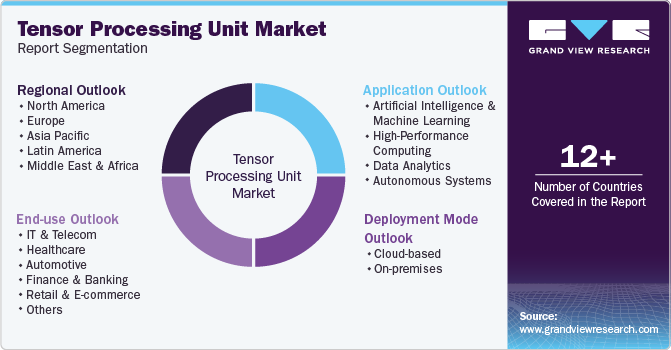

Tensor Processing Unit Market Size, Share & Trends Analysis Report By Application, By Deployment Mode, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-447-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Tensor Processing Unit Market Size & Trends

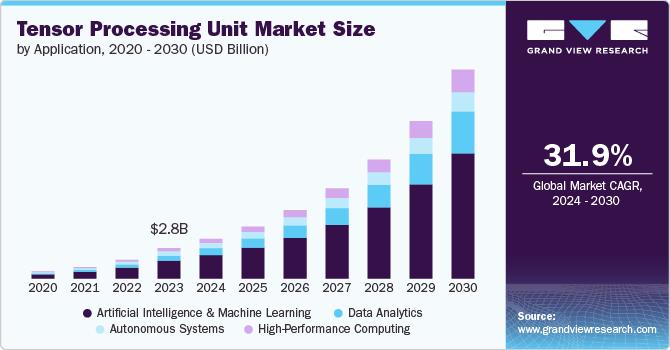

The global tensor processing unit market size was estimated at USD 2,848.9 million in 2023 and is projected to grow at a CAGR of 31.9% from 2024 to 2030. The market is expanding rapidly due to the growing demand for artificial intelligence (AI) and machine learning (ML) across various industries. TPUs are specifically designed to accelerate deep learning tasks, making them vital for AI-driven applications. In sectors like healthcare, finance, and automotive, TPUs process large datasets efficiently.

Healthcare uses TPUs for AI in medical imaging and diagnostics, while the finance sector employs them for fraud detection and algorithmic trading. Cloud-based TPU adoption is also increasing, particularly through Google Cloud, where businesses can access scalable AI resources. This cloud trend allows companies to harness the power of TPUs without the need for expensive on-premises infrastructure. As AI adoption grows, so does the demand for TPUs to handle increasingly complex tasks.

The TPU market is also growing due to its role in enabling edge computing and IoT (Internet of Things) applications. TPUs are becoming more integrated into edge devices, enabling AI models to run closer to data sources, reducing latency, and improving efficiency. Industries such as manufacturing and logistics use TPUs in smart factories and for real-time decision-making in automated systems. The automotive sector, particularly in autonomous driving, is utilizing TPUs to handle the vast amounts of data processed by AI in real time. TPUs are also gaining ground in telecommunications, where they are used to enhance network optimization and predictive maintenance. As edge computing grows, TPU deployment in smart cities and connected infrastructure is expected to rise. This trend will further accelerate the TPU market's growth over the next decade.

The market is also poised to benefit from open-source AI frameworks and the development of custom AI hardware. With the growing availability of TPU-compatible tools and libraries, more developers and enterprises are integrating TPUs into their AI workflows. Open-source platforms such as TensorFlow, optimized for TPUs, make it easier for companies to build and scale AI models. This has led to an increase in TPU adoption across startups and research institutions that need high performance without heavy infrastructure investments. Collaborations between AI hardware companies and tech giants are further pushingTensor Processing Unit (TPU) adoption by making it more accessible. For instance, partnerships between cloud providers and AI developers have simplified the deployment of TPU-powered AI applications. These advancements will continue to support the widespread use of TPUs, positioning them as a key player in the future of AI hardware.

Application Insights

The Artificial Intelligence and Machine Learning segment led the market and accounted for 59.0% of the global revenue in 2023. Artificial Intelligence and Machine Learning dominate the market because TPUs are specifically optimized for the tensor processing required in deep learning models. They offer superior performance for the large-scale matrix calculations central to AI and ML tasks, such as training and inference of neural networks. The rapid growth of AI applications in fields such as healthcare, finance, and autonomous systems drives high demand for TPUs. Cloud providers such as Google LLC utilize TPUs to offer scalable AI solutions, further boosting their market presence. As AI models become more complex, the need for TPUs to handle these sophisticated computations continues to rise.

