Testing, Inspection, And Certification Market Size, Share & Trends Analysis Report By Service Type (Testing, Inspection, Certification), By Sourcing Type (In-house, Outsourced), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-073-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

TIC Market Size & Trends

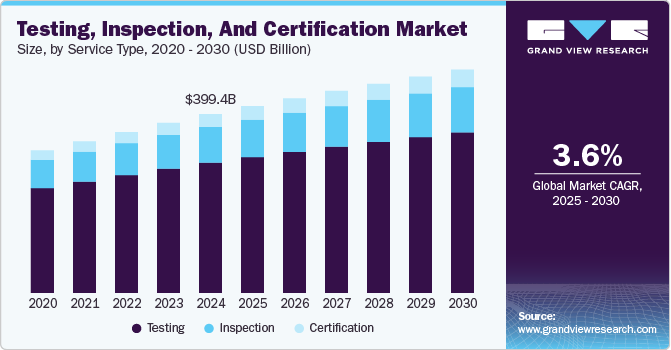

The global testing, inspection, and certification market size was estimated at USD 399.39 billion in 2024 and is projected to grow at a CAGR of 3.6% from 2025 to 2030. Stringent regulatory and compliance standards, growing emphasis on product quality and safety, expansion of global trade, advancement in technologies are primarily driving the growth of the market. Governments and regulatory bodies worldwide enforce strict quality, safety, and environmental standards, requiring organizations to adhere to rigorous testing and certification processes.

Moreover, various industries such as, automotive, healthcare, construction, and energy face increasing regulatory requirements, boosting demand for TIC services. For instance, in October 2024, Applus+ partnered with Four Hills Group, equipment and people hire services to the civil, mining, and construction sectors of Western Australia, to deliver advanced testing and inspection services across Australia. The partnership aims to generate employment opportunities, supporting both Indigenous and non-Indigenous individuals in pursuing meaningful and sustainable career paths within the testing and inspection sector of the construction and mining industries.

The growing demand among enterprises and corporations for safe and efficient testing, inspection, and certification (TIC) practices is driving the growth of the testing, inspection, and certification industry. These practices play a critical role in helping companies maintain optimal quality standards, enhance productivity, and achieve maximum efficiency. By adopting TIC solutions, businesses can tailor their supply chain activities to align with specific requirements, streamlining operations and simplifying overall business processes.

The rising growth of the transportation and logistics sector offers promising growth opportunities to the industry. This can be attributed to increasing global trade and the need to deploy intelligent logistics systems at companies. This facilitates TIC solutions to ensure the timely delivery of goods and products across the value chain to minimize operational expenditure.The rising infrastructure and renewable energy generation projects also offer significant growth opportunities to the global TIC market. The rising urbanization has led to a rise in infrastructure development activities in several developed and developing economies. This is promoting planners and decision-making authorities to deploy TIC-related solutions, which aid in improving safety and ensuring the quality of infrastructure projects. Additionally, renewable energy projects such as solar energy and wind energy require highly specialized equipment which has to function at total efficiency, thereby promoting the need to deploy effective TIC systems to ensure the functioning of essential machine components.

Service Type Insights

The testing segment led the market in 2024, accounting for over 72% share of the global revenue. This is owing to the high use of testing practices in automotive, energy & utilities, oil & gas and petroleum, and the manufacturing industry. Practical testing of products enables companies to maintain high-quality parameters and meet the needs of customers. This is promoting companies from various industries to increase operational expenditure on the investment of testing equipment, thereby offering an impetus to market growth.

The certification segment is anticipated to grow significantly in the coming years. The certification services segment in the TIC market is driven by regulatory mandates, the globalization of trade, heightened consumer awareness, and the need for industry-specific and sustainability-focused certifications. The adoption of new technologies and the expansion of industries like renewable energy and emerging technologies further boost demand for certification services globally. For instance, in November 2024, TUV Rheinland launched comprehensive testing services for three foundational wireless protocols such as Zigbee compliant platforms, Matter 1.4, and Thread. This milestone underscores TUV Rheinland's position as a key player in wireless device certification, enabling manufacturers to meet rigorous standards for product reliability, functionality, and interoperability.

Sourcing Type Insights

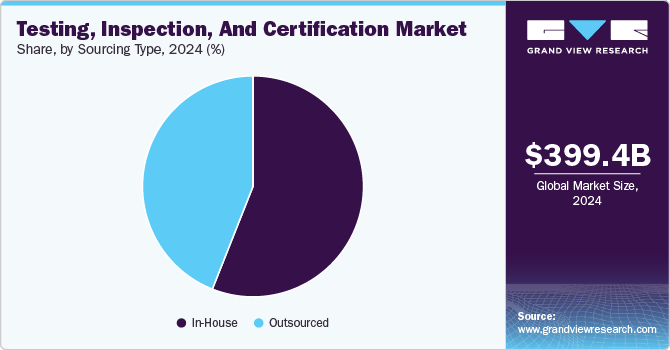

The in-house segment accounted for the largest market revenue share in 2024. Deploying in-house testing and inspection methods enables companies to practice practical TIC activities as there is on-site availability and the ability to hire talent and set up custom practices according to the need and desires of the company. Furthermore, deploying in-house TIC teams offers better control and a deeper understanding of business practices, which may benefit the organizational viewpoint. Companies prefer in-house TIC services to maintain direct oversight of their testing and inspection operations, ensuring alignment with internal quality and compliance standards.

