- Home

- »

- Specialty Polymers

- »

-

Textile Finishing Agents Market Size & Share Report, 2030GVR Report cover

![Textile Finishing Agents Market Size, Share & Trends Report]()

Textile Finishing Agents Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Aesthetic, Functional), By Product (Softeners, Fragrance Agents), By Application (Home Furnishing, Apparel), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-978-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global textile finishing agents market size was USD 2.4 billion in 2021 and is projected to reach USD 3.8 billion by 2030, growing at a CAGR of 5.1% from 2022 to 2030. The increasing per capita income and growing chemical manufacturing sector in emerging economies like China, Japan, and India are the major factors fostering the overall industry. The growing global population, coupled with the rapid change in fashion trends, has accelerated the consumption of clothes and other apparel worldwide. This has been fueling the production outcome of the textile manufacturers. The increasing migration of the rural population to urban areas for education and decent careers has also surged the consumption of apparel, such as clothes and shoes.

Moreover, they have become essential products used by youth across the world. Some people relate textile products to their standard of life as they use advanced home furnishing items or high-quality fabrics, while others only relate to them as necessities. Product manufacturers increasingly rely on the availability of raw materials at favorable costs for developing their products. Different types of textile finishing agents require different types of raw materials. Some of the key strategies adopted by manufacturers are carrying out low-cost manufacturing of their products, procuring raw materials in large quantities, building strong relationships with distributors, and commercializing all kinds of textile finishing agents across the world.

Increasing demand for apparel products, such as clothes, shoes, and more, is expected to drive industry growth. Apparel products are the key products of the textile industry. Products made with different types of fabrics, such as clothes, require many types of finishing touches to ascertain the quality and performance of clothes. Therefore, textile finishing agents are used to add additional characteristics, such as fragrance and water repellency to fabrics. The majority of the chemicals involved in the manufacturing process of textile finishing agents are hazardous and contain toxic particles. Furthermore, the production faces several restrictions regarding its mass production due to the usage of hazardous chemicals. The manufacturing process is often considered complex because of the same reason.

Type Insights

The functional segment dominated the global industry in 2021 accounting for the highest share of more than 88.00% of the overall revenue. Its high share is attributable to the ability of these product types to improve their performance and functional properties, such as strength and durability. Functional finishing is a back-end method, which does not add up to the product’s aesthetics. The primary purpose of functional finishing agents is to improve the overall performance of textile products. For instance, functional finishing is used in the production of umbrellas and raincoats to enhance their water-resistant capability.

Here, functional finishing is used for improving the functionality and performance of the umbrella, whereas aesthetic finishing includes printing an image or giving color to the umbrella. The aesthetic is an important factor for textiles to make them attractive to consumers. Aesthetic finishes influence the texture, drape, luster, surface, and hand feel of the fabric. Touch and sight are two ways to understand the aesthetics of textiles. The techniques used for improving aesthetics in textiles include texturizing, blending, zari, brocade, and embroidery. The finishing of textiles is either done by printing or dyeing.

Product Insights

On the basis of products, the global industry has been segmented into water repellant, flame retardant, softeners, antibacterial & antimicrobial, fragrance agents, and others. The softeners segment dominated the industry in 2021 and accounted for the highest share of more than 25.1% of the overall revenue. Its high share is attributed to the ability of softeners to remove the electrostatic charge generated during the production and use of fabrics. Softener finishes are applied to the surface of all textile products, on which frictional contracts can cause potential charge accumulation. Water repellent finishing agents wrap the surface of fiber with nanoparticle compounds and provide excellent water repellency to textile products.

Water repellency maintains the breathability of fabric or maintains air permeability. Water repellent finishing agents are extensively utilized in the production of electronic goods, clothes, and other consumer goods products. Flame retardant finishing agents are applied to the fabric to suppress the combustion process. Flame retardant fabrics burn slowly and limit the spread of fire. Firefighting suits are a good example of flame-retardant textile products. Firefighting suits suppress the effect of fire on it and do not catch fire easily.

Application Insights

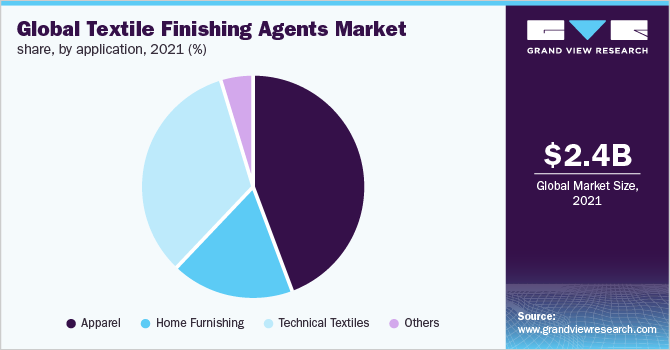

The apparel segment dominated the global industry in 2021 and accounted for the highest share of more than 44.30%of the overall revenue. Its high share is attributed to the extensive product utilization for the production of fabrics used for developing clothes, blankets, bedsheets, and footwear. These agents add color, softness, fragrance, and antibacterial effects to fabrics. Wide acceptance of a variety of apparel, coupled with rapidly changing fashion requirements, is anticipated to fuel the product demand globally over the forecast period. Technical textiles are developed and adopted for their technical functionalities. Textile finishing agents are expected to witness increased consumption in BuildTech, MedTech, and ProTech (protective textiles) applications.

