Terrestrial Trunked Radio Market Size, Share & Trends Analysis Report By Operation (Trunked Mode Operation, Direct Mode Operation), By Component, By Device, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-913-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Terrestrial Trunked Radio Market Trends

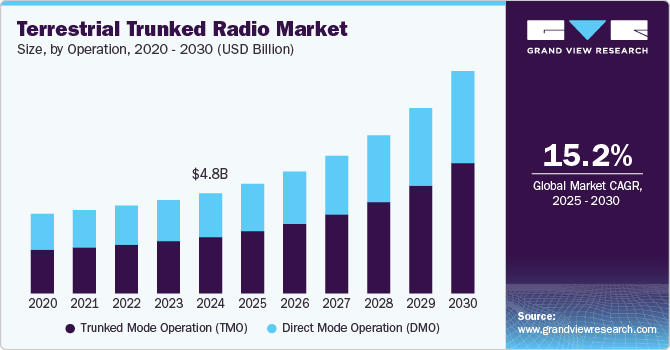

The global terrestrial trunked radio market size was valued at USD 4.82 billion in 2024 and is projected to grow at a CAGR of 15.2% from 2025 to 2030. The use of Terrestrial Trunked Radio (TETRA) in multiple industries, such as transportation, security, facility management, public safety, critical infrastructure management, and others, is primarily driving the growth of this market. Developed and standardized by the European Telecommunications Standards Institute (ETSI), the Terrestrial Trunked Radio (TETRA) technology allows multiple users to utilize a shared pool of radio frequencies for communication. Growing demand for TETRA-based devices in the emergency services and defense industry is expected to add lucrative growth opportunities to this market.

Operations associated with transportation and logistics, public safety, utility management, and facility management involve continuous communication among team members. These industries rely on TETRA hardware and technology to ensure a seamless flow of communication, uninterrupted exchange of information, and clarity of sound for both sender and receiver. This is attributed to key features of technology and devices, including durability, scalability, high performance in various environments, and more. The portable nature of the devices, ease of use, and compact size also contribute to the growing use.

The information and communication technology sector has experienced rapid transformation in recent years, reflected across industries and processes. Multiple industries have been adopting advanced technologies to simplify processes and reduce costs. TETRA-based devices offer comparatively longer range compatibility, which reduces the number of transmitters required and expenditure on infrastructure. In industries such as transportation and logistics, defense, public safety, and law enforcement, where dialogue among teams deployed across larger geographical areas plays a vital role in the success of tasks at hand, TETRA-based devices offer uninterrupted communication.

The growing focus of governments and public safety agencies on enabling their teams with advanced technology-driven devices that can assist in continuous dialogue among team members during critical missions and emergency responses is expected to fuel the growth of this market. Government agencies have been collaborating with private and public companies to embrace advanced technology networks and manage the existing infrastructure associated with Land Mobile Radio (LMR) technology to ensure reliability during routine operations.

For instance, in December 2024, Motorola Solutions, Inc., a communication technology provider, was given a five-year contract by a Norwegian government agency, the Norwegian Directorate for Civil Protection (DSB), to continue management of Nødnett, a nationwide critical communications network in Norway. The networks assist 60,000 first responders in seamless operations and reliable communication.

Growth in active shooter incidents in countries such as the U.S. and the increase in call volumes experienced by emergency response services driven by road accidents, acts of crime, natural calamities, fire incidents, and others have generated demand for reliable, scalable, and advanced technology for communication in developed countries. For instance, according to the Active Shooter Incidents in the United States report by the Federal Bureau of Investigation (FBI), in 2023, 48 active shooter incidents were reported.

Operation Insights

The Trunked Mode Operation (TMO) segment dominated the global terrestrial trunked radio industry with a revenue share of 56.4% in 2024. TMO allows numerous users to share a pool of radio channels, optimizes spectrum usage, and prevents congestion. In addition, TMO-based systems are often equipped with encryption capacities to protect sensitive information and conversations while preventing unauthorized access. Growing utilization of TMO-based devices by police, law enforcement agencies, emergency medical service teams, and others is expected to drive the growth of this segment.

The Direct Mode Operation (DMO) segment is anticipated to experience significant growth from 2025 to 2030. This is attributed to increasing demand from various industries such as facility management, public safety and security, transportation and logistics, healthcare, utility management, and others. Similar to traditional walkie-talkies, DMO-based devices are extensively used for localized communication in areas where network accessibility is limited; however, communication is significant.

