- Home

- »

- Alcohol & Tobacco

- »

-

Tequila Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Tequila Market Size, Share & Trends Report]()

Tequila Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Blanco, Reposado, Anejo, Super Premium), By Grade (Value, Premium, High-End Premium, Super Premium), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-488-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tequila Market Summary

The global tequila market size was estimated at USD 10.53 billion in 2023 and is projected to reach USD 19.73 billion by 2030, growing at a CAGR of 9.5% from 2024 to 2030. A significant driver is the increasing demand for premium and artisanal tequila. Consumers are shifting their focus toward quality over quantity, with many willing to pay more for high-quality, 100% agave tequilas.

Key Market Trends & Insights

- North America tequila market was the largest market globally in terms of revenue share of 63.50% in 2023, and it is projected to grow at a CAGR of 9.2% from 2024 to 2030.

- The Asia Pacific tequila market is expected to grow at a CAGR of 10.2% from 2024 to 2030.

- Based on product, blanco tequila was the most extensively consumed product, with a market size exceeding USD 6.65 billion in 2023.

- Based on distribution channel, off premise sales of tequila was the largest and accounted for a market revenue of USD 7.7 billion in 2023.

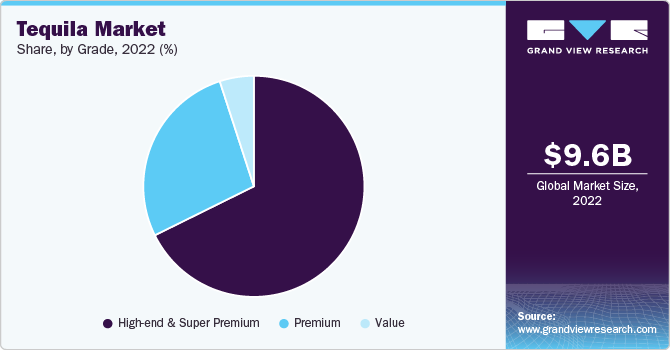

- Based on grade, the high-end premium and super-premium tequila segments were the largest together, accounting for a market revenue of USD 7.1 billion in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.53 Billion

- 2030 Projected Market Size: USD 19.73 billion

- CAGR (2024-2030): 9.5%

- North American: Largest market in 2023

- U.S.: Fastest growing market

This trend is particularly pronounced among younger consumers, with 54% of those aged 18-34 preferring premium ones. The premium segment is projected to grow substantially, contributing significantly to revenue growth in the industry. Consumer education and awareness are crucial factors in market growth. As consumers become more knowledgeable about the differences between tequila and mezcal, there is a growing demand for authentic products. Approximately 60% of consumers know these spirits' unique production methods and flavor profiles, enhancing their market appeal. This increased awareness also fosters a greater appreciation for the craftsmanship of producing high-quality tequila.

North America remains the dominant market, accounting for over two-thirds of global tequila sales in 2023. The U.S. market alone is expected to grow significantly, driven by evolving consumer tastes and an increasing inclination toward agave-based spirits. Meanwhile, Europe and Asia also witness rising demand for premium spirits, further expanding the market's reach.

There has been a notable rise in consumer curiosity about tequila, particularly among younger demographics. This interest is fueled by a desire to explore international spirits and unique drinking experiences. The region's expanding middle class and rising disposable incomes have made premium and craft spirits more accessible to consumers in countries such as China, Japan, and India. As urbanization continues to progress in Asia-Pacific, social lifestyles are evolving. The region's young adults are increasingly adopting Western drinking habits, which include a growing preference for cocktails that feature tequila. This trend is particularly evident in major urban centers where cocktail culture thrives.

The rise of cocktail culture has significantly transformed tequila's image from a simple party drink to a sophisticated spirit used in various cocktails. This shift has led to increased interest in tequila-based cocktails such as Palomas and Margaritas, which are becoming staples in bars and restaurants. In addition, manufacturers are innovating by introducing ready-to-drink (RTD) cocktails that cater to at-home consumption trends, further fueling the market's growth.

The penetration of e-commerce has significantly impacted tequila sales, especially following the COVID-19 pandemic, which accelerated online purchasing habits. Consumers are increasingly inclined to buy alcoholic beverages online, providing new opportunities for market expansion.

One of the primary challenges is the limited supply of blue agave, the essential ingredient for tequila production. Agave plants take several years to mature, and environmental factors such as droughts and pests can adversely affect yields, leading to supply shortages and price volatility. This situation is compounded by the strict regulatory environment governing tequila production, which includes rigorous standards for labeling and geographical indications. These regulations can create barriers for new entrants and stifle innovation within the industry, making it difficult for smaller brands to compete against established players.

