- Home

- »

- Consumer F&B

- »

-

Tempeh Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Tempeh Market Size, Share & Trends Report]()

Tempeh Market Size, Share & Trends Analysis Report By Type (Fresh, Frozen, Ready-to-eat), By Source (Soya Bean, Multi-grain), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-387-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Tempeh Market Size & Trends

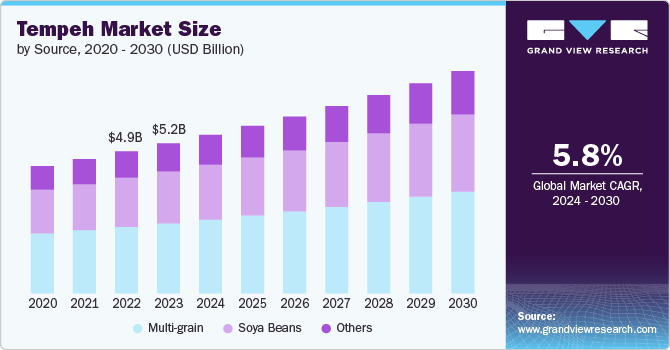

The global tempeh market size was estimated at USD 5.17 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The global market for tempeh is experiencing significant growth due to a combination of health benefits, evolving consumer preferences, and environmental concerns. Tempeh is celebrated for its high nutritional value, being rich in protein, fiber, vitamins, and minerals, and its probiotic content, which supports gut health. As more consumers adopt vegan and vegetarian diets, the demand for plant-based proteins such as tempeh has surged.

Tempeh originated in Indonesia, particularly on the island of Java, where it has been a staple food for centuries. Traditionally, tempeh is made by fermenting soybeans with the Rhizopus mold, resulting in a firm, cake-like product. Its long-standing cultural significance in Indonesian cuisine has facilitated its spread worldwide, especially as global interest in plant-based diets and sustainable eating has grown

The increasing vegan population has significantly boosted the demand for meat substitutes, including plant-based meat products like tempeh. Tempeh, known for its nutrient density and versatility, is becoming increasingly popular globally as a nutritious meal option. However, the sector faces challenges due to competition from other plant-based products such as tofu, textured vegetable protein (TVP), seitan, and Quorn.

In addition, growing concerns about animal abuse in meat production have shifted consumer preferences towards plant-based meats to reduce animal slaughter. Ethical considerations, supported by data such as Animal Clock's report that over 55 billion animals are slaughtered annually for food, further drive the demand for meat analogs.

Manufacturers are innovating with tempeh to meet the growing consumer demand for convenient and tasty plant-based protein options. Ready-to-eat tempeh products, such as Lightlife’s Tempeh Protein Crumbles, offer pre-seasoned varieties that save preparation time and can be easily added to various dishes. Flavored tempeh products, including smoky, spicy, and herb-infused options, cater to diverse taste preferences. Pre-cooked tempeh strips or cubes provide an easy way to incorporate tempeh into meals without extensive cooking. In addition, some brands offer tempeh as part of complete meal kits or ready-to-eat packaged meals, providing balanced and nutritious options for busy consumers. These innovations are making tempeh more accessible and appealing, supporting its growing popularity.

Type Insights

Fresh tempeh accounted for a market share of 46.7% of global revenues in 2023. Consumers often perceive fresh tempeh as healthier due to its minimal processing and lack of preservatives. This perception aligns with the broader trend towards clean eating and natural foods. Fresh tempeh retains more of its original nutrients compared to processed or preserved versions.

Ready-to-eat tempeh is expected to grow at a CAGR of 6.4% from 2024 to 2030. Ready-to-eat tempeh requires no additional preparation, making it an ideal choice for busy consumers who need a quick and easy meal or snack option. This convenience is especially appealing to those with hectic lifestyles. It is often pre-seasoned and cooked to perfection, ensuring a consistent taste and texture. This consistency helps consumers enjoy tempeh without the need for culinary skills or extensive cooking knowledge.

