- Home

- »

- Clothing, Footwear & Accessories

- »

-

Tennis Equipment Market Size, Share & Trends Report, 2030GVR Report cover

![Tennis Equipment Market Size, Share & Trends Report]()

Tennis Equipment Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Shoes, Apparel, Racquets, Ball, Strings, Bags, Accessories), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-954-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tennis Equipment Market Summary

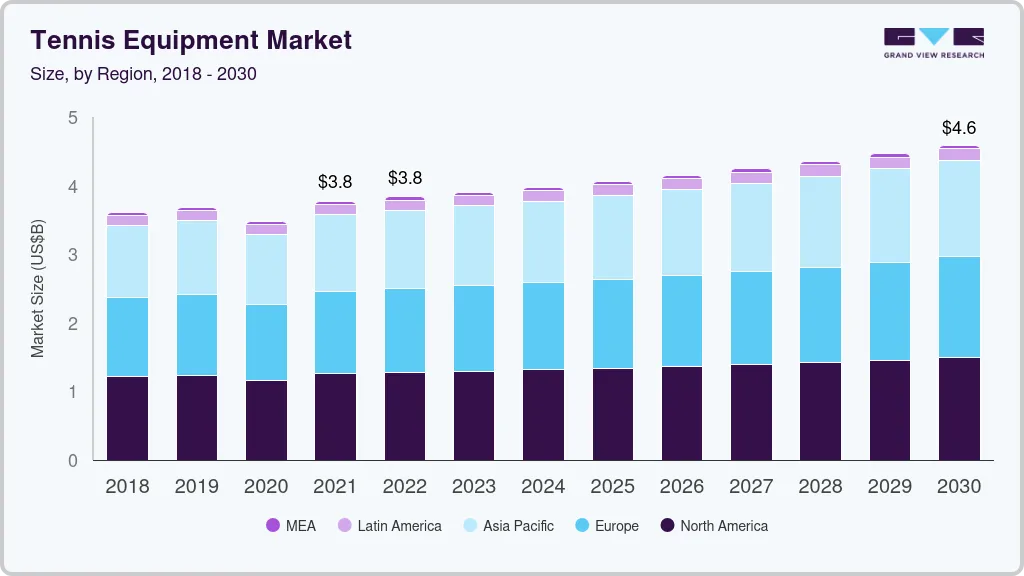

The global tennis equipment market size was estimated at USD 3,770.1 million in 2021 and is projected to reach USD 4,589.5 million by 2030, growing at a CAGR of 2.2% from 2022 to 2030. The increasing popularity of tennis and the growing preference for sports activities are some key factors expected to drive the global market over the forecast period.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2021.

- Country-wise, South Korea is expected to register the highest CAGR from 2022 to 2030.

- In terms of segment, shoes accounted for a revenue of USD 1,138.7 million in 2021.

- Racquets is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 3,770.1 Million

- 2030 Projected Market Size: USD 4,589.5 Million

- CAGR (2021-2030): 2.2%

- North America: Largest market in 2021

In addition, different Grand Slam tennis tournaments such as the Australian Open and Wimbledon are gaining popularity globally. This is one of the supportive factors expected to drive the market during the forecast period.

While the COVID-19 pandemic continues to impact global business, the sports industry has managed to return to pre-COVID-19 growth levels amid a difficult economic environment. In 2020, sporting goods executives focused on three trends: consumer shift, digital leap, and industry disruption. In 2021, these trends continue, in some cases accelerating, or taking interesting new turns. With many still working from home, the athleisure trend has grown further, reflecting a new attitude towards sports. Increasing health awareness has given a new perspective to exercise and general fitness. In addition, online shopping is booming as consumers continue to shop online, even after an ease in lockdown. Digital forms of individual or community-based exercise are becoming more popular and creating new possibilities for sports equipment manufacturing companies.

The increasing adoption of tennis racquets, balls, and other equipment by professional players, along with the increasing number of tennis tournaments across the globe, is expected to drive the industry. Growing awareness regarding the importance of exercise in maintaining health and fitness has increased tennis participation rates around the world. According to a study published by Oxford University and researchers in Finland and Australia, who tracked more than 80,000 people on average for nine years, regular racquet sports such as tennis may be the best exercise to prevent premature death. The report found that those who regularly participated in racquet sports were the least likely to die. There is a 47% lower risk of early death with racquet sports, 28% lower risk with swimming, 27% lower with aerobics, and 15% lower with cycling.