An increase in the number of public infrastructure development projects by governments of different countries, such as India, China, and Japan, is anticipated to boost the product demand in BuildTech applications. Finishing agents applied to technical textiles used in ProTech applications act as flame retardants. They are also applied as coatings to awning fabric, which is used in HomeTech (home textiles) applications. Technical textiles are manufactured using either natural or manmade fibers, including Kevlar and Spandex. They are used in agriculture, construction, medical, automotive, and packaging applications.

Textile finishing agents used for home furnishings are mostly developed to improve their functionalities. Finishing agents are applied to them to make home furnishings flame retardant, pollen & dust-free, UV-protected, water-repellent, soft-textured, and soil-resistant, along with reducing the use of VOC in them. The COVID-19 pandemic has led to a surge in work-from-home (remote work) culture and an increase in the number of consumers opting for Do It Yourself (DIY). This has positively impacted the growth of the home decor and furniture market worldwide.

Regional Insights

The Asia Pacific dominated the global industry and accounted for the highest revenue share of more than 56.85% in 2021. This is attributed to the region’s rapid urbanization, resiliency in the face of the COVID-19 pandemic, and modernization of the processes used to make textiles and chemicals. The Asian market is anticipated to profit from the increased use of smart textiles including flame-retardant and anti-microbial materials. The main producers are concentrating on reorganizing their business portfolio, expanding their production capacity, and raising money to create specialized products. Macroeconomic reasons like rapid urbanization and a growing population, as well as stringent regulations encouraging the use of shielding fabrics in the healthcare sector, are driving industry growth in Asian nations.

Furthermore, the majority of manufacturers from matured economies like the U.S. are setting up their production units in the developing regions of Asia due to the easy availability of raw materials and cheap labor. Europe is characterized by the existence of several major economies, such as the U.K., Germany, Spain, Italy, and France. Supportive policies, continuous employment creation, and an increase in wages are some of the factors contributing to the economic growth of the region. The U.K. is home to many famous apparel brands, such as Ed Hardy and Alexander McQueen. Such a strong presence of product manufacturers and significant growth in demand for innovative fabrics with a rich feel are expected to fuel the industry growth in the country. North America is expected to show a moderate growth rate over the forecasted period due to the presence of large-scale manufacturers in the region.

Key Companies & Market Share Insights

The global industry is relatively concentrated with the presence of numerous manufacturers engaged in the production of textile finishing agents, dominating the majority of the industry share. To obtain a competitive edge, businesses are investing in new product development, business alliances, collaborations, and other strategic activities. In addition, increasing the supplier base and production capacity to maintain competition over the long term is the main benefit of such industry tactics. Some of the prominent players in the global textile finishing agents market include:

-

Dow

-

Fineotex Chemical Ltd.

-

BASF SE

-

Synthomer plc

-

Huntsman International LLC

-

Sarex

-

Resil Chemicals Pvt. Ltd.

-

Zydex Group

-

DyStar Singapore Pte. Ltd.

-

Lubrizol Corp.

-

Archroma

-

Kemin Industries Inc.

-

BioTex Malaysia

-

AB Enzymes

-

Evonik Industries

-

Organic Dyes and Pigments LLC

Textile Finishing Agents Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.55 billion

Revenue forecast in 2030

USD 3.8 billion

Growth rate

CAGR of 5.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Turkey; China; India; Japan; South Korea; Vietnam; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Dow; Fineotex Chemical Ltd.; BASF SE;Synthomer plc; Huntsman International LLC; Sarex; Resil Chemicals Pvt. Ltd.; Zydex Group; DyStar Singapore Pte Ltd.; Lubrizol Corp.; Archroma; Kemin Industries Inc.; BioTex Malaysia; AB Enzymes; Evonik Industries; Organic Dyes; Pigments LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Finishing Agents Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global textile finishing agents market report on the basis of, type, product, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aesthetic

-

Functional

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water Repellant

-

Flame Retardant

-

Softeners

-

Antibacterial & Antimicrobial

-

Fragrance Agents

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Home Furnishing

-

Technical Textiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global textile finishing agents market size was estimated at USD 2.4 billion in 2021 and is expected to reach USD 2.55 billion in 2022.

b. The global textile finishing agents market is expected to grow at a compound annual growth rate of 5.1% from 2022 to 2030 to reach USD 3.8 billion by 2030

b. The Asia Pacific dominated the textile finishing agents market with a share of 56.9% in 2021. This is attributable to the region's rapid urbanization, resiliency in the face of the COVID-19 pandemic, and modernization of the processes used to make textiles and chemicals are some of the factors driving the market to rise.

b. Some key players operating in the textile finishing agents market include Dow, BASF SE, Huntsman International LLC, Lubrizol Corporation, and Zydex Group

b. Key factors that are driving the market growth include increasing per capita income and the flourishing chemical manufacturing sector in emerging economies like China, Japan, and India

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.