- Home

- »

- Organic Chemicals

- »

-

Textile Flame Retardants Market Size & Share Report, 2030GVR Report cover

![Textile Flame Retardants Market Size, Share & Trends Report]()

Textile Flame Retardants Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Halogenated, Non-halogenated), By Application, By Type, By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-485-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global textile flame retardants market size was valued at USD 519.5 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.6% from 2022 to 2030. The demand for the product is anticipated to be driven by the increased requirement of retardant fabrics in end-use industries such as defense, industrial manufacturing, and transportation. Governments across the world are concerned about fire safety. Fabrics and textiles, due to the complexity of their structure, are highly flammable and prone to fire accidents in households, industrial, defense, and manufacturing sectors. The spread of fire can be restricted using flame retardants, thus protecting the surrounding environment. Retarding properties of flame retardants enable a faster escape time. Various countries have developed fire safety regulations that need compulsory compliance by retardant manufacturers. This trend is expected to positively benefit the product market growth.

Flame retardants are chemicals that are used to retard flame propagation in textiles, plastics, building & construction, electrical & electronics, transportation, and defense applications. Flame retardants exhibit different chemical compositions and are classified into halogenated and non-halogenated retardants.

The demand for the product has been spurred by advances in chemical sciences along with closer scrutiny by regulatory bodies across the globe. This also has led to the implementation of regulations concerning the minimization of the risk of fire occurrences. Various flame retardants such as aluminum trihydroxide, brominated, chlorinated, antimony oxides, and organophosphorus are used in the manufacturing of flame-retardant-infused textile materials. They find applications in the manufacturing of polyolefins, epoxy resins, engineering thermoplastics, and styrenics.

Escape time has been a crucial concern during fire incidents among consumers; the effectiveness of flame retardants and advantages in this regard are anticipated to drive the growth of flame retardant fabrics. This trend has benefitted the product market in recent years and is anticipated to continue during the forecast period.

An increase in the demand for nylon-blended and cellulose/viscose fibers have driven the textile industry in recent years. However, the shift in consumer preferences towards these products and growth in the use of such fibers is anticipated to drive the market. Increasing product demand from the household sector for applications such as curtains, carpets, bedding, and disposable apparel is also projected to drive market growth. Moreover, the growing consumption of treated flame retardant textiles in the automotive sector is expected to bolster the market growth in the long run.

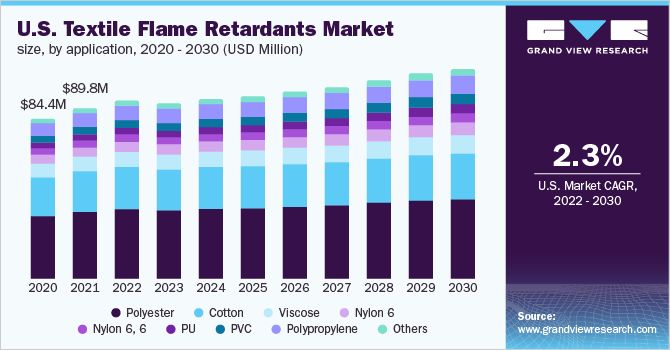

Application Insight

The polyester application segment accounted for 39.2% of the market revenue share in 2021. This share is attributed to the rise in demand for the product as it is used in finishing on textile fibers which would not let polyester ignite easily. However, the ignition and melting of the fabric could cause potential severe burns.

The polyurethane (PU) application segment is anticipated to witness the highest CAGR of 5.9% during the forecast period. The expected growth is owing to its characteristic to offer the utmost accurate imitation of leather when it comes to overall aesthetics, surface feel, and hand feel. PU also wrinkles or “breaks” similar to genuine leather when tufted, stitched, or gathered. Although polyurethane is comparatively cheap than real leather, it is considered to be one of the more expensive polymers.

Nylon 6, 6 is chemically characterized as an aliphatic thermoplastic polymer, prepared by the polycondensation of hexamethylenediamine and adipic acid. The melting point of this fiber is significantly higher compared to other synthetic fibers. This fiber is known to possess heat and friction resistance owing to its high melting point. In addition, it exhibits self-lubricating and high abrasion resistance properties. Furthermore, nylon 6, 6 exhibits high thermal stability, good processability & appearance, drawability, and fire resistance. Therefore, it is highly acceptable for different applications in flame retardant textiles.

Type Insights

The durable segment accounted for a dominant share of more than 54% in terms of revenue in the market in 2021. This type has been in use for several years in the same form. However, in the past few years, softer versions of these products have been developed using selected fiber blends or using process or chemical modifications. The durable flame retardants are classified into five groups, namely Group I: tris hydroxymethyl phosphine derivatives; Group II: phosphonamide; Group III: vinyl phosphate prepolymers; Group IV: phosphoramides; and Group V: phosphazenes, among others.

The most common durables in the market are halogenated compounds as well as organophosphorus compounds. In addition, nylon or cotton blends, when treated with flame retardants, show excellent laundering durability and an extraordinary level of performance.

