Temperature Sensors Market Size, Share & Trends Analysis Report By Product (Contact, Contactless), By Output (Analog, Digital), By Connectivity (Wired, Wireless), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-495-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Temperature Sensors Market Size & Trends

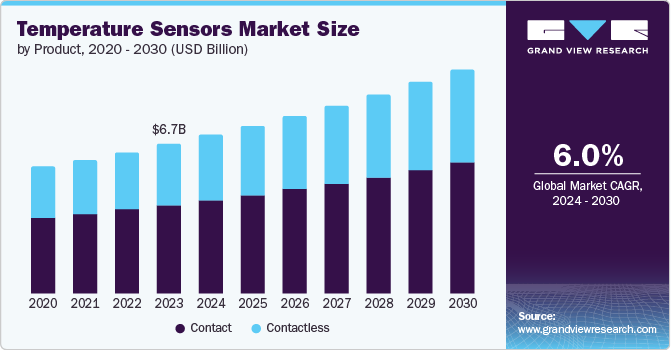

The global temperature sensors market size was valued at USD 6.72 billion in 2023 and is projected to grow at a CAGR of 6.0% from 2024 to 2030. The market growth is due to rising applications of temperature sensors and growth in the electronics sector. There is an increased demand for temperature sensors in industries such as microtechnology and nanotechnology, where the sensors are used to measure accurate data. Furthermore, increased investments in research and development in order to innovate and launch new sensors with better accuracy and efficiency have resulted in the growth of the temperature sensors market globally.

There is an increased demand for temperature sensors due to their increased applications for various sectors such as healthcare, automotive, and military. Increasing temperature sensors' integration with Internet of Things (IoT) devices allows accurate monitoring, automation, and data analytics. Furthermore, there is an increased demand for temperature sensors in Artificial Intelligence (AI) and Machine Learning applications as they aid in better process optimization with accurate data analysis. Furthermore, the growth and evolution of Industry 4.0 has increased demand for temperature sensors as major companies use temperature sensors to optimize their operations.

With growth in the construction industry, there is an increased demand for temperature sensors in home automation networks. Integration of temperature sensors in smart devices to detect surrounding temperatures. They are used in fire detection alarm systems and thermostats to control the room temperature, heating, ventilation, and air-conditioning (HVAC) of buildings. Furthermore, the increased integration of temperature sensors in healthcare devices has contributed to market growth. Medical devices use these sensors to measure and monitor the patient's body temperature during various medical procedures. Therefore, these factors have been attributed to the growth of this market.

Product Insights

The contact segment dominated the market and accounted for 59.4% in 2023 owing to the increased demand for contact temperature sensors in the medical, food, chemical, and manufacturing sectors. Contact temperature sensors require physical contact with the monitored surfaces or objects. They are widely used to monitor the temperatures of various solids, liquids, or gases. Therefore, this increased demand has resulted in upward market growth for this segment.

The contactless segment is expected to witness a CAGR of 6.4% over the forecast period pertaining to the increased applications of contactless temperature sensors, which measure temperatures with any contact using infrared radiation. These sensors can measure the temperature of moving and inaccessible objects within a very short time. Due to these advantages, there is an increased demand for these sensors in sectors such as the automotive, medical, and manufacturing industries. The temperature can be measured regardless of the material type, size, and state of aggregation.

Output Insights

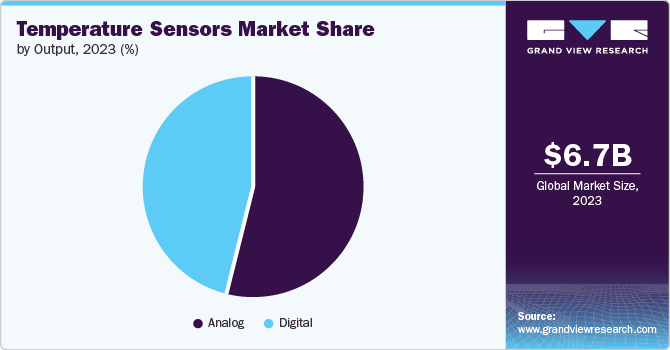

The analog segment accounted for the largest market revenue share of 54.4% in 2023 owing to the increased demand in sectors such as real estate, food, and electronics. Analog temperature sensors are used for applications such as thermostat control, fan control, refrigerators, freezers, rice cookers, food warmers, HVAC, and more. The temperature is measured by the sensors using voltage signals given by the devices. Therefore, these factors contribute to the market growth of this segment.

