- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Textile Coatings Market Size, Share & Growth Report, 2030GVR Report cover

![Textile Coatings Market Size, Share & Trends Report]()

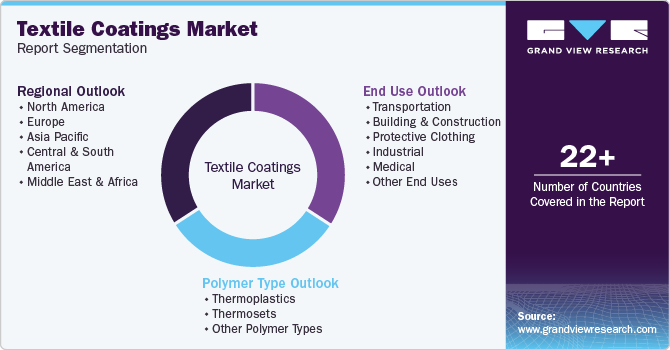

Textile Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report By Polymer Type (Thermoplastics, Thermosets, Other Polymer Types), By End Use (Protective Clothing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-344-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Textile Coatings Market Size & Trends

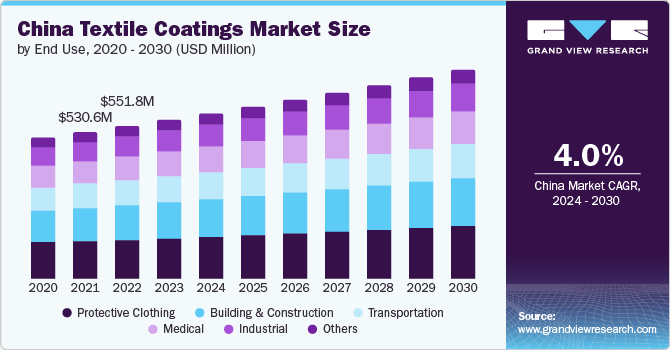

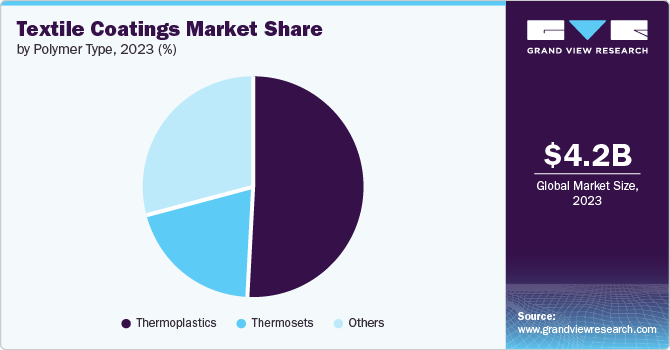

The global textile coatings market size was estimated at USD 4.19 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The market is primarily driven by factors such as the widening scope of polymer types for coatings, innovations in the textile industry, and increasing standards for protective material around the world. These factors have led to the development of the textile coatings industry in emerging economies such as China, India, and others.

The wider end use scope of textile coatings has emerged as a significant driver for the market growth, as the demand for coated textiles extends across various industries and polymer types. They are utilized in diverse sectors, including transportation, industrial, clothing, medical, and technical textiles, due to their ability to enhance and extend performance. For instance, in the transportation industry, they are used for polymer types such as automotive airbags, where specialized coatings are essential to ensure the safety and performance of the protective materials.

The Chinese market is influenced by several important factors, including regulations, industry trends, and market dynamics. The presence of several small- and medium-sized manufacturers in China, along with the easy availability of low-cost labor and government support, is expected to contribute to healthy market growth. Moreover, the increasing industrial quality standards and regulations are encouraging the use of textile coatings in China. The demand for thermoplastic polyurethane products is expected to garner a significant share of total growth, reflecting the emphasis on advanced coating technologies and their polymer types in the Chinese market.