Whereas, unpredictable and severe weather conditions due to global warming and other environmental conditions are the key factors that are expected to hinder the growth of the sporting goods market. Furthermore, the availability of counterfeit products, along with the high cost of some sporting goods, is expected to further restrain the growth of the market over the forecast period. On the other hand, certain associations set global standards for the manufacture of tennis equipment, which hampers the growth of tennis equipment up to a certain extent. For instance, the International Tennis Federation (ITF) defines the specifications for tennis racquets. Therefore, it is difficult for local manufacturers to produce tennis racquets according to their choice.

One of the major trends observed in the market is the use of information technology for direct promotion or marketing. The promotion of tennis as a fitness sport is another major trend observed in the market. For instance, cardio tennis is a high-energy fitness activity that combines the best features of tennis with a cardiovascular workout. It provides a full-body, calorie-burning cardio workout. In addition, tennis equipment manufacturers are adopting new technologies such as woofers, flex zones, and aerodynamic modules to make racquets more durable and comfortable.

Furthermore, the increasing availability of product advertisements, promotions, and tennis equipment on e-commerce portals across the globe is another factor expected to support the revenue growth of this market in the future. Various tennis equipment manufacturers have shifted their focus to distributing equipment through online sales channels. It can be seen that most tennis equipment manufacturers, such as Nike and Wilson Sporting Good, have turned their attention to obtaining sales of tennis equipment through online channels such as the company's official e-commerce website and third parties.

Product Insights

In 2021, the shoe segment held the largest revenue share of more than 30.0%. The use of eco-friendly materials to manufacture sports shoes is one of the major factors positively influencing the growth of this market. Consumer demand for sustainable footwear continues to grow due to the growing concerns regarding protecting the environment. In addition, various manufacturers are working hard to meet the needs of their customers and are constantly focusing on making sustainable and eco-friendly shoes. For instance, on Earth Day, Adidas and Parley launched three new tennis shoe designs, all made from plastic waste thrown into the ocean. Based on product, the market is segregated into shoes, apparel, racquets, ball, strings, bags, and accessories.

The ball segment is projected to grow at a significant rate of 2.5% over the forecast period. Rising purchasing power, improving living standards, and a major focus on leisure activities are anticipated to drive the global market over the forecast period. In addition, the increasing number of tennis events and the requirement for frequent replacement of tennis balls contribute to the market growth. Furthermore, the introduction of a range of slower balls and different court sizes is expected to drive this segment in the near future.

Distribution Channel Insights

The offline segment held the largest revenue share of over 75.0% in 2021. The offline segment can be classified into hypermarkets/supermarkets, specialty/sports shops, and other distribution channels. Specialty stores and sports shops are the most common and preferred channels for end-users. The easy availability of various products in specialty stores is one of the main factors attracting consumers to offline stores. These stores provide consumers with the information and support they need through skilled customer service staff. Based on distribution channels, the market has been segmented offline and online.

The online segment is expected to register a lucrative growth rate over the forecast period in the market. The online segment can be segregated into website-through selling and e-commerce portal offerings. The growing popularity of smartphone users has boosted the growth of e-commerce globally. Additionally, the ease of purchase and checkout processes of online retailers, including Amazon and Walmart, are expected to expand the reach of e-commerce as a sales medium. Furthermore, the introduction of different shopping apps and the availability of secure and convenient payment gateways are boosting the growth of the online retail industry. Blogs and social media apps like Pinterest and Instagram significantly influence trends in sports equipment.

Regional Insights

North America dominated the market in 2021 and accounted for over 30.0% share of the total revenue. The U.S. and Canada are the largest sports nations with diverse sports facilities and infrastructure, and they host major sporting events in major cities. The enhancement of fitness awareness among people of all ages has increased the proportion of people’s participation in sports, which is expected to boost the growth of the market during the forecast period. According to the data published by Tennis Industry Association (TIA), the tennis economy grew by 4.5% between 2016 and 2020. The USTA reports that entry-level racket sales are up more than 40% year over year. Youth adoption of tennis as a recreational sport is a major factor driving the market in North America.