In March 2022, Lightlife, a leading plant-based brand owned by Greenleaf Foods, SPC, introduced a new ready-to-cook product called Lightlife Tempeh Cubes. These tempeh cubes are a convenient and nutritious option, offering 13 grams of protein per serving. The cubes come in three flavored varieties: Teriyaki, Southwest, and Tikka Masala, and are now available on Amazon and in select retail locations.

Source Insights

Soya bean tempeh accounted for a market share of 45.2% of global revenues in 2023. Soybean tempeh is a complete protein source, providing all essential amino acids. It is also high in fiber, vitamins (including B vitamins), and minerals such as magnesium and phosphorus. This makes tempeh a great option for meeting nutritional needs through plant-based sources. In addition, the fermentation process used to produce tempeh generates beneficial probiotics that support gut health and improve digestion by balancing the gut microbiome and enhancing nutrient absorption.

Multi-grain tempeh is expected to grow at a CAGR of 6.4% from 2024 to 2030. Multi-grain tempeh is made from a variety of grains and legumes, offering a broader spectrum of nutrients. It provides high protein content, fiber, vitamins, and minerals that may not be as abundant in single-grain tempeh. Its complex flavor and texture make multi-grain tempeh versatile for various recipes. It can be used in salads, stir-fries, sandwiches, and more, adding depth to different dishes.

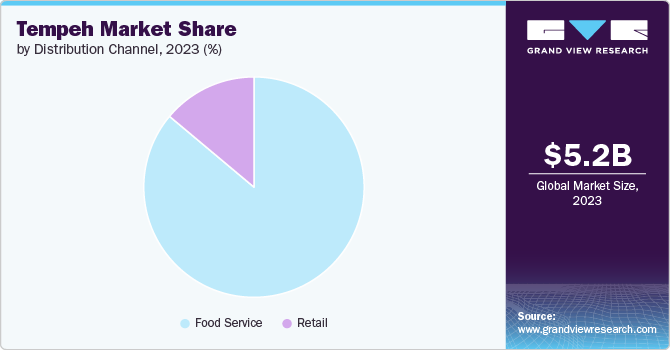

Distribution Channel Insights

Sales of tempeh through foodservice accounted for a share of 86.1% of the global revenues in 2023. Food service channels, such as wholesalers and distributors, cater to bulk buying needs. They offer tempeh in larger quantities, which is ideal for restaurants, cafes, and other food establishments that require substantial amounts of ingredients. Food service channels often offer additional services such as customized orders, flexible delivery schedules, and logistical support. This tailored service helps food service businesses streamline their operations and address specific needs.

Sales through retail channels are expected to grow at a CAGR of 6.5% from 2024 to 2030. Retail channels typically offer tempeh in smaller, consumer-friendly packages, which is ideal for individuals or households that do not require bulk quantities. This makes it easier for people to try tempeh or incorporate it into their diet without committing to large amounts. They often provide a range of tempeh products, including different flavors and brands. This variety allows consumers to choose based on their preferences, dietary needs, and price points.

The retail channel is further divided into supermarkets & hypermarkets, convenience stores, online, and others.

Regional Insights

Tempeh market in North America accounted for a market share of 19.4% in 2023. The rise of plant-based diets and vegetarianism/veganism has increased interest in tempeh as a versatile and nutritious meat substitute. As the food culture in North America becomes more diverse, there is growing curiosity about global cuisines. Tempeh, with its roots in Indonesian cuisine, is part of this broader interest in international foods.

U.S. Tempeh Market Trends

The rising popularity of plant-based and vegan diets in the U.S. has led to a growing interest in alternative protein sources. Tempeh, as a fermented soy product, aligns well with these dietary preferences and offers a meat substitute with nutritional benefits. Consumers are increasingly adventurous with their food choices. Tempeh's unique flavor, texture, and versatility in cooking appeal to those interested in exploring new ingredients and expanding their culinary repertoire.

Europe Tempeh Market Trends

The tempeh market in Europe accounted for a market share of 23.3% in 2023. Europeans are increasingly focused on health and nutrition. Tempeh is valued for its high protein content, probiotics, and essential nutrients, making it an attractive option for those looking to enhance their diet with plant-based foods. In addition, there is a growing awareness of environmental sustainability in Europe. Tempeh, as a plant-based protein, is seen as a more sustainable option compared to animal-based proteins, which appeals to environmentally conscious consumers.

