Tequila Seltzers Market Size, Share & Trends Analysis Report By Flavor (Lime, Strawberry), By Packaging (Cans, Bottles), By Distribution Channel (Off-trade, On-trade), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-369-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Tequila Seltzers Market Size & Trends

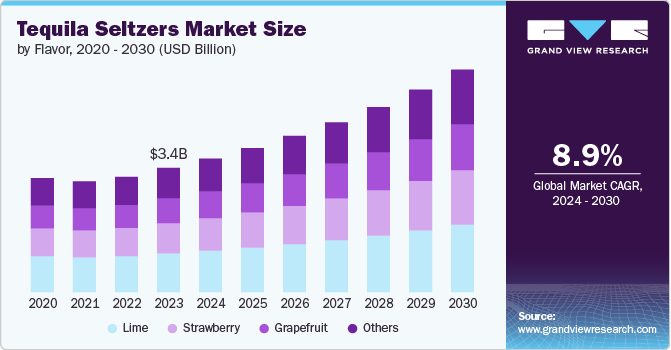

The global tequila seltzers market size was estimated at USD 3.36 billion in 2023 and is expected to grow at a CAGR of 8.9% from 2024 to 2030. The market is experiencing rapid growth, driven by consumer demand for refreshing, low-calorie alcoholic beverages that offer a unique twist on traditional seltzers. There is a strong demand for low-calorie, low-sugar alcoholic beverages. Tequila seltzers typically offer fewer calories and less sugar than traditional cocktails, making them attractive to health-conscious consumers. The ready-to-drink (RTD) format of tequila seltzers offers convenience, contributing to their popularity. These beverages are easy to transport and consume, making them ideal for social gatherings and outdoor activities.

Tequila is experiencing a remarkable surge in popularity within globally. According to the International Wine and Spirits Research (IWSR), consumption of tequila has skyrocketed by a staggering 40% over the past five years, solidifying its position as one of the fastest-growing alcoholic beverages in the U.S.

Additionally, established spirits brands are looking to diversify their offerings to include the rapidly growing ready-to-drink (RTD) segment. By partnering with emerging tequila brands, they can tap into the popularity of tequila seltzers and expand their product portfolios to meet changing consumer preferences.

In July 2023, Anheuser-Busch, the renowned beer giant, has forged a strategic partnership with Los Sundays, the award-winning California-based tequila brand, to introduce a tantalizing lineup of tequila-infused hard seltzers. This innovative partnership marks another milestone for Anheuser-Busch's Beyond Beer portfolio, driving growth in the rapidly expanding hard seltzer category.

Hard seltzers as a whole have experienced tremendous growth in recent years, driven by their light, refreshing qualities and versatility. Tequila seltzers leverage this momentum, tapping into the market established by other hard seltzers while offering a unique point of differentiation with the premium tequila base.

Tequila has enjoyed a surge in popularity, shifting from a niche spirit to a mainstream favorite. This growing appreciation for tequila's complex flavors and versatility paves the way for tequila-based beverages like seltzers to gain wider acceptance. Moreover, tequila seltzers are readily available, often sold in convenient single-serve cans or bottled in easy-to-carry formats. They also tend to be more affordable than traditional cocktails, making them an attractive option for budget-conscious consumers.

The rise of social media platforms has played a significant role in the popularity of tequila seltzers. Influencers and consumers alike are sharing their experiences with these beverages, creating buzz and generating interest among wider audiences. In April 2023, High Noon Spirits, a brand synonymous with good times and memorable moments, continues its 'Sun's Up' campaign, urging its audience to embrace every day with optimism and to create perfect moments filled with cherished friends, refreshing drinks, and laughter. Now, the brand is poised to elevate its offering with the launch of Tequila Seltzer, a tantalizing beverage designed to add zest and sparkle to any occasion under the golden rays of the sun.

Furthermore, the tequila seltzers market is constantly evolving, with brands introducing new flavors, innovative ingredients, and even premium versions with higher-quality tequila. This constant innovation keeps consumers engaged and ensures the category remains fresh and exciting. In March 2024, White Claw, the innovative force behind the wildly popular hard seltzer, has now unveiled a groundbreaking addition to its refreshing beverage lineup: White Claw™ Tequila Smash. This revolutionary creation marks the first time that tequila is blended seamlessly with the refreshing taste of ultra-pure seltzer and the vibrant fruit flavors that have made White Claw a fan favorite.

Flavor Insights

Lime tequila seltzers accounted for a revenue share of 31.2% in 2023. Lime tequila seltzers have gained popularity recently, especially among those who enjoy refreshing and convenient alcoholic beverages. The combination of tequila, lime flavoring, and the effervescence of seltzer water appeals to many for its light and crisp taste. This drink is often favored for its lower calorie content compared to traditional mixed drinks or beers. The trend towards ready-to-drink cocktails and seltzers has contributed to its rise in popularity, offering consumers a convenient option for enjoying a cocktail without the need for extensive preparation.