Component Insights

The hardware segment held the largest revenue share of the global terrestrial trunked radio industry in 2024. The core function of the technology heavily relies on hardware components, i.e., devices. Base stations, equipment, and devices play crucial roles in developing reliable communication networks. The launch of new products by major market participants is expected to contribute to the growth of this segment. For instance, in March 2024, Sepura Limited, an innovation-based communication solutions provider, launched SCL3 TETRA and a 4G/5G device. Developed especially for mission-critical users, the newly launched SCL3 device is equipped with features that Public Protection and Disaster Relief (PPDR) teams can rely upon.

The software components segment is projected to experience the fastest CAGR during the forecast period. This is attributed to the rapid pace of digital transformation across industries and the growing demand for robust cybersecurity solutions to provide an added layer of protection to communications across teams. The focus of key market participants and user organizations, such as government agencies and others, on enhancing network management capabilities and the availability of flexible upgrades facilitated by software is expected to drive the growth of this segment during the next few years.

Devices Insights

The portable devices segment held the largest revenue share of the global terrestrial trunked radio industry in 2024. The growth of this segment is mainly driven by the growing demand from the public safety and security industry, increasing utilization by government agencies, and large-scale adoption by facility management and commercial security management companies. Launching newly designed portable devices with advanced features has also contributed to this segment's growth. For instance, in April 2023, Hytera Communications Corporation Limited, a professional communication technology solutions provider, launched PT590, a portable TETRA radio specifically designed for the requirements of first responders and frontline workers.

The vehicular devices segment is projected to experience noteworthy growth from 2025 to 2030. This is attributed to increasing demand from law enforcement agencies in developed countries. TETRA technology is extensively used in the public safety industry owing to superior coverage, encryption capacity, and efficient trunking suitable for vehicular systems. Advanced vehicular TETRA devices available in the market are often integrated with ancillary systems easily and provide compatibility with software solutions for improved assistance in other functions.

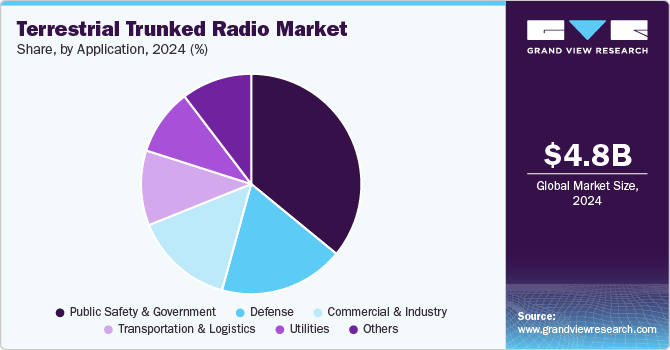

Application Insights

The public safety and government applications segment dominated the global market for terrestrial trunked radio in 2024. Public safety and government applications include utilization by law enforcement agencies, frontline workers, first responders, professional fire departments, emergency medical service teams, and others. The TETRA technology-driven devices, equipped with advanced capacities designed for mission-critical communications, are largely used by investigation agencies and military and security services agencies operating for the government. Key technology providers also contribute to the growth of this segment by adding specially designed products to the existing portfolios.

The transportation and logistics industry applications segment is anticipated to experience the fastest growth during the forecast period. Transportation and logistics companies primarily rely on TETRA technology-driven devices owing to their wide coverage capabilities, high performance in areas where cellular network accessibility is low, and the availability of dedicated communication channels. In addition, the availability of devices equipped with advanced features such as emergency buttons, encryption capabilities, and more also contributes to growing utilization.

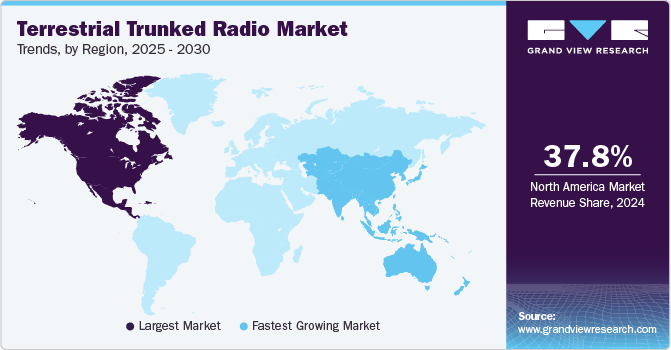

Regional Insights

North America dominated the global terrestrial trunked radio industry with a revenue share of 37.8% in 2024. This market is primarily driven by government agencies' growing utilization, including law enforcement and investigation bureaus, security teams of government individuals, and personal security teams of politicians, sports icons, celebrities, and others. Increasing demand from numerous industries such as healthcare, transportation and logistics, utility management, and others is expected to drive the growth of this market during the forecast period.

