- Home

- »

- Water & Sludge Treatment

- »

-

Tertiary Water And Wastewater Treatment Equipment Market Report 2030GVR Report cover

![Tertiary Water And Wastewater Treatment Equipment Market Size, Share & Trends Report]()

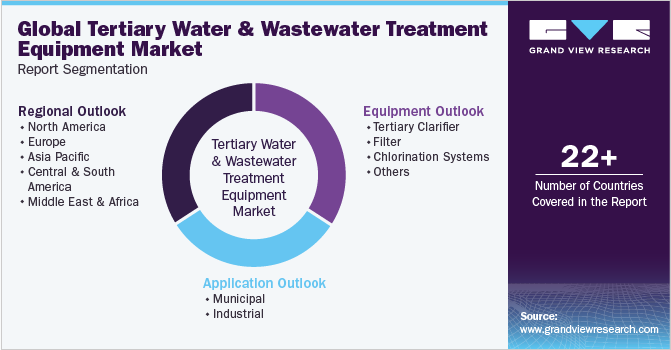

Tertiary Water And Wastewater Treatment Equipment Market Size, Share & Trends Analysis Report By Equipment (Tertiary Clarifier, Filter), By Application (Municipal, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-104-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

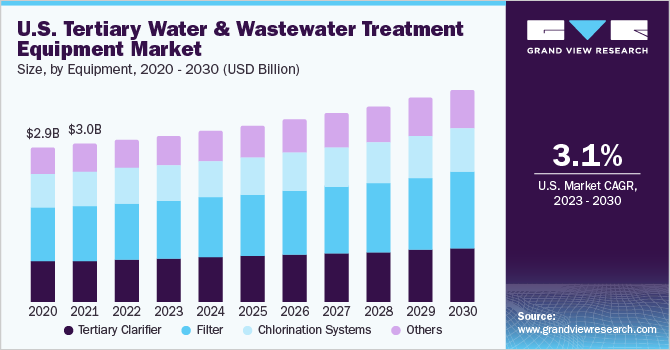

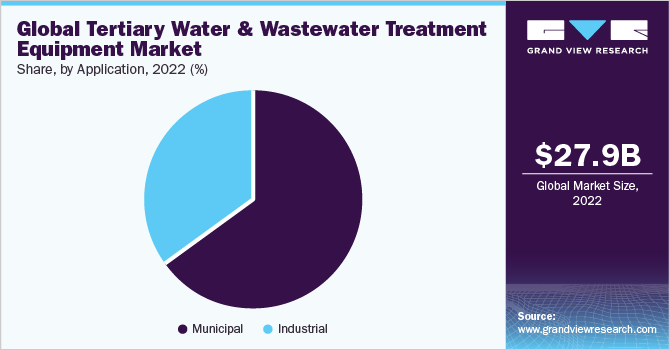

The global tertiary water & wastewater treatment equipment market size was estimated at USD 27.9 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. The stringent government regulations have primarily boosted various tertiary water & wastewater treatment activities worldwide, thereby augmenting the demand for water and wastewater treatment equipment over the forecast period. In addition, increasing government initiatives to provide safe drinking water are anticipated to have a positive impact on the growth of the market over the forecast period.

The metals & mining industry felt the impact of the pandemic early in 2020, with the shutting down of mines, as well as trains, ports, and other transportation infrastructures. This resulted in the trapping of shipments at sea with uneven restrictions enforced from country to country. This led to the supply-demand mismatch for raw materials for various manufacturing industries including the water & wastewater treatment equipment market.

The U.S. passed a new Public-Private Partnership (PPP) law to promote investments, in terms of upgrades and new establishment of desalination facilities and water purification plants, on a domestic level. This favorable initiative to promote investments in the water treatment industry on a domestic level is anticipated to have a positive impact on the tertiary water & wastewater treatment equipment industry growth over the forecast period.

Increased research and development (R&D) in ultrafiltration and microfiltration is expected to open new markets for wastewater and water treatment services in the U.S. over the forecast period, owing to the growing importance of membrane separation technology in the manufacturing sector. Furthermore, increasing demand for nanofiltration-membrane separation technology as it softens water while retaining calcium and magnesium content is expected to have a positive impact on the market.

The industrial sector is a major water user. Water is used in production processes, cooling purposes, cleaning/washing, and many other applications. In addition, the industrial sector is a major water polluter and numerous industries do not treat wastewater before disposing into the environment, which leads to a lack of clean water. Therefore, many governments have made strict laws for wastewater emissions into the environment. These factors are expected to drive the water and wastewater treatment equipment industry’s growth over the forecast period.

Equipment Insights

In terms of equipment, the filter segment held the largest market share of 34.8%, in terms of revenue, in 2022. Filters primarily aid in the removal of leftover suspended materials in the wastewater. When leftover toxins are found in wastewater, activated carbon filters them out by absorbing the poisons and removing them from the wastewater.

Chlorination is the technique of introducing a precise quantity of chlorine to the water to produce a residue sufficiently powerful to eradicate bacteria, viruses, and cysts. Chlorination has improved sanitation by minimizing the number of bacteria and viruses in the water, preventing recontamination with minimal effort, and it incurs very low costs.