The data analytics segment is predicted to foresee significant growth in the forecast period. Data analytics is growing in the market due to the increasing reliance on AI-driven insights to process and interpret large volumes of data. TPUs accelerate data analytics tasks by providing the computational power needed for real-time processing and analysis. Industries such as finance, healthcare, and retail are adopting TPUs to gain faster and more accurate insights from their data. The rise of big data and the need for predictive analytics and decision-making further drive the demand forTPUs. As organizations seek to enhance their data-driven strategies, the role of TPUs in data analytics is becoming increasingly important.

Deployment Mode Insights

The cloud-based segment accounted for the largest market revenue share in 2023. Cloud-based TPU solutions dominate the market because they offer scalable and flexible access to high-performance computing without the need for extensive on-premises infrastructure. Cloud providers such as Google Cloud make TPUs available as a service, allowing businesses to easily integrate and scale their AI workloads. This model reduces the capital expenditure associated with purchasing and maintaining dedicated hardware. Moreover, cloud-based TPUs enable users to quickly adapt to changing computational needs and access the latest advancements in AI technology. The convenience and cost-effectiveness of cloud-based solutions contribute significantly to their dominance in the TPU market.

The on-premises segment is projected to grow over the forecast period. On-premises TPU deployments are growing as organizations seek greater control over their computing environments and data security. Industries with high-security requirements, such as healthcare and finance, prefer on-premises solutions to ensure sensitive data remains within their infrastructure. On-premises TPUs also offer dedicated resources for critical and high-performance tasks, reducing latency and improving performance. As AI applications become more mission-critical, enterprises are investing in their own TPU hardware to meet specific performance and customization needs. The growing trend toward hybrid cloud models and edge computing also supports the expansion of on-premises TPU use.

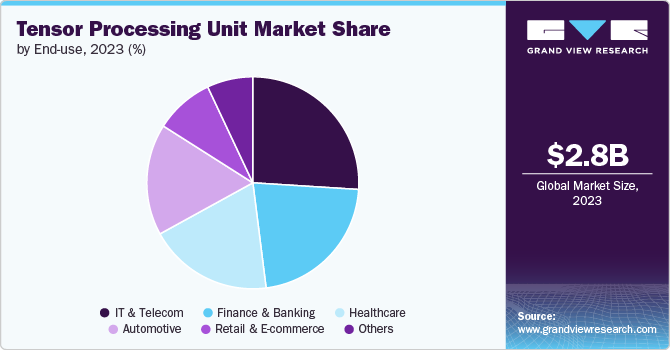

End-use Insights

The IT & Telecom segment accounted for the largest market revenue share in 2023. IT & Telecom sectors dominate the Tensor Processing Unit (TPU) market due to their significant need for AI-driven network optimization and enhanced customer service solutions. TPUs are used to accelerate tasks such as real-time data processing, predictive maintenance, and network management. These industries benefit from TPUs’ ability to handle complex algorithms and large datasets efficiently. Telecom companies utilize TPUs to improve network performance and implement AI-powered applications such as chatbots and customer insights. The critical role of AI in maintaining and expanding IT infrastructure contributes to the dominance of IT & Telecom in the market.

The finance and banking sector segment is predicted to foresee significant growth in the forecast period. The finance and banking sector is growing in the market due to increasing reliance on AI for fraud detection, risk management, and algorithmic trading. TPUs enable faster processing of vast amounts of financial data, facilitating real-time analytics and decision-making. As financial institutions adopt more sophisticated AI models for predictive analytics and personalized services, the demand for TPUs rises. The need for enhanced security and efficiency in handling sensitive financial transactions also drives Tensor Processing Unit (TPU) adoption. The continuous evolution of financial technology (fintech) further fuels the growth of TPUs in this sector.

Regional Insights

The tensor processing unit market in North America dominated globally and accounted for a 37.6% share in 2023.North America leads the TPU market due to its well-established ecosystem of technology and innovation. The region benefits from a high concentration of data centers and cloud providers that integrate TPUs into their AI services. The presence of numerous AI startups and established tech giants fuels the demand for TPUs, driving advancements in machine learning and deep learning applications. North American universities and research institutions are major contributors to TPU development, conducting advanced research and pushing the boundaries of AI capabilities. Moreover, strong venture capital investments in AI and machine learning technologies support the expansion of TPU usage across various industries.

U.S. Tensor Processing Unit Market Trends

The U.S. tensor processing unit market is driven by its influential technology sector and substantial investment in AI research and development. The U.S. government and military use TPUs for national security applications and advanced defense technologies. The country's thriving startup ecosystem and tech hubs, such as Silicon Valley, drive innovation and accelerate the adoption of TPUs for various AI applications. Moreover, leading universities and research institutions in the U.S. are heavily involved in TPU research and development, contributing to technological advancements.