Economic factors also play a crucial role; the market's performance heavily depends on economic conditions in key importing countries such as the United States and Canada. Economic downturns or shifts in consumer spending patterns can significantly impact demand for tequila products. Lastly, issues related to supply chain stability further complicate production efforts, particularly concerning the sourcing of agave. These combined restraints highlight the complexities producers must navigate to maintain growth in the market.

Product Insights

Blanco tequila was the most extensively consumed product, with a market size exceeding USD 6.65 billion in 2023. The growth of the Blanco tequila segment is propelled by several key market drivers that underscore its popularity and versatility. Blanco tequila, representing approximately 60% of the global market, is favored for its clean and crisp profile. It is an ideal base for a wide range of cocktails, particularly classics like Margaritas and Palomas. This versatility has made it a staple in bars and restaurants, contributing significantly to its market dominance.

The rising premiumization trend is another crucial factor driving the demand for Blanco tequila. Consumers increasingly seek high-quality spirits from 100% blue agave, reflecting a broader shift towards artisanal and premium beverages. This trend is particularly pronounced among younger consumers, who prioritize authenticity and are willing to pay more for superior products. In addition, blanco tequila is often perceived as a more authentic and traditional option than aged varieties, enhancing its appeal among consumers looking for genuine experiences.

Increased consumer education about different types of tequila and their production methods has led to a greater appreciation for Blanco tequila. As consumers become more knowledgeable about the nuances of agave spirits, they are more inclined to explore and enjoy various offerings within the category. These combined factors position Blanco tequila favorably within the global spirits market, driving its continued growth and popularity.

Reposado tequila was the second most consumed tequila globally and is expected to grow at a CAGR of 9.1% from 2024 to 2030. The reposado tequila segment is experiencing significant growth driven by several key market drivers that enhance its appeal among consumers. Reposado tequila, aged in oak barrels for at least two months and up to a year, offers a unique flavor profile that combines the fresh agave taste of blanco tequila with the complex, mellow notes imparted by the aging process. This balance of flavors has resonated well with consumers seeking more sophisticated drinking experiences.

Moreover, the rise of cocktail culture has further propelled the popularity of reposado tequila. Its versatility makes it an excellent choice for crafting cocktails that require a richer flavor profile, appealing to mixologists and home bartenders. The increasing awareness among consumers about the quality and craftsmanship behind reposado tequila, coupled with the growing interest in artisanal and small-batch products, has also contributed to its expanding market presence.

In addition, reposado tequila's ability to cater to diverse taste preferences-from those who enjoy the boldness of unaged tequila to those who appreciate the subtleties introduced through aging-positions it favorably within the broader spirit’s market. As consumers continue to explore and experiment with different types of tequila, reposado will likely maintain its upward growth and popularity trajectory.

Distribution Channel Insights

Off premise sales of tequila was the largest and accounted for a market revenue of USD 7.7 billion in 2023. The off-premises sales of tequila are significantly driven by the increasing consumer preference for premium and artisanal spirits. As consumers become more discerning, they are willing to invest in high-quality products that offer unique flavors and traditional production methods. This trend is particularly evident in the growing demand for premium tequila brands, which cater to consumers seeking authentic experiences and distinctive taste profiles. The rise of e-commerce has also facilitated access to a broader range of tequila options, allowing consumers to explore different types, such as Blanco, reposado, and añejo, from the comfort of their homes. This shift towards online purchasing has been accelerated by changing consumer habits during the COVID-19 pandemic, where safety and convenience became paramount, leading to increased sales through liquor stores and online retailers.

Moreover, the popularity of ready-to-drink (RTD) tequila cocktails has emerged as a significant driver in the off-trade segment. These convenient, pre-mixed options appeal particularly to younger demographics who favor hassle-free drinking experiences without the need for mixing or additional ingredients. The introduction of various flavored RTD tequila products has further attracted consumers looking for innovative and refreshing choices for social gatherings and parties. This trend aligns with the broader growth of the RTD category, which has seen substantial sales increases in recent years. As consumers continue to prioritize convenience alongside quality, off-premises sales of tequila are expected to thrive, supported by both traditional retail channels and the expanding online market.