Innovations in production have significantly driven market growth, aiding the development of advanced materials and processes that enhance the performance and functionality of textiles. One notable innovation is the integration of novel materials and technologies to extend traditional functionality, resulting in the creation of modern fibers that are eco-friendly, resilient, and mechanically flexible. For example, the development of plant-based products and antimicrobial fabrics showcase the versatility and sustainability of textile innovations. These advancements have not only expanded the range of polymer types for textiles but have also created commercially viable and environmentally friendly alternatives, driving the market demand.

The emphasis on technical textiles has propelled the demand for specialized coatings that offer functionalities such as flame retardance, enhanced water resistance, antibacterial treatment, and protective coatings. This trend indicates the important role of innovation in driving market growth as manufacturers seek to meet the evolving requirements of technical products with advanced coating solutions. Furthermore, technological advancements in machinery, synthetic fibers, and logistics have transformed the textile industry, leading to the development of high-performance products that require specialized coatings for enhanced functionality.

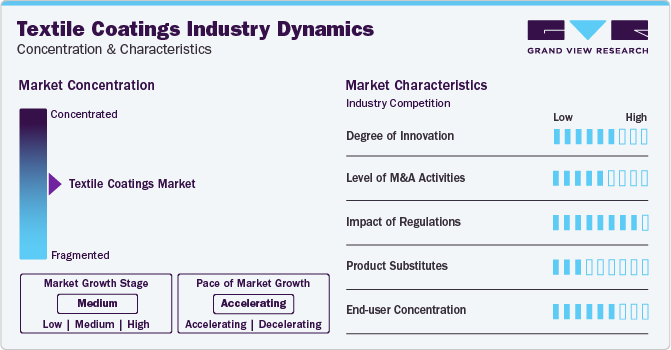

Market Concentration & Characteristics

The textile coatings industry can be characterized as moderately consolidated, with a notable degree of market concentration among key players. This consolidation is evident through the presence of a few major companies that hold significant market share and influence pricing dynamics within the industry. The competitive landscape is marked by the dominance of established players that have a strong foothold in the market, often leveraging their extensive resources, technological capabilities, and distribution networks to maintain their positions.

Global textile coatings industry consists of prominent companies such as Covestro AG, Huntsman Corporation, and BASF SE, which hold significant market share and exert considerable influence on market dynamics. These industry leaders have established themselves as key players through their extensive product portfolios, global presence, and strong R&D capabilities, contributing to the moderately consolidated nature of the industry.

Compliance with stringent regulations and standards, particularly concerning environmental sustainability, product safety, and chemical usage, is a critical factor influencing market dynamics. Companies operating in this space are required to adhere to a complex web of regulations governing the production, use, and disposal of textile coatings, thereby impacting their manufacturing processes, product formulations, and overall business strategies. Regulatory compliance serves as a significant barrier to entry, contributing to the consolidation of the market by favoring established players with the resources to navigate and adhere to these regulatory frameworks.

End Use Insights

Protective clothing dominated the market with a revenue share of 25.6% in 2023. Textile coatings play a vital role in enhancing the performance of protective clothing by imparting characteristics such as water resistance, flame retardancy, chemical resistance, and durability. For instance, in the development of chemical protective clothing, textile coatings are utilized to create multi-layered fabrics with specific properties, such as an outer fabric layer for mechanical protection, a layer for chemical absorption, and an inner layer for comfort and additional protection.

Protective textiles coated with thermoset polymers, such as aramid and blends, polyolefin, and polybenzimidazole (PBI), are widely used in protective clothing applications due to their high strength-to-weight ratio, abrasion resistance, fire resistance, and heat resistance. These enable the production of protective clothing that meets stringent safety standards and provides reliable protection against a wide range of hazards. The use of textile coatings in protective clothing extends to applications such as protective gloves, high-visibility warning clothing, and apparel designed for protection against foul weather, chemical substances, and radioactive contamination.

The building and construction industry serves as a significant end use segment for the market growth, encompassing a wide range of applications that leverage coated textiles for various purposes. They are utilized in the construction industry for applications such as architectural membranes, canopies, awnings, scaffolding nets, hoardings, and signage, among others. They offer properties such as weather resistance, durability, and structural functionality, making them essential for creating innovative building materials and structures.

