- Home

- »

- Backup Power Solutions

- »

-

Temporary Power Market Size, Share & Growth Report, 2030GVR Report cover

![Temporary Power Market Size, Share & Trends Report]()

Temporary Power Market (2025 - 2030) Size, Share & Trends Analysis Report By Fuel Type (Diesel, Gas), By End-use (Utilities, Oil & Gas, Construction & Mining, Events), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-376-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Temporary Power Market Summary

The global temporary power market size was estimated at USD 5,582.6 million in 2024 and is projected to reach USD 9,226.3 million by 2030, growing at a CAGR of 9.2% from 2025 to 2030. The temporary power industry is experiencing significant growth, driven by increasing demand from various sectors, including construction & mining, events, and utilities.

Key Market Trends & Insights

- North America temporary power market leads in the global industry.

- U.S. dominated the revenue share of the North America temporary power market.

- By end use, utilities segment held the largest revenue share of temporary power market in 2023.

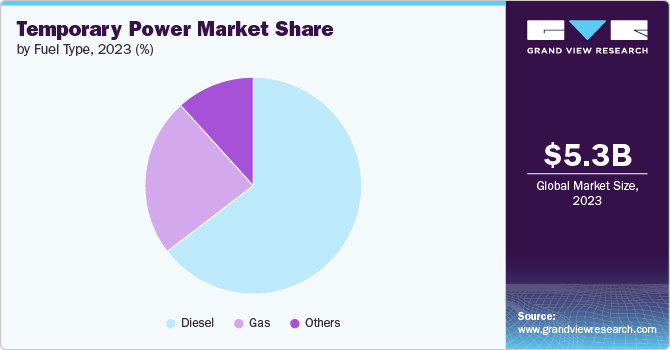

- By fuel type, diesel held the largest revenue share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 5,582.6 Million

- 2030 Projected Market Size: 9,226.3 Million

- CAGR (2025-2030): 9.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Rising infrastructure projects and urbanization contribute to the need for reliable power solutions, especially in regions facing energy shortages or unreliable grid systems. Additionally, the growing trend of renewable energy adoption is boosting the demand for hybrid and mobile power solutions in temporary applications.

The market benefits significantly from integrating renewable energy by expanding its offerings to include hybrid power solutions, such as solar and battery systems, which meet the growing demand for sustainable energy alternatives. This shift aligns with increasing regulatory pressures for environmentally friendly practices and enhances the versatility of temporary power solutions in various applications, including construction, events, and emergency response.

By leveraging renewable energy sources, companies in the temporary power sector can provide cost-effective, reliable, and eco-friendly power solutions, ultimately attracting a broader customer base and enhancing market competitiveness.

Drivers, Opportunities & Restraints

The expansion of the market is primarily driven by the increasing demand for reliable power during outages and ongoing construction activities. As businesses and industries seek to minimize downtime, temporary power solutions provide essential support during critical phases, ensuring operations continue uninterrupted. Significant investments in public infrastructure projects, such as roadways, bridges, and utilities, further amplify the need for temporary power. Large-scale events, including concerts, festivals, and sporting events, also contribute to heightened demand, as organizers require dependable energy sources to power equipment and enhance attendee experiences.

Despite the growth potential, the market faces certain restraints that can limit expansion in specific regions. High operational costs associated with maintaining and deploying temporary power solutions can be a significant barrier, particularly in price-sensitive markets. Additionally, the initial investment required for equipment and infrastructure can discourage potential clients, especially small and medium-sized companies. These financial constraints can lead to slower adoption rates of temporary power solutions in some areas, necessitating companies to develop cost-effective strategies and financing options to address these challenges and facilitate market growth.

Emerging markets in the Asia-Pacific and Latin America regions present substantial growth opportunities for the temporary power sector. Rapid urbanization and industrialization in these areas are driving a significant increase in construction and infrastructure projects, creating a heightened demand for temporary power solutions. Companies can capitalize on this trend by establishing local partnerships with construction firms and event organizers to expand their service offerings. By tailoring solutions to meet specific regional needs, such as adapting to local regulations and power requirements, businesses can effectively penetrate these markets and increase their competitive advantage.

End-use Insights

“Utilities segment held the largest revenue share of temporary power market in 2023.”

The utility sector, facing frequent disruptions from weather, equipment failures, or upgrades, heavily relies on temporary power to ensure reliable energy, grid stability, and service continuity. This demand is amplified by investments in renewable energy and infrastructure expansion, necessitating adaptable power solutions.

Temporary power aids operational resilience and regulatory compliance, making the utility sector crucial for the market growth. Companies in this market can boost their presence by offering advanced, customized solutions to meet utility providers' unique needs.

Temporary power solutions are essential during initial phases, enabling operations in remote locations and supporting large-scale projects without access to permanent power sources. As these industries continue to expand globally, the demand for reliable temporary power solutions will remain high, facilitating efficient project execution and minimizing downtime across construction and mining activities.

Fuel Type Insights & Trends

“Diesel held the largest revenue share in 2023.”

Diesel remains the most widely used temporary power solution in 2023, primarily due to its established reliability, availability, and robust application performance. Diesel generators are favored for delivering consistent and powerful energy, making them suitable for construction sites, events, and emergency backup situations. Its well-developed infrastructure ensures easy access and maintenance, which further cement diesel's position as the go-to choice for many businesses requiring temporary power solutions.