Asia Pacific Tempeh Market Trends

The market in Asia Pacific is expected to grow at a CAGR of 6.6% from 2024 to 2030. Tempeh is a traditional food in Indonesia, where it originates. Its familiarity and historical significance in local cuisine make it an appealing option for people in the region who want to maintain or reconnect with traditional dietary practices. With a growing interest in plant-based diets and sustainable eating, tempeh offers a valuable protein source for those seeking meat alternatives. This trend is particularly strong among younger generations and urban populations in the region.

Key Tempeh Company Insights

The tempeh market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Tempeh Companies:

The following are the leading companies in the tempeh market. These companies collectively hold the largest market share and dictate industry trends.

- Byron Bay Tempeh

- Margaret River Tempeh

- Tootie’s Tempeh

- Mighty Bean Sunshine Coast

- Nutrisoy Pty Ltd

- Turtle Island Foods, Inc.

- Plant Power

- Maple Leaf Foods Inc.

- Primasoy

- Lalibela Farm Tempeh

Recent Developments

-

In March 2024, Greenleaf Foods, SPC, a subsidiary of Maple Leaf Foods Inc. and owner of leading plant-based brands Lightlife® and Field Roast, announced the launch of Lightlife Tempeh Protein Crumbles. Recognizing the growing consumer demand for healthy, clean protein options, Lightlife introduced these crumbles in two flavors: Original and Smoked Chipotle. The Original variety is lightly seasoned with salt, pepper, and garlic, while the Smoked Chipotle variety features a bold blend of roasted peppers for a balanced heat level. Each serving contains 16 grams of protein and 6 grams of fiber, making them ideal for various meals such as salads, stir-fries, tacos, grain bowls, and pasta.

-

In June 2024, Dr. Schär, a leading gluten-free food brand, launched new gluten-free products: Marble Cake and Tempeh in Classic, Chocolate, and Chocolate Chip flavors. Crafted with care and precision, these tempeh and the Marble Cake offer a delightful, convenient, and indulgent treat for any occasion. This launch continues Dr. Schär’s mission to provide delicious and inclusive options for those with special dietary needs. These shelf-stable, ready-to-eat treats ensure no compromise on the source.

-

In January 2024, Better Nature introduced a Smoky Tempeh for Veganuary to meet the increasing demand for healthy and versatile meat-free options. This new tempeh variant, is made from naturally fermented whole soybeans and seasoned with smoked salt. It is suitable for pan-frying or baking. The Smoky Tempeh expands Better Nature’s existing range, which includes Organic Tempeh and Tempeh Pieces in Mediterranean, BBQ, and Curry flavors.

Tempeh Market Report Scope

Report Attribute

Details

Market source value in 2024

USD 5.46 billion

Revenue forecast in 2030

USD 7.68 billion

Growth rate (Revenue)

CAGR of 5.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Indonesia; Brazil; South Africa

Key companies profiled

Byron Bay Tempeh; Margaret River Tempeh; Tootie’s Tempeh; Mighty Bean Sunshine Coast; Nutrisoy Pty Ltd; Turtle Island Foods, Inc.; Plant Power; Maple Leaf Foods Inc.; Primasoy; Lalibela Farm Tempeh

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Tempeh Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global tempeh market report on the basis of type, source, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen

-

Fresh

-

Ready-to-Eat

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soya Beans

-

Multi-grain

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tempeh market size was estimated at USD 5.17 billion in 2023 and is expected to reach USD 5.46 billion in 2024.

b. The global tempeh market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 7.68 billion by 2030.

b. Soya bean accounted for a share of 45.2% in 2023. Soybean tempeh has a neutral flavor that easily absorbs the taste of marinades and spices, making it versatile for various culinary applications. It can be grilled, fried, baked, or added to soups and stews, providing flexibility in meal preparation.

b. Some key players operating in tempeh market include Byron Bay Tempeh, Margaret River Tempeh, Tootie’s Tempeh, Mighty Bean Sunshine Coast, and others.

b. Key factors that are driving the market growth include rising consumption gourmet and artisanal food among consumers and increasing health consiousness among consumers

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."