The use in the construction industry extends to lightweight construction materials, where cutting waste has been combined with epoxy resin and foundry sand to produce unique composite materials suitable for construction applications. The versatility and adaptability of textile coatings in the building and construction industry contribute to the development of innovative and sustainable construction materials, addressing the industry's evolving needs and environmental considerations.

Polymer Type Insights

Thermoplastics dominated the market with a revenue share of 51.1% in 2023. Thermoplastics play a significant role as a polymer type in the textile coatings industry due to their unique properties and versatility. These polymers soften when heated and solidify upon cooling, allowing them to be reshaped and remolded, making them ideal for diverse applications. The high viscosity of thermoplastics necessitates specific processing techniques to prepare precursor materials for composite component manufacturing.

Polyethylene, polypropylene, and polyvinyl chloride (PVC) are thermoplastics commonly used in textile coatings. These thermoplastics offer a range of properties suitable for coatings, including flexibility, durability, and resistance to environmental factors, making them well-suited for applications such as outdoor fabrics, upholstery, and protective clothing. The use of thermoplastics aligns with the demand for durable, high-performance coated textiles in industries such as automotive, outdoor gear, and protective clothing.

Thermoset polymers are a crucial polymer type in the textile coatings industry, offering unique properties that make them well-suited for various applications. These polymers are obtained by irreversibly hardening a soft solid or viscous liquid prepolymer through a process called curing, induced by heat, suitable radiation, high pressure, or mixing with a catalyst. The unique properties of thermoset polymers, such as their ability to form a permanent chemical bond during curing and their resistance to thermal deformation after curing, make them essential in demanding environments.

Thermoset polymers commonly used in textile coatings include epoxy, polyester, polyurethane, and vinyl ester resins. These polymers are known for their chemical and solvent resistance, high heat stability, and dimensional stability, making them suitable for applications in harsh conditions, such as high-performance composites for aerospace and automotive industries, electronic printed circuit boards, corrosion-resistant coatings, and construction materials.

Regional Insights

U.S. Textile Coatings Market Trends

The U.S. has a growing textile coatings industry with a significant focus on innovation and sustainability. Companies such as Covestro AG and Huntsman International LLC are key players in this market, driving advancements in technology. The U.S. has witnessed a growing demand for protective textiles, especially in sectors such as construction, medical, and home furnishing.

Germany has companies like Covestro AG and BASF SE, which are driving the market in technological advancements and product innovation. The country's textile industry has been at the forefront of sustainable practices, with a growing demand for more eco-friendly and sustainable products. The deployment of advanced technology and the use of materials such as natural rubber have contributed to the market's growth.

Asia Pacific Textile Coatings Market Trends

Asia Pacific dominated the market with a revenue share of 41.5% share in 2023. The region's textile industry is segmented by application into clothing, industrial and technical, household, and other applications, showcasing the wide-ranging use in various sectors. In addition, the Asia-Pacific home textile industry has seen substantial growth, particularly in segments such as bed linen, driven by increased spending in emerging economies and the hospitality industry, thereby boosting market growth.

India lays a strong emphasis on low-cost production, high-quality raw materials, and modern high-tech machinery. The country's textile industry accounts for a major share of the global market, with substantial exports to countries around the globe. The 'Make in India' campaign has provided a significant boost to the sector, leading to increased demand for robust, resistant, and abrasion-resistant coatings.

Brazil is witnessing notable growth in the textiles sector, creating opportunities for the application of textile coatings in various sectors. The demand for innovative and sustainable products is on the rise, aligning with the global trend towards eco-friendly and high-performance materials.

The hospitality sector in Saudi Arabia has shown substantial growth, leading to increased opportunities for textile coatings in applications such as hotel furnishings and interior textiles. The deployment of advanced technology and the use of materials such as natural rubber have contributed to the market's expansion. The growing demand and the deployment of advanced technology are driving the demand for textile coatings in the country.