Europe held the second-largest revenue share in 2021. The popularity of the sport in the region, coupled with strong government support to increase participation in youth tennis, is likely to propel market growth over the forecast period. The market in Europe has grown in both volume and value, although unit growth is higher than value growth, implying a lower overall average price across the continent. This is in line with other studies showing that Covid-19 and its associated lockdowns have boosted tennis engagement, especially among beginners. Compared to 2020, total volume and value in Europe increased by 45.3% and 40.7%, respectively, but it's not just the pandemic that disrupted sales in the second quarter of 2020. Even compared to 2019, sales in 2021 are up more than 10%.

Asia Pacific is estimated to register the fastest CAGR of 2.5% over the forecast period. The growing influence of tennis professionals among the Asian population presents lucrative opportunities for market players in East and Southeast Asia. In addition, factors such as China’s booming economy and the expansion of sports infrastructure and training facilities have created ample opportunities for various stakeholders in the sports equipment manufacturing ecosystem. In addition, a shift from recreational tennis to core tennis participation is likely to fuel the growth of the market significantly. The growing fitness trend among millennials in the Asia Pacific is expected to drive the market from 2022 to 2030.

Key Companies & Market Share Insights

The top players in the market have been incorporating multiple strategies to increase their brand presence in the field. The companies have been working with professional tennis players to support offering products. They have also been developing partnerships with tennis competitions to increase their market presence. These companies have adopted several competitive strategies, such as product and technological innovation, increasing production capacity, and establishing partnerships with online e-commerce companies to increase sales.

For instance, in January 2022, a tennis racquet bag brand, Geau Sport announced the addition of three new bags to its lineup. The Aether Backpack, Aether 3-park, and Stance Tote are the latest additions to Geau's line of tennis bags. In 2020, Yonex Co., Ltd. launched a limited-edition EZONE racquet, available in selected markets. The tennis racquet was designed by the company in collaboration with champion Naomi Osaka. Some prominent players in the global tennis equipment market include:

-

YONEX Co., Ltd.

-

Wilson Sporting Goods

-

Nike, Inc.

-

Adidas AG

-

BABOLAT VS S.A.

-

Solinco Inc.

-

Amer Sports

-

Head N.V.

-

Dunlop Sports

-

Technifibre

-

ASICS Corporation

-

Geau Sport

-

Prince Tennis

-

Volkltennis

-

Ame & Lulu

Tennis Equipment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.83 billion

Revenue forecast in 2030

USD 4.59 billion

Growth rate

CAGR of 2.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

YONEX Co., Ltd; Wilson Sporting Goods; Nike, Inc.; Adidas AG; BABOLAT VS S.A.; Solinco Inc.; Amer Sports; Head N.V.; Dunlop Sports; Technifibre; ASICS Corporation; Geau Sport; Prince Tennis; Volkltennis; Ame & Lulu

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. Grand View Research has segmented the global tennis equipment market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Shoes

-

Apparel

-

Racquets

-

Ball

-

Strings

-

Bags

-

Accessories

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tennis equipment market size was estimated at USD 3.77 billion in 2021 and is expected to reach USD 3.83 billion in 2022.

b. The global tennis equipment market is expected to grow at a compound annual growth rate of 2.2% from 2022 to 2030 to reach USD 4.59 billion by 2030.

b. North America dominated the tennis equipment market with a share of 33.3% in 2021. This is attributable to the popularity of the tennis sport in the region coupled with government support to conduct the tournaments and athletes' preparations.

b. Some key players operating in the tennis equipment market include YONEX Co., Ltd; Wilson Sporting Goods; Nike, Inc.; Adidas AG; BABOLAT VS S.A.; Solinco Inc.; Amer Sports; Head N.V.; Dunlop Sports; Technifibre; ASICS Corporation; Geau Sport; Prince Tennis; Volkltennis; and Ame & Lulu.

b. Key factors that are driving the tennis equipment market growth include a rise in the number of individual buyers of tennis equipment, an increasing number of women participating in tennis sports and tournaments, and manufacturers’ initiatives to launch lightweight and durable tennis equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.