Textile Fiber Market Size, Share & Trends Analysis Report By Product ( Natural Fiber, Synthetic Fiber), By End-use (Fashion & Clothing, Automotive, Building & Construction), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-540-5

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Textile Fiber Market Size & Trends

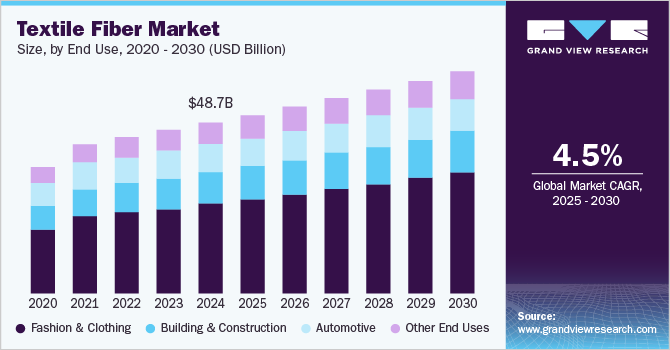

The global textile fiber market size was estimated at USD 48.70 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030, driven by the increasing demand for apparel and home textiles fueled by rising disposable incomes and changing fashion trends. The rapid growth of the global population, particularly in emerging economies such as India, China, and Brazil, has led to higher consumption of clothing, bedding, and upholstery products. In addition, the increasing penetration of e-commerce platforms has significantly influenced consumer purchasing behavior, making textiles more accessible to a broader customer base.

The demand for high-quality and sustainable fibers has also grown, prompting manufacturers to focus on innovative materials that offer durability, comfort, and environmental benefits.

The expanding technical textiles industry is another key driver of the textile fiber industry. Technical textiles, which include fibers used in automotive, medical, aerospace, and industrial applications, are gaining prominence due to their superior strength, functionality, and resistance to extreme conditions. The automotive industry, in particular, has witnessed an increased demand for high-performance fibers in seatbelts, airbags, and interior components. Similarly, the medical sector relies on advanced textile fibers for wound dressings, surgical gowns, and protective gear. The growing need for specialized fiber solutions across various industries continues to support market expansion.

Sustainability concerns and the increasing preference for eco-friendly fibers are shaping the global textile fiber industry. Consumers and regulatory authorities are placing greater emphasis on reducing the environmental impact of textile production, leading to a shift toward biodegradable and recycled fibers. Natural fibers such as organic cotton, hemp, and bamboo are gaining traction, while advancements in recycling technologies are boosting the demand for regenerated fibers, including recycled polyester and lyocell. Governments and industry players are implementing initiatives to promote sustainable fiber production, further driving market growth.

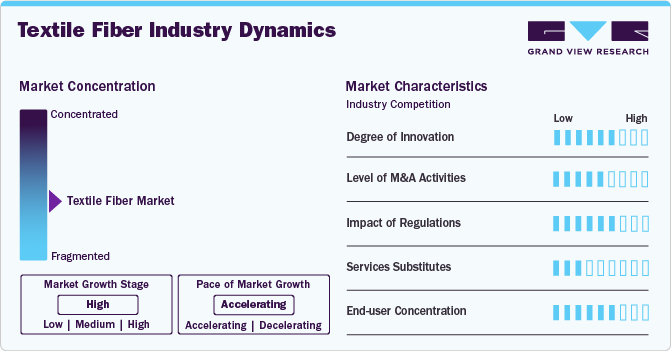

Market Concentration & Characteristics

The global textile fiber industry exhibits a moderate-to-high level of market concentration, with a few dominant players controlling significant market shares across natural and synthetic fiber segments. Innovation plays a crucial role in market dynamics, as manufacturers focus on developing sustainable and high-performance fibers to meet evolving consumer demands and regulatory requirements. The rise of eco-friendly and biodegradable fibers, such as organic cotton, recycled polyester, and bio-based synthetic fibers, reflects the industry's commitment to reducing environmental impact. Advanced manufacturing techniques, including nanotechnology and smart textiles, further enhance fiber properties, such as durability, moisture resistance, and antimicrobial capabilities. This ongoing innovation fosters competitiveness among key industry participants while encouraging collaborations with fashion, automotive, and industrial sectors to expand fiber applications.

