- Home

- »

- Renewable Chemicals

- »

-

Tetrahydrofuran Market Size, Share & Trends Report, 2030GVR Report cover

![Tetrahydrofuran Market Size, Share & Trends Report]()

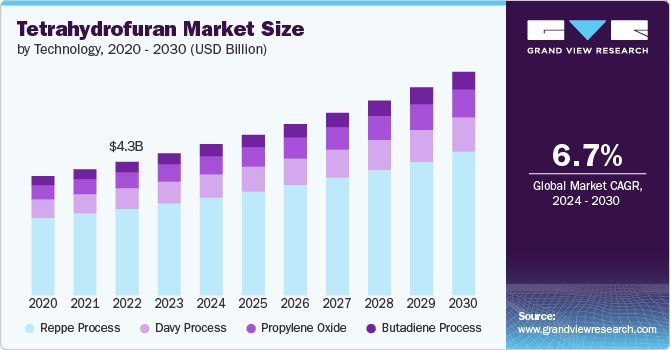

Tetrahydrofuran Market Size, Share & Trends Analysis Report By Technology (Reppe Process, Davy Process, Propylene Oxide), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-361-5

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

“2030 tetrahydrofuran market value to reach USD 7.13 billion.”

Tetrahydrofuran Market Size & Trends

The global tetrahydrofuran market size was estimated at USD 4.53 billion in 2023 and is expected to grow at a compound CAGR of 6.7% from 2024 to 2030. Growing production of polytetramethylene ether glycol (PTMEG) is expected to drive the market for tetrahydrofuran (THF) over the coming years.

PTMEG is a key raw material required for manufacturing the spandex fabric. The growing demand for sports apparel and stretchable fabrics in the fashion industry has led to an increased need for spandex, is expected to push the demand for tetrahydrofuran (THF) market over the forecast period. Additionally, the versatile properties of THF, such as its solvency and ability to produce high-performance polymers is further anticipated to fuel its demand across various industries.

Drivers, Opportunities & Restraints

Demand of tetrahydrofuran (THF) for its application as an industrial solvent is expected to serve as a key driver for the market over the coming years. THF's excellent solvent properties, including its ability to dissolve polar and non-polar compounds, make it extremely critical material in pharmaceuticals, PVC cements, and coatings applications. As manufacturers focus on for more efficient production processes and high-quality finishes, the demand for effective solvents like THF is anticipated to rise in near future.

The tetrahydrofuran (THF) market is expected to observe significant opportunities in development and commercialization of bio-based THF. With growing environmental concerns and stringent regulatory policies against the use of petroleum-based products, the industry is shifting towards sustainable solutions. Bio-based THF, derived from renewable resources, presents a lucrative opportunity for market participants, offering a greener alternative without compromising on performance.

Environmental and health concerns associated with its tetrahydrofuran (THF) production and use is expected to hinder the market growth over the short term. THF is highly flammable, and its vapors can form explosive mixtures with air, posing significant safety risks. Moreover, prolonged exposure to THF can lead to serious health issues, necessitating stringent handling and safety measures. These factors can restrict its use in certain applications and industries, hindering the market growth.

Technology Insights & Trends

“Reppe Process held the largest revenue share of over 64% in 2023.”

The Reppe process is a crucial industrial method for synthesizing tetrahydrofuran (THF), involving the catalytic hydrogenation of acetylene in the presence of a solvent. This process is renowned for producing THF of high purity, which is essential for applications requiring stringent quality standards, such as in pharmaceuticals and electronics. The efficiency and reliability of the Reppe process is expected to boost the segment over the coming years.

The Davy process is another important technology for producing THF. This involves the dehydrative cyclization of 1,4-butanediol (BDO) using a catalyst. This process is favored for its ability to achieve high yields and its adaptability to large-scale manufacturing. The scalability and cost-effectiveness of the Davy process make it ideal method for industrial THF production, catering to the high demand across various sectors.

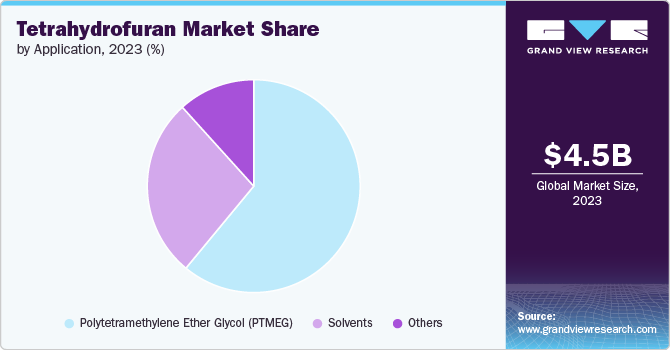

Application Insights & Trends

“Polytetramethylene Ether Glycol (PTMEG) application held the largest revenue share of over 61% in 2023.”