Semi-durable type when treated with cellulosic material can withstand limited laundry washes as well as leaching in water. Semi-durable normally contains melamine-formaldehyde resin and acrylic binder. Semi-durable finishes when combined with inorganic phosphates are not resilient to alkaline laundering situations. The semi-durable finish is impartially resilient to water washing when phosphoric acid groups are attached chemically and further neutralized by ammonium cations. Semi-durables are generally used in back coating technologies.

Technology Insights

The back-coating segment dominated the global textile flame retardants market with more than 65% revenue share in 2021. The growth is attributed to the increase in consumption of chemicals in coating formulation with respect to the nature of the polymer. The products that are utilized only on a single textile fiber, when in connection with a second altered flame-retarded fiber, can prove to be incompatible and reduce the composite flammability.

As a result, simple flame-retardant mixtures are either applied to halogen-based back coatings or applied to flame retardant. Moreover, the segment is anticipated to grow quickly during the projection period as a result of the back-coating process's value addition to a textile fiber.

Efficacious flame-retardant finishes are applied to textile fabrics by using conservative textile coating and finishing equipment. Flame retardant coatings are primarily used to inhibit or retard the combustion of flammable constituents, including foam, wood, electric cables, fiber-reinforced composites, and textile fabrics. Thor is engaged in producing textile flame-retardants for stable foam coatings under the brand name “AFLAMMIT”. These products are recommended for blackouts, dim-outs, and soft and medium handles. Rudolf GmbH manufactures halogen-free flame-retardants for foam coating applications.

End-use Insights

The public safety services end-use segment of the market accounted for 14.3% of the overall revenue share. It includes firefighting services, public safety, and institutions involved in law enforcement. Police and sheriff’s patrol officers face several occupational fire incidents that may be fatal. Law enforcement people in public safety services include associated supervisors, criminal investigators, detectives, correctional officers, and jailers & bailiffs, who are also required to wear protective and functional clothing such as vests during field operations.

Firefighting professionals are notable end-users of public safety services, which is a prominent end-use segment of the product market. They are also responsible for cleaning hazardous material spills or conduct technical rescue operations, besides firefighting operations.

The transportation segment comprises marine, railway, aircraft, and automobile end-uses, which require flame-retardant fabrics for seating, furnishing, and décor purposes. To improve passenger comfort, the textiles of seating, floor coverings, décor, and furnishings have become an integral part of players operating in the transportation industry. For instance: ICL-IP offers innovative fire safety solutions for the transportation industry. It offers flame-retardant textiles for seats in four-wheelers.

Industries are becoming more concerned about the safety of their employees, which has resultantly boosted the demand for flame-retardant textiles in the industrial end-use segment. In addition, government agencies are promoting the use of protective textiles or functional clothing at industrial sites. For instance, Occupational Safety and Health Administration (OSHA) is a federal agency implemented by the U.S. Department of Labor that is responsible for the health and safety of workers across all industries in the U.S.

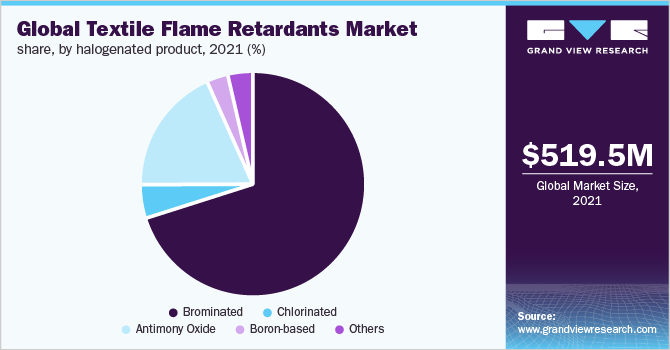

Product Insights

The halogenated segment dominated the market with 61.0% of the revenue share in 2021. The higher share is attributed to the increase in demand for brominated flame retardants, which are halogenated and are commonly associated with furniture upholstery. Furniture cushions, lampshades, curtains, privacy curtains, and drapery are commonly treated with these retardants. BFR chemical products, such as polybrominated diphenyl ethers (PBDEs), decabromodiphenyl ether (DBDE), hexabromocyclododecane (HBCD), and tetrabromobisphenol A (TBBPA) are widely used in the treatment of textiles/fabrics.

Chlorinated products are halogenated flame retardants that are used in plastics, fabrics, coatings, and paints. This type belongs to three chemical groups - aromatic, cycloaliphatic, and aliphatic compounds. Chlorinated paraffins are the majorly used retardants containing chlorine in the aforementioned applications. These retardants are used synergistically with antimony oxide-based products to increase the effectiveness of flame retardancy in textile applications. However, chlorinated products are used in composition with other flame retardants as they are unstable as compared to brominated ones.

The non-halogenated segment is anticipated to witness a CAGR of 3.2% during the forecast period, owing to the increase in demand for aluminum hydroxide (ATH) based flame retardants, which are extensively utilized in solid thermoplastics, foams, textile/paints/adhesives, thermosets, and wires & cables. Their solubility in organic solvents and water is low.