U.S. Terrestrial Trunked Radio Market Trends

The U.S. held the largest revenue share of the North America terrestrial trunked radio market in 2024. This market is mainly influenced by the demand from the military & defense industry and increasing utilization by security teams working for government agencies, organizations, and others. Increasing adoption by public safety professionals such as police departments, fire departments, emergency medical service providers, and others is expected to fuel the growth of this market in the next few years.

Europe Terrestrial Trunked Radio Market Trends

Europe was identified as one of the key regions in the global terrestrial trunked radio market in 2024. The growth of this market is driven by numerous factors, such as the focus of multiple countries on adopting advanced technologies across departments and agencies, growth in collaborations among government authorities and technology organizations operating in the TETRA market and increasing utilization by government agencies related to law enforcement.

The UK held the largest revenue share of the European terrestrial trunked radio industry in 2024. This is attributed to factors such as police departments' growing use and other sectors such as transportation and logistics, personal security services, facility management, etc. The availability of advanced devices launched by major market participants in the country and the increasing reliability of public safety management teams on TETRA-based devices are likely to add significant growth opportunities to this market.

Asia Pacific Terrestrial Trunked Radio Market Trends

The Asia Pacific terrestrial trunked radio market is anticipated to experience the fastest CAGR from 2025 to 2030. The region is characterized by the presence of countries such as China and India, where the government has been focusing on empowering public safety and security services with technology-driven devices. There is also a robust technology components manufacturing industry operating in the region and growth in infrastructure enhancements in numerous countries. Utilization of industries such as transportation and logistics, facility management, and defense is expected to fuel growth.

China dominated the regional industry for terrestrial trunked radio in 2024. This market is primarily driven by the presence of multiple manufacturing industry participants in the country, growing utilization by law enforcement agencies, and the availability of a large number of products delivered by domestic and international developers.

Key Terrestrial Trunked Radio Company Insights

Some of the key companies operating in the terrestrial trunked radio industry are Motorola Solutions, Inc., AIRBUS, Hytera Communications Corporation Limited, JVCKENWOOD Corporation, Sepura Limited, and others. To address growing applications and increasing demand for advanced technology assistance, major market participants have embraced strategies such as new product development, collaborations with government agencies, and a focus on including advanced features in products and partnerships.

-

Motorola Solutions, Inc., a communication technology organization, offers a wide range of products and solutions related to critical communication, video security, and command centers. It also provides managed and support services. Some of its key product categories include radio, software, and video security. Its radio portfolio features mission-critical P25 radio, professional DMR radio, broadband devices and apps, on-site business radios, and others.

-

Hytera Communications Corporation Limited, a professional communication technology company, specializes in two-way radios, MCS & PoC radios, body cameras, fast deployment solutions, command and control solutions, and satellite communications. Its portfolio is designed for public safety, oil & gas, mining, emergency response, education, facilities management, security, and more.

Key Terrestrial Trunked Radio Companies:

The following are the leading companies in the terrestrial trunked radio market. These companies collectively hold the largest market share and dictate industry trends.

- Motorola Solutions, Inc.

- AIRBUS

- Hytera Communications Corporation Limited

- JVCKENWOOD Corporation

- Sepura Limited

- Rolta India Limited

- Thales

- FREQUENTIS

- DAMM

- Leonardo S.p.A.

Recent Developments

-

In October 2024, SBS Transit, a public transport operator from Singapore, signed a contract with a communication technology company, Motorola Solutions, Inc. The agreement aims to support and maintain services for critical radio communications of SBS Transit’s Sengkang and Punggol Light Rapid Transit system and downtown line for 15 years.

-

In September 2024, Hytera Communications Corporation Limited announced that its subsidiary, HMF Smart Solutions, secured a tender for the implementation and management of the TETRA communication system for Gendarmería de Chile, a uniformed prison service military force in Chile. The contract aims to provide an ACCESSNET-T IP TETRA trunked system in the Valparaiso, Metropolitan, and Biobio regions for 72 months.

Terrestrial Trunked Radio Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.28 billion |

|

Revenue forecast in 2030 |

USD 10.71 billion |

|

Growth Rate |

CAGR of 15.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Operation, component, device, application, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Motorola Solutions, Inc.; AIRBUS; Hytera Communications Corporation Limited; JVCKENWOOD Corporation; Sepura Limited; Rolta India Limited; Thales; FREQUENTIS; DAMM; Leonardo S.p.A. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Terrestrial Trunked Radio Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global terrestrial trunked radio market report based on operation, component, device, application, and region.

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Trunked Mode Operation (TMO)

-

Direct Mode Operation (DMO)

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Devices Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Vehicular

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."