Grapefruit tequila seltzers is expected to witness a significant CAGR of 9.3% during 2024 to 2030. Grapefruit tequila seltzers are indeed expected to see significant growth in popularity. Grapefruit offers a tangy and slightly bitter flavor that complements tequila well, creating a refreshing and zesty combination. This flavor profile appeals to consumers looking for a more adventurous taste in their seltzer choices. Additionally, grapefruit is perceived as a healthier option due to its natural antioxidants and lower sugar content compared to some other fruits used in flavored beverages.

Packaging Insights

Bottled tequila seltzers accounted for a revenue share of 61.78% in 2023. Bottled tequila seltzers offer convenience as ready-to-drink cocktails. They are pre-mixed and typically come in single-serving bottles making them easy to grab and enjoy without the need for additional ingredients or preparation. Using glass for packaging can add a sense of sophistication and enhance the overall drinking experience, particularly appealing to certain consumer segments. Glass bottles offer a transparent and visually appealing option for packaging. The ability to see the product inside can be enticing to consumers, allowing them to evaluate its clarity, color, and carbonation levels. Additionally, glass bottles provide a canvas for showcasing the brand's design and label, helping it to stand out on store shelves and attract consumer attention effectively.

Canned tequila seltzers is expected to witness a significant CAGR during 2024 to 2030. Cans offer a lightweight and portable option that suits the active and mobile lifestyles of consumers. They are easy to carry and consume on-the-go, making them highly convenient. Metal cans provide excellent protection against light, oxygen, and other external factors that can affect the quality and taste of the beverage. This is particularly beneficial for hard seltzers, which often feature delicate flavors and carbonation that need to be preserved for optimal enjoyment.

Distribution Channel Insights

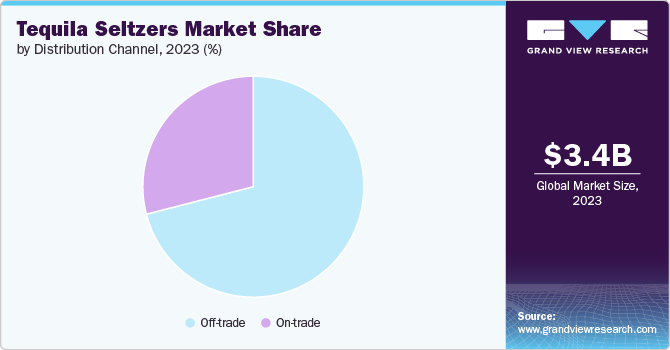

The distribution of tequila seltzers through off-trade channel accounted for revenue share of 71.0% in 2023. Off-trade channels, including supermarkets, liquor stores, and online retailers, offer consumers the convenience of purchasing tequila seltzers for home consumption. This accessibility is crucial for meeting the growing demand for ready-to-drink (RTD) beverages that consumers can enjoy at their leisure. These channels have a broader distribution network, ensuring that tequila seltzers are widely available across various regions. This extensive reach helps in capturing a larger market share compared to on-trade channels, which are limited to specific locations like bars and restaurants. Many consumers prefer entertaining at home, which includes having a variety of beverages readily available. Tequila seltzers, being a popular choice for home gatherings and casual consumption, see significant sales through off-trade channels.

The distribution of tequila seltzers through on-trade channel is expected to grow at a significant CAGR of 10.3% from 2024 to 2030. On-trade channels are poised to see significant growth in the distribution of tequila seltzers due to several key factors. On-trade establishments often serve as key venues for brand promotions and sampling. Tequila seltzer brands can leverage these settings to introduce their products to consumers, often through special events, tastings, and promotions, boosting awareness and driving trial. Moreover, many tequila seltzer brands form strategic partnerships with on-trade venues to secure prominent placement on menus and in promotional materials. These partnerships can include exclusive deals, co-branded events, and other marketing efforts that enhance visibility and encourage consumption.

Regional Insights

In 2023, the market in North America captured a revenue share of 31.43%. North American consumers have shown a strong preference for ready-to-drink alcoholic beverages that offer convenience and a refreshing taste. Tequila seltzers, with their blend of tequila and seltzer water infused with various flavors like lime, grapefruit, and others, appeal to consumers looking for lighter, more flavorful alternatives to traditional mixed drinks or beers. The market in North America has seen significant innovation in the flavors and formulations of tequila seltzers. Brands are continuously introducing new flavors and experimenting with ingredients to cater to diverse consumer tastes. This constant innovation keeps the market dynamic and appealing to a wide range of consumers.

Consumers in the region are seeking unique and flavorful beverages, propelling the growth of the tequila market. Leading manufacturers are introducing innovative flavors to cater to this demand and explore new taste sensations. According to data from the Distilled Spirits Council of the U.S. (DISCUS), the U.S. spirit market experienced a 1.2% increase in volume sales in 2023, with tequila/mezcal sales soaring by 7.9% in value.

U.S. Tequila Seltzers Market Trends

The market in the U.S. accounted for a notable revenue share in 2023. There is a strong consumer demand in the U.S. for convenient and low-calorie alcoholic beverages. Tequila seltzers, with their refreshing and flavorful profiles, appeal to consumers looking for alternatives to traditional cocktails and beers.