The outsourced testing, inspection, and certification systems segment is anticipated to witness significant growth in the coming years. Various factors such as cost efficiency and focus on core operations, increasing complexity of regulatory requirements, and expansion of global trade are primarily driving the growth of the segment. Outsourced TIC providers invest in advanced technologies such as AI, IoT, and blockchain, ensuring accurate and efficient testing and certification processes. Moreover, access to specialized expertise enables businesses to meet industry-specific standards, such as in the automotive, pharmaceuticals, and renewable energy sectors.

Application Insights

The infrastructure segment accounted for the largest market revenue share in 2024. Various factors such as increasing investments in infrastructure development, stringent regulatory and safety standards, growing demand for sustainable and green infrastructure, and urbanization and smart city development are driving the growth of the segment. Governments worldwide are heavily investing in infrastructure projects, including transportation, energy, water systems, and urban development. These projects require rigorous testing, inspection, and certification to ensure safety, compliance, and durability. Thus, driving the growth of the segment.

The consumer goods & retail segment is likely to show notable growth over the forecast period due to increasing inspection activities carried out by companies in the segment. Consumer goods companies comply with several quality regulations and standards to offer the best quality products to their customers. This facilitates the need to deploy highly effective and extensive inspection systems, thereby offering growth opportunities to the market. For instance, in October 2024, SGS Societe Generale de Surveillance SA introduced the industry’s most extensive suite of per- and polyfluoroalkyl substances (PFAS) testing services for various industries. SGS Societe Generale de Surveillance SA provides customized solutions to address the unique requirements of various sectors, including consumer products, electronics, food, and the environment.

Regional Insights

North America represented a significant revenue share of over 25% in 2024. North America has some of the most rigorous safety, quality, and environmental standards across industries such as automotive, aerospace, healthcare, and food & beverages.Compliance with these regulations drives demand for TIC services to ensure products and processes meet federal and state requirements.

U.S. Testing, Inspection, And Certification Market Trends

The U.S. testing, inspection, and certification industry is expected to grow at a significant CAGR from 2025 to 2030. The U.S. leads in the development of emerging technologies, including autonomous vehicles, AI, IoT, and renewable energy systems, requiring advanced TIC services to ensure safety, interoperability, and performance. High-tech industries, such as aerospace and defense, rely on rigorous testing and certification to meet stringent safety and reliability standards.

Europe Testing, Inspection, And Certification Market Trends

The testing, inspection, and certification industry in the Europe region is expected to witness significant growth over the forecast period. Europe’s highly interconnected market, with free trade across EU member states and exports to global markets, necessitates TIC services to ensure uniform standards, quality, and safety across the supply chain. Moreover, significant investments in infrastructure modernization and smart city projects across Europe drive demand for TIC services in construction, materials testing, and structural safety. The EU’s focus on sustainable and resilient infrastructure further promotes certification services.

Asia Pacific Testing, Inspection, And Certification Market Trends

The testing, inspection, and certification industry in the Asia Pacific region is expected to witness significant growth over the forecast period. Asia-Pacific is experiencing significant industrial and urban expansion, particularly in emerging economies such as China, India, and Southeast Asia. For instance, in October 2024, Merieux NutriSciences Corporation, practical auditing, testing, research, training, and consulting solutions provider acquired the food testing business of Bureau Veritas for USD 327.9 million (EUR 360 million). These services are delivered to food sector clients through a network of 34 laboratories staffed by 1,900 technical professionals across 15 countries in the Asia Pacific, Africa, and Americas.

Key Testing, Inspection, And Certification Company Insights

Some key players in the testing, inspection, and certification industry, such as SGS Societe Generale de Surveillance SA and Bureau Veritas.

-

SGS Societe Generale de Surveillance SA is a global player in the TIC market, offering a wide range of services across industries such as agriculture, automotive, oil & gas, and pharmaceuticals. The company has an extensive global presence with over 2,600 offices and laboratories worldwide. It has expertise in sustainability services and digital inspection technologies. It focuses on innovation, incorporating AI, IoT, and blockchain for enhanced service delivery.

-

Bureau Veritas operates in over 140 countries with a vast network of laboratories and technical experts. The company provides advanced certification services, particularly in sustainability and energy transition sectors. Moreover, it focuses on digital transformation, offering remote inspection and certification solutions.