The renewable energy solutions sector is experiencing growth driven by heightened regulatory mandates for sustainability and escalating demand for eco-friendly options. Market transformation is evident with the integration of solar and battery solutions in temporary power applications, offering cleaner alternatives to conventional energy sources. Technological advances and reducing costs further bolster this growth, positioning renewable energy as a compelling choice for businesses aiming to comply with regulations and attract environmentally conscious consumers.

Regional Insights

“U.S. dominated the revenue share of the North America temporary power market.”

North America temporary power market leads in the global industry, fueled by a thriving construction industry and dynamic events sector. Growth is spurred by major infrastructure investments, necessitating ongoing demand for temporary power for construction, renovation, and large events. The critical need for dependable power during such projects, combined with economic recovery and expansion, keeps the temporary power market essential to North America's energy landscape.

U.S. Temporary Power Market Trends

The temporary power market in the U.S. is driven by its substantial construction activities and the regular hosting of major events. The country's extensive infrastructure projects, spanning roads, bridges, and public facilities, highlight the growing necessity for reliable temporary power solutions. Furthermore, a broad range of industries, including entertainment, oil and gas, and emergency services, contribute to the robust demand for temporary power. Coupled with a commitment to sustainable energy practices, the U.S. stands out as a key player in the market.

Asia Pacific Temporary Power Market Trends

The temporary power market in Asia Pacific is emerging as a fast-growing market due to rapid urbanization, rising disposable incomes, and increasing infrastructure development across countries like India and China. The region's economic growth drives substantial demand for temporary power solutions across multiple sectors.

Europe Temporary Power Market Trends

The temporary power market in Europe is positioned as a significant player in the temporary power market, fueled by stringent environmental regulations, increasing infrastructure projects, and a focus on sustainability. Countries across the region are investing heavily in renewable energy initiatives and public infrastructure, which creates a robust demand for temporary power solutions.

Key Temporary Power Company Insights

Some of the key players operating in the market include Aggreko and United Rentals, Inc.

-

Aggreko is a leading provider of temporary power solutions, specializing in generator rental and energy services. The company offers a diverse range of equipment, including generators and hybrid systems, catering to sectors such as construction, events, and industrial applications.

-

United Rentals, Inc. is one of the leading equipment rental companies in the world, providing a broad spectrum of temporary power solutions. The company focuses on delivering reliable power solutions to construction sites and emergency situations, reflecting a commitment to meeting the evolving needs of its customers.

Key Temporary Power Companies:

The following are the leading companies in the temporary power market. These companies collectively hold the largest market share and dictate industry trends.

- Aggreko

- APR Energy PLC

- Ashted Group PLC

- Atlas Copco CB

- Caterpillar, Inc.

- Cummins, Inc.

- Kohler Co., Inc.

- Rental Solutions & Services LLC

- Smart Energy Solutions

- United Rentals, Inc.

Recent Developments

-

In January 2024, United Rentals, Inc. launched a strategic roadmap designed for businesses aiming to reduce greenhouse gas (GHG) emissions on job sites, without sacrificing productivity or safety. The roadmap offers guidelines for sustainable fleet management, adoption of cleaner power sources, integration of battery energy storage, and use of electric or hybrid equipment. This initiative supports construction and industrial sectors in achieving reduced emission goals, leveraging data-driven insights, eco-friendly equipment, and flexible rental options to ensure profitability.

-

In December 2023, Aggreko acquired nine community solar projects in New York, totaling 59 MW, advancing its energy transition strategy. This enhances its renewable energy portfolio and supports its growth in the community solar market. The acquisition broadens Aggreko's clean energy scale and fosters key commercial and industrial relationships. This move strategically positions Aggreko to serve the low- and moderate-income population in New York, reinforcing its leadership in providing energy transition solutions to commercial and industrial clients.

Temporary Power Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,945.4 million

Revenue forecast in 2030

USD 9,226.3 million

Growth Rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Fuel type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Aggreko; Rental Solutions & Services LLC; Ashted Group PLC; Caterpillar, Inc.; Cummins, Inc.; Atlas Copco CB; Kohler Co., Inc.; United Rentals, Inc.; Smart Energy Solutions; APR Energy PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Temporary Power Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global temporary power market report on the basis of fuel type, end-use, and region.

-

Fuel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diesel

-

Gas

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Utilities

-

Oil & Gas

-

Construction & Mining

-

Events

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global temporary power market size was estimated at USD 5.27 billion in 2023 and is expected to reach USD 5.58 billion in 2024.

b. The global temporary power market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 9.23 billion by 2030.

b. By end use, utilities dominated the market with a revenue share of over 60.0% in 2023.

b. Some of the key vendors of the global temporary power market are Aggreko, Rental Solutions & Services LLC, Ashted Group PLC, Caterpillar, Inc., Cummins, Inc., Atlas Copco CB, Kohler Co., Inc., United Rentals, Inc., Smart Energy Solutions, APR Energy PLC, among others.

b. The key factor driving the growth of the global temporary power market is attributed to the significant growth driven by increasing demand from various sectors, including construction & mining, events, and utilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.