Europe Tequila Seltzers Market Trends

In 2023, market in Europe is anticipated to grow with a CAGR of 9.0% during 2024 to 2030. European consumers appreciate diverse flavor profiles, and tequila seltzers offer a range of options that cater to varied tastes. Flavors like lime, grapefruit, and other fruit-infused varieties appeal to Europeans' penchant for refreshing and distinctive tastes. There is a growing awareness of health and wellness across Europe, prompting consumers to seek lower-calorie and lower-sugar alcoholic beverage options. Tequila seltzers, often marketed as lighter alternatives to traditional cocktails, align well with these preferences.

Asia Pacific Tequila Seltzers Market Trends

Asia Pacific market is expected to grow at a significant CAGR during 2024 to 2030. There is a rising interest in Western alcoholic beverages and flavors across Asia Pacific. Consumers are increasingly exploring new and exotic drink options, including tequila seltzers, which offer a refreshing and trendy alternative to traditional spirits and mixed drinks. Economic growth in countries like China, India, and Southeast Asian nations has led to an increase in disposable income among consumers. This has translated into higher spending on premium and imported beverages, including tequila seltzers.

Key Tequila Seltzers Company Insights

Key market players such as Anheuser-Busch InBev, Cutwater Spirits, Heineken N.V., Diageo plc; Jose Cuervo are among others contribute significantly to the innovation and growth of the market by utilizing tactics such as forging partnerships, making agreements, and expanding production capacity.

Key Tequila Seltzers Companies:

The following are the leading companies in the tequila seltzers market. These companies collectively hold the largest market share and dictate industry trends.

- Anheuser-Busch InBev

- Diageo plc

- Hard Seltzer Beverage Company, LLC

- Cutwater Spirits

- Que Onda Beverage, Inc.

- Jose Cuervo

- Suntory Global Spirits Inc.

- Heineken N.V.

- Constellation Brands, Inc.

- Boozy Bubbles

Recent Developments

-

In April 2024, Casatera, a renowned premium tequila seltzer brand well-known for its zero sugar and zero carb content, announced a momentous partnership with Fairfield Athletics. This strategic collaboration signals Casatera's unwavering commitment to fostering meaningful connections with local communities and prestigious educational institutions. Crafted from the finest tequila sourced from an award-winning distillery in Mexico, Casatera's coveted beverage offers discerning consumers a premium sipping experience without compromising on flavor or well-being.

-

In March 2024, Boston Beer introduced Truly Tequila Soda, the latest addition to its hard seltzer brand. This beverage is crafted with premium tequila blanco, sparkling water, and real fruit juice. Truly Tequila Soda has four flavors: Lime, Watermelon, Grapefruit, and Pineapple Guava. Each can contain 5% alcohol by volume and 110 calories.

-

In March 2024, Truly Hard Seltzer launched Tequila Soda, the perfect summertime sipper. This innovative spirit-based seltzer combines the boldness of classic tequila with the crispness of hard seltzer, creating a unique and delightful beverage. Made with real fruit juice, sparkling water, and premium Tequila Blanco, Truly Tequila Soda offers a balanced profile that is both flavorful and refreshing. Its subtle sweetness is complemented by the crispness of the seltzer, creating a light and effervescent experience.

Tequila Seltzers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.61 billion |

|

Revenue forecast in 2030 |

USD 6.01 billion |

|

Growth Rate |

CAGR of 8.9% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Flavor, packaging, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa |

|

Key companies profiled |

Anheuser-Busch InBev; Cutwater Spirits; Heineken N.V.; Diageo plc; Jose Cuervo; Hard Seltzer Beverage Company, LLC; Que Onda Beverage, Inc.; Suntory Global Spirits Inc.; Boozy Bubbles; Constellation Brands, Inc. |

|

Customization scope |

Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Global Tequila Seltzers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tequila seltzers market report based on flavor, packaging, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Lime

-

Strawberry

-

Grapefruit

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Cans

-

Bottles

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-trade

-

On-trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tequila seltzers market size was estimated at USD 3.36 billion in 2023 and is expected to reach USD 3.61 billion in 2024.

b. The global tequila seltzers market is expected to grow at a compounded growth rate of 8.9% from 2024 to 2030 to reach USD 6.01 billion by 2030.

b. The lime tequila seltzers segment dominated the tequila seltzers market with a share of 31.23% in 2023. Lime tequila seltzers have gained popularity recently, especially among those who enjoy refreshing and convenient alcoholic beverages. The combination of tequila, lime flavoring, and the effervescence of seltzer water appeals to many for its light and crisp taste. This drink is often favored for its lower calorie content compared to traditional mixed drinks or beers.

b. Some key players operating in the tequila seltzers market include Anheuser-Busch InBev, Cutwater Spirits, Heineken N.V., Diageo plc; Jose Cuervo, Constellation Brands, Inc.

b. Key factors that are driving the market growth include consumer demand for refreshing, low-calorie alcoholic beverages that offer a unique twist on traditional seltzers. Also, there is a strong demand for low-calorie, low-sugar alcoholic beverages.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."