Europe Tensor Processing Unit Market Trends

The tensor processing unit market in Europe is seeing growing TPU adoption as industries across the region embrace AI for data analytics, automation, and digital transformation. The European Union’s focus on AI and digital innovation policies supports the expansion of TPU use. Companies in sectors such as healthcare, automotive, and finance are increasingly implementing TPUs to enhance their AI capabilities. Moreover, European cloud service providers are incorporating TPUs into their offerings to meet local demand.

Asia Pacific Tensor Processing Unit Market Trends

The tensor processing unit market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Asia-Pacific is rapidly expanding in the TPU market due to the region’s fast-paced technological development and large-scale adoption of AI across various industries. Countries such as China, Japan, and South Korea are major contributors, with significant investments in AI research and infrastructure. The region’s growing e-commerce, automotive, and manufacturing sectors are increasingly utilizing TPUs for AI-driven innovations. Government initiatives and tech advancements in countries such as China are accelerating TPU deployment and integration. The high demand for scalable and efficient AI solutions in Asia-Pacific further drives the growth of the TPU market.

Key Tensor Processing Unit Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in July 2024, Apple Inc., a technology company in the U.S., announced a partnership with Google LLC to use Tensor Processing Units (TPUs) for training its AI models, utilizing TPUv5p and TPUv4 chips. This collaboration aims to advance Apple's AI capabilities by utilizing Google's advanced TPU technology.

Key Tensor Processing Unit Companies:

The following are the leading companies in the tensor processing unit market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Google Inc.

- Graphcore

- IBM Corporation

- Intel Corporation

- Micron Technology

- Microsoft Corporation

- NVIDIA Corporation

- Qualcomm Technologies

- Xilinx Inc.

Recent Developments:

-

In May 2024, Google Cloud introduced the Trillium TPU. It is designed to handle the most demanding AI workloads with significant improvements in compute performance, memory, and energy efficiency. This Trillium TPU aims to support large-scale AI models and be integrated into Google Cloud’s AI Hypercomputer platform.

-

In April 2024, Georgia Tech's College of Engineering, in partnership with NVIDIA Corporation, launched the AI Makerspace. This dedicated artificial intelligence supercomputer hub includes NVIDIA’s advanced Tensor Core GPUs and TPUs to enhance undergraduate education in AI and provide students with access to high-performance computational resources.

-

In April 2024, Samsung Electronics, a major South Korean multinational in appliances and consumer electronics, announced a collaboration with Google to integrate Google's Tensor Processing Unit (TPU) into its upcoming Galaxy S25 series to enhance AI functionalities. This partnership is expected to boost the AI performance of Samsung’s flagship smartphones significantly.

-

In January 2024, Google Cloud partnered with Hugging Face, Inc., a U.S.-based machine learning startup, to enhance AI software development by integrating Hugging Face’s open models with Google Cloud’s advanced infrastructure, including TPUs and GPUs. This collaboration aims to utilize Google Cloud’s Vertex AI and other tools to advance AI capabilities and support Hugging Face’s mission of making AI more accessible.

Tensor Processing Unit Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3,729.0 million |

|

Revenue forecast in 2030 |

USD 19,613.4 million |

|

Growth rate |

CAGR of 31.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, deployment mode, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Amazon Web Services, Inc.; Google Inc.; Graphcore; IBM Corporation; Intel Corporation; Micron Technology; Microsoft Corporation; NVIDIA Corporation; Qualcomm Technologies; Xilinx Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Tensor Processing Unit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tensor processing unit market report based onapplication, deployment mode, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Artificial Intelligence and Machine Learning

-

High-Performance Computing

-

Data Analytics

-

Autonomous Systems

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

Healthcare

-

Automotive

-

Finance and Banking

-

Retail and E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tensor processing unit market size was estimated at USD 2,848.9 million in 2023 and is expected to reach USD 3,729.0 million in 2024.

b. The global tensor processing unit market is expected to grow at a compound annual growth rate of 31.9% from 2024 to 2030 to reach USD 19,613.4 million by 2030.

b. North America dominated the tensor processing unit market and accounted for a 37.6% share in 2023. North America leads the TPU market due to its well-established ecosystem of technology and innovation. The region benefits from a high concentration of data centers and cloud providers that integrate TPUs into their AI services.

b. Some key players operating in the tensor processing unit market include Amazon Web Services, Inc., Google Inc., Graphcore, IBM Corporation, Intel Corporation, Micron Technology, Microsoft Corporation, NVIDIA Corporation, Qualcomm Technologies, Xilinx Inc.

b. Key factors that are driving the market include the growing demand for artificial intelligence (AI) and machine learning (ML) across various industries. TPUs are specifically designed to accelerate deep learning tasks, making them vital for AI-driven applications. In sectors like healthcare, finance, and automotive, TPUs process large datasets efficiently.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."