Tertiary clarifiers are frequently used to improve the removal of phosphate, suspended particles, metals, and microorganisms. The techniques for filtering treated wastewater employing fast filters and contact clarifiers, which are most often utilized in both domestic and international practices, are similar in design to the filters used for water treatment.

Application Insights

The municipal segment held a maximum share of 65.5%, in terms of revenue, in 2022 and is likely to continue to dominate the market over the forecast period. Increasing urban population, rising investment, and favorable government policies promoting infrastructure development are projected to witness tremendous demand for wastewater treatment systems in municipal sectors of developing markets including Turkey, China, India, Thailand, and Bangladesh. These factors are projected to propel the growth of the tertiary water & wastewater treatment equipment industry. For instance, in May 2022, WABAG signed an agreement with the Ghaziabad Nagar Nigam (GNN) to provide DOB service, which includes designing, building, and operation of the 40 MLD tertiary treatment reverse osmosis facility.

The industrial application segment presents a wide application scope for fresh and processed water in several industries including chemical, paper & pulp, food & beverages, mining, and refineries. Rapid urbanization, technological advancements, and a rising number of production units are resulting in high demand for fresh and processed water.

Regional Insights

The Asia Pacific region held the largest revenue share of 34.5% of the global tertiary water & wastewater treatment equipment market in 2022. The improving economy of emerging markets, including China, India, Thailand, Indonesia, and Malaysia is forcing governments to frame supportive policies to promote investments in the extraction of natural resources, including crude oil and natural gas. High penetration of nitrogenous fertilizer manufacturing units in Australia, China, and India considering easy access to raw materials is expected to play a key role in increasing the demand for tertiary treatment methods over the forecast period.

The robust presence of oil & gas reserves in Brazil, Columbia, Venezuela, and Argentina is expected to have a positive impact on the market. Furthermore, airport expansions and the development of large-scale commercial structures, especially in Brazil and Columbia, are anticipated to drive the demand over the forecast period.

The demand for potable water in the Middle East & Africa is expected to drive the growth of the disinfection market in the region. In addition, advancements in disinfection technologies, coupled with low-cost equipment, are expected to drive market growth. The use of membrane bioreactors in the region is expected to increase due to high levels of toxicity in municipal water. Increasing refurbishment of dysfunctional treatment plants in the economy, such as Oranjeville Wastewater Treatment and Leeuwkuil Waste Water Treatment, is expected to drive the growth of the region's tertiary water & wastewater treatment equipment industry. Furthermore, rising industrialization in the region is expected to propel market growth over the forecast period.

Key Companies & Market Share Insights

The industry is extremely competitive due to the presence of both international and local players. Tertiary water & wastewater treatment equipment manufacturers use various strategies to increase market penetration and meet the dynamic technological demands of application industries, such as municipal and industrial. For instance, in June 2022, PENTAIR completed the acquisition of Manitowoc Ice. With this initiative, the company has expanded its commercial water solutions platform that caters to the foodservice industry. Some prominent players in the global tertiary water and wastewater treatment equipment market include:

-

WesTech Engineering, Inc.

-

Veolia Group

-

Membracon

-

Xylem, Inc.

-

Pentair plc

-

Lamor Corporation AB

-

Calgon Carbon Corporation

-

Evoqua Water Technologies Corporation

-

Ecologix Environmental Systems, LLC

-

Pure Aqua Inc.

-

Parkson Corporation

-

Lenntech B.V.

-

Ovivo

Tertiary Water And Wastewater Treatment Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.0 billion

Revenue forecast in 2030

USD 40.7 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Norway; Finland; China; India; Japan; Australia; South Korea; Argentina; Brazil; Venezuela; Saudi Arabia; UAE; Egypt

Key companies profiled

WesTech Engineering, Inc.; Veolia Group; Membracon; Xylem, Inc.; Pentair plc; Lamor Corporation AB; Calgon Carbon Corporation; Evoqua Water Technologies Corporation; Ecologix Environmental Systems, LLC; Pure Aqua Inc.; Parkson Corporation; Lenntech B.V.; Ovivo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tertiary Water And Wastewater Treatment Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tertiary water & wastewater treatment equipment market report based on equipment, application, and region:

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tertiary Clarifier

-

Filter

-

Chlorination Systems

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Norway

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the tertiary water and wastewater treatment equipment market with a revenue share of 34.5% in 2022. The urban population growth and rising disposable incomes in the region are expected to promote the housing sector growth on a domestic level. As a result, improving the housing sector is expected to increase the penetration of municipal wastewater facilities, which, in turn, is likely to promote the demand for equipment for tertiary water & wastewater treatment equipment over the forecast period.

b. Some of the key players operating in the tertiary water and wastewater treatment equipment market include WesTech Engineering, Inc., Veolia Group, Membracon, Xylem, Inc., Pentair plc, Lamor Corporation AB, Calgon Carbon Corporation, Evoqua Water Technologies Corporation, Ecologix Environmental Systems, LLC among others.

b. The key factors that are driving the tertiary water and wastewater treatment equipment market include stringent government regulations have primarily boosted various tertiary water & wastewater treatment activities across the globe, thereby augmenting the demand for water and wastewater treatment equipment over the forecast period.

b. The global tertiary water and wastewater treatment equipment market size was estimated at USD 27.9 billion in 2022 and is expected to reach USD 29.0 billion in 2023.

b. The global tertiary water and wastewater treatment equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 and reach USD 40.7 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."