Mergers and acquisitions have been a defining trend in the textile fiber industry, enabling companies to strengthen their market positions, expand production capacities, and diversify product portfolios. Large-scale acquisitions, particularly in the synthetic fiber sector, have led to vertical integration strategies, optimizing raw material sourcing and products. In addition, stringent environmental regulations, particularly regarding carbon emissions, water consumption, and chemical usage in fiber production, have influenced market dynamics, pushing manufacturers toward sustainable practices and regulatory compliance. Substitutes such as plant-based leathers, 3D-printed materials, and bioengineered textiles present moderate competition, particularly in the fashion and home furnishing sectors. However, end-user concentration remains high in apparel, home textiles, and industrial applications, where traditional and technical textile fibers continue to dominate due to their cost-effectiveness, durability, and functional advantages.

End Use Insights

The fashion & clothing segment dominated the market with the largest revenue share of 52.85% in 2024, driven by increasing consumer demand for diverse and high-quality apparel. The rise in fast fashion and e-commerce platforms has significantly accelerated textile fiber consumption as brands continuously introduce new collections to keep up with evolving fashion trends. Consumers' growing preference for stylish, comfortable, and functional clothing has driven the demand for a variety of textile fibers, including Natural Fibers like cotton and wool, as well as synthetic fibers such as polyester and nylon. In addition, the increasing disposable income in emerging economies has contributed to higher spending on fashion and apparel, further propelling the market growth.

The building & construction segment is expected to grow significantly at a CAGR of 4.7% over the forecast period, driven by increasing adoption of advanced textile materials for structural applications. The demand for high-performance and durable fibers has risen due to their superior properties, such as high tensile strength, flexibility, resistance to weather conditions, and fire retardancy. Textile fibers are widely used in reinforced concrete structures, roofing materials, wall coverings, and insulation systems, enhancing the durability and efficiency of modern buildings. With the expansion of infrastructure projects worldwide, particularly in emerging economies, the need for innovative construction materials has accelerated, directly contributing to the growth of textile fiber consumption.

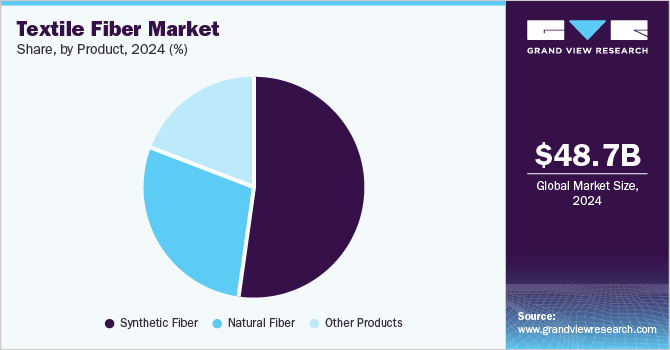

Product Insights

The synthetic fiber segment held the largest revenue share of 52.0% in 2024, driven by its superior properties, cost-effectiveness, and wide-ranging applications across multiple industries. Synthetic fibers, such as polyester, nylon, acrylic, and polypropylene, offer excellent durability, resistance to moisture and chemicals, and ease of maintenance compared to natural fibers. These advantages make them highly preferred in apparel, home textiles, and industrial applications. In addition, the increasing consumer demand for affordable and wrinkle-resistant clothing has further propelled the adoption of synthetic fibers in the fashion and textile industries.

The natural fiber segment is expected to grow significantly at a CAGR of 4.3% over the forecast period, driven by increasing consumer preference for eco-friendly and biodegradable textiles. With rising awareness of environmental sustainability and concerns over synthetic fiber pollution, industries are shifting towards natural fibers such as cotton, wool, silk, and flax. Governments and regulatory bodies worldwide are also promoting the use of sustainable materials by implementing stringent environmental regulations on synthetic fiber production and disposal. This growing emphasis on sustainability is encouraging manufacturers to invest in the production and processing of natural fibers, further propelling market growth.

Regional Insights

The North America textile fiber industry is driven by the growing demand for sustainable and eco-friendly fibers. Consumers are increasingly prioritizing sustainability in their purchasing decisions, leading to a surge in demand for organic cotton, recycled polyester, and biodegradable fibers. The fashion industry, in particular, is embracing sustainability initiatives, with major brands committing to reducing their environmental footprint by sourcing eco-friendly fibers. In addition, government regulations promoting sustainable manufacturing practices, such as the U.S. Environmental Protection Agency (EPA) guidelines on textile waste reduction, are encouraging fiber producers to innovate and develop environmentally responsible alternatives. The increasing consumer preference for circular economy practices, including fiber recycling and upcycling, is further fueling the demand for sustainable textile fibers in the region.