Key Textile Coatings Company Insights

The global textile coatings industry has a competitive landscape with several major players driving market growth through innovative product offerings. Key players in the sector include Arkema Group, Clariant, Covestro AG, BASF SE, The Lubrizol Corporation, Sumitomo Chemical Company, and others. These companies have undertaken various strategies to maintain their competitive edge, including acquisitions, mergers, product launches, and others. The market's emphasis on environmentally friendly practices signifies the progressive nature of the global textile coatings sector and the strategic importance of sustainable and innovative solutions in driving market development.

Some of the key players operating in the market include Arkema Group, Clariant, and Solvay.

-

Arkema offers a wide range of innovative solutions based on sustainable technologies. The company offers textile coatings under its Arkema Coating Resins (ACR) segment, including oil-free polyester resins, powder polyester resins, acrylics, opacifiers, solvent-based alkyds, and aqueous polymer emulsions.

-

Clariant is a key specialty chemical company that offers a diverse portfolio of products ranging from adhesives and sealants, adsorbents, chemical intermediates, and others. The company offers flame retardants, polymer additives and wax additives under the textiles & fibres business segments.

Formulated Polymer Products Ltd., Tanatex Chemicals B.V., and Omnova Solutions Inc. are some of the emerging market participants.

-

Formulated Polymer Products Ltd offers high-performance materials subdivided into four segments: Fluoropolymers (PVDF), Molecular sieves, Hydrogen peroxides, and Special polyamides. Formulated Polymer Products Ltd's extensive portfolio of specialty polyamide polymers includes Rilsan, Rilsamid, Orgalloy, Pebax, and Platamid.

-

Tanatex Chemicals B.V. develops chemicals for textile industry for a wide range of coating applications such as binders, antistatic agents, cross linkers and boosters. The company offers Spiro-Tex waterborne, solvent-free coating concepts for windproofing and waterproofing purposes in a sustainable manner.

Textile Coatings Companies:

The following are the leading companies in the textile coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema

- Clariant

- Covestro AG

- Huntsman International LLC

- Solvay

- OMNOVA North America Inc.

- The Lubrizol Corporation

- Sumitomo Chemical Co. Ltd.

- Tanatex Chemicals B.V.

- Formulated Polymer Products Ltd.

Recent Developments

-

In November 2023, Covestro AG announced the launch of Impranil CQ DLU, a new polyether polyurethane (PU) dispersion for textile coating purposes. 34% of the carbon in the product is extracted from plant-based origins, reflecting its sustainable qualities for customers with environmental concerns.

-

In December 2022, Arkema announced the doubling of capacity in its polyester raisin manufacturing plant in Navi Mumbai, India. The expansion would allow the company to expand its geographic coverage in India and enable the distribution of sustainable and low-VOC products around the country.

Textile Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.33 billion

Revenue forecast in 2030

USD 5.58 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Polymer type, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Colombia, Saudi Arabia, South Africa

Key companies profiled

Arkema, Clariant, Covestro AG, Huntsman International LLC, Solvay, OMNOVA North America Inc., The Lubrizol Corporation, Sumitomo Chemical Co. Ltd., Tanatex Chemicals B.V., Formulated Polymer Products Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global textile coatings market report based on polymer type, end use, and region:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thermoplastics

-

Thermosets

-

Other Polymer Types

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Building & Construction

-

Protective Clothing

-

Industrial

-

Medical

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global textile coatings market size was estimated at USD 4.19 billion in 2023 and is expected to reach USD 4.33 billion in 2024.

b. The global textile coatings market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 5.58 billion by 2030.

b. Asia Pacific dominated the textile coatings market with a share of 41.5% in 2023. This is attributable to a strong emphasis on low-cost production, high-quality raw materials, and modern high-tech machinery.

b. Some key players operating in the textile coatings market include Arkema, Clariant, Covestro AG, Huntsman International LLC, Solvay, OMNOVA North America Inc., The Lubrizol Corporation, Sumitomo Chemical Co. Ltd., Tanatex Chemicals B.V., Formulated Polymer Products Ltd.

b. Key factors that are driving the market growth include factors such as the widening scope of polymer types for coatings, innovations in the textile industry and increasing standards for protective material around the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.