The on-premises sale of tequila is primarily driven by the social and experiential aspects associated with its consumption in bars and restaurants. These venues serve as social hubs where consumers gather to enjoy drinks in a lively atmosphere, making them ideal for tequila, which is often associated with celebration and enjoyment. The interactive nature of on-premise settings allows bartenders to educate patrons about different tequila varieties, enhancing the overall drinking experience. Notably, younger consumers, particularly those aged 18 to 34, are increasingly frequenting these establishments, with many expressing a willingness to pay more for premium options. This demographic trend is significant as it aligns with the growing preference for high-quality spirits and unique cocktail experiences, further boosting tequila sales in On-premise environment.

Grade Insights

The high-end premium and super-premium tequila segments were the largest together, accounting for a market revenue of USD 7.1 billion in 2023. High-end premium tequila refers to tequila priced between USD 175 and USD 255, compared to Super Premium, which is tequila priced over USD 255.

The super-premium tequila segment is witnessing robust growth driven by several key market drivers that reflect evolving consumer preferences and market dynamics. A significant factor is the increased demand for high-quality spirits, as consumers increasingly seek premium and super-premium options that offer unique and sophisticated drinking experiences. This trend is fueled by rising disposable incomes, particularly among millennials and affluent consumers, who are willing to invest in high-quality products from 100% blue agave.

Moreover, the premiumization trend has gained momentum, with consumers gravitating towards artisanal and craft beverages that emphasize authenticity and traditional production methods. Brands such as Patron, Don Julio, and Clase Azul have successfully capitalized on this trend by highlighting their heritage and craftsmanship, appealing to discerning consumers who value provenance in their purchasing decisions.

The high-end premium market is experiencing significant growth driven by several key factors that reflect evolving consumer preferences and market dynamics. A primary driver is the increased consumer willingness to pay for quality, as more individuals seek authentic and artisanal products. This trend is particularly pronounced among millennials and affluent consumers who prioritize unique and luxurious drinking experiences. The high-end premium segment, characterized by its meticulous production processes and the use of 100% blue agave, offers richer and more complex flavors compared to lower-tier options, attracting discerning consumers.

Moreover, the expansion of sales channels, mainly through e-commerce platforms, has made high-end premium tequila more accessible to a broader audience. As consumers become more knowledgeable about tequila's diverse offerings, the appreciation for high-end products continues to rise. The presence of significant industry players investing in marketing and product innovation also strengthens this segment's growth potential. Overall, these factors collectively position the high-end premium market for continued expansion as it aligns with contemporary trends in the spirits industry.

Regional Insights

North America tequila market was the largest market globally in terms of revenue share of 63.50% in 2023, and it is projected to grow at a CAGR of 9.2% from 2024 to 2030. The growth of the tequila market in North America is driven by several key factors that reflect changing consumer preferences and economic conditions. One of the primary reasons is the increased consumer demand for premium and craft tequilas, as individuals are becoming more discerning about the quality of spirits they consume. This trend is particularly evident among millennials and affluent consumers willing to pay a premium for high-quality, 100% agave tequilas, often perceived as more authentic and flavorful.

In addition, the transformation of tequila's image from a party drink to a refined spirit has significantly contributed to its popularity. Consumers increasingly appreciate tequila's versatility in cocktails, such as Margaritas and Tequila Sunrises, and as a sipping spirit comparable to whiskey or cognac. This shift is supported by the rise of cocktail culture in bars and restaurants, where mixologists favor high-quality tequila.

Moreover, consumer education regarding the different types of tequila and their production processes has led to a greater interest in artisanal brands and specific agave varietals like Blue Weber. The presence of major industry players, such as Patron and Jose Cuervo, who are expanding their product offerings and marketing efforts, has also played a crucial role in driving market growth.

Furthermore, the expansion of e-commerce sales has made tequila more accessible to consumers, allowing them to explore various brands and products from their homes. This accessibility, combined with rising disposable incomes and changing social drinking habits, positions North America as a leading market for tequila consumption. Overall, these factors collectively contribute to the robust growth of the market in North America.

Mexico was the second largest tequila consumer, accounting for nearly 20% of the North American market. The presence of significant distilleries in key tequila-producing regions such as Jalisco, Michoacán, Tamaulipas, Nayarit, and Guanajuato enhances the production capabilities and supports the launch of new products. Expanding sales channels, mainly through On-premise venues like bars and restaurants, has also increased tequila consumption. As consumer awareness regarding the quality and authenticity of tequila rises, there is a growing appreciation for artisanal brands that emphasize traditional production methods.