Key Testing, Inspection, And Certification Companies:

The following are the leading companies in the testing, inspection, and certification market. These companies collectively hold the largest market share and dictate industry trends.

- Applus+

- Bureau Veritas

- DEKRA SE

- Det Norske Veritas group

- Eurofins Scientific

- Intertek Group plc

- SGS Societe Generale de Surveillance SA

- TUV Rheinland

- TUV SUD

- UL LLC

Recent Developments

-

In October 2024, Applus+ partnered with Four Hills Services Pty Ltd, construction equipment services provider, to provide inspection and testing services in Australia. The partnership, known as Inspection Partners Pty Ltd, aims to create job opportunities, empowering both Indigenous and non-Indigenous individuals to pursue careers in the testing and inspection sectors of the construction and mining industries.

-

In September 2024, Eurofins Scientific partnered with Pharmaoffer, provider of digital pharmaceutical platform, to establish new benchmarks for quality and safety standards in pharmaceutical supply chain audits. Through this collaboration, Pharmaoffer integrates Eurofins Healthcare Assurance’s extensive audit libraries into its platform, providing Active Pharmaceutical Ingredients (API) buyers and suppliers with efficient access to essential auditing resources.

-

In May 2024, Bureau Veritas signed an agreement to acquire two companies in the South Korea and one company in India to expand its scope in testing and certification services within the Electrical and Electronics consumer products segment across South and North-East Asia. KOSTEC Co., Ltd. and ONETECH CORP. deliver services to a diverse range of domestic clients in South Korea, encompassing major manufacturers, exporters, and brands across sectors such as household appliances, new mobility solutions, and electrical and electronic products. Hi Physix Laboratory India Pvt. operates as a testing and certification services laboratory in India, specializing in a broad spectrum of products, including electrical and electronic items, solar equipment, and household appliances.

Testing, Inspection, And Certification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 417.76 billion |

|

Revenue forecast in 2030 |

USD 499.00 billion |

|

Growth rate |

CAGR of 3.6% from 2025 to 2030 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, sourcing type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Russia; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; South Africa; KSA |

|

Key companies profiled

|

Applus+; Bureau Veritas; DEKRA SE; Det Norske Veritas group; Eurofins Scientific; Intertek Group plc; SGS Societe Generale de Surveillance SA; TUV Rheinland; TUV SUD; UL LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Testing, Inspection, And Certification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global testing, inspection, and certification market report based on service type, sourcing type, application, and region.

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Testing

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Million, 2017 - 2030)

-

In-House

-

Outsourced

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Environmental Services

-

Education

-

Government

-

Consumer Goods & Retail

-

Softlines & Accessories

-

Hardlines (incl. Toys)

-

Electrical & Electronics (E&E)

-

Others

-

-

Agriculture

-

Seed & Crop Testing

-

Commodity Testing

-

Others

-

-

Food

-

Chemicals

-

Commodities (Trade)

-

Downstream

-

Upstream

-

Others

-

-

Infrastructure

-

Non-Destructive Testing (NDT)

-

Health & Safety or Industrial Safety

-

Others

-

-

Energy & Power

-

Manufacturing

-

Non-Destructive Testing (NDT)

-

Health & Safety

-

Others

-

-

Healthcare

-

Cosmetics Testing

-

Hygiene Testing

-

Others

-

-

Mining

-

Commodities

-

Coal

-

Others

-

-

Metallurgical Testing

-

Upstream

-

Coal

-

Others

-

-

Others

-

-

Oil & Gas and Petroleum

-

Commodities (Trade)

-

Downstream

-

Upstream

-

Others

-

-

Public Sector

-

Upstream

-

Road Safety

-

Others

-

-

Automotive

-

Hardlines Testing

-

Connected Device Testing

-

Others

-

-

Aerospace & Defense

-

Supply Chain & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Russia

-

Eurozone

-

Spain

-

Italy

-

Germany

-

France

-

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Taiwan

-

New Zealand

-

-

Latin America

-

Brazil

-

Chile

-

Peru

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

Turkey

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global testing, inspection, and certification market size was estimated at USD 399.39 billion in 2024 and is expected to reach USD 417.76 billion in 2025.

b. The global testing, inspection, and certification market is expected to grow at a compound annual growth rate of 3.6% from 2025 to 2030 to reach USD 499.00 billion by 2030.

b. The Asia Pacific dominated the global testing, inspection, and certification market in 2024 with a revenue share of 33.4%.

b. Some key players operating in the TIC market include Applus+; Bureau Veritas; DEKRA SE; Det Norske Veritas group; Eurofins Scientific; Intertek Group plc; SGS Societe Generale de Surveillance SA; TUV Rheinland; TUV SUD; and UL LLC

b. Key factors that are driving the TIC market growth include strict implementation of TIC regulations, globalization and the rise of global trade, increasing outsourcing of TIC services, and emerging digital technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."