The digital segment is expected to register the fastest CAGR of 6.3% over the forecast period. This market growth is attributed to the increased demand for digital temperature sensors, which provide more accurate readings efficiently and are power-efficient. There is an increased demand for digital temperature sensors in the medical, scientific research, automotive, and aerospace sectors. Hence, these factors are responsible for the market growth in this segment.

Connectivity Insights

The wired segment dominated the market in 2023, with a market share of 73.3%. This is attributable to the sensors' robust and reliable characteristics. There is increased demand for wired temperature sensors in the manufacturing, automotive, and laboratory industries, as these industries require real-time temperature monitoring without interruptions. These temperature sensors are widely used due to their accuracy, durability, and versatility with automation systems.

The wireless segment is projected to grow at the fastest CAGR of 6.6% over the forecast period. The increased demand for wireless sensors in IoT and automation systems drives the growth. These sensors provide flexibility and simple installation, making them appropriate for use in smart homes, healthcare, and logistics. Companies are seeking to manufacture long-range wireless sensors that consume less energy. Therefore, this segment is growing due to increased applications of wireless sensors in various industries.

Application Insights

In 2023, the automotive segment dominated the market with a market share of 29.6%. This is attributable to the growth in the automotive sector and increased demand for temperature sensors due to their increased integration in vehicle manufacturing. Temperature sensors are used to measure and monitor the temperatures of various liquids and gases in a vehicle. There is an increase in the applications of sensors such as HVAC, measuring the temperature of the engine, transmission, and exhaust.

The environmental segment is projected to grow at the fastest CAGR of 7.2% over the forecast period. The growth is driven by the increased use of temperature sensors in industries such as manufacturing, scientific research, and chemicals. These sensors allow for monitoring the work environment, ensuring safe conditions. They also aid in decision-making by detecting changes in the temperature and humidity of the environment. Hence, these factors are responsible for the market growth of this segment.

Regional Insights

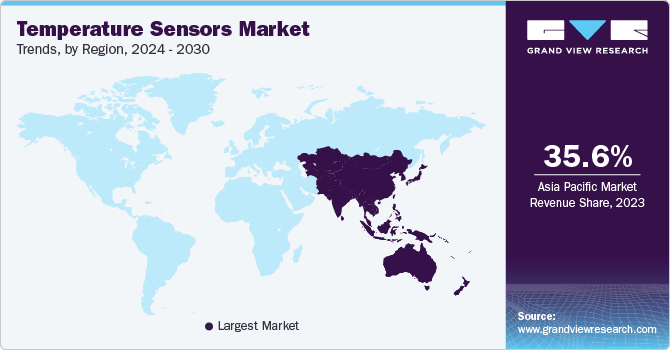

North America dominated the market in 2023 with a market share of 28.4%. It is attributable to the increased use of temperature sensors in developed industries such as automotive, medicine, and technology. There is an increased demand for sensors in manufacturing HVAC systems, electronic devices, medical devices, and more. Furthermore, the integration of temperature sensors in smart home devices and building automation has resulted in market growth in this region.

U.S. Temperature Sensors Market Trends

The U.S. temperature sensors market held a dominant position in 2023 due to the presence of well-developed industries and the integration of temperature sensors in various sectors such as automotive, medical, and aerospace. The growth in the construction industry resulted in the demand for these sensors, as they are used in HVAC systems and fire alarm systems. Hence, these factors resulted in the growth of the temperature sensors market in the country.