U.S. Textile Fiber Market Trends

The textile fiber industry in the U.S. is driven by technological advancements in fiber production and textile manufacturing, which is fueling market growth in the U.S. Innovations such as nanotechnology, smart textiles, and moisture-wicking fibers have expanded applications across multiple industries, including sportswear, healthcare, and industrial textiles. The development of performance-enhancing fibers that offer properties such as thermal regulation, UV protection, and antibacterial resistance is driving demand among consumers looking for functional and high-tech apparel. In addition, advancements in automated fiber production processes have improved efficiency and cost-effectiveness, enabling manufacturers to scale up production while maintaining high quality.

Asia Pacific Textile Fiber Market Trends

Asia Pacific textile fiber industry dominated globally in 2024 with the largest revenue share of about 47.29%. Rising population growth and increasing disposable incomes across the Asia Pacific contribute significantly to the growing demand for textile fibers. As the middle-class population expands in countries such as China, India, Indonesia, and Thailand, there is a rising preference for high-quality and fashionable clothing. The fast fashion industry, driven by increasing consumer spending and changing fashion trends, requires a steady supply of textile fibers to meet market demand. In addition, the shift in consumer behavior towards comfortable, durable, and sustainable clothing materials is pushing textile fiber manufacturers to innovate and expand production capacity, further strengthening the market in the region.

The China textile fiber industry growth is attributed to the rising demand for synthetic fibers, particularly polyester, and it has been a significant driver for market growth. As the world’s largest producer of polyester fibers, China benefits from abundant petrochemical resources and advanced polymerization technologies that support large-scale fiber production. Polyester’s affordability, versatility, and durability make it the preferred choice for a wide range of applications, including apparel, home textiles, and industrial fabrics. The increasing global preference for performance textiles, such as moisture-wicking and wrinkle-resistant fabrics, further boosts the demand for synthetic fibers, with China at the forefront of innovation and production in this segment.

Europe Textile Fiber Market Trends

The Europe textile fiber industry is well supported by the European fashion and apparel market’s robust growth, and it is also serving as a major catalyst for the market, with the region being home to some of the world’s leading fashion houses and retailers. The demand for premium-quality and sustainable textiles in the luxury and fast fashion segments is fueling the adoption of innovative fibers. In addition, the rising popularity of athleisure and functional apparel has increased the need for high-performance fibers, such as spandex blends, merino wool, and moisture-resistant synthetics. The shift towards local and nearshoring manufacturing to ensure supply chain resilience post-pandemic has further strengthened fiber consumption in Europe, as brands prioritize regional sourcing to reduce transportation emissions and improve production efficiency.

The Germany textile fiber industry is driven by its advanced automotive industry, which is playing a significant role in driving the demand for high-performance textile fibers. As one of the world’s largest automotive manufacturing hubs, Germany requires a vast number of technical textiles for applications in vehicle interiors, airbags, seatbelts, and composite materials. The increasing focus on lightweight and durable materials in automotive production has fueled the demand for high-strength synthetic fibers such as aramid and carbon fibers. With the growing adoption of electric vehicles, the need for advanced fiber materials in insulation, lightweight components, and sustainable automotive interiors continues to rise, further propelling the textile fiber industry.

Central & South America Textile Fiber Market Trends

Central & South American textile fiber industry is boosted by the significant role played by trade agreements and favorable government policies. Countries in the region benefit from trade pacts such as the United States-Mexico-Canada Agreement (USMCA) and the Mercosur trade bloc, which facilitate the export of textile products to key international markets. The reduction of tariffs and increased market access for Central & South American textile producers have encouraged investment in fiber production and textile manufacturing, ensuring a stable demand for both natural and synthetic fibers. In addition, government incentives, such as tax breaks and financial support for textile manufacturers, have further strengthened the regional textile industry, promoting long-term growth in fiber consumption.

