Worn Again Technologies, Lenzing Group, Birla Cellulose, BLS Ecotech, The Woolmark Company, iinouiio Ltd, Ecotex Group, The Boer Group, Unifi, Inc., Textile Recycling International, Hyosung Group, Martex Fiber, Re:NewCell, Pistoni S.r.l., and RE TEXTIL Deutschland GmbH.

b. Key factors that are driving the textile recycling market growth include rising environmental concerns over textile waste disposal, increasing initiatives in waste managements, developments in the recycling technologies and increasing consumer social awareness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.