Europe Temperature Sensors Market Trends

The European market was identified as a lucrative region in 2023, with a market share of 22.8%. The market growth is attributed to the increased demand for temperature sensors in industries such as construction, medical, and automotive. Major medical and automotive companies are in this region. Due to extreme weather, temperature sensors are used more frequently in HVAC systems in the region. Furthermore, the increased use of temperature sensors in smart home devices has resulted in market growth in this region.

The UK temperature sensors market is expected to grow rapidly in the coming years due to the growing construction and automobile industries, which have an increased demand for temperature sensors. The integration of these sensors in home appliances and smart devices has further propelled the growth of this market in the country.

Asia Pacific Temperature Sensors Market Trends

The Asia Pacific market had a market share of 35.6% and is anticipated to grow at a CAGR of 6.5% during the forecast period. This growth is attributed to the region's growing manufacturing and automation industry. The integration of temperature sensors for accurate measurements and monitoring in these industries has resulted in the increased demand for temperature sensors in this region. Growing industrialization and development in technology have resulted in market growth.

The China temperature sensors market held a substantial market share in 2023 owing to the presence of major manufacturing companies and increased demand for temperature-measuring solutions in industries such as automotive and manufacturing. The presence of cheap labor and raw materials further aids in the market growth of temperature sensors in this country.

Key Temperature Sensors Company Insights

Some of the key companies in the temperature sensors market include STMicroelectronics, NXP Semiconductors, Omega Engineering, Inc., Yokogawa Electric Corporation, and others. Organizations are focusing on improving the data collection capability of sensors by innovations and collaborations. The companies are focusing on expanding their portfolio to various applications in segments such as automobile, medical, communication, and industry.

-

Omega Engineering, Inc. is an instrumentation company specializing in products such as thermocouples, flow meters, pH meters, sensors, electric heaters, data collection, and automation devices.

-

STMicroelectronics is a technology company that specializes in the designing and manufacturing of semiconductors. It deals with products such as integrated circuits, microcontrollers, microprocessors, transistors, and smartcards.

Key Temperature Sensors Companies:

The following are the leading companies in the temperature sensors market. These companies collectively hold the largest market share and dictate industry trends.

- STMicroelectronics

- NXP Semiconductors

- Omega Engineering, Inc.

- Yokogawa Electric Corporation

- Murata Manufacturing Co., Ltd.

- IFM Electronic GmbH

- Dwyer Instruments, LLC

- Vishay Intertechnology, Inc.

- Panasonic Corporation

- Denso Corporation

- Kongsberg Maritime

- Ametek, Inc.

- AMS-Osram AG

Recent Developments

-

In October 2023, Omega Engineering, Inc. announced upgrades to its HANI temperature sensors. The upgrades included an IP67 rating for all HANI products, which will protect the sensors against immersion in up to 1 meter of water for 30 minutes. This upgrade was targeted to improve the sensors' survival under harsh wash-down environments.

-

In June 2023, Omega Engineering, Inc. announced a noninvasive temperature sensing technology for metal tanks named HANI Temperature Sensor. The sensor can read in-tank process media temperatures without the downtime of installing invasive, in-tank temperature sensors. The sensors are mounted outside of the tank and read the temperature of the process media inside the tank.

Temperature Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.11 billion |

|

Revenue forecast in 2030 |

USD 10.07 billion |

|

Growth rate |

CAGR of 6.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, output, connectivity, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

STMicroelectronics. NXP Semiconductors, Omega Engineering, Inc., Yokogawa Electric Corporation, Murata Manufacturing Co., Ltd., IFM Electronic GmbH, Dwyer Instruments, LLC, Vishay Intertechnology, Inc., Panasonic Corporation, Denso Corporation, Kongsberg Maritime, Ametek, Inc., AMS-Osram AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Temperature Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global temperature sensors market report based on product, output, connectivity, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contact

-

Contactless

-

-

Output Outlook (Revenue, USD Million, 2018 - 2030)

-

Analog

-

Digital

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Environmental

-

Healthcare/Medical

-

Process Industries

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."