Middle East & Africa Textile Fiber Market Trends

The Middle East & Africa textile fiber industry is driven by the expansion of textile fiber production capabilities in Africa, particularly in countries such as Ethiopia, Kenya, and South Africa, which is further driving market growth. African nations are emerging as major players in global textile supply chains due to their abundant natural resources, including cotton, wool, and silk, as well as strategic government incentives to attract foreign investment. Ethiopia, for example, has positioned itself as a textile and apparel manufacturing hub, offering incentives such as tax breaks and duty-free access to key export markets. The establishment of industrial parks and textile clusters is enabling the region to enhance fiber production, reduce raw material import dependency, and cater to both domestic and international textile markets.

Key Textile Fiber Company Insights

Some of the key players operating in the market include Tongkun Holding Group, Indorama Ventures Public Company Limited, among others.

-

Tongkun Holding Group is a Chinese manufacturer specializing in polyester fibers and filament yarns. The company is a major player in the global textile fiber industry, with an extensive product portfolio that includes polyester chips, fully drawn yarn (FDY), partially oriented yarn (POY), and drawn textured yarn (DTY).

-

Indorama Ventures Public Company Limited is a Thailand-based multinational company engaged in the production of polyester, polyethylene terephthalate (PET), and various textile fibers. The company’s product offerings include staple fibers, polyester yarns, and high-performance fibers used in apparel, automotive, home textiles, and nonwoven applications.

Alpek and Toray Industries, Inc. are some of the emerging market participants in the textile fiber industry.

-

Alpek is a Mexico-based global leader in the polyester and petrochemical industry, supplying raw materials for textile fiber production. The company manufactures polyester fibers, PET resins, and purified terephthalic acid (PTA), which serve as essential components in textile and industrial fiber production. Alpek focuses on delivering high-performance synthetic fibers used in apparel, home furnishings, and automotive textiles while emphasizing sustainability and operational efficiency in fiber manufacturing.

-

Toray Industries, Inc. is a Japanese multinational corporation with a strong presence in the textile fiber industry, offering a wide range of synthetic fibers and performance materials. Its product portfolio includes polyester, nylon, carbon fiber, and specialty high-function fibers designed for applications in fashion, sportswear, industrial textiles, and aerospace. Toray is recognized for its innovation in high-tech fibers, including moisture-wicking, antibacterial, and eco-friendly solutions, catering to the evolving demands of global markets.

Key Textile Fiber Companies:

The following are the leading companies in the textile fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Tongkun Holding Group

- Indorama Ventures Public Company Limited

- Alpek

- Toray Industries, Inc.

- Reliance Industries Limited

- Lenzing AG

- Indorama Ventures Public Company Limited

- Teijin Limited

- Toray Industries, Inc.

- Hyosung TNC Corporation

View a comprehensive list of companies in the Textile Fiber Market

Recent Developments

-

In August 2024, Unifi, Inc. introduced a new line of circular polyester materials derived from textile waste, reinforcing its commitment to sustainable innovation in the textile fiber industry. This latest development aligns with the growing industry shift toward closed-loop recycling, reducing environmental impact by transforming post-industrial and post-consumer textiles into high-quality polyester fibers.

Textile Fiber Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 50.89 billion |

|

Revenue forecast in 2030 |

USD 63.42 billion |

|

Growth rate |

CAGR of 4.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Turkey; China; India; Japan; Australia |

|

Key companies profiled |

Tongkun Holding Group; Indorama Ventures Public Company Limited; Alpek; Toray Industries, Inc.; Reliance Industries Limited; Lenzing AG; Indorama Ventures Public Company Limited; Teijin Limited; Toray Industries, Inc.; Hyosung TNC Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Textile Fiber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global textile fiber market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Fiber

-

Synthetic Fiber

-

Other Products

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Fashion & Clothing

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global textile fiber market size was estimated at USD 48.70 billion in 2024 and is expected to reach USD 50.89 billion in 2025.

b. The textile fiber market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 63.42 billion by 2030.

b. The fashion & clothing segment dominated the market and accounted for the largest revenue share of 52.85% in 2024, driven by increasing consumer demand for diverse and high-quality apparel.

b. Some of the key players operating in the textile fiber market include Tongkun Holding Group, Indorama Ventures Public Company Limited, Alpek, Toray Industries, Inc., Reliance Industries Limited, Lenzing AG, Indorama Ventures Public Company Limited, Teijin Limited, Toray Industries, Inc., Hyosung TNC Corporation.

b. The key factors that are driving the textile fiber market include rising demand from the apparel and home textiles industries, increasing adoption in industrial and construction applications, advancements in sustainable and high-performance fibers, population growth, and expanding urbanization.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."