In the Polytetramethylene Ether Glycol (PTMEG) production, THF serves as a critical raw material required for synthesizing this polymer, It is widely used in making spandex fibers, polyurethane elastomers, and copolyesters. The properties imparted by PTMEG, such as elasticity, durability, and resistance to chemicals and abrasion, are essential for high-performance apparel and materials. This application underscores the integral role of THF in advancing textile and polymer industries.

In solvents, THF's remarkable ability to dissolve a wide range of materials makes it product in pharmaceutical formulations, adhesives, and coatings. Its efficacy in facilitating chemical reactions and processes by dissolving reactants, polymers, and other compounds efficiently translates into high-quality products and streamlined production processes, highlighting its versatile utility in industrial and research applications.

Regional Insights

“Asia Pacific held over 60% revenue share of the overall tetrahydrofuran market.”

Asia Pacific Tetrahydrofuran Market Trends

Asia Pacific THF market is expected to observe rapid growth, driven by expanding industries such as textiles, pharmaceuticals, and automotive. Countries like China and India, with their expanding manufacturing sectors and increasing focus on industrial innovations, are expected to remain key markets for producers.

North America Tetrahydrofuran Market Trends

THF market in North America is characterized by advanced technological adoption and stringent environmental regulations. The region's focus on sustainable and high-performance materials, especially in the automotive and pharmaceutical sectors, propels the demand for THF. The regions also leads in terms of research and development efforts, aiming at innovation and environmental sustainability, which in turn is likely to benefit the expansion in the region.

U.S. Tetrahydrofuran Market Trends

Advanced industrial and technological landscape of the country remains a key factor for market growth. With a robust industrial base and a focus on sustainable practices, the U.S. is expected to dominate the North American industry, contributing to technological advancements and market growth.

Europe Tetrahydrofuran Market Trends

The tetrahydrofuran market in Europe is characterized by the region’s commitment to reducing carbon footprints and embracing bio-based and renewable resources. This is also expected to provider presenting new growth avenues for market participants. Europe's emphasis on research and regulation provides a conducive environment for THF market industry, supported by a focus on quality, and safety.

Key Tetrahydrofuran Company Insights

Some of key players operating in market include Ashland, BASF, Dairen Chemical, and Sipchem.

-

Ashland Inc. is a one of the leading specialty chemicals that serves variety of industries, including pharmaceutical, personal care, and automotive. The company’s operations are spread cross over 100 countries, providing a broad range of products and services designed to help customers and their business growth

-

Dairen Chemical is a leading chemical company based in Taiwan, specializing in the production of petrochemical products, notably Vinyl Acetate Monomer (VAM), butanediol (BDO), and several solvents including tetrahydrofuran (THF). The company serves wide industries including coatings, textiles, and plastics.

Key Tetrahydrofuran Companies:

The following are the leading companies in the tetrahydrofuran market. These companies collectively hold the largest market share and dictate industry trends.

- Ashland Inc.

- Banner Chemicals Limited

- BASF

- BioAmber

- Dairen Chemical

- INVISTA

- LyondellBasell

- Nova Molecular Technologies

- Penn A Kem

- Sipchem

Recent Developments

-

In January 2024, Lycra Company announced large scale commercial production of bio-based spandex. The base material for this bio-based product is PTMEG, contributing around 70% in overall consumption. Thus, this will help the compmay to expand its product portfolio bio-based materials.

-

In October 2022, researchers in Wuhan University developed a new electrolyte from di-isopropyl ether, THF and lithium sulfur batteries. This new electrolyte is capable of dissolving lithium polysulfides.

Tetrahydrofuran Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.82 billion

Revenue forecast in 2030

USD 7.13 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil; GCC; South Africa

Key companies profiled

Ashland Inc.; Banner Chemicals Limited; BASF; BioAmber; Dairen Chemical; INVISTA; LyondellBasell; Nova Molecular Technologies; Sipchem

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tetrahydrofuran Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tetrahydrofuran market report based on technology, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Reppe Process

-

Davy Process

-

Propylene Oxide

-

Butadiene Process

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Polytetramethylene Ether Glycol (PTMEG)

-

Solvents

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tetrahydrofuran market size was estimated at USD 4.53 billion in 2023 and is expected to reach USD 4.82 billion in 2024.

b. The global tetrahydrofuran market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 7.13 billion by 2030.

b. Asia Pacific dominated the tetrahydrofuran market with a share of 60.5% in 2023. This is attributable to expanding industries such as textiles, pharmaceuticals, and automotive. Countries like China and India, with their expanding manufacturing sectors and increasing focus on industrial innovations, are expected to remain key markets for producers.

b. Some key players operating in the tetrahydrofuran market include Ashland Inc., Banner Chemicals Limited, BASF, BioAmber, Dairen Chemical, INVISTA, LyondellBasell, Nova Molecular Technologies, and Sipchem

b. Key factors that are driving the market growth include growing production of polytetramethylene ether glycol (PTMEG). PTMEG is a key raw material required for manufacturing the spandex fabric. The growing demand for sports apparel and stretchable fabrics in the fashion industry has led to an increased need for spandex, is expected to push the demand for tetrahydrofuran (THF)

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."