U.S. Tequila Market Trends

A significant driver is the increased consumer interest in premium and super-premium tequilas, as individuals are increasingly willing to pay more for high-quality products from 100% blue agave. This trend aligns with the broader movement toward premiumization in the spirits industry, where consumers prioritize quality over quantity. In addition, the rising popularity of cocktail culture has significantly boosted tequila consumption, particularly in bars and restaurants, where classic cocktails like Margaritas and innovative tequila-based drinks are becoming staples on menus.

In addition, the influence of celebrity endorsements and the launches of celebrity-owned tequila brands have generated significant buzz around the category, drawing attention to premium options. Celebrity endorsements are pivotal in driving tequila sales in the U.S., significantly influencing consumer perceptions and purchasing behaviors. High-profile figures such as George Clooney, Dwayne "The Rock" Johnson, and Kendall Jenner have successfully launched their tequila brands, creating a strong association between these celebrities and the spirit. This association not only elevates tequila's status to a luxury item but also attracts diverse consumer demographics, particularly younger audiences who are fans of these celebrities.

The expansion of e-commerce platforms has made it easier for consumers to access a variety of tequila brands, facilitating growth in sales channels. Favorable economic conditions, including rising disposable incomes and changing social drinking habits, have contributed to the robust growth of tequila sales in the U.S., positioning it as one of the fastest-growing spirit categories in the market.

Asia Pacific Tequila Market Trends

The Asia Pacific tequila market is expected to grow at a CAGR of 10.2% from 2024 to 2030. One of the primary drivers is the increasing disposable income among consumers in countries such as China, Japan, and India. As the middle class expands and more individuals gain higher earnings, there is a growing willingness to spend on premium and craft spirits, including tequila. This trend is particularly pronounced among younger consumers eager to explore international beverages and unique drinking experiences.

Key Tequila Market Company Insights

The competitive landscape of the tequila market is characterized by a mix of established brands and emerging players, each vying for market share in a rapidly growing industry. North America dominates the market, accounting for over 60% of global tequila sales, with major players such as Jose Cuervo, Patrón, Don Julio, and Sauza leading the charge. In addition, the rise of celebrity-owned tequila brands has further intensified competition, as high-profile endorsements draw new consumers into the category. Brands like Casamigos (co-founded by George Clooney) and Teremana (founded by Dwayne Johnson) have gained substantial market traction, appealing particularly to younger demographics.

Key Tequila Companies:

The following are the leading companies in the tequila market. These companies collectively hold the largest market share and dictate industry trends

- Jose Cuervo

- Patrón

- Don Julio

- Sauza

- 1800 Tequila

- El Jimador

- Milagro

- Clase Azul

- Espolón

- Olmeca (including Altos)

- Casamigos

- Tres Generaciones

- Codigo 1530

- Corralejo

- Maestro Dobel

Tequila Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.43 billion

Revenue forecast in 2030

USD 19.73 billion

Growth rate (Revenue)

CAGR of 9.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, grade, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Colombia, South Africa

Key companies profiled

Jose Cuervo; Patrón; Don Julio; Sauza; 1800 Tequila; El Jimador; Milagro; Clase Azul; Espolón; Olmeca (including Altos); Casamigos; Tres Generaciones; Codigo 1530; Corralejo; Maestro Dobel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Tequila Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tequila market report based on product, grade, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blanco

-

Reposado

-

Anejo

-

Super Premium

-

-

Grade Outlook (Revenue, USD Billion, 2018 - 2030)

-

Value

-

Premium

-

High-End Premium

-

Super Premium

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Off- premise

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tequila market was valued at USD 10.53 billion in 2023 and is expected to reach USD 11.43 billion in 2024.

b. The global tequila market is expected to expand at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030 to reach USD 19.73 billion by 2030.

b. The high-end premium and super-premium tequila segments were the largest together, accounting for a market revenue of USD 7.1 billion in 2023. High-end premium tequila refers to tequila priced between USD 175 and USD 255, compared to Super Premium, which is tequila priced over USD 255.

b. Some of the key players operating in the tequila market include Jose Cuervo; Patrón; Don Julio; Sauza; 1800 Tequila; El Jimador; Milagro; Clase Azul; Espolón; Olmeca (including Altos); Casamigos; Tres Generaciones; Codigo 1530; Corralejo; Maestro Dobel

b. A significant driver is the increasing demand for premium and artisanal tequila. Consumers are shifting their focus toward quality over quantity, with many willing to pay more for high-quality, 100% agave tequilas. This trend is particularly pronounced among younger consumers, with 54% of those aged 18-34 preferring premium options. The premium segment is projected to grow substantially, contributing significantly to revenue growth in the industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.