The working principle of this chemical is based on its thermal decomposition into aluminum oxide and water vapor. Aluminum oxide acts as a barrier for the material against decomposition, while water vapor cools the surface of the material and reduces the concentration of burnable gases in the surroundings.

Regional Insights

The Asia Pacific region dominated the market with a 55.3% share in terms of revenue in 2021. This can be attributed to the increase in demand for the product in the military, transportation, and industrial sector in China. However, a reduction in China’s textile and apparel exports to developed economies of North America and Europe, owing to its high domestic consumption, is estimated to provide more opportunities for the competing countries, such as Vietnam, Myanmar, and Bangladesh, to upsurge their textile export shares.

Increasing industrial and transportation activities in Asia Pacific, coupled with factors such as cheap raw materials, low labor costs, and a growing disposition of key mining players to expand in the region owing to the presence of large mineral resources, are the key factors driving the demand for the product in India, China, Japan, and Australia among others.

The Asia Pacific product market is driven by improved safety measures against fire, high demand from end-use industries, favorable government initiatives, and technological developments in developing economies. Flame retardants are used for producing workers’ uniforms in the mines.

On the other hand, the Latin America region is anticipated to witness a CAGR of 3.9% during the forecast period. The growth is expected due to an increase in consumption of the product in Brazil. Also, the country projects significant opportunities for growth during the forecast period, as it is expected to expand at a lucrative rate between 2020 and 2030. The aluminum hydroxide-based segment emerged as the top-selling product, while polyester is the most preferred application fabric in the region.

Brazil and Mexico and other countries of the Latin America region are in the developing stage. Implementation of nationwide fire safety regulations in such countries is challenging. However, with the increasing awareness of consumers towards fire safety that can be achieved by the application of flame-retardants chemicals on different textiles for industrial, household, transportation, and defense sectors, among others, the market is expected to grow in near future.

Key Companies & Market Share Insights

The global market for textile flame retardants is highly competitive, with major international brands focusing on the development of long-term relationships with end-users. The increasing demand for flame retardant fabric has led to increased competition in the market. In order to sustain in the competitive environment, manufacturers are engaged in adopting several strategic initiatives, including product capacity expansion, acquisitions, and broadening the geographical reach.

Companies such as Albemarle Corporation, Thor Group Ltd., and Nabaltec AG have a high degree of integration across the value chain as they are also engaged in the production of flame retardants. These companies have established themselves as key manufacturers and focus on research and development for novel uses of the product. Some of the top players in the global textile flame retardants market include:

-

Albemarle Corporation

-

ICL

-

Lanxess A.G

-

Clariant International Ltd.

-

Italmatch Chemicals S.p.A

-

Huber Engineered Materials

-

BASF SE

-

Thor Group Ltd

-

Avocet Dye & Chemical Co. Ltd.

Textile Flame Retardants Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 545.6 million

Revenue forecast in 2030

USD 717.0 million

Growth rate

CAGR of 3.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; China; India; Japan; Australia; Brazil; Mexico; South Africa; GCC

Key companies profiled

Albemarle Corporation; ICL; Lanxess A.G; Clariant International Ltd.; Italmatch Chemicals S.p.A; Huber Engineered Materials; BASF SE; Thor Group Ltd; Avocet Dye & Chemical Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global textile flame retardants market report on the basis of product, application, type, technology, end-use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Halogenated

-

Brominated

-

Chlorinated

-

Antimony Oxide

-

Boron-based

-

Others

-

-

Non-Halogenated

-

Aluminum Hydroxide

-

Magnesium Dihydroxide

-

Organophosphorus

-

Others

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Polyester

-

Cotton

-

Viscose

-

Nylon 6

-

Nylon 6, 6

-

PU

-

PVC

-

Polypropylene

-

Aramid

-

Others

-

-

Type Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Durable

-

Semi-durable

-

Non-durable

-

-

Technology Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Dyeing

-

Padding

-

Back-Coating

-

-

Spraying

-

Printing

-

Foam Coating

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Industrial

-

Defense

-

Public Safety Services

-

Transportation

-

Household

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global Textile Flame Retardants market size was estimated at USD 519.45 million in 2021 and is expected to reach USD 545.64 million in 2022.

b. The global Textile Flame Retardants market is expected to grow at a compound annual growth rate of 3.6% from 2022 to 2030 to reach USD 717.0 million by 2030.

b. Asia Pacific dominated the Textile Flame Retardants market with a share of 55.3% in 2021. This is attributable to significant production base for textiles in China, India and ASEAN countries

b. Some key players operating in the Textile Flame Retardants market include Albemarle Corporation, Israel Chemicals Ltd. (ICL), LANXESS A.G., Clariant International Ltd., Nabaltec A.G. Albermarle Corporation, Huber Engineered Materials, Thor Group Ltd., FRX Polymers

b. Key factors that are driving the Textile Flame Retardants market growth include several regulations operating at state and federal levels along with fire safety performance standards across end-use industries including transportation, military, mattresses, drapery, and commercial upholstered furniture

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.